Edinburg

commented on

Here is how it works:

Step 1: Learn & Master the related contents

Step 2: Take the quiz & Leave your answer in the comment

Step 3: Share the screenshot of your subscription to the CSOP iEdge Southeast Asia + TECH Index ETF

Event Rewards:

Users who participate in this event and have answered all questions correctly will be awarded:

![]() The first winner: 666 points

The first winner: 666 points

![]() The 2nd-5th winner: 233 points

The 2nd-5th winner: 233 points

![]() 200 lucky participants (better with subscription screenshots)...

200 lucky participants (better with subscription screenshots)...

Step 1: Learn & Master the related contents

Step 2: Take the quiz & Leave your answer in the comment

Step 3: Share the screenshot of your subscription to the CSOP iEdge Southeast Asia + TECH Index ETF

Event Rewards:

Users who participate in this event and have answered all questions correctly will be awarded:

78

423

12

Edinburg

voted

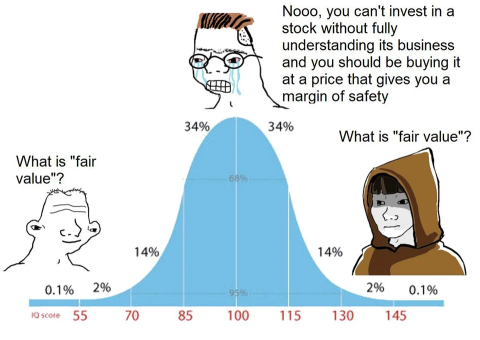

The word "level" has several different meanings.

First, the word can be used to describe "a position on a scale."

Secondly, it can mean a position within a system in which people are arranged.

Thirdly, maybe it represents only the height of something.

In today's moohumor, everything is related to "level."

Let's take a look.

@Brandony: Market just doesn't give a s*** $Tesla (TSLA.US)$

@robinmc: Have a good weekend. @ $SPDR S&P 500 ETF (SPY.US)$

@Scare_DontMakeNo_: $AMC Entertainment (AMC.US)$

���������...

First, the word can be used to describe "a position on a scale."

Secondly, it can mean a position within a system in which people are arranged.

Thirdly, maybe it represents only the height of something.

In today's moohumor, everything is related to "level."

Let's take a look.

@Brandony: Market just doesn't give a s*** $Tesla (TSLA.US)$

@robinmc: Have a good weekend. @ $SPDR S&P 500 ETF (SPY.US)$

@Scare_DontMakeNo_: $AMC Entertainment (AMC.US)$

���������...

+8

39

35

12

Edinburg

reacted to

ETFs managed by Cathie Wood's ArkInvestment Management bought 488,270 shares of Nu Holdings

ARK's buys

$Nu Holdings (NU.US)$ $Property Services and Management (LIST1090.HK)$ $2U Inc (TWOU.US)$ $Robinhood (HOOD.US)$ $Sea (SE.US)$ $XPeng (XPEV.US)$

ARK's sells

$Zillow-C (Z.US)$ $Disney (DIS.US)$ $Intercontinental Exchange (ICE.US)$ $3D Systems (DDD.US)$

ARK's buys

$Nu Holdings (NU.US)$ $Property Services and Management (LIST1090.HK)$ $2U Inc (TWOU.US)$ $Robinhood (HOOD.US)$ $Sea (SE.US)$ $XPeng (XPEV.US)$

ARK's sells

$Zillow-C (Z.US)$ $Disney (DIS.US)$ $Intercontinental Exchange (ICE.US)$ $3D Systems (DDD.US)$

16

1

Edinburg

reacted to

Only thing is, would you dare to buy? Or will you try to ”time the market” and wait for them to hit rock-bottom before purchasing?

