$Bitcoin (BTC.CC)$ companies noticing how mstr works, Rumble testing the waters, this thing is about to explode like it's never done before. Will be a fiat currency vacuum.

2

3

$Bitcoin (BTC.CC)$ weak hands dropped thier bitcoin today. HODL

1

1

d150mopar87

commented on

$Rumble (RUM.US)$ to become the next mstr stock

2

1

$Rumble (RUM.US)$ as a rumble user, I can see why this stock is gaining value, Trump train

3

I think they did at 7pm lol

d150mopar87

liked

$XRP (XRP.CC)$ nobody sell. hold like your kife depended on it. you will create generational wealth for you and your family.

6

1

d150mopar87

liked

$XRP (XRP.CC)$ pretty sure the japanese are knocking the xrp door way harder than anyone

3

d150mopar87

liked

$XRP (XRP.CC)$ keep on up , Break $ 2 !!

4

d150mopar87

voted

Hey mooers! ![]()

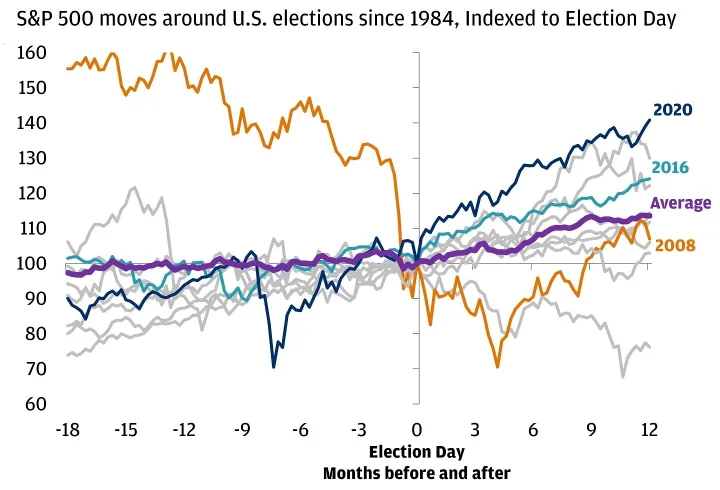

The eagerly awaited U.S. presidential election is set to commence on November 5, likely ushering in a turbulent market period. As the date approaches, investors are preparing for increased volatility. What are the potential effects and strategies you should consider?![]()

Additionally, as October progressed, Harris's lead in polls diminished, particularly in crucial swing states, leading to a rise in bets on a Trump win on p...

The eagerly awaited U.S. presidential election is set to commence on November 5, likely ushering in a turbulent market period. As the date approaches, investors are preparing for increased volatility. What are the potential effects and strategies you should consider?

Additionally, as October progressed, Harris's lead in polls diminished, particularly in crucial swing states, leading to a rise in bets on a Trump win on p...

28

8

1

d150mopar87

liked

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)