HappyG0Lucky

voted

Hi, mooers. Welcome to Ask & Help. This is where knowledgeable mooers share their precious insights with their fellow mooers. We value active interactions among mooers with different interests. We are glad to see mooers helping each other and establishing connections in a harmonious and inclusive atmosphere.

In this Frequently Asked Questions post, we've put together some commonly asked questions and valuable answers from mooers about moomoo and the Moo community. Before reading th...

In this Frequently Asked Questions post, we've put together some commonly asked questions and valuable answers from mooers about moomoo and the Moo community. Before reading th...

544

45

HappyG0Lucky

liked and commented on

Everyone has been calling BTFD! Have we truly bottomed?

Based off my analysis, we still have yet to complete the measured move down to 12200 on the $E-mini NASDAQ 100 Futures(SEP4)(NQmain.US$ and around 4000 on the $E-mini S&P 500 Futures(SEP4)(ESmain.US$ .

There is still tons of downside from here. As much as it seems like a reversal the past 3 days, bearish divergences have been starting to form again signifying downside coming. Everytime we form regular bearish divergence on the 4...

Based off my analysis, we still have yet to complete the measured move down to 12200 on the $E-mini NASDAQ 100 Futures(SEP4)(NQmain.US$ and around 4000 on the $E-mini S&P 500 Futures(SEP4)(ESmain.US$ .

There is still tons of downside from here. As much as it seems like a reversal the past 3 days, bearish divergences have been starting to form again signifying downside coming. Everytime we form regular bearish divergence on the 4...

44

783

HappyG0Lucky

commented on

What are we to expect from FOMC today? 25BP is what I know the FEDs want as they can't service their current and future debts with high interest rates. But 50BP I feel might be their move as inflation has yet to peak despite all the promises since 2021. Let's see tonight.

Yields have inversed on the 7yr and $Cboe Interest Rate 10 Year T Note(.TNX.US$ and the spread between the 2yr and 10yr is getting tighter signalling incoming inverse curve which I have been warning since 16th Jan. Yesterday ...

Yields have inversed on the 7yr and $Cboe Interest Rate 10 Year T Note(.TNX.US$ and the spread between the 2yr and 10yr is getting tighter signalling incoming inverse curve which I have been warning since 16th Jan. Yesterday ...

53

1289

HappyG0Lucky

reacted to

Weekly market recap

Stock futures fluctuated in overnight trading Sunday following a losing week as investors continued to grapple with the resurgence of Covid cases and an upcoming shift in the Federal Reserve's easy monetary policy.

The major averages are coming off a negative week, with the $S&P 500 Index(.SPX.US$ declining 1.9%. The tech-heavy $Nasdaq Composite Index(.IXIC.US$ dropped nearly 3% last week as investors dumped high-flying growth stocks on the prospect of higher interest rates, while the $Dow Jones Industrial Average(.DJI.US$ slipped 1.7%.

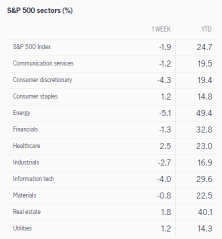

Here's a look at the return of S&P 500 sectors

The week ahead in focus

Stock and bond markets around the world will be closed Friday in observance of Christmas. Before the holiday break, Nike and Micron Technology report on Monday, BlackBerry and General Mills on Tuesday, and CarMax, Cintas, and Paychex on Wednesday.

It will be a busy week of economic data releases. On Monday, the Conference Board publishes its Leading Economic Index for November, followed by its Consumer Confidence Index for December on Wednesday.

On Thursday, the Bureau of Economic Analysis reports personal income and consumption expenditures for November. Consumer earnings are forecast to have risen 0.6% while spending is seen climbing 0.5%. The Federal Reserve's preferred measure of inflation, the core PCE price index, is expected to have spiked 4.5% in November.

Also Thursday, the Census Bureau releases the durable goods report for November, which will provide a window into investment spending in the economy. New orders are forecast to have risen 2.1%. Housing-market indicators out this week include existing-home sales for November on Wednesday and new-home sales for November on Thursday.

Monday 12/20

$Micron Technology(MU.US$ and $Nike(NKE.US$ report quarterly results.

The Conference Board releases its Leading Economic Index for November. Consensus estimate is for a 119 reading, which would be 0.6% more than October's level. The Conference Board currently projects a 5% growth rate for fourth-quarter gross domestic product and a slower but still robust 2.6% for 2022.