I’ll enter and DCA cautiously at support levels![]()

$Disney (DIS.US)$

$Tesla (TSLA.US)$

$Microsoft (MSFT.US)$

$Meta Platforms (FB.US)$

$NVIDIA (NVDA.US)$

$Advanced Micro Devices (AMD.US)$

$Apple (AAPL.US)$

$Palantir (PLTR.US)$

I’ll enter and DCA cautiously at support levels

$Disney (DIS.US)$

$Tesla (TSLA.US)$

$Microsoft (MSFT.US)$

$Meta Platforms (FB.US)$

$NVIDIA (NVDA.US)$

$Advanced Micro Devices (AMD.US)$

$Apple (AAPL.US)$

$Palantir (PLTR.US)$

12

Edinburg

reacted to

Beginning of this year 2021, I had a prediction that Nasdaq 100 will hit around 16,000 before correcting or see a meaningful adjustment. You may wish to take a quick look at this youtube video with the link as follows:-

Youtube video on Nasdaq 100's prediction:-

https://www.youtube.com/watch?v=bH7IG5UR0NQ

Since then, Nasdaq 100 future had hit 16,200 before coming down to around 15300 and then retest 16100 and coming down to around 15800 (all based on my memory) before retesting around 16800 and coming down to around 15800 and retesting 16100 then back down to 15800 and then 16450 and now at the level of around 15860...

(I have not went to check back the chart but rather this is based on my memory)

This price action certainly indicates that the bulls and bears of tech stocks are uncertain about how the interest rate hike is going to impact on growth stocks.

When uncertainty emerges and narratives over interest rate hike and growth stocks happen, this will sure happen. What would I do now?

Ultimately, pricing and valuation matter alot more these days and the back to basic valuation rather than narratives will sway price movements. I will continue to update my list of watchlist for good tech stocks. Ultimately, I am still a "buy" growth (companies with good balance sheet and already generating positive operating cashflow and profit). Should such companies come along at good discount where I can still play the long game, I will buy.

A support level that I will look at is whether Nasdaq 100 will find support at around 15300 to 15500.

As always, this should not be construed as any investment or trading advice.

$Grab Holdings (GRAB.US)$ $UP Fintech (TIGR.US)$ $Futu Holdings Ltd (FUTU.US)$ $TENCENT (00700.HK)$ $Upstart (UPST.US)$ $Cloudflare (NET.US)$ $Sea (SE.US)$ $HUYA Inc (HUYA.US)$ $NetEase (NTES.US)$ $DocuSign (DOCU.US)$ $Etsy Inc (ETSY.US)$

Youtube video on Nasdaq 100's prediction:-

https://www.youtube.com/watch?v=bH7IG5UR0NQ

Since then, Nasdaq 100 future had hit 16,200 before coming down to around 15300 and then retest 16100 and coming down to around 15800 (all based on my memory) before retesting around 16800 and coming down to around 15800 and retesting 16100 then back down to 15800 and then 16450 and now at the level of around 15860...

(I have not went to check back the chart but rather this is based on my memory)

This price action certainly indicates that the bulls and bears of tech stocks are uncertain about how the interest rate hike is going to impact on growth stocks.

When uncertainty emerges and narratives over interest rate hike and growth stocks happen, this will sure happen. What would I do now?

Ultimately, pricing and valuation matter alot more these days and the back to basic valuation rather than narratives will sway price movements. I will continue to update my list of watchlist for good tech stocks. Ultimately, I am still a "buy" growth (companies with good balance sheet and already generating positive operating cashflow and profit). Should such companies come along at good discount where I can still play the long game, I will buy.

A support level that I will look at is whether Nasdaq 100 will find support at around 15300 to 15500.

As always, this should not be construed as any investment or trading advice.

$Grab Holdings (GRAB.US)$ $UP Fintech (TIGR.US)$ $Futu Holdings Ltd (FUTU.US)$ $TENCENT (00700.HK)$ $Upstart (UPST.US)$ $Cloudflare (NET.US)$ $Sea (SE.US)$ $HUYA Inc (HUYA.US)$ $NetEase (NTES.US)$ $DocuSign (DOCU.US)$ $Etsy Inc (ETSY.US)$

30

2

Edinburg

reacted to

$Invesco QQQ Trust (QQQ.US)$ $S&P 500 Index (.SPX.US)$ Thoughts?

“Reported inflation is understated. Owners’ Equivalent Rent (OER) relies on owner surveys to estimate inflation in housing costs. This is an extremely imprecise metric. The single family rental market provides more accurate data. OER in today’s reported core CPI was 3.5% YoY.

