How time flies. It is September, it is fall again. ![]() When we talk about fall, we always think of a season of harvest. But for some, "fall" is a verb declining.

When we talk about fall, we always think of a season of harvest. But for some, "fall" is a verb declining.

So was my September a noun or a verb?

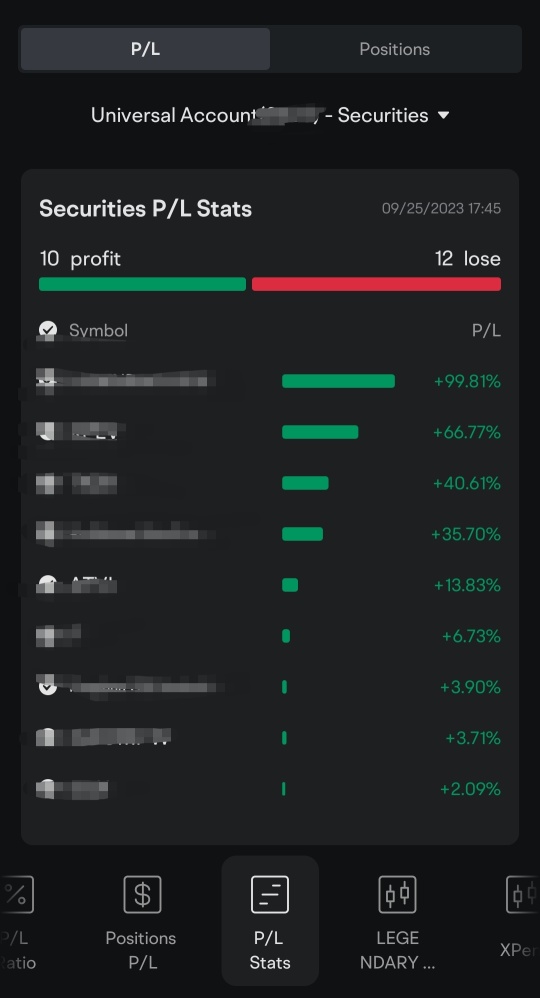

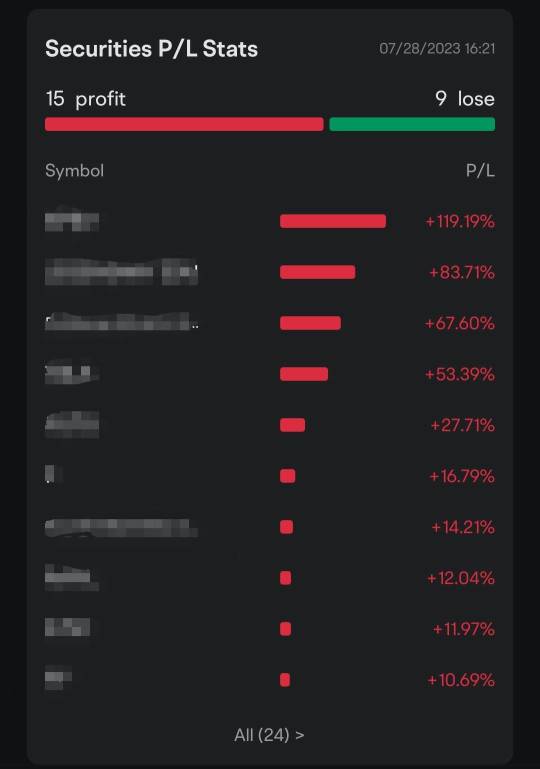

Well, I'd like to say harvest. But the fact is "declining" whatever.![]() 10 profit VS 12 lose. At least, not too bad.

10 profit VS 12 lose. At least, not too bad.![]()

My best-performing stock-LEGENDARY EDU, with an increase of 99.81%.![]()

![]()

![]() I have been investing in it for more than 1 year. Most of the time, it performed quite w...

I have been investing in it for more than 1 year. Most of the time, it performed quite w...

So was my September a noun or a verb?

Well, I'd like to say harvest. But the fact is "declining" whatever.

My best-performing stock-LEGENDARY EDU, with an increase of 99.81%.

11

1

Cool traderrr

commented on

Stocks market in August has been turbulent. The S&P 500', which has witnessed significant rise this year, has relinquished over a quarter of its previous growth. As earnings reports wind down, Nvidia's impressive resurgence is making waves in the tech industry...

Looking back on my P/L ratio, -0.16%, a not-too-bad result. And on the other hand, I earned 115 usd among my positions. Keep investing smartly in September!![]()

![]()

Looking back on my P/L ratio, -0.16%, a not-too-bad result. And on the other hand, I earned 115 usd among my positions. Keep investing smartly in September!

16

3

Hey, fellow traders!![]()

I was checking out the 13F portfolio yesterday and noticed that tech stocks are still major players in their positions during Q2. I mean, we're talking about Apple taking up more than half of Berkshire's positions!![]() Even JP Morgan and Morgan Stanley have their largest positions at Microsoft, while Blackrock is all about Apple. It got me thinking about my own tech stock holdings and the proportion they make up.

