desmond888

liked

$Trump Media & Technology (DJT.US)$ Donald Trump announced on Truth: 'I am pleased to announce that Paul Atkins has been nominated as the next chairman of the Securities and Exchange Commission.'

Translated

6

1

1

desmond888

commented on and voted

Hi, mooers! ![]()

Tenaga Nasional Bhd $TENAGA (5347.MY)$ is expected to release its latest quarterly earnings on November 28*. How will the market react to the power company's results? Vote your answer to participate!

*The exact release date depends on the company's announcement.

🎁 Rewards

![]() An equal share of 5,000 points: For mooers who correctly guess the price range of $TENAGA (5347.MY)$'s closing price on 28 November!

An equal share of 5,000 points: For mooers who correctly guess the price range of $TENAGA (5347.MY)$'s closing price on 28 November!

(Vot...

Tenaga Nasional Bhd $TENAGA (5347.MY)$ is expected to release its latest quarterly earnings on November 28*. How will the market react to the power company's results? Vote your answer to participate!

*The exact release date depends on the company's announcement.

🎁 Rewards

(Vot...

41

61

5

desmond888

commented on and voted

Morning, mooers! ![]()

This week, $MAYBANK (1155.MY)$ (11/26) and $PBBANK (1295.MY)$ (11/27) are said to report their quarterly earnings. After the recent pullback, investors are focusing on the performance of these two local banking giants. Who will be the winner of earnings week? Make your choice and grab some point rewards!![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guessed the winner who makes the biggest % gains in...

This week, $MAYBANK (1155.MY)$ (11/26) and $PBBANK (1295.MY)$ (11/27) are said to report their quarterly earnings. After the recent pullback, investors are focusing on the performance of these two local banking giants. Who will be the winner of earnings week? Make your choice and grab some point rewards!

Rewards

● An equal share of 5,000 points: For mooers who correctly guessed the winner who makes the biggest % gains in...

72

67

22

desmond888

commented on and voted

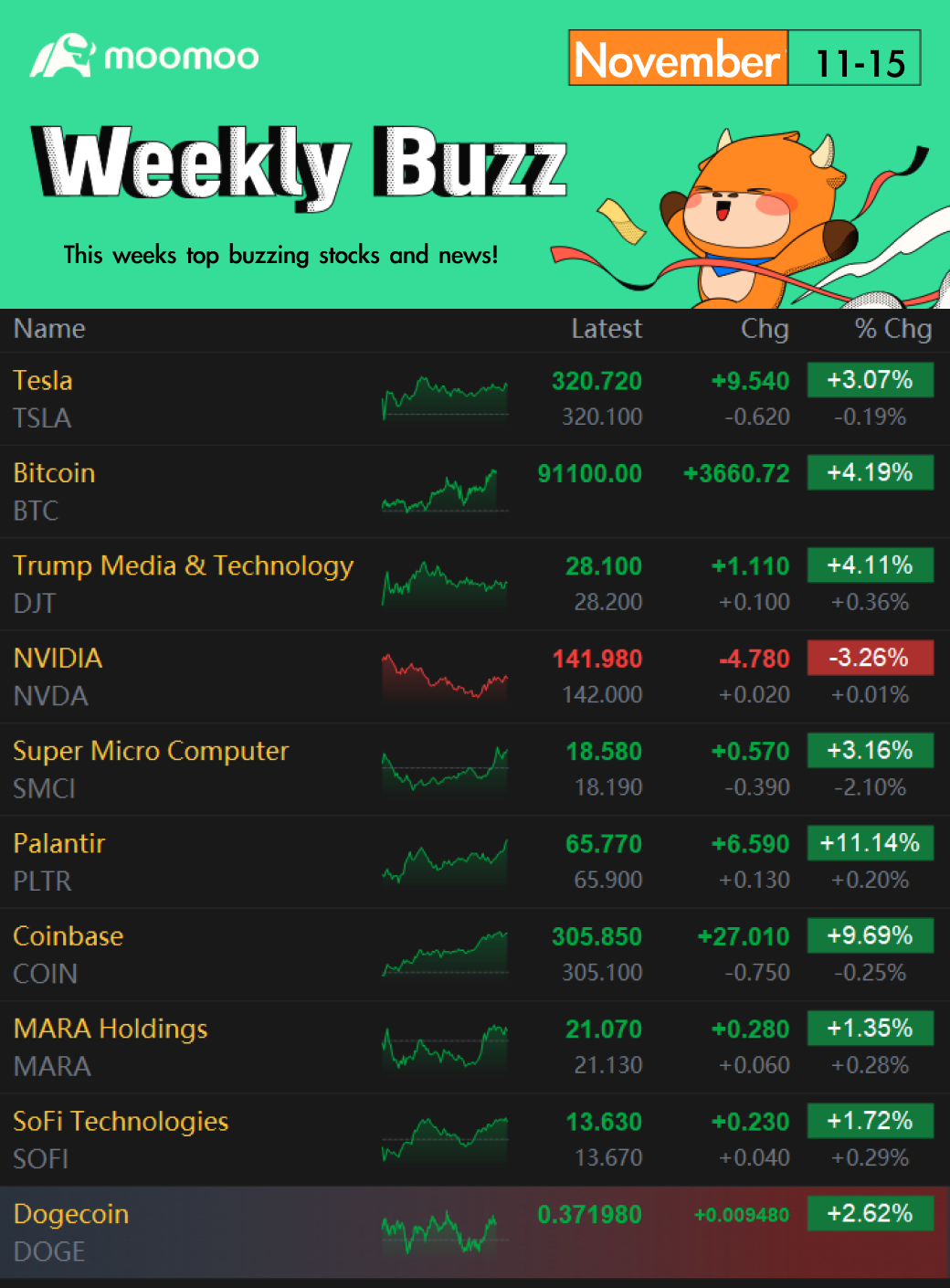

Happy weekend, investors! Welcome back to Weekly Buzz where we talk about the top ten buzzing stocks on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Make Your Choice

Weekly Buzz

The market overall advanced on Friday. The news followed Nvidia's earnings on Wednesday night and Bitcoin's all-time highs.