The largest owners of nationwide single family rentals are reporting 17% YoY rent increases. OER is 30% of the Core CPI calculation and 24% of reported CPI. Using the more empirical measure in the calculation increases today’s Core CPI from 4.9% to 9.0% and CPI from 6.8% to 10.1%

Housing inflation is unlikely to abate based on supply and demand trends. The inflation that households are actually experiencing is raging and well in excess of reported gov’t statistics.”

“Reported inflation is understated. Owners’ Equivalent Rent (OER) relies on owner surveys to estimate inflation in housing costs. This is an extremely imprecise metric. The single family rental market provides more accurate data. OER in today’s reported core CPI was 3.5% YoY.

The largest owners of nationwide single family rentals are reporting 17% YoY rent increases. OER is 30% of the Core CPI calculation and 24% of reported CPI. Using the more empirical measure in the calculation increases today’s Core CPI from 4.9% to 9.0% and CPI from 6.8% to 10.1%

Housing inflation is unlikely to abate based on supply and demand trends. The inflation that households are actually experiencing is raging and well in excess of reported gov’t statistics.”

184

11

2

Edinburg

reacted to

$Palantir (PLTR.US)$ has quite an interesting story. This company is often regarded as the most secretive startup in Silicon Valley. The firm started building cutting-edge software platforms for the CIA and FBI. Furthermore, the CIA and Pentagon deployed Palantir's platform in Afghanistan and Iraq. It also allegedly helped to track and locate Osama Bin Laden.

Sounds kind of cool. For retail investors, Palantir is a company investors have found a reason to jump on. This year, PLTR stock surged during the previous meme stock rally to hit $45 per share. However, like many meme stocks, Palantir has since fallen back to earth.

For many retail investors, this discount may seem intriguing. Personally, I remain neutral on PLTR stock right now. (See Analysts' Top Stocks on TipRanks)

Let's dive into the bull and bear case around this stock.

Impressive Growth Not Enough for the Market

One of the key bull theses driving interest in Palantir is the company's growth prospects moving forward. This software and analytics company has a business model at the intersection of growth and stability that many long-term investors like.

Palantir focuses on providing high-value customers (we'll discuss that more in a second) with meaningful insights via software analytics tools based on big data and AI. Thus, Palantir's success in generating market-beating revenue growth could signal that a strong, long-term cash flow machine is right around the corner.

Now, Palantir has not been consistently profitable, ever. This is a company that's continued investing heavily in its platform at the expense of profit. However, recent earnings suggest the tide may be turning on this front as well.

This past quarter, Palantir brought in $0.04 per share in earnings, meeting analyst expectations. It's earning a profit – a good sign for long-term investors looking at this stock.

However, on the top line, Palantir beat expectations, bringing in $392 million versus an estimated $385 million. That translates to 36% year-over-year growth. Certainly, not bad, particularly for a company of this size.

That said, PLTR stock sold off dramatically following this earnings report. It should be noted that investors had bid up shares prior to the report. Accordingly, it appears the market was pricing in some sort of massive beat this past quarter, which didn't materialize.

This sort of volatile price action has made Palantir a stock that's hard to intrinsically value. On the one hand, market sentiment shifts continue to provide volatile swings to the upside and the downside. With momentum driving shares all over the map, PLTR stock looks more like a trading vehicle right now than a long-term hold.

For those taking the longer view with PLTR stock, perhaps this volatility doesn't matter in the grand scheme of things. However, for those looking to hold this stock for a limited period of time, continued volatility will be something to watch with Palantir in the quarters to come.

Revenue Mix a Key Driver of Interest in Palantir

Another one of the key factors investors seem to like with Palantir is the company's client mix. Unlike many large corporations, which ultimately sell their goods to consumers or other large businesses, Palantir's focus has been on growing its revenue from government agencies.

As of the second quarter of this year, the

Revenue mix as of Q2

Having the U.S. government as the company's core client is generally seen as a good thing. The government will pay its bills and has unlimited resources to do so. However, one misstep and this whole game could be over should the government switch its software analytics provider.

It should be noted that this relationship between Palantir and the government appears to be pretty entrenched. Switching costs are likely very high at this point, and there seems to be a relatively wide moat around Palantir's core customer base. For bulls, this is a good thing.

