Gibson Chu

liked

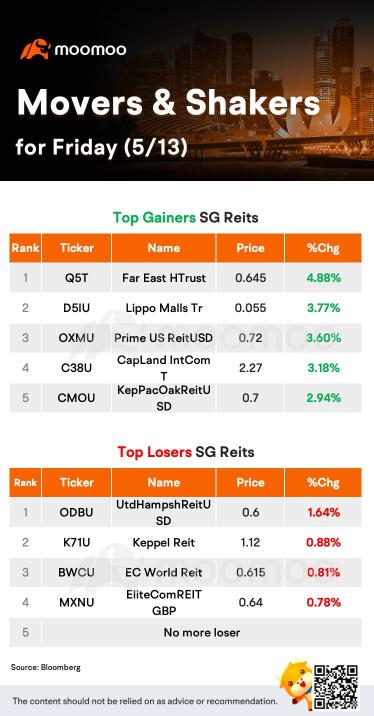

Singapore real estate investment trusts can benefit from their safe-haven status during a time of market volatility as the U.S. Fed raises interest rates, analysts from DBS say in a research note.

The Fed's clarity on its rate-rise trajectory will likely lead to more price stability for Singapore REITs, they say.

What are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are funds that invest in a port...

The Fed's clarity on its rate-rise trajectory will likely lead to more price stability for Singapore REITs, they say.

What are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are funds that invest in a port...

1537

1277

382

My guess the war would not end soon because …

What comes next for Ukraine could be bleak, these experts say, with many expecting a long and drawn-out conflict, noting that even in the most positive scenario — that Russia withdraws its troops and Ukraine remains a sovereign nation — Europe is unlikely to return to the prewar status quo.

What comes next for Ukraine could be bleak, these experts say, with many expecting a long and drawn-out conflict, noting that even in the most positive scenario — that Russia withdraws its troops and Ukraine remains a sovereign nation — Europe is unlikely to return to the prewar status quo.

1

Gibson Chu

liked

$OCBC Bank (O39.SG)$ slow recovery

12

Gibson Chu

liked

How to start short term trading?

most important point is that as a beginner, focus on a maximum of one to two stocks during a session. Tracking and finding opportunities is easier with just a few stocks.

next, never get into penny stocks. they r extremely volatile. avoid new emerging meme stocks such as $Biora Therapeutics (PROG.US)$ or $Pear Therapeutics (PEAR.US)$ too. they can easily go down 10% in 5min… 😩either go moon or hell…. personally, i would prefer large cap stocks like $Apple (AAPL.US)$ or $Tesla (TSLA.US)$. comfirm less profit…. but it’s much safer.

it may be better just to read the market without making any moves for the first 15 to 20 minutes.The middle hours are usually less volatile, and then movement begins to pick up again toward the closing bell, especially during power hour. safer for beginners to watch the market first

don’t panic if things doesn’t go in your way. no personal feelings, emotions!!!! cool down, stick to your technical analysis. if the chart does not meet your technical analysis, just cut loss and move on.

LASTLY, SAY NO TO MARGINN

Hope i can win a $ContextLogic (WISH.US)$ or $American Airlines (AAL.US)$ stock!!!

sharing the poster i got from the $Futu Holdings Ltd (FUTU.US)$ 9th anniversary challenge for those who r interested as well!! please like and share your reviews!

most important point is that as a beginner, focus on a maximum of one to two stocks during a session. Tracking and finding opportunities is easier with just a few stocks.

next, never get into penny stocks. they r extremely volatile. avoid new emerging meme stocks such as $Biora Therapeutics (PROG.US)$ or $Pear Therapeutics (PEAR.US)$ too. they can easily go down 10% in 5min… 😩either go moon or hell…. personally, i would prefer large cap stocks like $Apple (AAPL.US)$ or $Tesla (TSLA.US)$. comfirm less profit…. but it’s much safer.

it may be better just to read the market without making any moves for the first 15 to 20 minutes.The middle hours are usually less volatile, and then movement begins to pick up again toward the closing bell, especially during power hour. safer for beginners to watch the market first

don’t panic if things doesn’t go in your way. no personal feelings, emotions!!!! cool down, stick to your technical analysis. if the chart does not meet your technical analysis, just cut loss and move on.

