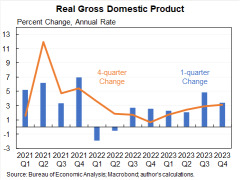

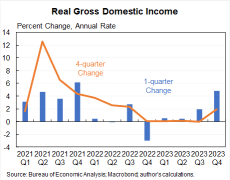

The final reading of US Q4 2023 GDP comes in at 3.4%, above expectations of 3.2%.

This officially marks 6 consecutive quarters of positive GDP growth.

We have not had 2 consecutive quarters with declining GDP since Q2 2022.

Is the Fed on track for a soft landing?![]()

![]() $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

This officially marks 6 consecutive quarters of positive GDP growth.

We have not had 2 consecutive quarters with declining GDP since Q2 2022.

Is the Fed on track for a soft landing?

4

1

Waller is a Board governor and thus a voter at the Federal Open Market Committee (FOMC).

Federal Reserve Board Governor Christopher Waller

![]() 'Still no rush' to cutting rates in current economy

'Still no rush' to cutting rates in current economy

![]() Fed may need to maintain current rate target for longer than expected

Fed may need to maintain current rate target for longer than expected

![]() Needs to see more inflation progress before supporting rate cut

Needs to see more inflation progress before supporting rate cut

![]() Needs at least a couple of months of data to be sure inflation heading to 2%

Needs at least a couple of months of data to be sure inflation heading to 2%

![]() Still...

Still...

Federal Reserve Board Governor Christopher Waller

1

US markets, along with UK and EU, will be closed on Good Friday, 29 March 2024.

Stocks, futures, bonds, all closed.

A few FX desks may be manned with a skeleton crew. Liquidity will be super-thin. Spreads will be wide.

Against that backdrop, the good news is the all-important PCE inflation data for February will be released! What is this? More on it below.

Oh yeah, Powell will be on deck with comments too. At...

Stocks, futures, bonds, all closed.

A few FX desks may be manned with a skeleton crew. Liquidity will be super-thin. Spreads will be wide.

Against that backdrop, the good news is the all-important PCE inflation data for February will be released! What is this? More on it below.

Oh yeah, Powell will be on deck with comments too. At...

1

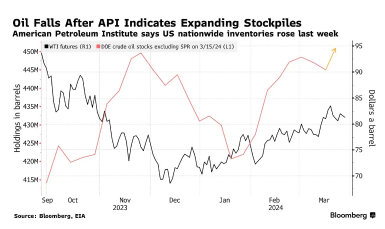

Oil prices fall as API reports a 9.3 million barrel surge in US stockpiles, amidst broader market weakness and geopolitical tensions.

Key Takeaway

Oil prices fell, with Brent crude below $86 and WTI near $81, after an API report showed a 9.3 million barrel US stockpile increase.

The potential largest weekly gain in Cushing's crude levels since January 2023 contrasts with an eighth consecutive week of gasoline inventory declines.

Geopolitical t...

Key Takeaway

Oil prices fell, with Brent crude below $86 and WTI near $81, after an API report showed a 9.3 million barrel US stockpile increase.

The potential largest weekly gain in Cushing's crude levels since January 2023 contrasts with an eighth consecutive week of gasoline inventory declines.

Geopolitical t...

3

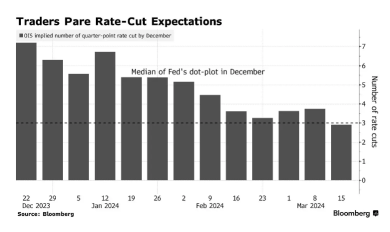

Federal Reserve (Fed) Bank of Atlanta President Raphael Bostic said on Friday that he expected just one interest rate cut this year instead of the two rate cuts he had forecast, citing persistent inflation and stronger-than-anticipated economic data.

Key quotes

![]() “Economy has proved more resilient than anticipated so much so that he's doubled his expected GFP growth estimate to 2%.”

“Economy has proved more resilient than anticipated so much so that he's doubled his expected GFP growth estimate to 2%.”

![]() “Sees little or no change in the current 3.9% unemployment...

“Sees little or no change in the current 3.9% unemployment...

Key quotes

4

1

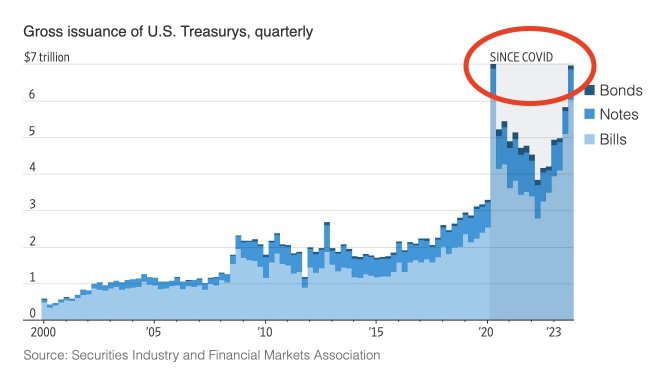

Issuances of US Treasuries are now at pandemic levels:

We saw nearly $7 trillion in gross issuances of US Treasures in just 3 months during 2023.

