Hdl tradecraft u ru

Set a live reminder

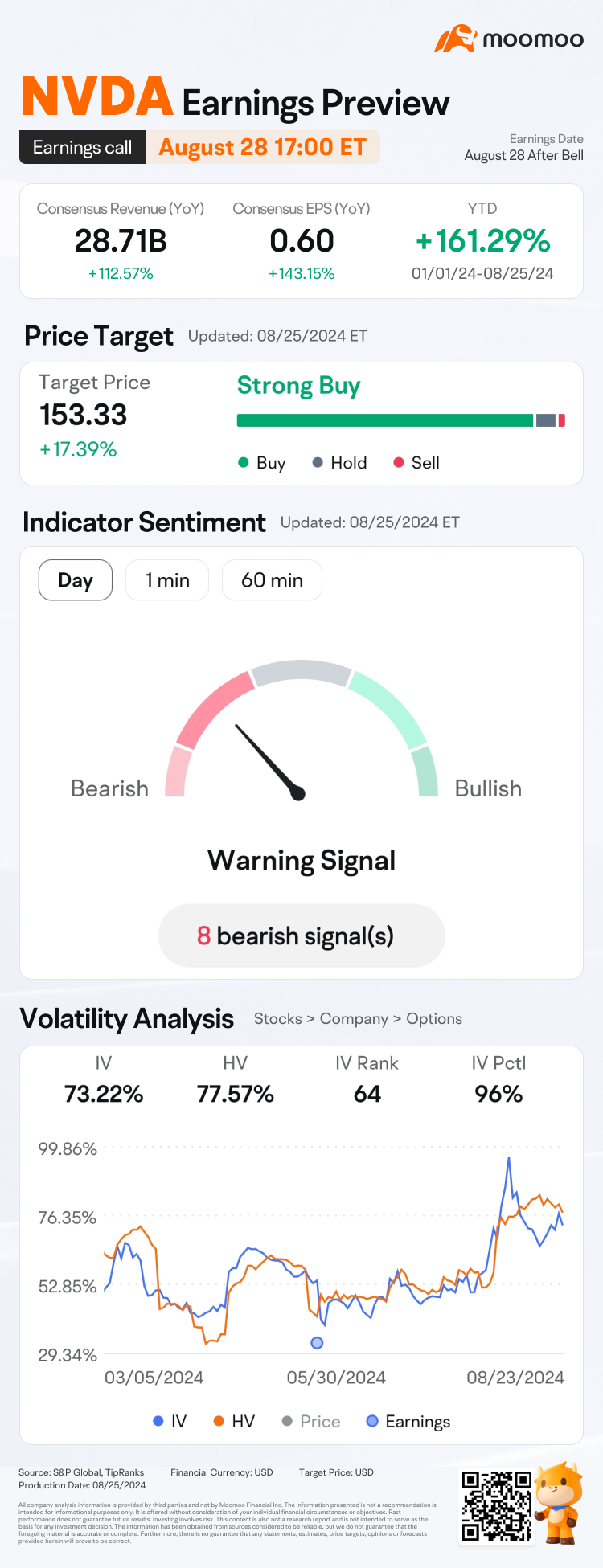

$NVIDIA (NVDA.US)$

NVIDIA Q2 FY2025 earnings conference call is scheduled for August 28 at 5:00 PM EDT /August 29 at 5:00 AM SGT /August 29 at 7:00 AM AEST. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from NVIDIA's Q2 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what management has to say!

Disclaimer:

This presentation is for information and ...

NVIDIA Q2 FY2025 earnings conference call is scheduled for August 28 at 5:00 PM EDT /August 29 at 5:00 AM SGT /August 29 at 7:00 AM AEST. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from NVIDIA's Q2 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what management has to say!

Disclaimer:

This presentation is for information and ...

NVIDIA Q2 FY2025 earnings conference call

Aug 28 16:00

74

17

Hdl tradecraft u ru

voted

Hi mooers!

$NVIDIA (NVDA.US)$ is releasing its Q2 earnings on August 28 after the bell. Unlock insights with NVDA Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its last earnings release, shares of $NVIDIA (NVDA.US)$ have seen an increase of 35.64%. What do you think of this earnings report? Let's see if you can be motivated by the following information!