LASTLY, SAY NO TO MARGINN

Hope i can win a $ContextLogic (WISH.US)$ or $American Airlines (AAL.US)$ stock!!!

sharing the poster i got from the $Futu Holdings Ltd (FUTU.US)$ 9th anniversary challenge for those who r interested as well!! please like and share your reviews!

84

2

Gibson Chu

liked

$SIA (C6L.SG)$

$4.88 good to start buying back now

$4.88 good to start buying back now

3

1

Gibson Chu

voted

Spoiler:

At the end of this post, there is a chance for you to win points!

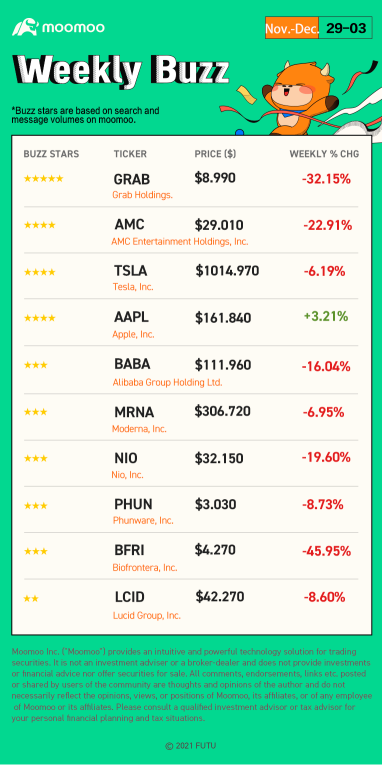

Happy Monday mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Every major index moved lower last week. Here is the week...

At the end of this post, there is a chance for you to win points!

Happy Monday mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Every major index moved lower last week. Here is the week...

+11

116

64

40

Gibson Chu

liked

Reporter: Recently, the SEC released its rules for implementing the Holding Foreign Companies Accountable Act and certain Chinese company announced that it started to delist from the U.S.. This has attracted wide attention in the market. What is the CSRC’s comment on this matter and what are your views on prospect of audit oversight cooperation between China and U.S. and that of domestic companies’ listing in the U.S.?

Spokesperson: We have taken notice of this recent development and the market’s concerns over the audit oversight issues and the prospect of domestic companies listing in the U.S. The CSRC and relevant Chinese regulatory authorities have always been open to and fully respect Chinese companies’ independent choices of overseas listing venues in compliance with relevant laws and regulations. Recently, some overseas media reported that Chinese regulators will ban overseas listing of companies with VIE structure and demand Chinese companies to delist from U.S. stock exchanges, which is a completely misunderstanding and misinterpretation. As far as we know, some domestic companies are actively communicating with domestic and foreign regulators to seek listing in the U.S. markets.

In terms of audit oversight cooperation, the CSRC has recently conducted candid and constructive communications with the U.S. SEC and PCAOB to address issues in bilateral cooperation and has made positive progress on several important issues. We believed that as long as regulators on both sides continue to conduct dialogues and negotiations in the spirit of mutual respect and trust, and deal with regulatory issues in a rational, pragmatic and professional way, we will certainly be able to find a mutually acceptable path of cooperation. In fact, both sides have been cooperating on audit oversight of US-listed Chinese companies, and worked together on pilot inspection programmes in order to find a more efficient way of cooperation, which has laid a good foundation for future cooperation. In recent years, however, certain political fractions in the U.S. have turned capital market regulation into part of their politicizing tools, waging unwarranted clampdowns on Chinese companies and coercing them into delisting from U.S. stock exchanges. This lose-lose mentality goes against the fundamental principles and rule of law of the market economy, harms the interests of global investors, undermines the international status of the U.S. capital markets, and benefits nobody. In today’s era when the capital markets are highly globalized, it has become more imperative than ever for regulatory authorities to engage with each other on audit oversight cooperation in a pragmatic, rational and professional manner. Forcing Chinese companies to delist from U.S. stock exchanges is by no means a responsible policy option.

