cole soo

liked

Happy new year, mooers! ![]()

In 2022, the Moo community launched 10 technical analysis challenges. Big thanks to all mooers for your active participation! There's no end to learning, so let us keep it up to become pro traders together!![]()

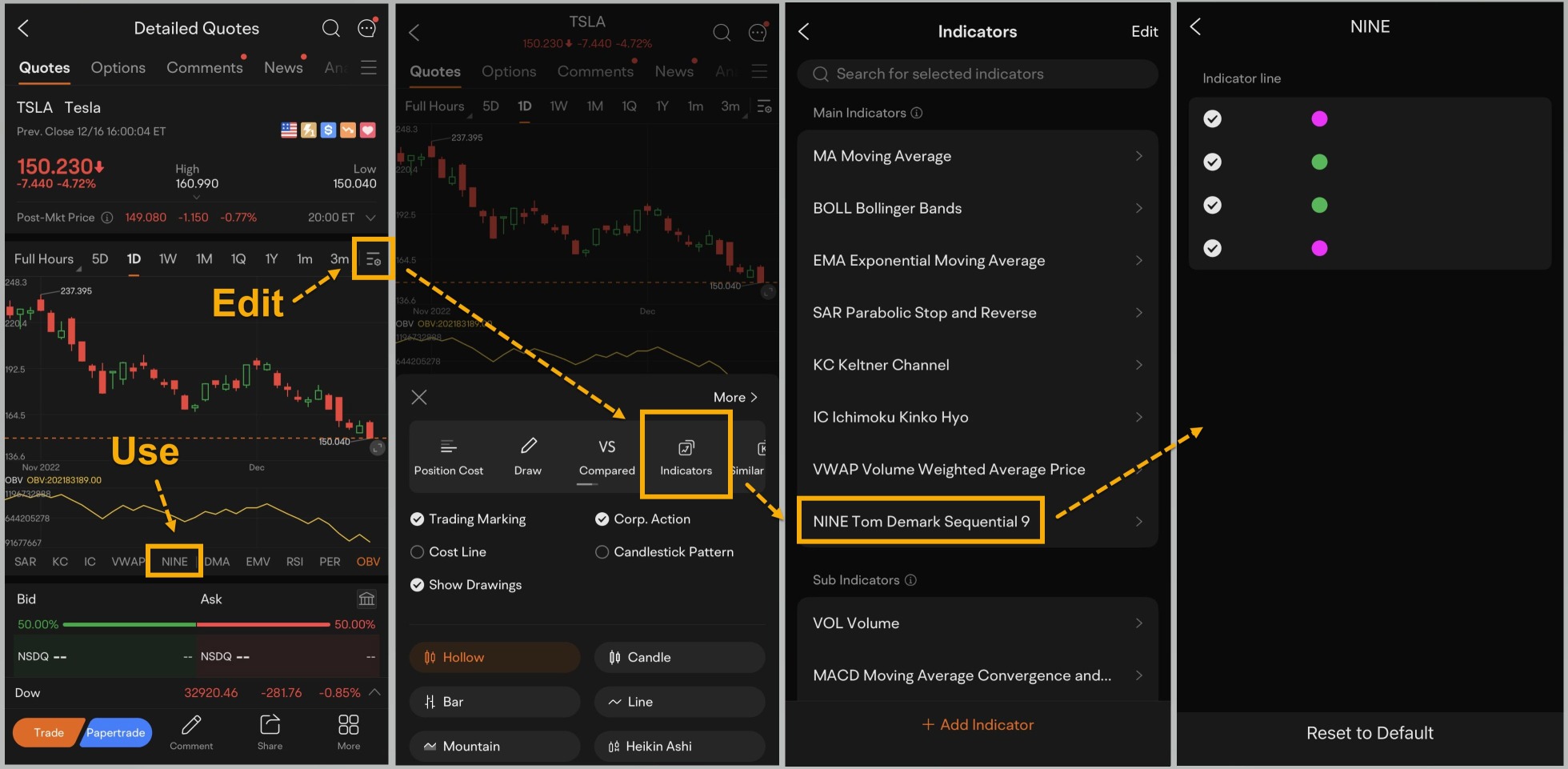

Today, we'd like to introduce another indicator to you: DeMark 9® (TDS 9). TDS 9 is an automatically generated sequence. Want to have a try? All you need to do is select it from the ...