Overall, Palantir's inability to provide profitable growth over many years has some investors worried about its pricing power with its core customer. Growth is great, but doing so profitably is important. Thus, the extent to which new contracts can be negotiated at better rates remains a key factor investors should keep an eye on.

Wall Street's Take

Turning to Wall Street, Palantir has a Moderate Sell consensus rating, based on one Buy, three Holds, and four Sells assigned in the past three months. The average Palantir price target of $23.14 implies 11.5% upside potential.

Analyst price targets range from a high of $31 per share to a low of $18 per share.

Bottom Line

The hopes for Palantir are high as a "best in breed" player in the field of data analytics, data mining, and security services. With the U.S. government as Palantir's biggest client, what could go wrong? This is a company that continues to grow its top line quickly, providing bulls with a strong investment thesis today.

However, bears seem to be vindicated in their view that this company's earnings potential remains muted. On a forward-looking price-to-earnings valuation basis, this stock is expensive. Accordingly, Palantir has work to do on its bottom line before many fundamental investors jump aboard.

Sounds kind of cool. For retail investors, Palantir is a company investors have found a reason to jump on. This year, PLTR stock surged during the previous meme stock rally to hit $45 per share. However, like many meme stocks, Palantir has since fallen back to earth.

For many retail investors, this discount may seem intriguing. Personally, I remain neutral on PLTR stock right now. (See Analysts' Top Stocks on TipRanks)

Let's dive into the bull and bear case around this stock.

Impressive Growth Not Enough for the Market

One of the key bull theses driving interest in Palantir is the company's growth prospects moving forward. This software and analytics company has a business model at the intersection of growth and stability that many long-term investors like.

Palantir focuses on providing high-value customers (we'll discuss that more in a second) with meaningful insights via software analytics tools based on big data and AI. Thus, Palantir's success in generating market-beating revenue growth could signal that a strong, long-term cash flow machine is right around the corner.

Now, Palantir has not been consistently profitable, ever. This is a company that's continued investing heavily in its platform at the expense of profit. However, recent earnings suggest the tide may be turning on this front as well.

This past quarter, Palantir brought in $0.04 per share in earnings, meeting analyst expectations. It's earning a profit – a good sign for long-term investors looking at this stock.

However, on the top line, Palantir beat expectations, bringing in $392 million versus an estimated $385 million. That translates to 36% year-over-year growth. Certainly, not bad, particularly for a company of this size.

That said, PLTR stock sold off dramatically following this earnings report. It should be noted that investors had bid up shares prior to the report. Accordingly, it appears the market was pricing in some sort of massive beat this past quarter, which didn't materialize.

This sort of volatile price action has made Palantir a stock that's hard to intrinsically value. On the one hand, market sentiment shifts continue to provide volatile swings to the upside and the downside. With momentum driving shares all over the map, PLTR stock looks more like a trading vehicle right now than a long-term hold.

For those taking the longer view with PLTR stock, perhaps this volatility doesn't matter in the grand scheme of things. However, for those looking to hold this stock for a limited period of time, continued volatility will be something to watch with Palantir in the quarters to come.

Revenue Mix a Key Driver of Interest in Palantir

Another one of the key factors investors seem to like with Palantir is the company's client mix. Unlike many large corporations, which ultimately sell their goods to consumers or other large businesses, Palantir's focus has been on growing its revenue from government agencies.

As of the second quarter of this year, the

Revenue mix as of Q2

Having the U.S. government as the company's core client is generally seen as a good thing. The government will pay its bills and has unlimited resources to do so. However, one misstep and this whole game could be over should the government switch its software analytics provider.

It should be noted that this relationship between Palantir and the government appears to be pretty entrenched. Switching costs are likely very high at this point, and there seems to be a relatively wide moat around Palantir's core customer base. For bulls, this is a good thing.

Overall, Palantir's inability to provide profitable growth over many years has some investors worried about its pricing power with its core customer. Growth is great, but doing so profitably is important. Thus, the extent to which new contracts can be negotiated at better rates remains a key factor investors should keep an eye on.

Wall Street's Take

Turning to Wall Street, Palantir has a Moderate Sell consensus rating, based on one Buy, three Holds, and four Sells assigned in the past three months. The average Palantir price target of $23.14 implies 11.5% upside potential.

Analyst price targets range from a high of $31 per share to a low of $18 per share.

