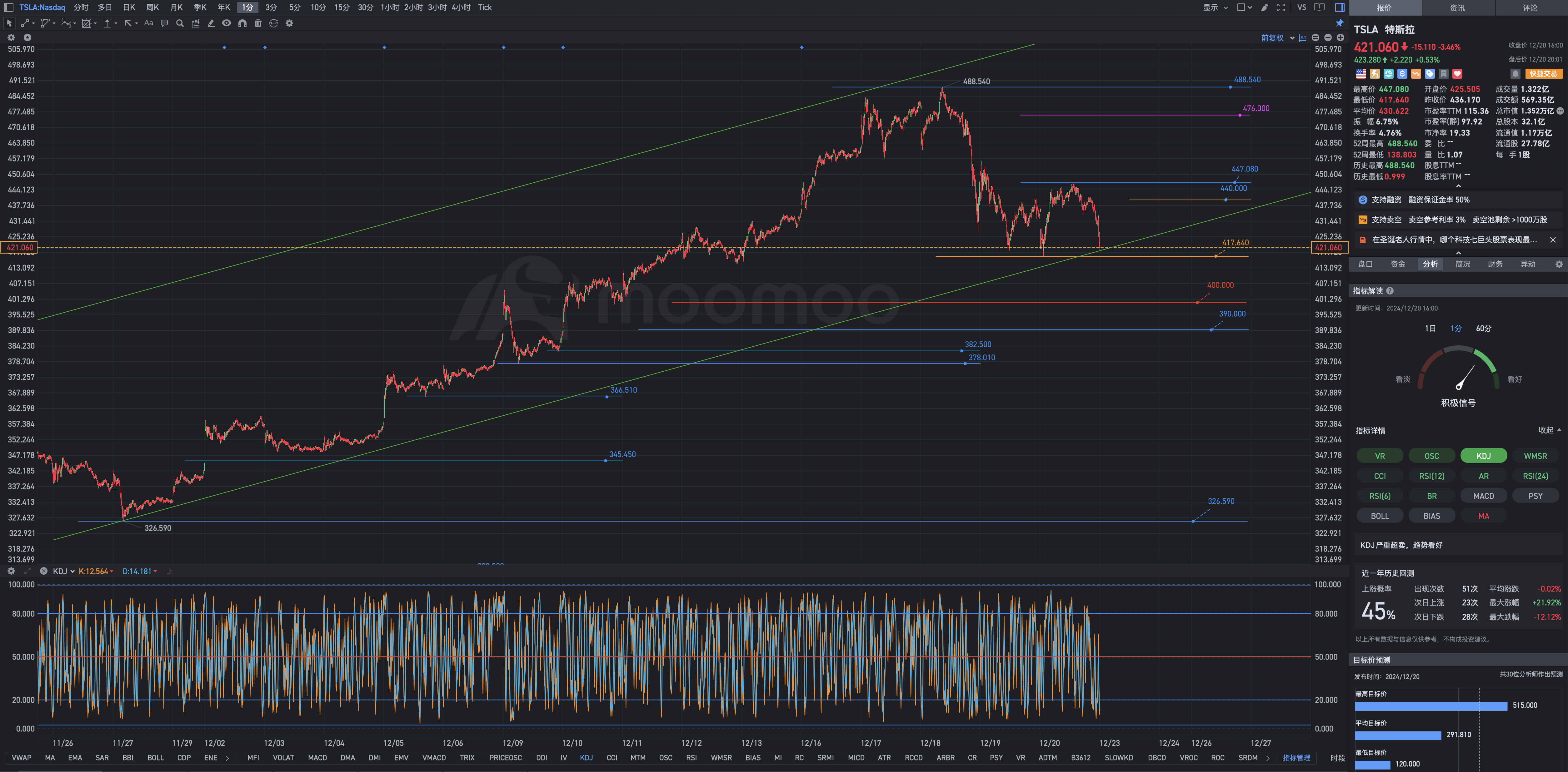

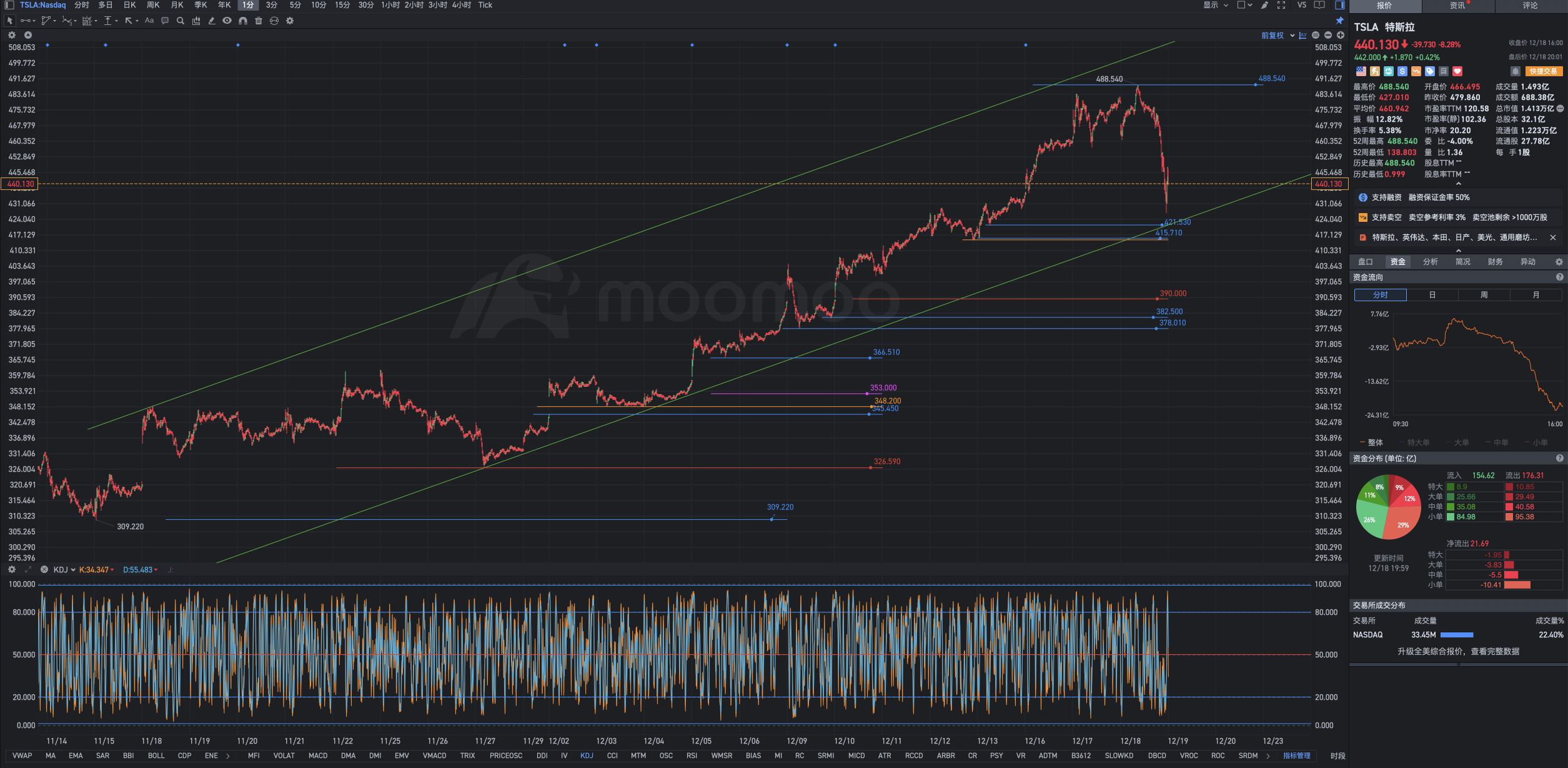

$Tesla (TSLA.US)$

Musk’s Trump Trade Makes Tesla a Winner With a $570 billion rally.

What triggered the turnaround? The company had nothing, demand for cars remained unstable, and the future seemed increasingly uncertain. Instead, investors view it as Elon Musk's political masterpiece, actively supporting then-President-elect Donald Trump during the election and playing an unofficial role in his administration.

What happened that led to this turnaround? The company had nothing going for it, the demand for cars remained unstable, and the future seemed more and more uncertain. Instead, investors see it as Elon Musk's political masterpiece, actively supporting the elected President Donald Trump during the election and having an unofficial role in his government.

"How do you value the fact that Musk has in-depth contact with the upcoming government?" said Steve Sosnick, Chief Strategist at Interactive Brokers. "You can almost assign any number to it."

Investors seem to be doing this. Before the US presidential election, Tesla's stock price has fallen 2.3% this year. Since the election day, they have risen by 73% and by 69% by 2024. This means that in less than two months, this electric...

Musk’s Trump Trade Makes Tesla a Winner With a $570 billion rally.

