FAB101845437

liked

Consumers logged online Monday and spent $10.7 billion, marking a 1.4% decrease from year-ago levels, according to data released Tuesday by Adobe Analytics. This year's tally marks the first time that Adobe has tracked a slowdown in spending on major shopping days. ![]()

![]()

![]()

Cyber Week (from Thanksgiving Day through Cyber Monday) generated $33.9 billion in online spending, down 1.4% YoY, as Black Friday dipped 1.3% YoY at $8.9 billion vs $9 billion (2020) and Thanksgiving Day stayed flat at $5.1 billion.

Consumer spending on Cyber Monday is not growing as fast as it did last year. It reaffirms that many consumers had fulfilled their shopping urge earlier in the season. When all is said and done however, we still expect to see a record season and year for e-commerce.”

—— said Vivek Pandya, lead analyst of Adobe Digital Insights.

Last Cyber Monday, retailers rang up $10.8 billion in sales on the web, as more people stayed home and avoided shopping in retailers' stores due to the ongoing coronavirus pandemic. It marked a record day for e-commerce purchases in the U.S.

Mooers, did you shop online and what did you buy on Cyber Monday?![]()

![]()

![]()

Source: Forbes, CNBC, Foxbusiness

Cyber Week (from Thanksgiving Day through Cyber Monday) generated $33.9 billion in online spending, down 1.4% YoY, as Black Friday dipped 1.3% YoY at $8.9 billion vs $9 billion (2020) and Thanksgiving Day stayed flat at $5.1 billion.

Consumer spending on Cyber Monday is not growing as fast as it did last year. It reaffirms that many consumers had fulfilled their shopping urge earlier in the season. When all is said and done however, we still expect to see a record season and year for e-commerce.”

—— said Vivek Pandya, lead analyst of Adobe Digital Insights.

Last Cyber Monday, retailers rang up $10.8 billion in sales on the web, as more people stayed home and avoided shopping in retailers' stores due to the ongoing coronavirus pandemic. It marked a record day for e-commerce purchases in the U.S.

Mooers, did you shop online and what did you buy on Cyber Monday?

Source: Forbes, CNBC, Foxbusiness

63

9

FAB101845437

liked

By Julianna

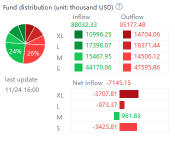

Investors appear to be losing patience with Ark Investment Management's genomics fund.![]()

![]()

$ARK Genomic Revolution ETF (ARKG.US)$ is an actively managed ETF that focus on health care, information technology, materials, energy, and consumer discretionary.

Companies within ARKG are focused on and are expected to substantially benefit from extending and enhancing the quality of human and other life by incorporating technological and scientific developments and advancements in genomics into their business.

- according to ARKG fund description.

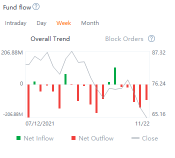

However, ARKG is down 30% this year as investors shun health-care stocks in favor for more cyclical names that perform well during an economic recovery. Even so, this ETF is faring far worse than the broader biotech sector, with the $Dow Jones U.S. Biotechnology Index (.DJUSBT.US)$up 11.35% this year.![]()

![]()

ARKG is currently trading at $65.16 a share, 43% lower from its peak in this February. The genomics fund has also seen the largest outflows among Ark's ETFs this year.![]()

![]()

It's interesting that typically loyal Ark investors have been bailing on the ETF.

The fund's assets have been chopped in half since February. While I don't believe the ETF is experiencing some of sort of 'doom loop,' clearly the outflows are putting downward price pressure on the underlying holdings and testing the will of remaining fund owners.

- said Nate Geraci, president of The ETF Store, an advisory firm.

![]()

![]() FOLLOW ME to know more about ETFs

FOLLOW ME to know more about ETFs

PLZ leave your comments and likes below![]()

ARKG's top two holdings, $Teladoc Health (TDOC.US)$and $Exact Sciences (EXAS.US)$, heavily impact its performance, with drops of 47% and 33.5% this year, respectively.![]()

![]()

![]()

The recent outflows may be due to investors looking for shorter-term opportunities into the year-end and freeing up cash.

- said Sylvia Jablonski, chief investment officer at Defiance ETFs.