Just past the Friday close at 4 pm ET, the $S&P 500 Index (.SPX.US)$ traded...

Make Your Choice

Weekly Buzz

The market overall advanced on Friday. The news followed Nvidia's earnings on Wednesday night and Bitcoin's all-time highs.

Just past the Friday close at 4 pm ET, the $S&P 500 Index (.SPX.US)$ traded...

+11

97

43

21

desmond888

commented on and voted

Hi, mooers! ![]()

YTL Power $YTLPOWR (6742.MY)$ is expected to release its latest quarterly earnings on November 26*. How will the market react to the company's results? Vote your answer to participate!

*The exact release date depends on the company's announcement.

🎁 Rewards

![]() An equal share of 5,000 points: For mooers who correctly guess the price range of $YTLPOWR (6742.MY)$'s closing price on 26 November!

An equal share of 5,000 points: For mooers who correctly guess the price range of $YTLPOWR (6742.MY)$'s closing price on 26 November!

(Vote will clos...

YTL Power $YTLPOWR (6742.MY)$ is expected to release its latest quarterly earnings on November 26*. How will the market react to the company's results? Vote your answer to participate!

*The exact release date depends on the company's announcement.

🎁 Rewards

(Vote will clos...

61

91

16

desmond888

liked

$CEB (5311.MY)$ Not dropping much today, I'll get off the ship first.

The main reason is still performance, I am bullish on fundamentals. The current PE is 44, super high. It was only PE 9 before. I will come back when it drops back to a single-digit PE. The second point is a forex loss of 12 million, which dominates among 19 million. I am bullish on the progress of Malaysia, the Malaysian Ringgit will perform well, relatively weaker against the US Dollar. CEB needs a solution for this. The IPO funds will be settled by May 2025. This ship is not heading in the direction I want.

Currently, the only chance to turn around is to acquire Chong Ai, make it a speculative stock with fragile characteristics and hype up. There is still a chance for speculative gains, but it's not the type I want.

The main reason is still performance, I am bullish on fundamentals. The current PE is 44, super high. It was only PE 9 before. I will come back when it drops back to a single-digit PE. The second point is a forex loss of 12 million, which dominates among 19 million. I am bullish on the progress of Malaysia, the Malaysian Ringgit will perform well, relatively weaker against the US Dollar. CEB needs a solution for this. The IPO funds will be settled by May 2025. This ship is not heading in the direction I want.

Currently, the only chance to turn around is to acquire Chong Ai, make it a speculative stock with fragile characteristics and hype up. There is still a chance for speculative gains, but it's not the type I want.

Translated

12

2

desmond888

commented on

$CEB (5311.MY)$ If everyone can collaborate and provide the ticket, we will buy the expensive ticket for him. ![]()

Translated

5

desmond888

voted

1. PDD Holdings: $PDD Holdings (PDD.US)$ Some may think the financial report will cause a drop, but looking at the distribution of call and put options, it's clear that most people are optimistic.

2. Nvidia: $NVIDIA (NVDA.US)$ Continue to increase positions, not predicting financial reports, not predicting stock prices, mainly for arbitrage, and add some put options for a perfect strategy.

3. NIO Xiaopeng: $NIO Inc (NIO.US)$ $XPeng (XPEV.US)$ Occasionally playing in the short term is fine, but it's better not to play long term, it's exhausting and costly.

2. Nvidia: $NVIDIA (NVDA.US)$ Continue to increase positions, not predicting financial reports, not predicting stock prices, mainly for arbitrage, and add some put options for a perfect strategy.

3. NIO Xiaopeng: $NIO Inc (NIO.US)$ $XPeng (XPEV.US)$ Occasionally playing in the short term is fine, but it's better not to play long term, it's exhausting and costly.

Translated

3

1

desmond888

commented on and voted

Happy weekend, investors! Welcome back to Weekly Buzz where we talk about the top ten buzzing stocks on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Make Your Choice

Weekly Buzz

This week was the first full trading week after the presidential election, and the market continued to respond positively to President-Elect Donald Trump and watched as the GOP won a majority in the Congressional House and Senat...

Make Your Choice

Weekly Buzz

This week was the first full trading week after the presidential election, and the market continued to respond positively to President-Elect Donald Trump and watched as the GOP won a majority in the Congressional House and Senat...

+10

82

42

8

desmond888

voted

$NVIDIA (NVDA.US)$ , the kingpin of the semiconductor industry, especially shining bright in the AI chip market with its robust growth potential, always piques the market's curiosity before its fiscal report drops. 👀

Historical data whispers that Nvidia often dips into discount territory before its earnings announcement, then bounces back post-release. Currently, its price action suggests it's consolidating around a fair value ...

Historical data whispers that Nvidia often dips into discount territory before its earnings announcement, then bounces back post-release. Currently, its price action suggests it's consolidating around a fair value ...

+2

14

2

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)