What triggered the turnaround? The company had nothing, demand for cars remained unstable, and the future seemed increasingly uncertain. Instead, investors view it as Elon Musk's political masterpiece, actively supporting then-President-elect Donald Trump during the election and playing an unofficial role in his administration.

What happened that led to this turnaround? The company had nothing going for it, the demand for cars remained unstable, and the future seemed more and more uncertain. Instead, investors see it as Elon Musk's political masterpiece, actively supporting the elected President Donald Trump during the election and having an unofficial role in his government.

"How do you value the fact that Musk has in-depth contact with the upcoming government?" said Steve Sosnick, Chief Strategist at Interactive Brokers. "You can almost assign any number to it."

Investors seem to be doing this. Before the US presidential election, Tesla's stock price has fallen 2.3% this year. Since the election day, they have risen by 73% and by 69% by 2024. This means that in less than two months, this electric...

Translated

+23

4

$Tesla (TSLA.US)$

In a person's life, the most glorious day is not the day of success, but the day when the desire to challenge life arises from sorrow and despair, and bravely moves towards this challenge. - Gustave Flaubert

In a person's life, the most glorious day is not the day when he becomes famous, but the day when the desire to challenge life arises from lamentation and despair, and the day when he bravely steps towards this challenge. ——Flaubert

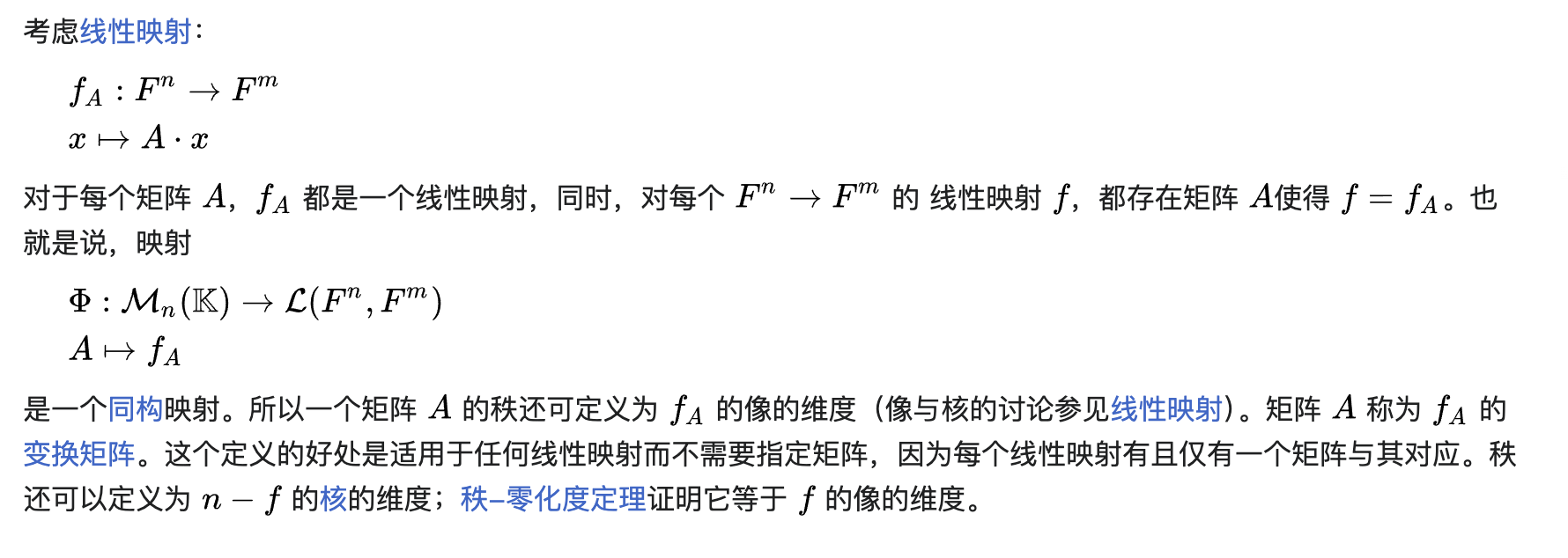

The row rank and column rank of a matrix are equal, an important part of the fundamental theorem of linear algebra. The basic proof idea is that a matrix can be seen as the transformation matrix of a linear mapping, where the column rank is the dimension of the image space, and the row rank is the dimension of the non-zero preimage space. Therefore, the column rank is equal to the row rank, which means the dimension of the image space is equal to the dimension of the non-zero preimage space (here, the non-zero preimage space refers to the quotient space obtained after removing the zero space: the preimage space). This can be seen from the matrix singular value decomposition.