![]() Mooer's insights:

Mooer's insights:

· @Mr Long Te...

$NVIDIA (NVDA.US)$ is releasing its Q2 earnings on August 28 after the bell. Unlock insights with NVDA Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its last earnings release, shares of $NVIDIA (NVDA.US)$ have seen an increase of 35.64%. What do you think of this earnings report? Let's see if you can be motivated by the following information!

· @Mr Long Te...

+8

101

116

Hdl tradecraft u ru

voted

Hi, mooers!

Singapore is turning 59! Let’s give our sunny island a big shoutout and wish it a Happy Birthday! 🎈🎊

Did you plan to join any National Day celebrations tonight? Spot any interesting NDP decorations? Our staff went to Jewel Changi Airport and caught the amazing light show there. Any mooers there too? Share your story with us NOW for a chance to win some reward points! Tap to join the discussion>>

Source: moomoo...

Singapore is turning 59! Let’s give our sunny island a big shoutout and wish it a Happy Birthday! 🎈🎊

Did you plan to join any National Day celebrations tonight? Spot any interesting NDP decorations? Our staff went to Jewel Changi Airport and caught the amazing light show there. Any mooers there too? Share your story with us NOW for a chance to win some reward points! Tap to join the discussion>>

Source: moomoo...

57

81

Hdl tradecraft u ru

voted

The market’s been a bloodbath 😱 lately, and I’m not alone in feeling the sting. Scouring the Moo community, I’ve seen countless stories of losses – folks pouring their hearts out about their shrinking portfolios. It’s a humbling reminder that we’re all in this together. Sure, there are a few lucky souls boasting about their gains 🤑, but they’re like unicorns 🦄 in a field of wounded gazelles. @104240685 @Wenhao95 @sky9191, you’re one of those lucky fe...

108

63

Hdl tradecraft u ru

voted

In recent days, global markets, led by the U.S. stock market, seem to be struggling

Last Friday, the U.S. non-farm payroll data and unemployment rate came in worse than expected, sparking fears of an economic recession and widespread market panic.

U.S. technology stocks were especially hard hit. In the Mag7 group, only $Apple (AAPL.US)$ saw a slight increase, while the rest declined, with $NVIDIA (NVDA.US)$ falling s...

46

5

Hdl tradecraft u ru

voted

The recent market crash felt like a gut punch, especially for those of us holding onto tech darlings like NVDA😭. My portfolio was a graveyard of plummeting stocks💔, and watching NVDA tumble to a shocking $91.30 felt like a nightmare come true. It was like watching my life savings evaporate before my eyes.

But amidst the wreckage, I saw a glimmer of hope. The opportunity to buy low, to gamble on a rebound, was too tempting to ignore. I took a risk...

But amidst the wreckage, I saw a glimmer of hope. The opportunity to buy low, to gamble on a rebound, was too tempting to ignore. I took a risk...

