Elon Mars

voted

Recent weeks have witnessed notable market fluctuations due to a confluence of factors, including corporate earnings releases, economic indicators, and political events. Amidst this tumultuous backdrop, August stands out as a month teeming with key topics and decisions that could shape the trajectory of global markets. Investors are observing the Federal Reserve's annual Jackson Hole symposium with interest, staying informed on politic...

53

12

10

Elon Mars

voted

Hi, mooers!

Kucingko Bhd is expected to officially start trading on July 26. According to the animation production house company, it has received 21,929 applications for 2.5 billion shares, far exceeding the 25 million shares available for public subscription.

How will the market react to the IPO results? Make your guess now!![]()

🎁 Rewards:

● An equal share of 3,000 points: Predict the percentage change in Kucingko's closing pr...

Kucingko Bhd is expected to officially start trading on July 26. According to the animation production house company, it has received 21,929 applications for 2.5 billion shares, far exceeding the 25 million shares available for public subscription.

How will the market react to the IPO results? Make your guess now!

🎁 Rewards:

● An equal share of 3,000 points: Predict the percentage change in Kucingko's closing pr...

106

110

18

bhb

Translated

Elon Mars

voted

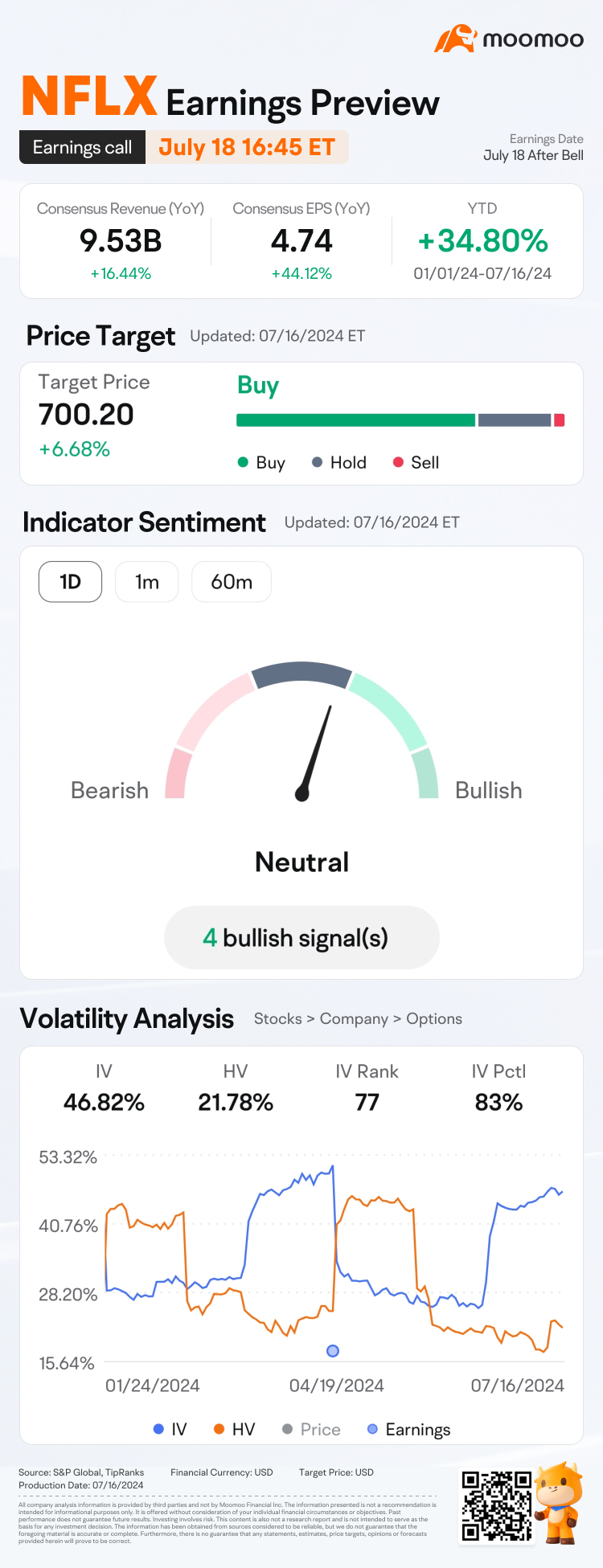

$Netflix (NFLX.US)$ is releasing its Q2 earnings on July 18 after the bell. Unlock insights with NFLX Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Netflix (NFLX.US)$ have seen an increase of 6.95%.![]() How will the market react to the upcoming results? Make your guess now!

How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the...

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Netflix (NFLX.US)$ have seen an increase of 6.95%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the...

Expand

Expand 97

165

15

Elon Mars

commented on

Elon Mars

reacted to

We used to have FAANG ... currently we have the magnificent 7 ... may I introduce you to what's next (Thoughts?)

