FlmaBW6kl4

commented on

Achieving a yearly gain exceeding 20% seemed impossible for a typical retail investor like myself. I was surprised to accomplish that in my first year using Moomoo.

Reflecting on my journey, I attribute my success primarily to two key factors: moomoo's low fee structure and the availability of free educational resources like webinars and courses.

Thank you, Moomoo.

Reflecting on my journey, I attribute my success primarily to two key factors: moomoo's low fee structure and the availability of free educational resources like webinars and courses.

Thank you, Moomoo.

22

6

FlmaBW6kl4

commented on

- The most wonderful and meaningful moments in my Investment Journey was starting to trade with Moomoo this year on August 24th.

- This was my first time using Moomoo for trading.

- I switched to Moomoo because I noticed it offers many valuable features, including free learning resources, stock forecasts, and analysis tools, which are often charged by other brokers.

- What I love most about Moomoo is that it's like an all-in-one pl...

- This was my first time using Moomoo for trading.

- I switched to Moomoo because I noticed it offers many valuable features, including free learning resources, stock forecasts, and analysis tools, which are often charged by other brokers.

- What I love most about Moomoo is that it's like an all-in-one pl...

21

8

FlmaBW6kl4

commented on

#2024 recap: The most stonks moment in my 2024 journey was to begin my investment journey on Moomoo, snapping up undervalued stocks and others with big catalysts. Grrr in particular will continue to reward my patience in investing and I'm already up 45% total in just my first two months.

Thank you Moomoo for the social and news section which have led to these stonks in my rewarding journey.

Thank you Moomoo for the social and news section which have led to these stonks in my rewarding journey.

22

7

1

FlmaBW6kl4

commented on

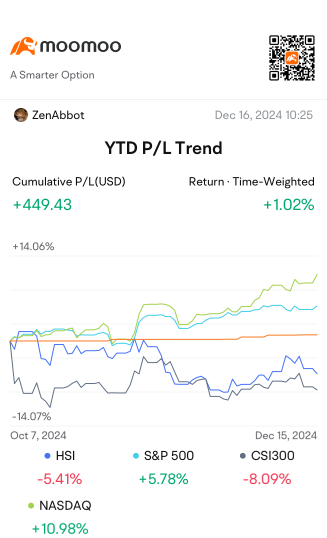

my p/l

I started around mid of this year. At that time I'm still a beginner. So, I started with $Vanguard S&P 500 ETF (VOO.US)$ because it's stable and low risk. currently it's earning 14%

Then I tried Malaysian stock, and I earned some cash on it.

$MAYBANK (1155.MY)$

$YTL (4677.MY)$

then I invested in penny stocks (less than RM1)

all of it drops and I'm stuck because I don't want to cut loss and I'm confident they will rebound. But even though the ...

I started around mid of this year. At that time I'm still a beginner. So, I started with $Vanguard S&P 500 ETF (VOO.US)$ because it's stable and low risk. currently it's earning 14%

Then I tried Malaysian stock, and I earned some cash on it.

$MAYBANK (1155.MY)$

$YTL (4677.MY)$

then I invested in penny stocks (less than RM1)

all of it drops and I'm stuck because I don't want to cut loss and I'm confident they will rebound. But even though the ...

loading...

49

7

6

FlmaBW6kl4

commented on

The most enlightening moment in my 2024 investment journey was US presidential election. The outcome of this event seems to change market trajectory, at least in the short term. Bond yields are on the rise, foreign markets are retreating, and don’t even get me started on bitcoin bull market. The lesson learned in that market is ever unpredictable and may go sideways in a moment.

My personal choice for Moomoo feature most useful in trading is Papertrade. If you are a b...

My personal choice for Moomoo feature most useful in trading is Papertrade. If you are a b...

21

7

FlmaBW6kl4

commented on

As 2024 is coming to an end, this year's market has made me love and hate it again. I have stood at the peak of profitability, and also tasted the bitterness of greed. However, after experiencing the ups and downs of the market, I have realized a truth: no matter how beautiful the profit curve is, it is not as important as the smiles on my family's faces. So, in the last one or two days, I closed the trading software, and spent time in more meaningful ways - to accompany and take care of my family.

There are always opportunities in the market, but companionship is the only investment that cannot be repeated. This year, I not only learned how to trade, but also learned how to live.

These are notes for myself, feel free for classmates who want to copy, but don't forget to practice~

High returns are temporary, the market will always fight back.

Control your position, don't gamble with your life.

There is always the next opportunity in the market.

Missing one opportunity is not scary, trading is about patiently waiting for the next more secure entry point.

Every loss is a tuition fee.

Losing half of the profit this time truly makes me understand the market's volatility.

Remember: the experience of losing money is often more valuable than the experience of making money.

Reviewing and analyzing is the royal road.

After each decline, I will carefully analyze: is it a strategy issue? Position management error? Or simply because of greed? Record the mistakes and always remind myself not to repeat them.

Trade Philosophy Summary

Finally, I was able to recover the losses, but this experience deeply reminded me that trading requires humility and discipline. I hope that every future trade will make me more mature and stable.

