Hello Is Me

reacted to

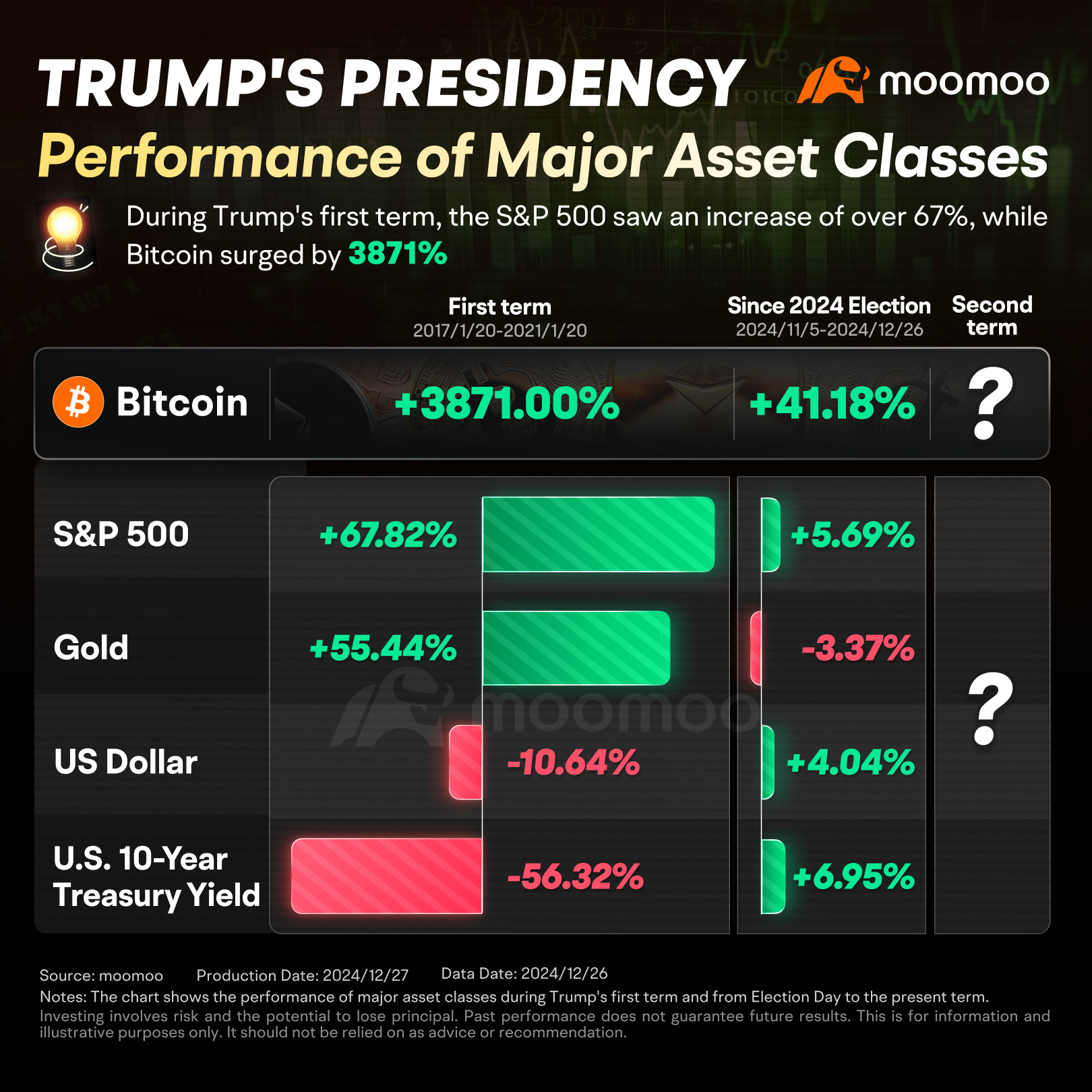

Trump's first term spanned from January 20, 2017, to January 20, 2021, during which time major asset classes like $Bitcoin (BTC.CC)$, $S&P 500 Index (.SPX.US)$, and $XAU/USD (XAUUSD.CFD)$ saw remarkable gains, increasing by 3,871%, 67.82%, and 55.44% respectively. Conversely, $USD (USDindex.FX)$ and $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ experienced declines of 10.64% and 56.32% respectively.

Since Election Day on November 5, 2024, up to December 26, 2024, the S&P 5...

Since Election Day on November 5, 2024, up to December 26, 2024, the S&P 5...

+1

67

10

99

Hello Is Me

reacted to

$NVIDIA (NVDA.US)$ if in 1230 not touch 140.2 u r safe and has broken out of trend in 1mins.

5

Hello Is Me

reacted to

$Bitcoin (BTC.CC)$ small correction perhaps 80-90k/medium 50-70k/big 26-40k, after that rebound again, DYOR.