In 2022, the Moo community launched 10 technical analysis challenges. Big thanks to all mooers for your active participation! There's no end to learning, so let us keep it up to become pro traders together!

Today, we'd like to introduce another indicator to you: DeMark 9® (TDS 9). TDS 9 is an automatically generated sequence. Want to have a try? All you need to do is select it from the ...

50

26

cole soo

voted

Shares of $AMTD Digital (HKD.US)$ plunged 40% on Wednesday to snap an eye-popping rally fueled by retail investors this week that briefly took the Hong Kong-based fintech's market value past that of $Meta Platforms (META.US)$ .

The company's market capitalization closed above $300 billion in a 128% jump on Tuesday, reminding investors of the meme stock mania last year that drove record rallies in shares of companies such as $GameStop (GME.US)$ and �����...

The company's market capitalization closed above $300 billion in a 128% jump on Tuesday, reminding investors of the meme stock mania last year that drove record rallies in shares of companies such as $GameStop (GME.US)$ and �����...

9

4

cole soo

liked

is it too late to buy in to BYD?

7

1

cole soo

liked

Hello everyone, I'm Lao Li

There is no market that only rises and does not fall, and there is no market that only falls but does not rise. The higher you jump, the more pain you will fall, and the deeper you squat, the higher and farther you will jump in the future.

Although today the market has set new lows again, this new low can be used as a starting point for the mid-term market. Because the pessimism is released more thoroughly, from the perspective of transaction volume, the market looks like funds will enter the market after the index is at a new low. If the market goes out of a big positive tomorrow, this will further stimulate the accelerated entry of incremental funds. .

It has a mitigating effect on the short-term liquidity of the market.

$Hang Seng Index (800000.HK)$ The Hang Seng Index rebounded again after a new low, and the short-term market wind has not changed. However, after the continuous decline in the market and the recovery of the external market, there is not much room for the index to fall, but the probability of a substantial rebound in the short-term is also not large. Yes, wait for the low position to converge and choose the main direction. At the technical level, the Hang Seng Index continues to remain in the downward channel, supporting 23,000 within the day, and 24,300 above pressure waiting for the direction to be selected.

$BYD COMPANY (01211.HK)$ BYD has completely reproduced Tesla’s trend of low and high. It should be noted that the valuation is too high in the short term. Secondly, although the industry’s prosperity does not change, the growth rate of performance affects the adjustment of valuation, and with the upstream The rise in prices squeezes downstream profits, and near the end of the year, there is indeed the possibility of high-low switching. The current price is high, waiting for the adjustment to end. If the intraday support 240 breaks to open up the downward space, the upward rebound pressure 280 is an upward trend line pressure. , Wait for the adjustment to be over.

$SMIC (00981.HK)$ SMIC continues to fall today, and still maintains yesterday's view. This decline was not caused by bad news, and the sentiment fell. Kdj diverged directly upwards, which is expected to form a golden fork to drive the stock price to usher in an anti-truck. The more and more carefully this location becomes a golden pit.

$PING AN (02318.HK)$ China Ping An continues to consolidate. It can be seen that China Ping An has obvious signs of strengthening recently, and does not follow the index fluctuations. After the negatives are exhausted, it is expected to correct the decline during the year. The daily support is mainly 55 bargain hunting, and the top is stable and 63 opens. Rebound space.

$TENCENT (00700.HK)$ Tencent continued its downward trend and tested the previous lows again in the short term. The current stock price remains fluctuating at the bottom edge of the box. However, it can be seen that the volatility of Alibaba $BABA-W (09988.HK)$ , $MEITUAN-W (03690.HK)$ , and $XIAOMI-W (01810.HK)$ has declined recently, and the fundamentals have been exhausted.

China's concept stocks are now on the left, and the odds on the left are enough, but it takes time to stabilize and move up, and try to buy as low as possible.

There is no market that only rises and does not fall, and there is no market that only falls but does not rise. The higher you jump, the more pain you will fall, and the deeper you squat, the higher and farther you will jump in the future.