The series of policy measures that relevant Chinese regulatory authorities have introduced in the past months with respect to regulating the development of the platform economy are aimed at limiting monopoly, protecting SMEs, safeguarding data and personal information security, and preventing the disorderly expansion of capital. Regulators in other parts of the world are also taking various regulatory measures against such emerging issues and challenges, with a view to promoting the sound and sustainable development of platform economy. Therefore, relevant policy initiatives of the Chinese government are not targeted at specific industries or private companies, nor are they necessarily connected to overseas listing of Chinese companies.

In the process of implementing the relevant policy measures, the Chinese regulatory authorities will continue to steadfastly promote reform and opening-up, stick to the principle of the “Two Unwaverings”, strive to engage with stakeholders including investors, companies and peer regulators, and further enhance policy transparency and predictability. CSRC will also continue its candid dialogues with its U.S. counterparts, and endeavour to resolve the remaining issues in audit oversight cooperation in the near future.

$Alibaba (BABA.US)$ $DiDi Global (Delisted) (DIDI.US)$ $NIO Inc (NIO.US)$

Spokesperson: We have taken notice of this recent development and the market’s concerns over the audit oversight issues and the prospect of domestic companies listing in the U.S. The CSRC and relevant Chinese regulatory authorities have always been open to and fully respect Chinese companies’ independent choices of overseas listing venues in compliance with relevant laws and regulations. Recently, some overseas media reported that Chinese regulators will ban overseas listing of companies with VIE structure and demand Chinese companies to delist from U.S. stock exchanges, which is a completely misunderstanding and misinterpretation. As far as we know, some domestic companies are actively communicating with domestic and foreign regulators to seek listing in the U.S. markets.

In terms of audit oversight cooperation, the CSRC has recently conducted candid and constructive communications with the U.S. SEC and PCAOB to address issues in bilateral cooperation and has made positive progress on several important issues. We believed that as long as regulators on both sides continue to conduct dialogues and negotiations in the spirit of mutual respect and trust, and deal with regulatory issues in a rational, pragmatic and professional way, we will certainly be able to find a mutually acceptable path of cooperation. In fact, both sides have been cooperating on audit oversight of US-listed Chinese companies, and worked together on pilot inspection programmes in order to find a more efficient way of cooperation, which has laid a good foundation for future cooperation. In recent years, however, certain political fractions in the U.S. have turned capital market regulation into part of their politicizing tools, waging unwarranted clampdowns on Chinese companies and coercing them into delisting from U.S. stock exchanges. This lose-lose mentality goes against the fundamental principles and rule of law of the market economy, harms the interests of global investors, undermines the international status of the U.S. capital markets, and benefits nobody. In today’s era when the capital markets are highly globalized, it has become more imperative than ever for regulatory authorities to engage with each other on audit oversight cooperation in a pragmatic, rational and professional manner. Forcing Chinese companies to delist from U.S. stock exchanges is by no means a responsible policy option.

The series of policy measures that relevant Chinese regulatory authorities have introduced in the past months with respect to regulating the development of the platform economy are aimed at limiting monopoly, protecting SMEs, safeguarding data and personal information security, and preventing the disorderly expansion of capital. Regulators in other parts of the world are also taking various regulatory measures against such emerging issues and challenges, with a view to promoting the sound and sustainable development of platform economy. Therefore, relevant policy initiatives of the Chinese government are not targeted at specific industries or private companies, nor are they necessarily connected to overseas listing of Chinese companies.

In the process of implementing the relevant policy measures, the Chinese regulatory authorities will continue to steadfastly promote reform and opening-up, stick to the principle of the “Two Unwaverings”, strive to engage with stakeholders including investors, companies and peer regulators, and further enhance policy transparency and predictability. CSRC will also continue its candid dialogues with its U.S. counterparts, and endeavour to resolve the remaining issues in audit oversight cooperation in the near future.

$Alibaba (BABA.US)$ $DiDi Global (Delisted) (DIDI.US)$ $NIO Inc (NIO.US)$

20

2

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)