3

3

Hello Is Me

reacted to

Good days don’t last forever. I would say the crash or pullback on the tech stocks is long overdue. I am fine with drop although it seems quite heavy.

$Tesla (TSLA.US)$ leads the pack with the largest drop. However it looks like it is recovering from some of that already pre market today.

Still maintaining great outlook for this month. As for next year, I believe the bull will still be with us.![]()

$NVIDIA (NVDA.US)$ $Broadcom (AVGO.US)$ $Meta Platforms (META.US)$ $Amazon (AMZN.US)$ $GraniteShares 2x Long NVDA Daily ETF (NVDL.US)$ $Advanced Micro Devices (AMD.US)$

...

$Tesla (TSLA.US)$ leads the pack with the largest drop. However it looks like it is recovering from some of that already pre market today.

Still maintaining great outlook for this month. As for next year, I believe the bull will still be with us.

$NVIDIA (NVDA.US)$ $Broadcom (AVGO.US)$ $Meta Platforms (META.US)$ $Amazon (AMZN.US)$ $GraniteShares 2x Long NVDA Daily ETF (NVDL.US)$ $Advanced Micro Devices (AMD.US)$

...

22

11

2

Hello Is Me

liked

VIX is a fear gage for the market but it isn't the best one. It's just the one everyone seems to use because it's easily available to retail traders. The one institutions actually use because the correlation is WAY more accurate is credit spreads. The narrower the credit spreads are, the better. The less fear, risk and cause for concern. Guess what. Although VIX spiked 75% today, credit spreads DID NOT BUDGE. You can track them on trading ciew btw but they are lagged by a day.

The...

The...

6

6

1

Hello Is Me

reacted to

$Tesla (TSLA.US)$

I am also confused.![]()

Hold positions and continue to enjoy the bull market. Those without positions need to resist temptation and avoid chasing highs. There are plenty of opportunities.

Be cautious of risks, I will not sell. The total position is already around 20-30%. Let's continue to take it step by step.

There is a large amount, at the extreme of human nature, I will mention the top structure, but as long as the trend remains unchanged, it is still a bullish arrangement. I hope for a pullback to the 20-day moving average to enter the market.

Happy trading for the bulls, be cautious bears.

I am also confused.

Hold positions and continue to enjoy the bull market. Those without positions need to resist temptation and avoid chasing highs. There are plenty of opportunities.

Be cautious of risks, I will not sell. The total position is already around 20-30%. Let's continue to take it step by step.

There is a large amount, at the extreme of human nature, I will mention the top structure, but as long as the trend remains unchanged, it is still a bullish arrangement. I hope for a pullback to the 20-day moving average to enter the market.

Happy trading for the bulls, be cautious bears.

Translated

79

4

3

Hello Is Me

reacted to

$NVIDIA (NVDA.US)$ be mature..there are trap or your so called god here. everyone is free to have their say…it is either up or down…we all are considered small fly here…just enjoy life, pray that u buy the correct up or down.

13

2

Hello Is Me

liked

$NVIDIA (NVDA.US)$ I expect 150 next week

6

1

Hello Is Me

liked

$MicroStrategy (MSTR.US)$ The strategy of MicroStrategy is very simple, which is to develop new shareholders, allocate a portion of the money invested by each new shareholder to old shareholders, and the remaining portion is the share he holds in the company. Under the current premium, the former is a large portion, while the latter is a small portion.

Is this a good deal for existing shareholders? Of course. Is this a good investment for new shareholders? This entirely depends on how many people you think will join this gaming after you.

As for whether this is a Ponzi scheme, it is actually a definition problem of little significance. Its strategy is very clear, hard to say it's a scam, more like a pyramid scheme. Pyramid schemes have also sparked similar frenzies in the past, with many extremely dedicated 'followers.'

As for the company using this money to buy BTC, it is not essential. It's just like MLM requiring a product, just needing a story. This is not the essence of this business model.

As for Convertible Bonds, they are just minor optimizations. Selling Call Options and selling Stocks have differences, but essentially the same.

Is this a good deal for existing shareholders? Of course. Is this a good investment for new shareholders? This entirely depends on how many people you think will join this gaming after you.

As for whether this is a Ponzi scheme, it is actually a definition problem of little significance. Its strategy is very clear, hard to say it's a scam, more like a pyramid scheme. Pyramid schemes have also sparked similar frenzies in the past, with many extremely dedicated 'followers.'

As for the company using this money to buy BTC, it is not essential. It's just like MLM requiring a product, just needing a story. This is not the essence of this business model.

As for Convertible Bonds, they are just minor optimizations. Selling Call Options and selling Stocks have differences, but essentially the same.

Translated

5

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)