Tuesday 12/21

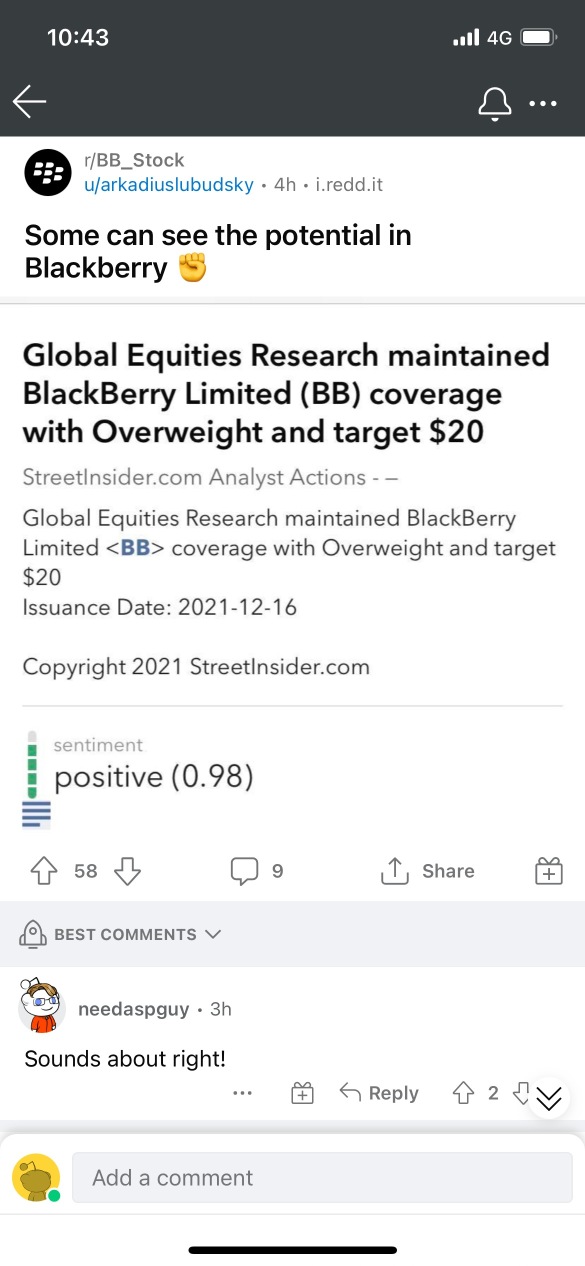

$BlackBerry(BB.US$, $FactSet Research Systems(FDS.US$, and $General Mills(GIS.US$ announce earnings.

Wednesday 12/22

The NAR reports existing-home sales for November. Economists forecast a seasonally adjusted annual rate of 6.4 million homes sold, slightly more than in October and the highest since the beginning of the year.

$CarMax(KMX.US$, $Cintas(CTAS.US$, and $Paychex(PAYX.US$ hold conference calls to discuss quarterly results.

The Bureau of Economic Analysis reports its third and final estimate for third-quarter GDP. Economists forecast a 2.1% seasonally adjusted annual growth rate, unchanged from November's second estimate.

The Conference Board releases its Consumer Confidence Index for December. Expectations are for a 110 reading, roughly even with the November data. The index is 15% lower than the postpandemic peak reached in June of this year, due to concerns about rising prices and, to a lesser degree, Covid-19 variants.

Thursday 12/23

The Department of Labor reports initial jobless claims for the week ending on Dec. 18. Jobless claims have averaged 225,667 a week in November and December, and have finally reached prepandemic levels.

The Census Bureau reports new-home sales for November. Consensus estimate is for a seasonally adjusted annual rate of 770,000 new single-family houses sold, 25,000 more than in October. The median sales price of new houses sold in October was $407,700, while the average sales price was $477,800 -- both record highs.

The BEA reports personal income and consumption expenditures for November. Economists forecast a 0.6% monthly increase for income and 0.5% for consumption. This compares with gains for 0.5% and 1.3%, respectively, in October. The Federal Reserve's preferred inflation gauge, the core PCE price index, jumped 4.1% year over year in October, the fastest rate since 1991. Predictions are for it to spike 4.6% in November.

The Census Bureau releases the durable goods report for November. New orders for durable manufactured goods are expected to increase 2.1%, to $265.6 billion. Excluding transportation, new orders are seen gaining 0.6%, compared with a 0.5% rise in October.

Friday 12/24

U.S. equity and fixed-income markets are closed in observance of Christmas.

Source: CNBC, jhinvestments, Dow Jones Newswires

Stock futures fluctuated in overnight trading Sunday following a losing week as investors continued to grapple with the resurgence of Covid cases and an upcoming shift in the Federal Reserve's easy monetary policy.

