FooTY

voted

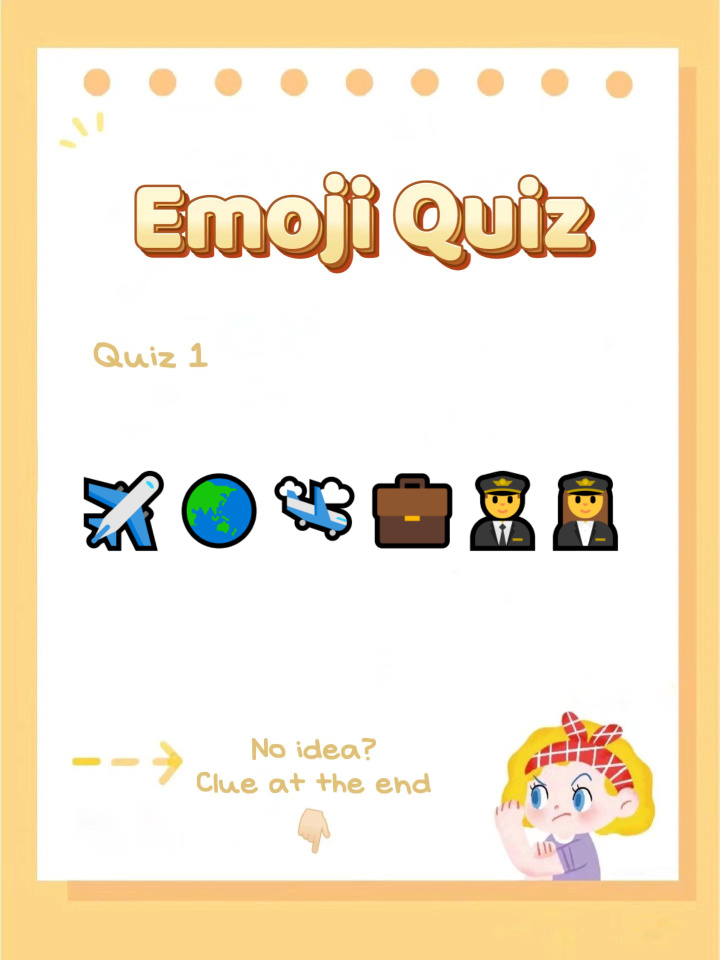

Do you use emoji in your daily life? ![]()

![]() Everything can be expressed with emoji, and any number of emoji can form countless complex puzzles.

Everything can be expressed with emoji, and any number of emoji can form countless complex puzzles.

You only need to decipher each string of permutations and combinations to get the hidden information!![]()

Guessing stocks by emoji is a fun and simple quiz! You need to guess the Singapore stocks or SREITs it represents based on the emoji combination!

For example, 📞📱📶📡🌍may represent $Singtel (Z74.SG)$, ...

You only need to decipher each string of permutations and combinations to get the hidden information!

Guessing stocks by emoji is a fun and simple quiz! You need to guess the Singapore stocks or SREITs it represents based on the emoji combination!

For example, 📞📱📶📡🌍may represent $Singtel (Z74.SG)$, ...

+1

90

395

10

FooTY

liked

$NIO Inc (NIO.US)$ What's going on today? The volume after market hours is higher than during market hours.

Translated

6

2

FooTY

liked

FooTY

liked

134

86

8

FooTY

liked

$Tesla (TSLA.US)$ and 2021 I have seen the price gone up from 550 to 1200 range but recently pulled back due to bad market sentiment and selling from Elon Musk. This year I also witnessed semiconductor stocks especially $Advanced Micro Devices (AMD.US)$ and $NVIDIA (NVDA.US)$ doing extremely well. $Apple (AAPL.US)$ will also be my cash rich stock and it didn't dispointed either towards the end of 2021. My average price was 130 USD from the free stock I get from moomoo and extra positions. 2021 also saw the theme of metaverse which is highly anticipated after $Meta Platforms (FB.US)$ decided to focus their business on this new trend. other stock that will benefited from this trend includes $Unity Software (U.US)$ $Roblox(RBLX.US)

28

1

FooTY

commented on

Columns Sector Rotation?

What happened after FED's meeting?

We are currently having a sector rotation from tech growth stocks into value stocks after Wednesday's Fed policy of 3 rate hikes in 2022 instead of 2 and also speed up tapering and ending it a few months earlier than expected.

The initial taper plan was $10B for treasury securities and $5B for MBS (Mortgage Backed Securities) but now it has doubled the speed of tapering to $20B for treasury securities and $10B for MBS and tapering to end by March 2022. Which shortly after, rate hikes should come in progressively.

The reason for the fed turning hawkish and a quick shift to taper at a quicker pace and more rate hikes was due to inflation at a 40 year high. They also did not expect inflation to rise above 2% in 2021 and kept mentioning about higher inflation rate being transitory. Current inflation is at 6.8% based on the YOY report.

How did this affect the market on Thursday?

When tapering is sped up, liquidity will be tightened in the market. There will not be as much free cash to be pumped into the market to let prices rally like we have seen the last 2 years.

Interest rate hikes will also dampen valuation on growth stocks as growth stocks are priced in more to future earnings expectations. If rates rise, it will hurt those expectations. Investors will start to see bonds and value stocks that thrive in high-interest rate environments a better asset class thus making it more appealing against higher-risk growth stocks.

Small-cap stocks usually also suffer because they tend to loan more money to fund the growth of the company thus making them more sensitive towards the rate hikes.