For the entire year of 2023, a whopping $23 TRILLION in US Treasuries were issued.

US federal debt is rising by $1 trillion every 90 days right now.

US government spending as a percentage of GDP is at World War 2 levels.

Why are Treasury issuances and deficits at record levels if we are on track for a "soft landing?"

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

We saw nearly $7 trillion in gross issuances of US Treasures in just 3 months during 2023.

For the entire year of 2023, a whopping $23 TRILLION in US Treasuries were issued.

US federal debt is rising by $1 trillion every 90 days right now.

US government spending as a percentage of GDP is at World War 2 levels.

Why are Treasury issuances and deficits at record levels if we are on track for a "soft landing?"

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

1

- $FedEx (FDX.US)$ jumps on Q3 profit beat

- $Nike (NKE.US)$ falls after revenue forecast disappoints

- Indexes: $Dow Jones Industrial Average (.DJI.US)$ down 0.77%, $S&P 500 Index (.SPX.US)$ down 0.14%, $Nasdaq Composite Index (.IXIC.US)$ up 0.16%

What a week for the markets!

The S&P 500 stayed relatively flat on Friday, but it scored its largest weekly gain of 2024. The Federal Reserve stuck with its projections for three interest r...

- $Nike (NKE.US)$ falls after revenue forecast disappoints

- Indexes: $Dow Jones Industrial Average (.DJI.US)$ down 0.77%, $S&P 500 Index (.SPX.US)$ down 0.14%, $Nasdaq Composite Index (.IXIC.US)$ up 0.16%

What a week for the markets!

The S&P 500 stayed relatively flat on Friday, but it scored its largest weekly gain of 2024. The Federal Reserve stuck with its projections for three interest r...

4

Key Highlights:

📍 Federal Reserve keeps interest rates steady at 5.25%-5.5%.

📍 Signals three quarter-point rate cuts by end of 2024, first since March 2020.

📍 Current rate is the highest in over 23 years, influencing various consumer debts.

📍 "Dot plot" projections indicate future rate reductions, with eventual settling around 2.6%.

📍 GDP growth projection for 2024 upgraded to 2.1%, with a slight adjustment in unemployment to 4%.

📍 Core ...

📍 Federal Reserve keeps interest rates steady at 5.25%-5.5%.

📍 Signals three quarter-point rate cuts by end of 2024, first since March 2020.

📍 Current rate is the highest in over 23 years, influencing various consumer debts.

📍 "Dot plot" projections indicate future rate reductions, with eventual settling around 2.6%.

📍 GDP growth projection for 2024 upgraded to 2.1%, with a slight adjustment in unemployment to 4%.

📍 Core ...

3

Fed's Rate Cut Forecast for 2024 Spurs Market Optimism, Pushing S&P 500 Past 5,200 Amid Falling Yields🤑🤭🙌📈

Powell's Job Is Done.

Key Takeaway

🤑Fed's forecast of three rate cuts in 2024 boosts stocks, with S&P 500 hitting 5,200 and Nasdaq up by 1%.

🤑Market analysts view Fed's announcement as dovish, predicting benefits for high-quality fixed income bonds and possible rate cuts by June.

🤑Despite higher inflation forecasts, the Fed's nuanced policy s...

Powell's Job Is Done.

Key Takeaway

🤑Fed's forecast of three rate cuts in 2024 boosts stocks, with S&P 500 hitting 5,200 and Nasdaq up by 1%.

🤑Market analysts view Fed's announcement as dovish, predicting benefits for high-quality fixed income bonds and possible rate cuts by June.

🤑Despite higher inflation forecasts, the Fed's nuanced policy s...

+1

10

API Inventory Moves

Crude oil -1.519 million (exp. +77,000)

Gasoline -1.574 million

Distillates +512,000

Cushing +325,000

SPR +.7 million

$Occidental Petroleum (OXY.US)$ $Chevron (CVX.US)$ $Exxon Mobil (XOM.US)$

Crude oil -1.519 million (exp. +77,000)

Gasoline -1.574 million

Distillates +512,000

Cushing +325,000

SPR +.7 million

$Occidental Petroleum (OXY.US)$ $Chevron (CVX.US)$ $Exxon Mobil (XOM.US)$

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)