54

15

Hdl tradecraft u ru

voted

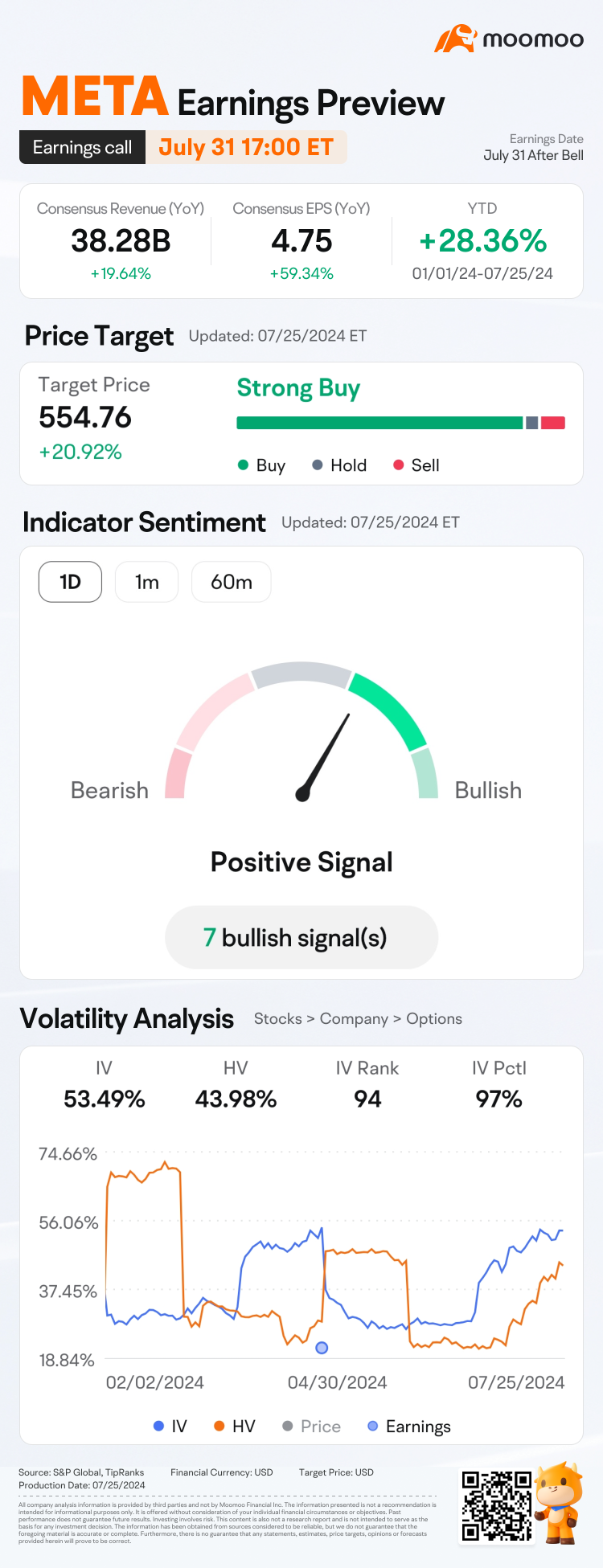

Hi, mooers!

Join the Q2 Earnings Challenge and share 30,000 points! Tap to learn more!

$Meta Platforms (META.US)$ is releasing its Q2 earnings on July 31 after the bell. Unlock insights with META Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Meta Platforms (META.US)$ have seen an decrease of 8.03%. How will the market react to the upcoming results?...

Join the Q2 Earnings Challenge and share 30,000 points! Tap to learn more!

$Meta Platforms (META.US)$ is releasing its Q2 earnings on July 31 after the bell. Unlock insights with META Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Meta Platforms (META.US)$ have seen an decrease of 8.03%. How will the market react to the upcoming results?...

Expand

Expand 84

154

Hdl tradecraft u ru

Set a live reminder

[Synopsis]

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

A Pivotal Year: Strategies for Capturing Income

Jun 28 04:00

24

Hdl tradecraft u ru

Set a live reminder

[Synopsis]

Mid-2024 - where are we for Asia's Fixed Income space? What is the outlook and how can investors utilise the potential window of opportunities in the current global market context? We delve deeper into possible strategies you may leverage on for Fixed Income, so join us to find out more on the analysis as we transition into the second half of the year with our experts from UOB Asset Management. Come learn with us and stand a chance to win some...

Mid-2024 - where are we for Asia's Fixed Income space? What is the outlook and how can investors utilise the potential window of opportunities in the current global market context? We delve deeper into possible strategies you may leverage on for Fixed Income, so join us to find out more on the analysis as we transition into the second half of the year with our experts from UOB Asset Management. Come learn with us and stand a chance to win some...

Asia Fixed Income: A Window of Opportunity

Jun 28 02:00

7

Hdl tradecraft u ru

Set a live reminder

[Synopsis]

With the US interest rate cycle transitions since the start of 2024 - where are we now given there is no rate cutes in 2024 by the Fed? How can investors potentially benefit and what can we expect from the US market going into the second half of the year? Find out more in the latest live webinar with our expert from CSOP Asset Management. Join us and you might be rewarded with some giveaways and quiz questions.@olivehiggo

[Speake...

With the US interest rate cycle transitions since the start of 2024 - where are we now given there is no rate cutes in 2024 by the Fed? How can investors potentially benefit and what can we expect from the US market going into the second half of the year? Find out more in the latest live webinar with our expert from CSOP Asset Management. Join us and you might be rewarded with some giveaways and quiz questions.@olivehiggo

[Speake...

US Interest rate cycle overview by CSOP Asset Management

Jun 27 04:00

8

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)