$GENM (4715.MY)$ today fly !

2

Horng Chang

liked

$GENM (4715.MY)$ 2.55 or 2.60 let's go

4

2

Horng Chang

liked

(Kuala Lumpur, 3rd) Analysts pointed out that the stock performance of gambling companies last year lagged behind the FTSE Bursa Malaysia KLCI, but they believe it will gradually rebound in the first half of 2025.

Dahua Jixian pointed out: 'We believe that the industry's profit growth, undervalued financial indicators, and generous dividend yield are very compatible with our potential lagging investment strategy.'

'We expect profits to strengthen seasonally from the fourth quarter of the 2024 fiscal year (4Q24) to the first half of 2025, mainly due to the influx of international tourists and a strong domestic consumption trend.'

This will lead to a gradual recovery of the industry's stock price in the first half of this year, but the momentum is relatively mild.

According to the data from this research institution, the trend of tourism consumption is still in a growth range, with a year-on-year increase of 4.9% in consumer spending in the third quarter of 2024.

"Our channel survey shows that the business volume of two sectors, casinos and numbers forecast operations, remained strong between October and November 2024."

"In the casino sector, multiple related indicators (such as flight capacity and international tourist visitation) have all increased month-on-month. As for the numbers forecast operations, lottery sales have recovered and stabilized at over 90% of the pre-pandemic levels."

The report points out that the valuation of the Gambling industry is currently 1.5 to 2 standard deviations below the average level, very attractive as it is still in the early stages after the pandemic.

"In addition, the industry still offers a lucrative weekly dividend yield of 5.1% to 10.5%, benefiting from the period between 2024 and 2025...

Dahua Jixian pointed out: 'We believe that the industry's profit growth, undervalued financial indicators, and generous dividend yield are very compatible with our potential lagging investment strategy.'

'We expect profits to strengthen seasonally from the fourth quarter of the 2024 fiscal year (4Q24) to the first half of 2025, mainly due to the influx of international tourists and a strong domestic consumption trend.'

This will lead to a gradual recovery of the industry's stock price in the first half of this year, but the momentum is relatively mild.

According to the data from this research institution, the trend of tourism consumption is still in a growth range, with a year-on-year increase of 4.9% in consumer spending in the third quarter of 2024.

"Our channel survey shows that the business volume of two sectors, casinos and numbers forecast operations, remained strong between October and November 2024."

"In the casino sector, multiple related indicators (such as flight capacity and international tourist visitation) have all increased month-on-month. As for the numbers forecast operations, lottery sales have recovered and stabilized at over 90% of the pre-pandemic levels."

The report points out that the valuation of the Gambling industry is currently 1.5 to 2 standard deviations below the average level, very attractive as it is still in the early stages after the pandemic.

"In addition, the industry still offers a lucrative weekly dividend yield of 5.1% to 10.5%, benefiting from the period between 2024 and 2025...

Translated

27

5

Horng Chang

liked

$GENM (4715.MY)$ This stock will have to wait till the Ex-Date for dividends to see it rise to 2.3 - 2.4 next year. ![]()

![]()

![]()

1

Horng Chang

reacted to

Tmr go Genting M. Today buy some stocks first before it runs out of stock during CNY.

Allt he best !

$GENM (4715.MY)$

Allt he best !

$GENM (4715.MY)$

14

Horng Chang

voted

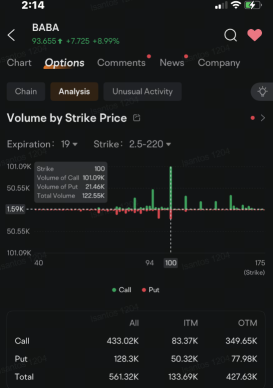

$Alibaba (BABA.US)$'s options volume more than tripled after reports that China's politburo, the Asian nation's most important decision-making body, vowed to use fiscal and monetary policy to bolster economic growth.

More than 561,000 Alibaba call and put options changed hands across 19 expiration dates that stretch through Jan. 15, 2027, as of 2:14 p.m. in New York Monday. That's more than triple the previous session's 1...

More than 561,000 Alibaba call and put options changed hands across 19 expiration dates that stretch through Jan. 15, 2027, as of 2:14 p.m. in New York Monday. That's more than triple the previous session's 1...

32

10

12

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)