...

There are always opportunities in the market, but companionship is the only investment that cannot be repeated. This year, I not only learned how to trade, but also learned how to live.

These are notes for myself, feel free for classmates who want to copy, but don't forget to practice~

High returns are temporary, the market will always fight back.

Control your position, don't gamble with your life.

There is always the next opportunity in the market.

Missing one opportunity is not scary, trading is about patiently waiting for the next more secure entry point.

Every loss is a tuition fee.

Losing half of the profit this time truly makes me understand the market's volatility.

Remember: the experience of losing money is often more valuable than the experience of making money.

Reviewing and analyzing is the royal road.

After each decline, I will carefully analyze: is it a strategy issue? Position management error? Or simply because of greed? Record the mistakes and always remind myself not to repeat them.

Trade Philosophy Summary

Finally, I was able to recover the losses, but this experience deeply reminded me that trading requires humility and discipline. I hope that every future trade will make me more mature and stable.

...

Translated

24

6

FlmaBW6kl4

commented on

$On Holding (ONON.US)$

Switzerland, known for precision watchmaking and pure natural beauty, is now emerging as a dark horse in the sports goods market, with the 2010-founded sports brand On Holding taking the spotlight. With its unique CloudTec® cushioning technology, On quickly won the hearts of runners and trend enthusiasts, sparking a revolution in the global sports goods market.

On's products not only focus on performance but also combine design aesthetics. Its star product, the Cloud series, integrates technology and aesthetics, redefining the functionality and fashion standards of running shoes. For professional runners, this is a comfortable and high-performance sports partner; for ordinary consumers, the stylish appearance of the Cloud series makes it a highlight in daily outfits. This dual positioning has successfully attracted a wide consumer cohort and propelled On's brand image to the forefront of the global running shoe market.

However, On's ambition does not stop at running shoes. In recent years, the company has gradually expanded its product line, venturing into sportswear and accessories in an attempt to build a complete sports lifestyle brand. This strategy not only consolidates the brand's market position but also provides diversified support for its steady revenue growth.

From a financial performance perspective, On has consistently delivered impressive results in the recent quarters. The steady growth in revenue reflects the market demand for its products...

Switzerland, known for precision watchmaking and pure natural beauty, is now emerging as a dark horse in the sports goods market, with the 2010-founded sports brand On Holding taking the spotlight. With its unique CloudTec® cushioning technology, On quickly won the hearts of runners and trend enthusiasts, sparking a revolution in the global sports goods market.

On's products not only focus on performance but also combine design aesthetics. Its star product, the Cloud series, integrates technology and aesthetics, redefining the functionality and fashion standards of running shoes. For professional runners, this is a comfortable and high-performance sports partner; for ordinary consumers, the stylish appearance of the Cloud series makes it a highlight in daily outfits. This dual positioning has successfully attracted a wide consumer cohort and propelled On's brand image to the forefront of the global running shoe market.

However, On's ambition does not stop at running shoes. In recent years, the company has gradually expanded its product line, venturing into sportswear and accessories in an attempt to build a complete sports lifestyle brand. This strategy not only consolidates the brand's market position but also provides diversified support for its steady revenue growth.

From a financial performance perspective, On has consistently delivered impressive results in the recent quarters. The steady growth in revenue reflects the market demand for its products...

Translated

loading...

12

7

1

FlmaBW6kl4

commented on

The most eye-opening moment in my investment and trading journey in 2024 was undoubtedly discovering the power and versatility of options. Options are like a Swiss Army knife, enabling investors to generate income, hedge risk, and enhance portfolio flexibility.

As a value investor, I learned to use cash secured puts to earn extra income while waiting for stock prices to reach my desired buy levels. I could also employ covered calls during sideways markets to enhance returns on my hold...

As a value investor, I learned to use cash secured puts to earn extra income while waiting for stock prices to reach my desired buy levels. I could also employ covered calls during sideways markets to enhance returns on my hold...

+2

21

5

1

FlmaBW6kl4

commented on

The most horrific moment in my 2024 investment was when I intuitively found a great opportunity, only to screw it all up soon after with my carelessness. It happened only last week.

I found out about the $UnitedHealth (UNH.US)$ CEO's passing on Friday and, at the same time, some of the potential malpractices of this insurance giant. The deeper I dug into this rabbit hole, the more I felt there was an opportunity to short this stock for a qui...

I found out about the $UnitedHealth (UNH.US)$ CEO's passing on Friday and, at the same time, some of the potential malpractices of this insurance giant. The deeper I dug into this rabbit hole, the more I felt there was an opportunity to short this stock for a qui...

24

2

1

FlmaBW6kl4

commented on

2024 has been a great year for investing, with my individual portfolio up 273.69% total YTD so far with my best returns in the month of November which was up a whopping 55% in that month alone. I’m very grateful for the opportunity to invest in amazing companies and also during one of the strongest bull markets we have seen in a long time. I look forward to next year and hope we can continue to make smart and balanced decisions. God bless everyone!

21

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

FlmaBW6kl4 : Keep learning!