Ark Chief Executive Officer Cathie Wood is well-known for prioritizing longer term investments over short-term gains.![]()

![]()

This is a 5-10 year hold. AI in health care is going to change the way that we can predict, treat and manage the most difficult diseases like cancer, and the Ark fund gives investors access to the companies who are on the cutting edge of that research.

- Jablonski added.

Have you ever invested in the Biotechnology sector? Do you agree with Jablonski's opinion?![]()

![]()

Source: Bloomberg

Investors appear to be losing patience with Ark Investment Management's genomics fund.

$ARK Genomic Revolution ETF (ARKG.US)$ is an actively managed ETF that focus on health care, information technology, materials, energy, and consumer discretionary.

Companies within ARKG are focused on and are expected to substantially benefit from extending and enhancing the quality of human and other life by incorporating technological and scientific developments and advancements in genomics into their business.

- according to ARKG fund description.

However, ARKG is down 30% this year as investors shun health-care stocks in favor for more cyclical names that perform well during an economic recovery. Even so, this ETF is faring far worse than the broader biotech sector, with the $Dow Jones U.S. Biotechnology Index (.DJUSBT.US)$up 11.35% this year.

ARKG is currently trading at $65.16 a share, 43% lower from its peak in this February. The genomics fund has also seen the largest outflows among Ark's ETFs this year.

It's interesting that typically loyal Ark investors have been bailing on the ETF.

The fund's assets have been chopped in half since February. While I don't believe the ETF is experiencing some of sort of 'doom loop,' clearly the outflows are putting downward price pressure on the underlying holdings and testing the will of remaining fund owners.

- said Nate Geraci, president of The ETF Store, an advisory firm.

PLZ leave your comments and likes below

ARKG's top two holdings, $Teladoc Health (TDOC.US)$and $Exact Sciences (EXAS.US)$, heavily impact its performance, with drops of 47% and 33.5% this year, respectively.

The recent outflows may be due to investors looking for shorter-term opportunities into the year-end and freeing up cash.

- said Sylvia Jablonski, chief investment officer at Defiance ETFs.

Ark Chief Executive Officer Cathie Wood is well-known for prioritizing longer term investments over short-term gains.

This is a 5-10 year hold. AI in health care is going to change the way that we can predict, treat and manage the most difficult diseases like cancer, and the Ark fund gives investors access to the companies who are on the cutting edge of that research.

- Jablonski added.

Have you ever invested in the Biotechnology sector? Do you agree with Jablonski's opinion?

Source: Bloomberg

+1

128

25

FAB101845437

liked and commented on

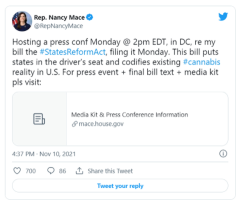

Cannabis ETFs were blazing after Representative Nancy Mace (R-SC) tweeted that she plans to unveil a new bill that would legalize marijuana at the federal level. The bill would remove the plant from the list of federally controlled substances.![]()

![]()

While cannabis-related ETFs have been on a decline for much of the year, this news was enough to lift them by double digits last week. The U.S.-focused $Advisorshares Trust Pure Us Cannabis Etf (MSOS.US)$ gained 14.0% in past week. The $Advisorshares Pure Cannabis Etf (YOLO.US)$ and the $Etfmg Alternative Harvest Etf (MJ.US)$, which take a global approach, were up 12.8% and 10.9%, respectively.

Cannabis-related ETFs shot higher after Joe Biden's nomination. Both he and Vice President Harris had stated they were in favor of policy reform. President Biden, however, has only backed medical legalization and decriminalization.

The lack of movement on the issue after Biden took office brought these ETFs off their highs. But Mace’s bill, which would see marijuana regulated similarly to alcohol, could appeal to those on the right side of the aisle because it invokes states'rights.![]()

![]()

The proposed bill would also not call for the degree of regulation or taxation as prior legalization bills have, such as of that proposed by Senator Chuck Schumer.

Several Options Available

Here is a list of Marijuana ETF ranks by AUM, with MJ and MSOS being the largest, at over $1 billion in AUM each.![]()

![]()

![]()

Currently, the cheapest cannabis ETF is the $Cambria Cannabis Etf (TOKE.US)$, with a 0.42% expense ratio. This is significantly lower than the average expense ratio of 0.71%. The low cost is especially notable when you consider that TOKE is active.

