Constant Invest Guy

liked

US Market Key Charts (S&P, US Dollar, Gold)

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ **]We maintain our bullish directional bias. Price is currently near 6055 resistance level. A 4 hour candlestick closing above 6055 resistance would open push towards 6120 resistance level. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A 4 hour candlestick closing below 6055 resistance would...

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ **]We maintain our bullish directional bias. Price is currently near 6055 resistance level. A 4 hour candlestick closing above 6055 resistance would open push towards 6120 resistance level. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A 4 hour candlestick closing below 6055 resistance would...

12

1

Constant Invest Guy

voted

Hi, mooers! ![]()

YTL Power $YTLPOWR (6742.MY)$ is expected to release its latest quarterly earnings on November 26*. How will the market react to the company's results? Vote your answer to participate!

*The exact release date depends on the company's announcement.

🎁 Rewards

![]() An equal share of 5,000 points: For mooers who correctly guess the price range of $YTLPOWR (6742.MY)$'s closing price on 26 November!

An equal share of 5,000 points: For mooers who correctly guess the price range of $YTLPOWR (6742.MY)$'s closing price on 26 November!

(Vote will clos...

YTL Power $YTLPOWR (6742.MY)$ is expected to release its latest quarterly earnings on November 26*. How will the market react to the company's results? Vote your answer to participate!

*The exact release date depends on the company's announcement.

🎁 Rewards

(Vote will clos...