The major averages are coming off a negative week, with the $S&P 500 Index(.SPX.US$ declining 1.9%. The tech-heavy $Nasdaq Composite Index(.IXIC.US$ dropped nearly 3% last week as investors dumped high-flying growth stocks on the prospect of higher interest rates, while the $Dow Jones Industrial Average(.DJI.US$ slipped 1.7%.

Here's a look at the return of S&P 500 sectors

The week ahead in focus

Stock and bond markets around the world will be closed Friday in observance of Christmas. Before the holiday break, Nike and Micron Technology report on Monday, BlackBerry and General Mills on Tuesday, and CarMax, Cintas, and Paychex on Wednesday.

It will be a busy week of economic data releases. On Monday, the Conference Board publishes its Leading Economic Index for November, followed by its Consumer Confidence Index for December on Wednesday.

On Thursday, the Bureau of Economic Analysis reports personal income and consumption expenditures for November. Consumer earnings are forecast to have risen 0.6% while spending is seen climbing 0.5%. The Federal Reserve's preferred measure of inflation, the core PCE price index, is expected to have spiked 4.5% in November.

Also Thursday, the Census Bureau releases the durable goods report for November, which will provide a window into investment spending in the economy. New orders are forecast to have risen 2.1%. Housing-market indicators out this week include existing-home sales for November on Wednesday and new-home sales for November on Thursday.

Monday 12/20

$Micron Technology(MU.US$ and $Nike(NKE.US$ report quarterly results.

The Conference Board releases its Leading Economic Index for November. Consensus estimate is for a 119 reading, which would be 0.6% more than October's level. The Conference Board currently projects a 5% growth rate for fourth-quarter gross domestic product and a slower but still robust 2.6% for 2022.

Tuesday 12/21

$BlackBerry(BB.US$, $FactSet Research Systems(FDS.US$, and $General Mills(GIS.US$ announce earnings.

Wednesday 12/22

The NAR reports existing-home sales for November. Economists forecast a seasonally adjusted annual rate of 6.4 million homes sold, slightly more than in October and the highest since the beginning of the year.

$CarMax(KMX.US$, $Cintas(CTAS.US$, and $Paychex(PAYX.US$ hold conference calls to discuss quarterly results.

The Bureau of Economic Analysis reports its third and final estimate for third-quarter GDP. Economists forecast a 2.1% seasonally adjusted annual growth rate, unchanged from November's second estimate.

The Conference Board releases its Consumer Confidence Index for December. Expectations are for a 110 reading, roughly even with the November data. The index is 15% lower than the postpandemic peak reached in June of this year, due to concerns about rising prices and, to a lesser degree, Covid-19 variants.

Thursday 12/23

The Department of Labor reports initial jobless claims for the week ending on Dec. 18. Jobless claims have averaged 225,667 a week in November and December, and have finally reached prepandemic levels.

The Census Bureau reports new-home sales for November. Consensus estimate is for a seasonally adjusted annual rate of 770,000 new single-family houses sold, 25,000 more than in October. The median sales price of new houses sold in October was $407,700, while the average sales price was $477,800 -- both record highs.

The BEA reports personal income and consumption expenditures for November. Economists forecast a 0.6% monthly increase for income and 0.5% for consumption. This compares with gains for 0.5% and 1.3%, respectively, in October. The Federal Reserve's preferred inflation gauge, the core PCE price index, jumped 4.1% year over year in October, the fastest rate since 1991. Predictions are for it to spike 4.6% in November.

The Census Bureau releases the durable goods report for November. New orders for durable manufactured goods are expected to increase 2.1%, to $265.6 billion. Excluding transportation, new orders are seen gaining 0.6%, compared with a 0.5% rise in October.

Friday 12/24

U.S. equity and fixed-income markets are closed in observance of Christmas.

Source: CNBC, jhinvestments, Dow Jones Newswires

+2

113

7

HappyG0Lucky

liked

Columns Sector Rotation?

What happened after FED's meeting?

We are currently having a sector rotation from tech growth stocks into value stocks after Wednesday's Fed policy of 3 rate hikes in 2022 instead of 2 and also speed up tapering and ending it a few months earlier than expected.

The initial taper plan was $10B for treasury securities and $5B for MBS (Mortgage Backed Securities) but now it has doubled the speed of tapering to $20B for treasury securities and $10B for MBS and tapering to end by March 2022. Which shortly after, rate hikes should come in progressively.