Provide two proofs of this result...

In a person's life, the most glorious day is not the day of success, but the day when the desire to challenge life arises from sorrow and despair, and bravely moves towards this challenge. - Gustave Flaubert

In a person's life, the most glorious day is not the day when he becomes famous, but the day when the desire to challenge life arises from lamentation and despair, and the day when he bravely steps towards this challenge. ——Flaubert

The row rank and column rank of a matrix are equal, an important part of the fundamental theorem of linear algebra. The basic proof idea is that a matrix can be seen as the transformation matrix of a linear mapping, where the column rank is the dimension of the image space, and the row rank is the dimension of the non-zero preimage space. Therefore, the column rank is equal to the row rank, which means the dimension of the image space is equal to the dimension of the non-zero preimage space (here, the non-zero preimage space refers to the quotient space obtained after removing the zero space: the preimage space). This can be seen from the matrix singular value decomposition.

Provide two proofs of this result...

Translated

+1

1

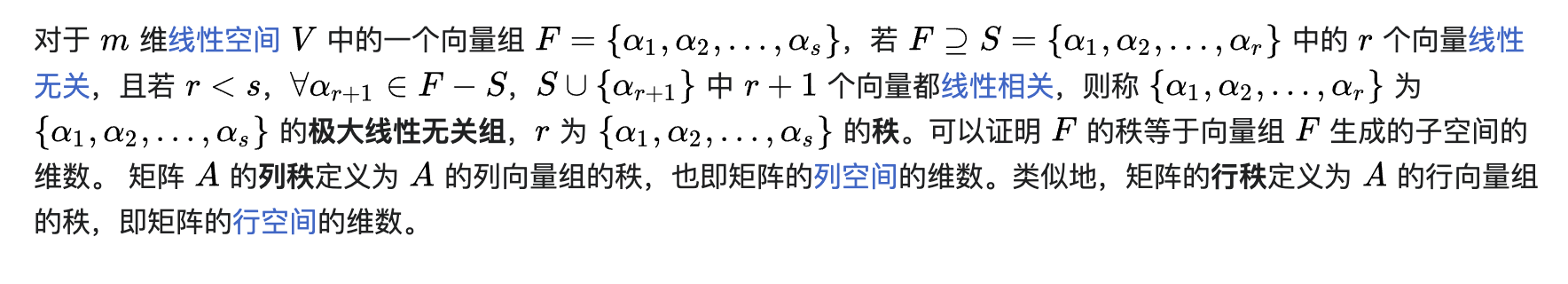

$Tesla (TSLA.US)$

Given a differentiable function f from Rm to Rn, the critical points of f are those points such that the Jacobian matrix of f has rank less than n. The image of a critical point under f is called a critical value. A point is called a regular value if it lies in the complement of the set of all critical values. By Sard's theorem, the set of critical values of a smooth function is a set of zero measure. In particular, there are finite critical values in ...

Given a differentiable function f from Rm to Rn, the critical points of f are those points such that the Jacobian matrix of f has rank less than n. The image of a critical point under f is called a critical value. A point is called a regular value if it lies in the complement of the set of all critical values. By Sard's theorem, the set of critical values of a smooth function is a set of zero measure. In particular, there are finite critical values in ...

+8

1

$Tesla (TSLA.US)$

The ability of a person to see the symbol is a combination of experience, training, and demand.

When sad, one must learn to be silent, otherwise the future will be filled with laughter.

On the branches of memory, who doesn't have two or three graceful flowers, blooming with emotions.

Lack of patience, will miss the best opportunity; lack of patience, will not wait for the most appropriate moment.

Not being on the same channel, unable to communicate. Continuing like this, will only hurt each other?

A person's ability to see objects is a combination of experience, training, and needs.

Learn to be silent when you are sad, otherwise you will be a laughing stock in the future.

On the stalk of memory, who doesn't have two or three graceful flowers, covered with emotional flowers.

If you lack patience ...

The ability of a person to see the symbol is a combination of experience, training, and demand.

When sad, one must learn to be silent, otherwise the future will be filled with laughter.

On the branches of memory, who doesn't have two or three graceful flowers, blooming with emotions.

Lack of patience, will miss the best opportunity; lack of patience, will not wait for the most appropriate moment.

Not being on the same channel, unable to communicate. Continuing like this, will only hurt each other?