Thus we saw the $NASDAQ 100 Index (.NDX.US)$ and $iShares Russell 2000 ETF (IWM.US)$ mostly small-cap and tech stocks falling much sharper than $Dow Jones Industrial Average (.DJI.US)$ yesterday which consist mainly of value stocks.

What to do now? Should I exit my growth holdings?

That being said, inflation and rate hikes over the long run still don't pose a huge threat to growth stocks. It is usually short-term when the rotation happens towards value stocks. So take this opportunity to find good entry points into the stocks which are undergoing the selloff.

As always, trade safe & invest wise!

$Apple (AAPL.US)$ $Tesla (TSLA.US)$ $Meta Platforms (FB.US)$ $Microsoft (MSFT.US)$ $Amazon (AMZN.US)$ $NVIDIA (NVDA.US)$ $Adobe (ADBE.US)$ $Invesco QQQ Trust (QQQ.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$

We are currently having a sector rotation from tech growth stocks into value stocks after Wednesday's Fed policy of 3 rate hikes in 2022 instead of 2 and also speed up tapering and ending it a few months earlier than expected.

The initial taper plan was $10B for treasury securities and $5B for MBS (Mortgage Backed Securities) but now it has doubled the speed of tapering to $20B for treasury securities and $10B for MBS and tapering to end by March 2022. Which shortly after, rate hikes should come in progressively.

The reason for the fed turning hawkish and a quick shift to taper at a quicker pace and more rate hikes was due to inflation at a 40 year high. They also did not expect inflation to rise above 2% in 2021 and kept mentioning about higher inflation rate being transitory. Current inflation is at 6.8% based on the YOY report.

How did this affect the market on Thursday?

When tapering is sped up, liquidity will be tightened in the market. There will not be as much free cash to be pumped into the market to let prices rally like we have seen the last 2 years.

Interest rate hikes will also dampen valuation on growth stocks as growth stocks are priced in more to future earnings expectations. If rates rise, it will hurt those expectations. Investors will start to see bonds and value stocks that thrive in high-interest rate environments a better asset class thus making it more appealing against higher-risk growth stocks.

Small-cap stocks usually also suffer because they tend to loan more money to fund the growth of the company thus making them more sensitive towards the rate hikes.

Thus we saw the $NASDAQ 100 Index (.NDX.US)$ and $iShares Russell 2000 ETF (IWM.US)$ mostly small-cap and tech stocks falling much sharper than $Dow Jones Industrial Average (.DJI.US)$ yesterday which consist mainly of value stocks.

What to do now? Should I exit my growth holdings?

That being said, inflation and rate hikes over the long run still don't pose a huge threat to growth stocks. It is usually short-term when the rotation happens towards value stocks. So take this opportunity to find good entry points into the stocks which are undergoing the selloff.

As always, trade safe & invest wise!

$Apple (AAPL.US)$ $Tesla (TSLA.US)$ $Meta Platforms (FB.US)$ $Microsoft (MSFT.US)$ $Amazon (AMZN.US)$ $NVIDIA (NVDA.US)$ $Adobe (ADBE.US)$ $Invesco QQQ Trust (QQQ.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$

168

6

8

FooTY

liked

8

1

FooTY

liked

$NIO Inc (NIO.US)$ $XPeng (XPEV.US)$ $Li Auto (LI.US)$ $Contemporary Amperex Technology (300750.SZ)$ As they scour the globe for the lithium, nickel and cobalt resources needed to keep China on top in the electric vehicle (EV) stakes, Chinese battery and EV makers are fretting about supply of another mineral closer to home - graphite.

Graphite, in both natural and synthetic forms, is used for the negative end of a lithium-ion battery, known as the anode. Around 70% of all graphite comes from China, and there are few viable alternatives for batteries.

Chinese producers have their work cut out keeping up with global demand for graphite, which has surged along with rapid growth in the battery market in recent years.

Consultancy Benchmark Mineral Intelligence (BMI) sees a roughly 20,000 tonne graphite deficit in 2022, versus a similar-sized surplus last year. About 20,000 tonnes of graphite is enough to make batteries for roughly 250,000 EVs, an industrial source said.

"Demand from clients such as $Tesla (TSLA.US)$ is growing rapidly while supply of raw materials has been extremely tight," the source said, adding that the recent power rationing on industry had exacerbated the situation.

Graphite, in both natural and synthetic forms, is used for the negative end of a lithium-ion battery, known as the anode. Around 70% of all graphite comes from China, and there are few viable alternatives for batteries.

Chinese producers have their work cut out keeping up with global demand for graphite, which has surged along with rapid growth in the battery market in recent years.

Consultancy Benchmark Mineral Intelligence (BMI) sees a roughly 20,000 tonne graphite deficit in 2022, versus a similar-sized surplus last year. About 20,000 tonnes of graphite is enough to make batteries for roughly 250,000 EVs, an industrial source said.

"Demand from clients such as $Tesla (TSLA.US)$ is growing rapidly while supply of raw materials has been extremely tight," the source said, adding that the recent power rationing on industry had exacerbated the situation.

18

FooTY

liked

$NIO Inc (NIO.US)$ It should be noted the option market is currently pricing in a 14% probability NIO closes at or above $40 by the January op-ex next year, so it's currently a lower probability event.But if the $30 level can hold for this week and there is no hawkishness out of the Fed for the FOMC on Dec. 15, then equities might get a Christmas rally to end the year, as the bearish pressure leading into the FOMC could subside.

On the other hand, if the stock closes below the $30 level on a weekly closing basis, then the next support does not come in until around $25.

On the other hand, if the stock closes below the $30 level on a weekly closing basis, then the next support does not come in until around $25.

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)