Even JP Morgan and Morgan Stanley have their largest positions at Microsoft, while Blackrock is all about Apple. It got me thinking about my own tech stock holdings and the proportion they make up.![]()

Curr...

I was checking out the 13F portfolio yesterday and noticed that tech stocks are still major players in their positions during Q2. I mean, we're talking about Apple taking up more than half of Berkshire's positions!

Curr...

2

1

1

Cool traderrr

commented on

I find the withdrawal process very unclear for 2 days. I tried to withdraw but couldn't. I called the contact centre and can't help but email. When I originally deposited funds to trade, straight away it except my money.

Secondly, I have used Plus500 for years. It gives me more stock trading leverage options. I also use eToro, although not as extensive as Plus500. For $500 USD, they allow leverage. As traders, this is a risk, but we should be given these options. I made some investments here and...

Secondly, I have used Plus500 for years. It gives me more stock trading leverage options. I also use eToro, although not as extensive as Plus500. For $500 USD, they allow leverage. As traders, this is a risk, but we should be given these options. I made some investments here and...

3

4

Hi, mooers.

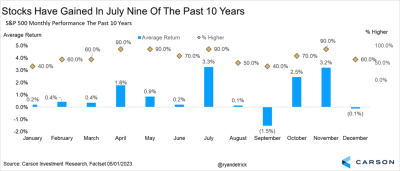

A few days ago, I came across an article that impressed me most. It was titled Why July Brings the Bulls posted by Carson Group. Now I'd like to quote some details from that article here and discuss that with you. And here is the source.

"For starters, stocks have gained 9 of the past 10 years in July, with no month sporting a better average return over the past decade than the 3.3% July gain for the S&P 500. Why is this you ask? The one thing I keep thin...

A few days ago, I came across an article that impressed me most. It was titled Why July Brings the Bulls posted by Carson Group. Now I'd like to quote some details from that article here and discuss that with you. And here is the source.

"For starters, stocks have gained 9 of the past 10 years in July, with no month sporting a better average return over the past decade than the 3.3% July gain for the S&P 500. Why is this you ask? The one thing I keep thin...

+1

12

8

1

Cool traderrr

liked

When plotting key Support and Resistance for the first time it is imperative to zoom out to the higher time frames. Levels that can be visually (and easily) seen at these levels will be much more significant. Remember, if you have to strain your eyes to see it, it is likely not a key level.

I personally use the color blue for resistance (like the sky above) and orange for support (close to a ground color). You can choose as you like, or stay with one color since support often flips t...

I personally use the color blue for resistance (like the sky above) and orange for support (close to a ground color). You can choose as you like, or stay with one color since support often flips t...

14

1

Cool traderrr

voted

$Microsoft (MSFT.US)$ shares witnessed profit booking and a sudden rise in selling volume is also visible indicating mild bearishness. However, the price is near to the 50-day EMA which is likely to act as immediate support for the bulls.

MSFT stock is sustaining above the 50-day and 200-day EMA showcases the trend is in an upward direction. Therefore, any short-term correction is likely to get absorbed by the buyers near the support le...

MSFT stock is sustaining above the 50-day and 200-day EMA showcases the trend is in an upward direction. Therefore, any short-term correction is likely to get absorbed by the buyers near the support le...

4

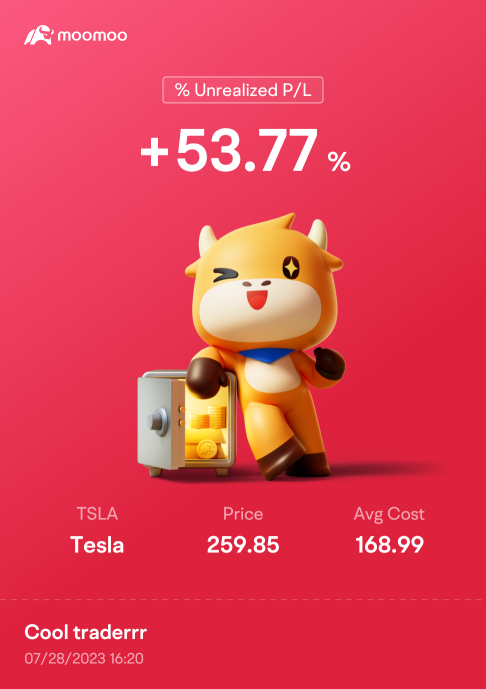

$Tesla (TSLA.US)$ $Ford Motor (F.US)$ $XPeng (XPEV.US)$

here are some reasons why i have an eye for the ev sector next half year:

First, according to the news that EV sales are set to increase by 35% in 2023. Also. i have read about the news that the three-wheelrs sold in india in 2022(last year), more than half of them were electric. So, yeah, I think that would be a large market needs and demands in the future.

EV is also goibg to reduce oil demand a lot(which is also great ...

here are some reasons why i have an eye for the ev sector next half year:

First, according to the news that EV sales are set to increase by 35% in 2023. Also. i have read about the news that the three-wheelrs sold in india in 2022(last year), more than half of them were electric. So, yeah, I think that would be a large market needs and demands in the future.

EV is also goibg to reduce oil demand a lot(which is also great ...

loading...

24

4

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)