A person's ability to see objects is a combination of experience, training, and needs.

Learn to be silent when you are sad, otherwise you will be a laughing stock in the future.

On the stalk of memory, who doesn't have two or three graceful flowers, covered with emotional flowers.

If you lack patience ...

Translated

8

1

1

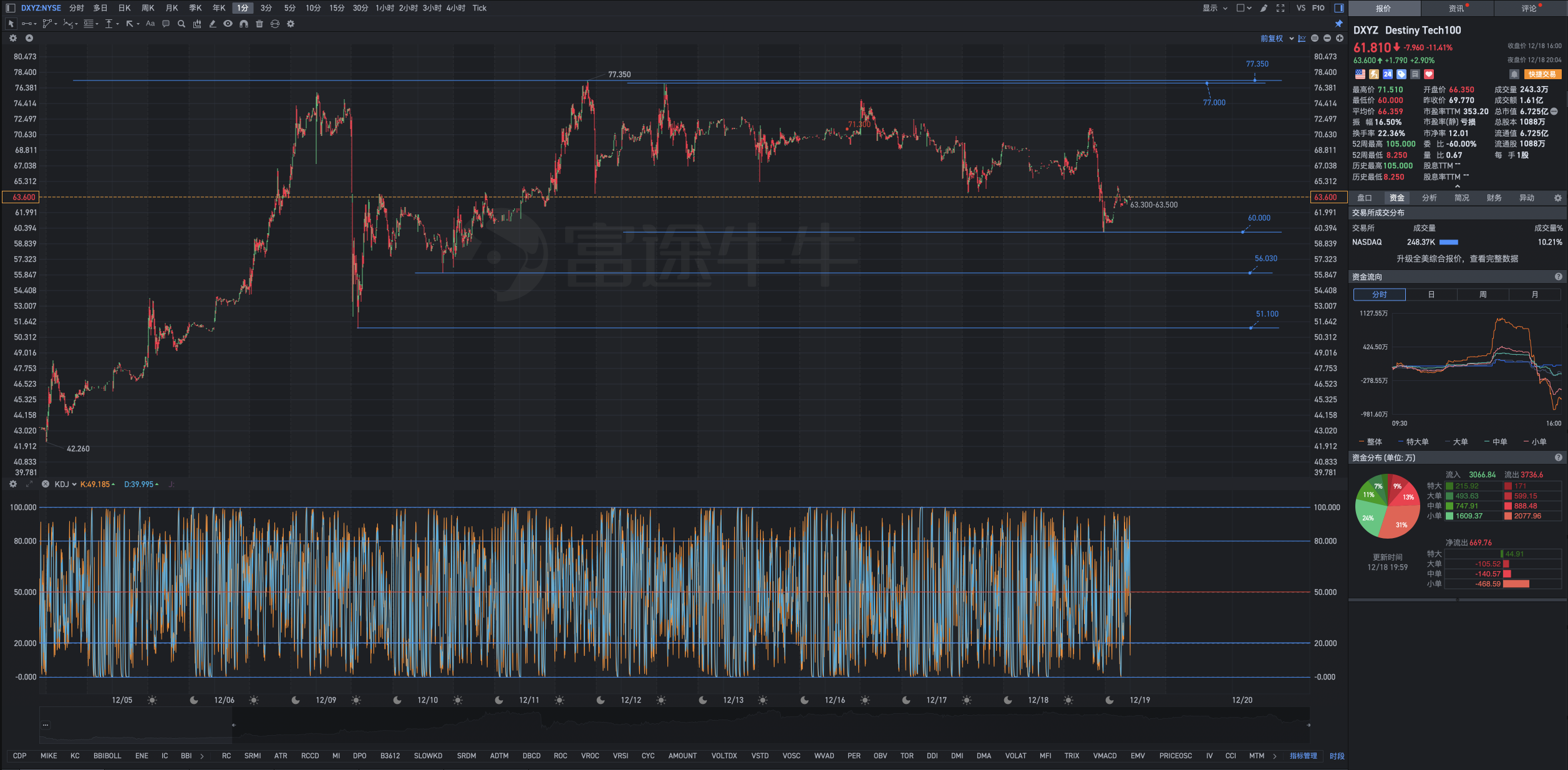

$Destiny Tech100 (DXYZ.US)$

Buy when falling, do not buy when rising; sell when rising, do not sell when falling.

Kill more PE, more is better.

Buy when falling, do not buy when rising; sell when rising, do not sell when falling.

Kill more PE, more is better.

Translated

5

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)