56

91

Constant Invest Guy

liked

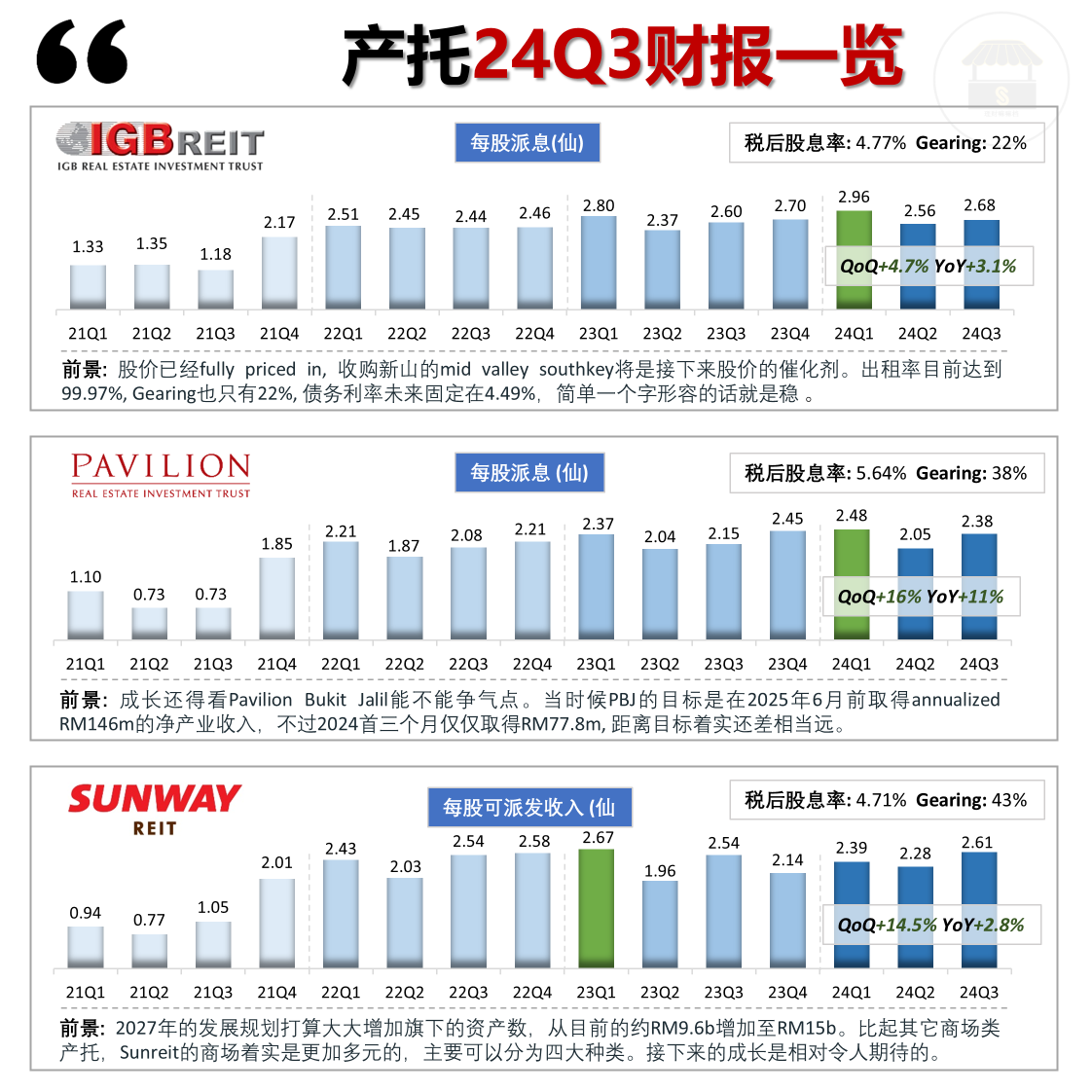

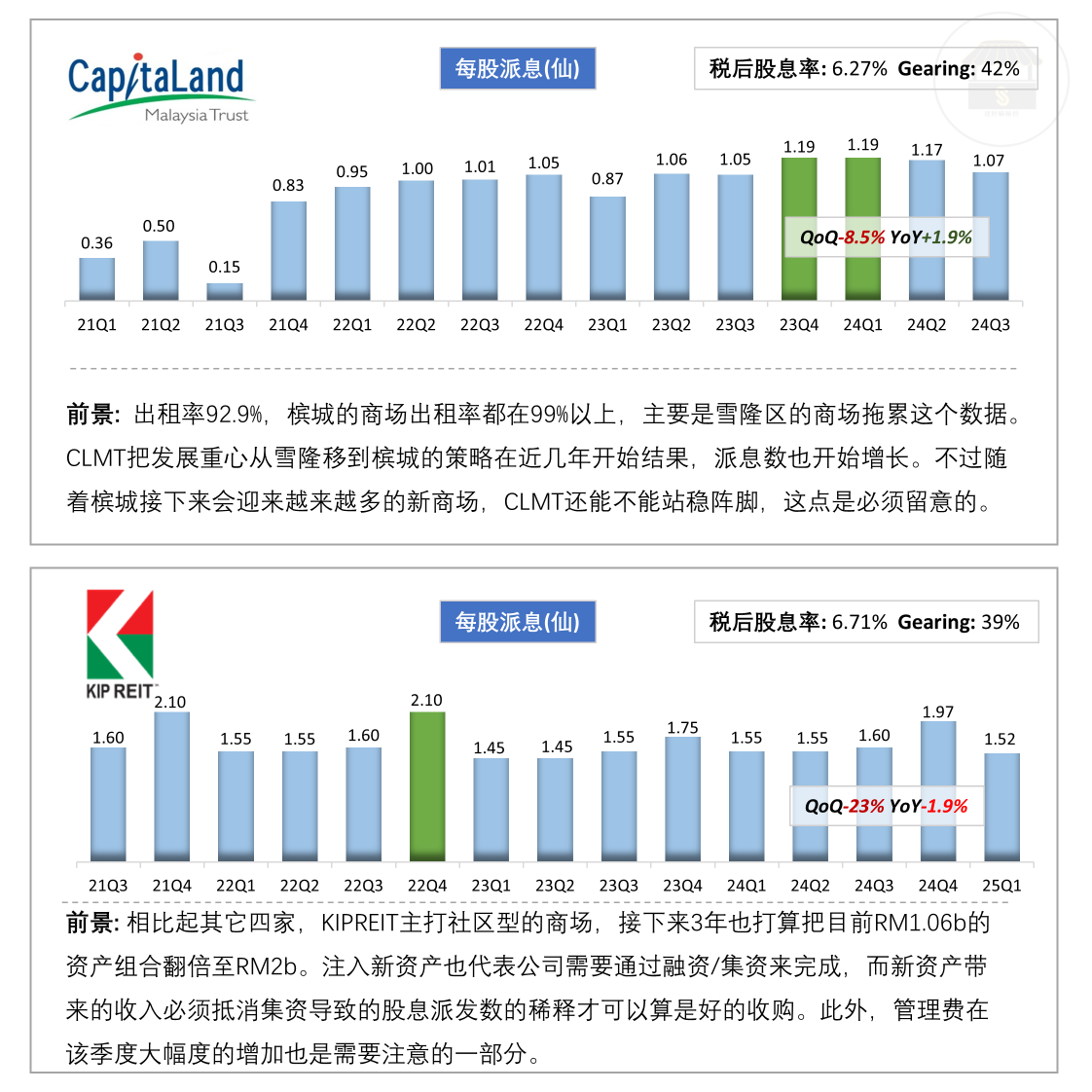

The third quarter financial reporting season is here again. Take advantage of this weekend to update the latest performance and progress of REITs in the watchlist, then organize and share with readers. The year-end work is really busy, I kindly ask readers for understanding as the recent update speed has dropped sharply.

Compared to Singapore's real estate investment trusts, Malaysia's various real estate investment trusts have actually shown quite stable performance in recent years, even surpassing the overall market performance. The real estate investment trusts I've been tracking have been steadily recovering their earnings per share distributions after the 2020 COVID period, with many even surpassing their pre-pandemic performance.

Taking the performance of the real estate investment trust I've been tracking from early 2024 until now (including dividend returns), in this period:

$PAVREIT (5212.MY)$ : 33.66%

$CLMT (5180.MY)$ : 28.41%

$IGBREIT (5227.MY)$ : 28.11%

$SUNREIT (5176.MY)$ : 25.19%

$ALAQAR (5116.MY)$ : 15.55%

$KIPREIT (5280.MY)$ : 8.28%

Such performance can be quite exaggerated, the stock price even feels a bit overvalued, there are really not many choices for me to enter at this time. In fact, apart from industrial trusts, many dividend stocks have achieved the largest annual increase in recent years. Maybe it's because the overall market is unstable, and dividend stocks have become the safe haven of the market?

...

Compared to Singapore's real estate investment trusts, Malaysia's various real estate investment trusts have actually shown quite stable performance in recent years, even surpassing the overall market performance. The real estate investment trusts I've been tracking have been steadily recovering their earnings per share distributions after the 2020 COVID period, with many even surpassing their pre-pandemic performance.

Taking the performance of the real estate investment trust I've been tracking from early 2024 until now (including dividend returns), in this period:

$PAVREIT (5212.MY)$ : 33.66%

$CLMT (5180.MY)$ : 28.41%

$IGBREIT (5227.MY)$ : 28.11%

$SUNREIT (5176.MY)$ : 25.19%

$ALAQAR (5116.MY)$ : 15.55%

$KIPREIT (5280.MY)$ : 8.28%

Such performance can be quite exaggerated, the stock price even feels a bit overvalued, there are really not many choices for me to enter at this time. In fact, apart from industrial trusts, many dividend stocks have achieved the largest annual increase in recent years. Maybe it's because the overall market is unstable, and dividend stocks have become the safe haven of the market?

...

Translated

29

1

Constant Invest Guy

commented on

4

2

Constant Invest Guy

liked

$Sea (SE.US)$ lets dump this stupid stock

2

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)