What are people's view of a likely Trump victory on BHP?

My main concern is this increases the likelihood of tariffs on China and other countries - which will ultimately affect demand for raw materials like iron ore. $BHP Group Ltd (BHP.AU)$

My main concern is this increases the likelihood of tariffs on China and other countries - which will ultimately affect demand for raw materials like iron ore. $BHP Group Ltd (BHP.AU)$

I'm both😑 $Fortescue Ltd (FMG.AU)$

IF.. IO over $125 by January = $FMG may test $30 again

What you think fmg will get to this time?

IF.. IO over $125 by January = $FMG may test $30 again

What you think fmg will get to this time?

2

1

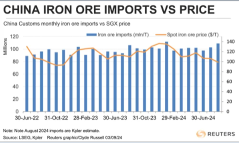

‘Nothing happens in China by chance, which extends to its access to raw materials… That’s why you should be observingiron ore importscarefully.

‘Strong numbers (in the face offalling steel production) will add weight to the theory that China is perhaps cutting steel production in a bid to drive down iron ore prices.’

So, what’s the latest import data telling us?

Official customs data for August won’t be released until next week…given the pressure in the iron ore market, this will be one of the m...

‘Strong numbers (in the face offalling steel production) will add weight to the theory that China is perhaps cutting steel production in a bid to drive down iron ore prices.’

So, what’s the latest import data telling us?

Official customs data for August won’t be released until next week…given the pressure in the iron ore market, this will be one of the m...

Gold FLAT @ $2553

Paper Silver up 0.44% to $29.65

Platinum up 2.1% to $975

Palladium up 3% to $942

Copper up 1% to $4.20

Brent Crude down 1.46% to $76.05

Iron ore up 3% to $98.30 $Rio Tinto Ltd (RIO.AU)$ $BHP Group Ltd (BHP.AU)$

Paper Silver up 0.44% to $29.65

Platinum up 2.1% to $975

Palladium up 3% to $942

Copper up 1% to $4.20

Brent Crude down 1.46% to $76.05

Iron ore up 3% to $98.30 $Rio Tinto Ltd (RIO.AU)$ $BHP Group Ltd (BHP.AU)$

1

Silver Mines rallied 11.76% after telling the market they will submit a new mining proposal with the government that includes more detail on the transmission line…..I think they will get approval again. SPEC BUY $Silver Mines Ltd (SVL.AU)$

4

Lynas ( $Lynas Rare Earths Ltd (LYC.AU)$ ) rallied 7.41% on no news….

It’s likely that Gina is buying more….Perhaps Rio Tinto ( $Rio Tinto Ltd (RIO.AU)$ ) is having a nibble….

With the price of rare earths currently in the toilet, now is the time for a big player to make a takeover bid for this globally significant and strategic miner.

It’s likely that Gina is buying more….Perhaps Rio Tinto ( $Rio Tinto Ltd (RIO.AU)$ ) is having a nibble….

With the price of rare earths currently in the toilet, now is the time for a big player to make a takeover bid for this globally significant and strategic miner.

Magellan ( $Magellan Financial Group Ltd (MFG.AU)$ ) has been up more than 7 per cent after announcing its FY24 results and a strategic partnership with Vinva Investments. Statutory profit was up 31% year over year to $239 million, and the company declared a dividend of 35.7 cents per share.

Australia’s policy decision follows a highly-anticipated meeting by the Federal Reserve last week, when chair Jerome Powell signalled that the US is on course to begin easing in September. The Bank of England also last week cut rates for the first time since early 2020 and signalled further reductions ahead. $AUD (LIST20039.AU)$ $S&P/ASX 200 OPIC (OXJO.AU)$

1

So inflation went up from 3.6% to 3.8%, is above the target of 2-3% and there is pressure for multiple cuts? The only pressure is from the media who need something to write about. Low rates are gone and higher rates are here to stay for a while. And they aren't that high. If anything i'd wonder whether they're considering if they need one more rise.

2

It’s not a pretty picture for the outlook for the iron ore price. If you’re a sandgroper like me, you’re probably thinking about putting your house up for sale and moving East! (No, it could never be that bad!😁)

It might not be so bad for the two major Aussie iron ore producers, though, suggest UBS. BHP’s dividend is likely to be lower than it was in 2023, but it’s still going to pay out a whopping US$3.5 billion in dividends – and that's just for the current June half...

It might not be so bad for the two major Aussie iron ore producers, though, suggest UBS. BHP’s dividend is likely to be lower than it was in 2023, but it’s still going to pay out a whopping US$3.5 billion in dividends – and that's just for the current June half...

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)