MEATMAAN

Microsoft $Microsoft (MSFT.US)$

Eli Lilly $Eli Lilly and Co (LLY.US)$

Apple $Apple (AAPL.US)$

Tesla $Tesla (TSLA.US)$

Meta $Meta Platforms (META.US)$

Amazon $Amazon (AMZN.US)$

Alphabet $Alphabet-A (GOOGL.US)$

Nvidia $NVIDIA (NVDA.US)$

MEATMAAN

Microsoft $Microsoft (MSFT.US)$

Eli Lilly $Eli Lilly and Co (LLY.US)$

Apple $Apple (AAPL.US)$

Tesla $Tesla (TSLA.US)$

Meta $Meta Platforms (META.US)$

Amazon $Amazon (AMZN.US)$

Alphabet $Alphabet-A (GOOGL.US)$

Nvidia $NVIDIA (NVDA.US)$

9

1

Elon Mars

commented on and voted

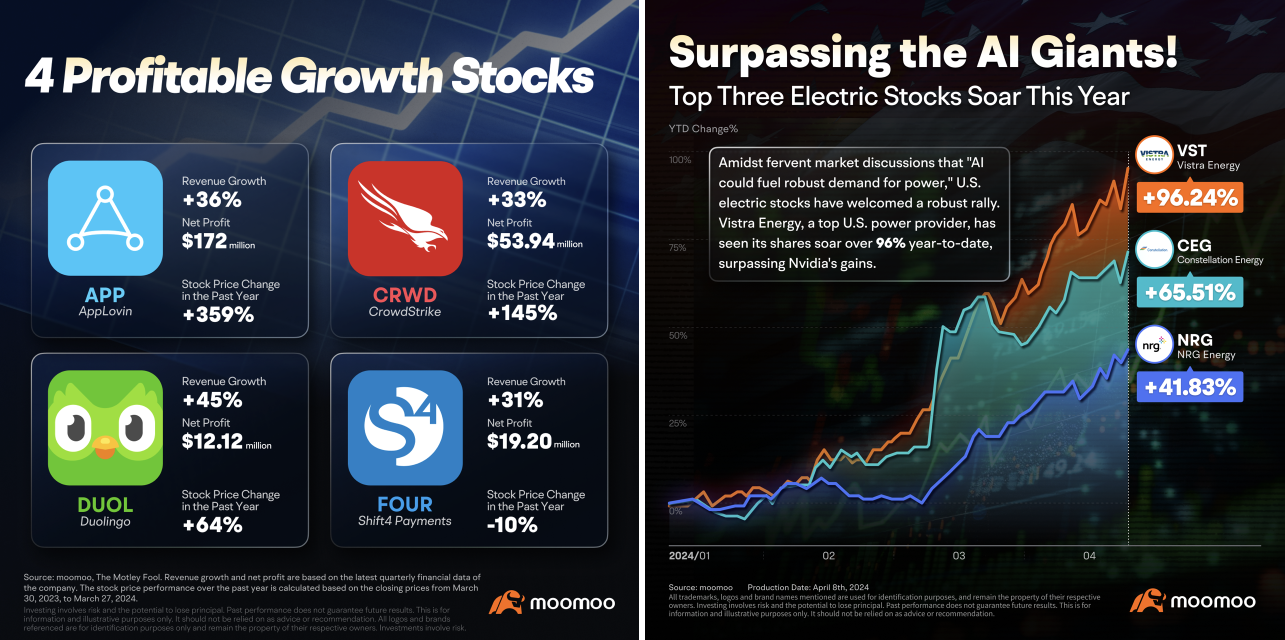

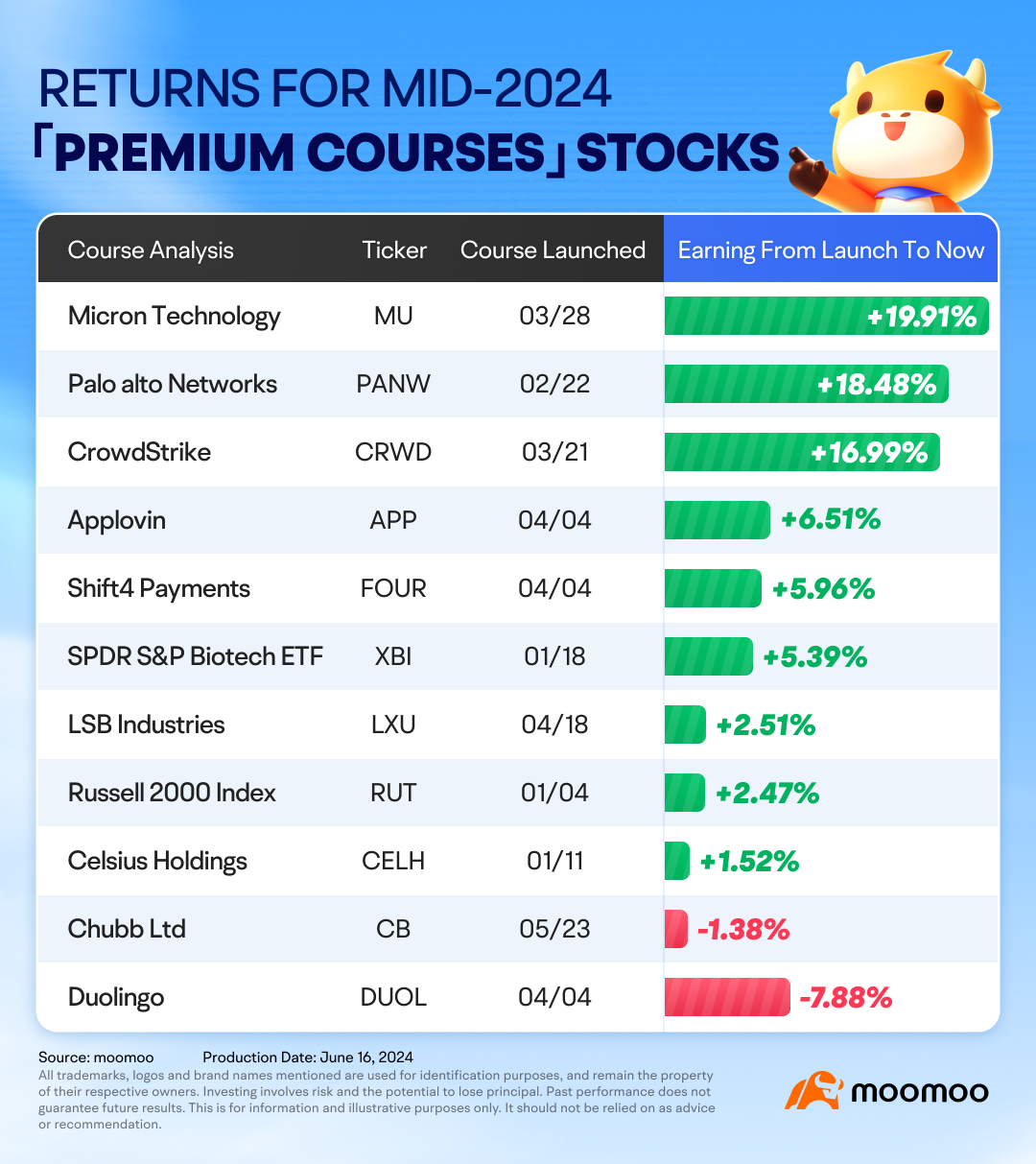

The U.S. stock market has hit new highs again! Congrats!👏 If you started investing in the US market at the beginning of the year and haven't made any major mistakes, you've probably seen some gains! 🎉

As we hit the mid-year mark, let's take a look back at our Premium Learning journey. Driven by AI and major tech stocks, the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ have repeatedly reached new highs over...

As we hit the mid-year mark, let's take a look back at our Premium Learning journey. Driven by AI and major tech stocks, the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ have repeatedly reached new highs over...

+5

437

226

34

Elon Mars

Set a live reminder

[Synopsis]

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

A Pivotal Year: Strategies for Capturing Income

Jun 28 17:00

24

3

Elon Mars

Set a live reminder

[Synopsis]

Mid-2024 - where are we for Asia's Fixed Income space? What is the outlook and how can investors utilise the potential window of opportunities in the current global market context? We delve deeper into possible strategies you may leverage on for Fixed Income, so join us to find out more on the analysis as we transition into the second half of the year with our experts from UOB Asset Management. Come learn with us and stand a chance to win some...

Mid-2024 - where are we for Asia's Fixed Income space? What is the outlook and how can investors utilise the potential window of opportunities in the current global market context? We delve deeper into possible strategies you may leverage on for Fixed Income, so join us to find out more on the analysis as we transition into the second half of the year with our experts from UOB Asset Management. Come learn with us and stand a chance to win some...

Asia Fixed Income: A Window of Opportunity

Jun 28 15:00

7

2

Elon Mars

Set a live reminder

[Synopsis]

With the US interest rate cycle transitions since the start of 2024 - where are we now given there is no rate cutes in 2024 by the Fed? How can investors potentially benefit and what can we expect from the US market going into the second half of the year? Find out more in the latest live webinar with our expert from CSOP Asset Management. Join us and you might be rewarded with some giveaways and quiz questions.@olivehiggo

[Speake...

With the US interest rate cycle transitions since the start of 2024 - where are we now given there is no rate cutes in 2024 by the Fed? How can investors potentially benefit and what can we expect from the US market going into the second half of the year? Find out more in the latest live webinar with our expert from CSOP Asset Management. Join us and you might be rewarded with some giveaways and quiz questions.@olivehiggo

[Speake...

US Interest rate cycle overview by CSOP Asset Management

Jun 27 17:00

8

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)