Greats Nancy

liked

$CapitaLandInvest (9CI.SG)$ all my REITs . please continue to move upwards. I will polish the ladder everyday. Chiong Ahhh.

17

Greats Nancy

liked

I think everyone like the market today. Rocket is going to the moon ![]()

![]()

![]() Did you catch it or miss it?

Did you catch it or miss it?

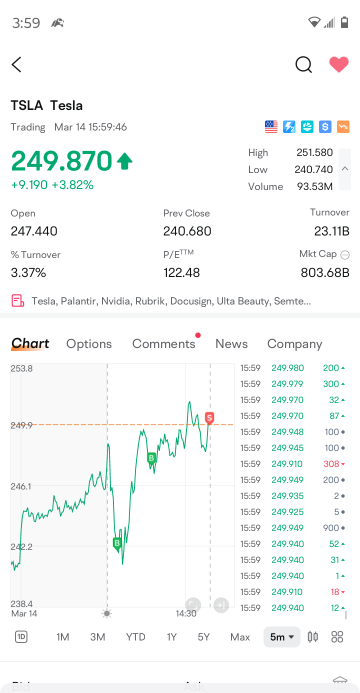

Let’s go! $Tesla (TSLA.US)$ $Direxion Daily TSLA Bull 2X Shares (TSLL.US)$ $Meta Platforms (META.US)$ $Advanced Micro Devices (AMD.US)$ $NVIDIA (NVDA.US)$ $GraniteShares 2x Long NVDA Daily ETF (NVDL.US)$ $Tempus AI (TEM.US)$ $Hims & Hers Health (HIMS.US)$

Let’s go! $Tesla (TSLA.US)$ $Direxion Daily TSLA Bull 2X Shares (TSLL.US)$ $Meta Platforms (META.US)$ $Advanced Micro Devices (AMD.US)$ $NVIDIA (NVDA.US)$ $GraniteShares 2x Long NVDA Daily ETF (NVDL.US)$ $Tempus AI (TEM.US)$ $Hims & Hers Health (HIMS.US)$

26

9

Greats Nancy

liked

Let’s break down the 1-hour chart for Agape ATP Corporation (ATPC) as of March 20, 2025. The stock’s sitting at $1.02, down about 1%, and it’s been a wild ride lately.

The price spiked to $3.00 in late January before crashing hard. Since then, it’s been hanging around the $1.00 mark, which has been a solid support—buyers keep stepping in here, like clockwork, especially in early March. The Bollinger Bands show the price dipping below the lower ...

The price spiked to $3.00 in late January before crashing hard. Since then, it’s been hanging around the $1.00 mark, which has been a solid support—buyers keep stepping in here, like clockwork, especially in early March. The Bollinger Bands show the price dipping below the lower ...

5

Greats Nancy

liked

Dear everyone,

CRWD dropped 9% when it released their Q4 2025 results.

Coupled with the tariff scare, the price dropped even more.

While others see danger, we see opportunity again.

I just bought more at USD308 and getting ready for the upside.

Watch my video to know my reasons before the market catches on!

$CrowdStrike (CRWD.US)$

CRWD dropped 9% when it released their Q4 2025 results.

Coupled with the tariff scare, the price dropped even more.

While others see danger, we see opportunity again.

I just bought more at USD308 and getting ready for the upside.

Watch my video to know my reasons before the market catches on!

$CrowdStrike (CRWD.US)$

From YouTube

9

Greats Nancy

liked

$Accenture (ACN.US)$ is expected to release its quarterly fiscal Q2 2025 earnings result on 20 March 2025 before the market open.

ACN is expected to report revenues of $16.58 billion, up 4.9% from the year-ago quarter.

Analysts expect Accenture (ACN) to post quarterly earnings of $2.82 per share, which indicates a year-over-year increase of 2.5%.

Accenture (ACN) Last Positive Earnings Call Saw Share Price Decline By 6.38%

ACN last positive earnings call on ...

ACN is expected to report revenues of $16.58 billion, up 4.9% from the year-ago quarter.

Analysts expect Accenture (ACN) to post quarterly earnings of $2.82 per share, which indicates a year-over-year increase of 2.5%.

Accenture (ACN) Last Positive Earnings Call Saw Share Price Decline By 6.38%

ACN last positive earnings call on ...

+1

9

Greats Nancy

liked

Are retail investors sitting out from buying the dip?

According to data from Barclays, retail outflows from US equities rose to about $4 billion over the past 2 weeks due to tariff chaos and mounting economic concerns. This has caused a 3-week pullback in the S&P 500.

As mentioned previously, the latest rally lacked strength. And true enough, S&P500 and Nasdaq both pulled back more than 1% on Tuesday.

Next up - FOMC meeting!

$Tesla (TSLA.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $NVIDIA (NVDA.US)$ $Meta Platforms (META.US)$ $Microsoft (MSFT.US)$ $Alphabet-A (GOOGL.US)$ $Amazon (AMZN.US)$ $Netflix (NFLX.US)$ $Apple (AAPL.US)$ $Palantir (PLTR.US)$ $Strategy (MSTR.US)$ $Baidu (BIDU.US)$ $BYD COMPANY (01211.HK)$

According to data from Barclays, retail outflows from US equities rose to about $4 billion over the past 2 weeks due to tariff chaos and mounting economic concerns. This has caused a 3-week pullback in the S&P 500.

As mentioned previously, the latest rally lacked strength. And true enough, S&P500 and Nasdaq both pulled back more than 1% on Tuesday.

Next up - FOMC meeting!

$Tesla (TSLA.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $NVIDIA (NVDA.US)$ $Meta Platforms (META.US)$ $Microsoft (MSFT.US)$ $Alphabet-A (GOOGL.US)$ $Amazon (AMZN.US)$ $Netflix (NFLX.US)$ $Apple (AAPL.US)$ $Palantir (PLTR.US)$ $Strategy (MSTR.US)$ $Baidu (BIDU.US)$ $BYD COMPANY (01211.HK)$

From YouTube

8

3

2

Greats Nancy

liked

$Microsoft (MSFT.US)$ (Microsoft, MSFT)近期憑藉AI技術的強勢發展,成功在雲端服務與生產力工具領域站穩腳步,吸引投資人關注。Azure AI雲端運算與Copilot智慧助理已成為企業數位轉型的重要推動力,為微軟帶來龐大增長動能。根據最新財報,微軟AI業務的年化營收已突破13 billion美元,年增長175%,市場對其未來發展充滿期待。然而,AI基礎設施的高額投入、與亞馬遜(Amazon, AMZN)、Google(GOOG)競爭加劇,仍是投資人需要關注的關鍵變數。本篇文章將透過數據分析、產業競爭與市場趨勢,解析微軟的AI戰略,並評估MSFT股價的潛在投資機會。

微軟AI成長爆發,雲端與企業市場雙向發展

Microsoft's AI technology is primarily driven by two core businesses: Azure AI cloud services and Microsoft 365 Copilot. Azure AI has become a key part of enterprise computing architecture, providing solutions such as machine learning, data analysis, and automated decision-making. According to Microsoft's latest report,about one-third of Azure customers have already implemented AI technology...

微軟AI成長爆發,雲端與企業市場雙向發展

Microsoft's AI technology is primarily driven by two core businesses: Azure AI cloud services and Microsoft 365 Copilot. Azure AI has become a key part of enterprise computing architecture, providing solutions such as machine learning, data analysis, and automated decision-making. According to Microsoft's latest report,about one-third of Azure customers have already implemented AI technology...

Translated

11

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)