Bottom Line

The hopes for Palantir are high as a "best in breed" player in the field of data analytics, data mining, and security services. With the U.S. government as Palantir's biggest client, what could go wrong? This is a company that continues to grow its top line quickly, providing bulls with a strong investment thesis today.

However, bears seem to be vindicated in their view that this company's earnings potential remains muted. On a forward-looking price-to-earnings valuation basis, this stock is expensive. Accordingly, Palantir has work to do on its bottom line before many fundamental investors jump aboard.

37

2

1

Edinburg

reacted to

Stop timing the market! Take profits when you can.

The market will always fluctuate. Good things only happen when we least expect it. Just because the stock is dropping a lot doesn't mean it will rise the next day.

A lot of factors come into play. As long as you do your due diligence to research about the company, you will stay fine!

.

Also, take profits when you can. Most of the time, stocks rise very high due to a sheer number of people trying to short it. After the short, the stock will start crashing. Take profits and leave. You are bound to feel disappointed when you see the stock continuing to rise but at least you know you earned.

.

Lastly, if you are losing a lot in the stocks you are holding, do consider holding for long term or just reinvesting the money into growth stocks. It is always good to cut losses.

.

$Sea (SE.US)$

$Tesla (TSLA.US)$

$Moderna (MRNA.US)$

The market will always fluctuate. Good things only happen when we least expect it. Just because the stock is dropping a lot doesn't mean it will rise the next day.

A lot of factors come into play. As long as you do your due diligence to research about the company, you will stay fine!

.

Also, take profits when you can. Most of the time, stocks rise very high due to a sheer number of people trying to short it. After the short, the stock will start crashing. Take profits and leave. You are bound to feel disappointed when you see the stock continuing to rise but at least you know you earned.

.

Lastly, if you are losing a lot in the stocks you are holding, do consider holding for long term or just reinvesting the money into growth stocks. It is always good to cut losses.

.

$Sea (SE.US)$

$Tesla (TSLA.US)$

$Moderna (MRNA.US)$

47

4

1

Edinburg

reacted to

I will cover a topic on supply chain and inflation in due course on my YouTube channel: Hopehope赋予希望

https://youtube.com/channel/UCAPWOEQKCpCWmzKkdo7v-iw

too many people try to comment on inflation without even doing the research...

Stay tuned and subscribed if you like my research and analysis.

Nevertheless, I will be quite busy this week and may not have the time to research so much so do keep the notification button on for YouTube if you like to be kept updated promptly when I released my video

$IPATH GS CRUDE OIL TOTAL RET INDEX (OIL.US)$ $NIO Inc (NIO.US)$ $Tesla (TSLA.US)$ $Pfizer (PFE.US)$ $JD-SW (09618.HK)$ $BABA-W (09988.HK)$ $Microsoft (MSFT.US)$ $Apple (AAPL.US)$ $Metalore Resources Ltd (MET.CA)$ $Meta Platforms (FB.US)$ $HUYA Inc (HUYA.US)$ $Amazon (AMZN.US)$ $E-mini NASDAQ 100 Futures(MAR5) (NQmain.US)$ $Beyond Meat (BYND.US)$ $Upstart (UPST.US)$

https://youtube.com/channel/UCAPWOEQKCpCWmzKkdo7v-iw

too many people try to comment on inflation without even doing the research...

Stay tuned and subscribed if you like my research and analysis.

Nevertheless, I will be quite busy this week and may not have the time to research so much so do keep the notification button on for YouTube if you like to be kept updated promptly when I released my video

$IPATH GS CRUDE OIL TOTAL RET INDEX (OIL.US)$ $NIO Inc (NIO.US)$ $Tesla (TSLA.US)$ $Pfizer (PFE.US)$ $JD-SW (09618.HK)$ $BABA-W (09988.HK)$ $Microsoft (MSFT.US)$ $Apple (AAPL.US)$ $Metalore Resources Ltd (MET.CA)$ $Meta Platforms (FB.US)$ $HUYA Inc (HUYA.US)$ $Amazon (AMZN.US)$ $E-mini NASDAQ 100 Futures(MAR5) (NQmain.US)$ $Beyond Meat (BYND.US)$ $Upstart (UPST.US)$

18

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)