The reason for the fed turning hawkish and a quick shift to taper at a quicker pace and more rate hikes was due to inflation at a 40 year high. They also did not expect inflation to rise above 2% in 2021 and kept mentioning about higher inflation rate being transitory. Current inflation is at 6.8% based on the YOY report.

How did this affect the market on Thursday?

When tapering is sped up, liquidity will be tightened in the market. There will not be as much free cash to be pumped into the market to let prices rally like we have seen the last 2 years.

Interest rate hikes will also dampen valuation on growth stocks as growth stocks are priced in more to future earnings expectations. If rates rise, it will hurt those expectations. Investors will start to see bonds and value stocks that thrive in high-interest rate environments a better asset class thus making it more appealing against higher-risk growth stocks.

Small-cap stocks usually also suffer because they tend to loan more money to fund the growth of the company thus making them more sensitive towards the rate hikes.

Thus we saw the $NASDAQ 100 Index(.NDX.US$ and $iShares Russell 2000 ETF(IWM.US$ mostly small-cap and tech stocks falling much sharper than $Dow Jones Industrial Average(.DJI.US$ yesterday which consist mainly of value stocks.

What to do now? Should I exit my growth holdings?

That being said, inflation and rate hikes over the long run still don't pose a huge threat to growth stocks. It is usually short-term when the rotation happens towards value stocks. So take this opportunity to find good entry points into the stocks which are undergoing the selloff.

As always, trade safe & invest wise!

$Apple(AAPL.US$ $Tesla(TSLA.US$ $Meta Platforms(FB.US$ $Microsoft(MSFT.US$ $Amazon(AMZN.US$ $NVIDIA(NVDA.US$ $Adobe(ADBE.US$ $Invesco QQQ Trust(QQQ.US$ $SPDR Dow Jones Industrial Average Trust(DIA.US$

We are currently having a sector rotation from tech growth stocks into value stocks after Wednesday's Fed policy of 3 rate hikes in 2022 instead of 2 and also speed up tapering and ending it a few months earlier than expected.

The initial taper plan was $10B for treasury securities and $5B for MBS (Mortgage Backed Securities) but now it has doubled the speed of tapering to $20B for treasury securities and $10B for MBS and tapering to end by March 2022. Which shortly after, rate hikes should come in progressively.

The reason for the fed turning hawkish and a quick shift to taper at a quicker pace and more rate hikes was due to inflation at a 40 year high. They also did not expect inflation to rise above 2% in 2021 and kept mentioning about higher inflation rate being transitory. Current inflation is at 6.8% based on the YOY report.

How did this affect the market on Thursday?

When tapering is sped up, liquidity will be tightened in the market. There will not be as much free cash to be pumped into the market to let prices rally like we have seen the last 2 years.

Interest rate hikes will also dampen valuation on growth stocks as growth stocks are priced in more to future earnings expectations. If rates rise, it will hurt those expectations. Investors will start to see bonds and value stocks that thrive in high-interest rate environments a better asset class thus making it more appealing against higher-risk growth stocks.

Small-cap stocks usually also suffer because they tend to loan more money to fund the growth of the company thus making them more sensitive towards the rate hikes.

Thus we saw the $NASDAQ 100 Index(.NDX.US$ and $iShares Russell 2000 ETF(IWM.US$ mostly small-cap and tech stocks falling much sharper than $Dow Jones Industrial Average(.DJI.US$ yesterday which consist mainly of value stocks.

What to do now? Should I exit my growth holdings?

That being said, inflation and rate hikes over the long run still don't pose a huge threat to growth stocks. It is usually short-term when the rotation happens towards value stocks. So take this opportunity to find good entry points into the stocks which are undergoing the selloff.

As always, trade safe & invest wise!

$Apple(AAPL.US$ $Tesla(TSLA.US$ $Meta Platforms(FB.US$ $Microsoft(MSFT.US$ $Amazon(AMZN.US$ $NVIDIA(NVDA.US$ $Adobe(ADBE.US$ $Invesco QQQ Trust(QQQ.US$ $SPDR Dow Jones Industrial Average Trust(DIA.US$

168

6

HappyG0Lucky

liked

HappyG0Lucky

liked

$AMC Entertainment(AMC.US$ other stocks red af and amc green😎😎

12

HappyG0Lucky

liked

19

HappyG0Lucky

liked

$Apple(AAPL.US$ fed cannot raise rates high enough to cover inflation…Rates will have to be above 10 to 15 % to cover and they can't do that now after all the stupid they have done!!!

So sit back for next 3 years and enjoy the APPLE Ride it's gonna be the best!

So sit back for next 3 years and enjoy the APPLE Ride it's gonna be the best!

11

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)