Although today the market has set new lows again, this new low can be used as a starting point for the mid-term market. Because the pessimism is released more thoroughly, from the perspective of transaction volume, the market looks like funds will enter the market after the index is at a new low. If the market goes out of a big positive tomorrow, this will further stimulate the accelerated entry of incremental funds. .

It has a mitigating effect on the short-term liquidity of the market.

$Hang Seng Index (800000.HK)$ The Hang Seng Index rebounded again after a new low, and the short-term market wind has not changed. However, after the continuous decline in the market and the recovery of the external market, there is not much room for the index to fall, but the probability of a substantial rebound in the short-term is also not large. Yes, wait for the low position to converge and choose the main direction. At the technical level, the Hang Seng Index continues to remain in the downward channel, supporting 23,000 within the day, and 24,300 above pressure waiting for the direction to be selected.

$BYD COMPANY (01211.HK)$ BYD has completely reproduced Tesla’s trend of low and high. It should be noted that the valuation is too high in the short term. Secondly, although the industry’s prosperity does not change, the growth rate of performance affects the adjustment of valuation, and with the upstream The rise in prices squeezes downstream profits, and near the end of the year, there is indeed the possibility of high-low switching. The current price is high, waiting for the adjustment to end. If the intraday support 240 breaks to open up the downward space, the upward rebound pressure 280 is an upward trend line pressure. , Wait for the adjustment to be over.

$SMIC (00981.HK)$ SMIC continues to fall today, and still maintains yesterday's view. This decline was not caused by bad news, and the sentiment fell. Kdj diverged directly upwards, which is expected to form a golden fork to drive the stock price to usher in an anti-truck. The more and more carefully this location becomes a golden pit.

$PING AN (02318.HK)$ China Ping An continues to consolidate. It can be seen that China Ping An has obvious signs of strengthening recently, and does not follow the index fluctuations. After the negatives are exhausted, it is expected to correct the decline during the year. The daily support is mainly 55 bargain hunting, and the top is stable and 63 opens. Rebound space.

$TENCENT (00700.HK)$ Tencent continued its downward trend and tested the previous lows again in the short term. The current stock price remains fluctuating at the bottom edge of the box. However, it can be seen that the volatility of Alibaba $BABA-W (09988.HK)$ , $MEITUAN-W (03690.HK)$ , and $XIAOMI-W (01810.HK)$ has declined recently, and the fundamentals have been exhausted.

China's concept stocks are now on the left, and the odds on the left are enough, but it takes time to stabilize and move up, and try to buy as low as possible.

+1

109

cole soo

liked

$Hang Seng TECH Index (800700.HK)$ $HSI ADR (.HSIADR.US)$ Shares in Chinese healthcare and technology firms tumbled on Wednesday after a report that the United States would add more Chinese firms, including the largest commercial drone maker and biotech firms, to investment and export blacklists this week.

Citing two sources briefed on the plans, the Financial Times said the United States would add eight Chinese firms, including the drone maker, DJI Technology Co Ltd, to an investment blacklist on Thursday.

The U.S. commerce department is also set to place more than two dozen Chinese firms, some of them involved in biotechnology, on an "entity list" restricting exports to them by U.S. firms, the newspaper cited the sources as saying.

The report hastened a sell-off in Chinese healthcare shares in afternoon trade, knocking 3.2% off a mainland index tracking the sector against a drop of 0.87% in the broader index.

The impact was sharper still in Hong Kong, where the Hang Seng Healthcare Index was down 7.6% in late afternoon trade.

Citing two sources briefed on the plans, the Financial Times said the United States would add eight Chinese firms, including the drone maker, DJI Technology Co Ltd, to an investment blacklist on Thursday.

The U.S. commerce department is also set to place more than two dozen Chinese firms, some of them involved in biotechnology, on an "entity list" restricting exports to them by U.S. firms, the newspaper cited the sources as saying.

The report hastened a sell-off in Chinese healthcare shares in afternoon trade, knocking 3.2% off a mainland index tracking the sector against a drop of 0.87% in the broader index.

The impact was sharper still in Hong Kong, where the Hang Seng Healthcare Index was down 7.6% in late afternoon trade.

8

cole soo

liked

$TENCENT (00700.HK)$ Market rebounded, time to pick good value stocks

12

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)