Though it is 0.33% cheaper than the passive MJ, TOKE has underperformed by 4.1% year-to-date.

Domestic or Global

Legalization is not just a domestic issue. In fact, the U.S. has some of the most marijuana-friendly laws around the world. The substance remains illegal in much of the world.

Though this suggests there is substantial growth ahead for global cannabis-related companies, current legalization talks in the U.S. are likely to benefit domestically focused ETFs such as MSOS the most.

Source: ETF.com, ETF Managers Group

While cannabis-related ETFs have been on a decline for much of the year, this news was enough to lift them by double digits last week. The U.S.-focused $Advisorshares Trust Pure Us Cannabis Etf (MSOS.US)$ gained 14.0% in past week. The $Advisorshares Pure Cannabis Etf (YOLO.US)$ and the $Etfmg Alternative Harvest Etf (MJ.US)$, which take a global approach, were up 12.8% and 10.9%, respectively.

Cannabis-related ETFs shot higher after Joe Biden's nomination. Both he and Vice President Harris had stated they were in favor of policy reform. President Biden, however, has only backed medical legalization and decriminalization.

The lack of movement on the issue after Biden took office brought these ETFs off their highs. But Mace’s bill, which would see marijuana regulated similarly to alcohol, could appeal to those on the right side of the aisle because it invokes states'rights.

The proposed bill would also not call for the degree of regulation or taxation as prior legalization bills have, such as of that proposed by Senator Chuck Schumer.

Several Options Available

Here is a list of Marijuana ETF ranks by AUM, with MJ and MSOS being the largest, at over $1 billion in AUM each.

Currently, the cheapest cannabis ETF is the $Cambria Cannabis Etf (TOKE.US)$, with a 0.42% expense ratio. This is significantly lower than the average expense ratio of 0.71%. The low cost is especially notable when you consider that TOKE is active.

Though it is 0.33% cheaper than the passive MJ, TOKE has underperformed by 4.1% year-to-date.

Domestic or Global

Legalization is not just a domestic issue. In fact, the U.S. has some of the most marijuana-friendly laws around the world. The substance remains illegal in much of the world.

Though this suggests there is substantial growth ahead for global cannabis-related companies, current legalization talks in the U.S. are likely to benefit domestically focused ETFs such as MSOS the most.

Source: ETF.com, ETF Managers Group

+1

58

14

FAB101845437

liked

The following tickers are the top trending stocks mentioned by the polular sub-reddit, WallStreetBets, over the last 24 hours. Let's check it out!

$Tesla (TSLA.US)$ , $NVIDIA (NVDA.US)$, and $Rivian Automotive (RIVN.US)$ are among the stocks seeing the highest interest on WSB today.

*Follow me to know what is hot on the market![]()

![]()

![]()

$Lucid Group (LCID.US)$ $Tilray Brands (TLRY.US)$

$Tesla (TSLA.US)$ , $NVIDIA (NVDA.US)$, and $Rivian Automotive (RIVN.US)$ are among the stocks seeing the highest interest on WSB today.

*Follow me to know what is hot on the market

$Lucid Group (LCID.US)$ $Tilray Brands (TLRY.US)$

14

2

FAB101845437

liked

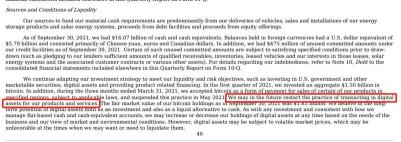

In $Tesla (TSLA.US)$ 's recent 10-Q filing, it is stated that Tesla may start accepting Bitcoin for payment again.![]()

![]()

![]()

Would you pay for a car with Bitcoin?![]()

![]()

![]()

What's your guess on when Tesla will start accepting Bitcoin again?![]()

![]()

![]()

FYI: click HERE to check out Tesla's 10-Q filing

Would you pay for a car with Bitcoin?

What's your guess on when Tesla will start accepting Bitcoin again?

FYI: click HERE to check out Tesla's 10-Q filing

44

8

FAB101845437

liked

FAB101845437

commented on

$SGX (S68.SG)$ looks stable enough to buy?

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)