Huat made

voted

Last week, the markets were dominated by escalating trade tensions, with tariffs on steel and aluminum imports sparking fears of a global trade war. The European Union retaliated with counter-tariffs on $28 billion worth of U.S. goods, further spooking investors. Meanwhile, concerns over valuations and earnings continued to weigh on the tech sector, with $Adobe (ADBE.US)$ and $Intel (INTC.US)$ making headlines f...

+13

2073

359

23

Huat made

voted

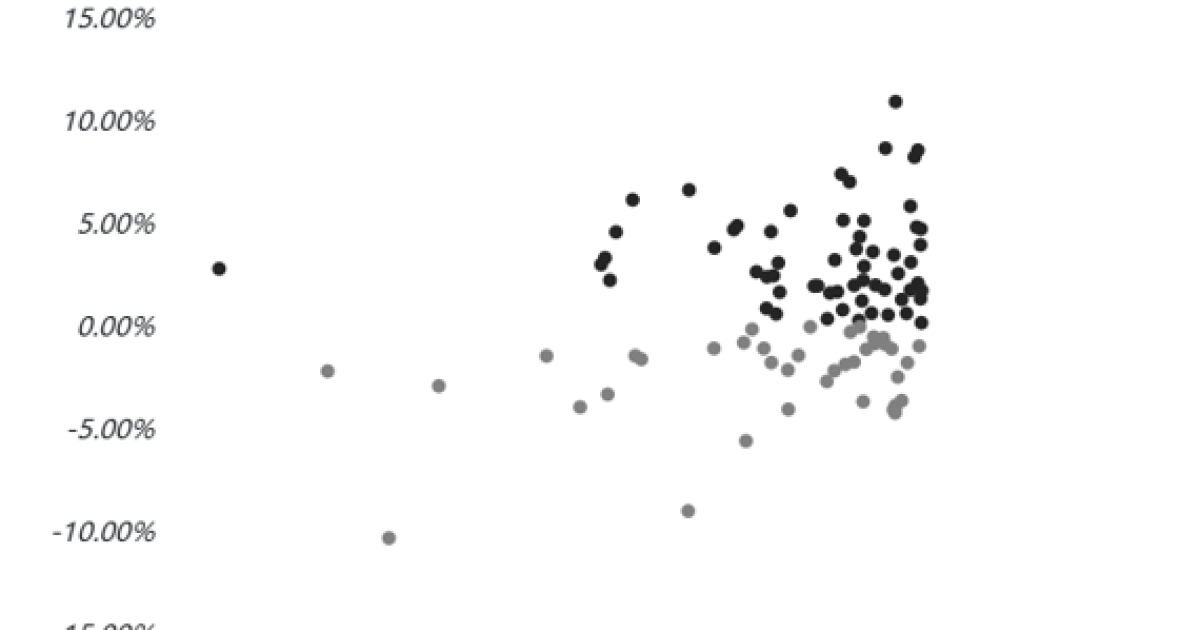

Given the extensive updates and technological innovations expected at NVIDIA's GTC 2025, coupled with historical data suggesting a high likelihood of $NVIDIA (NVDA.US)$'s stock price increasing during such events, a strategic approach to options trading can be particularly beneficial. Here's an integrated strategy that leverages both the expected technological announcements and historical stock performance.

Introduction

$NVIDIA (NVDA.US)$'s premier...

+6

108

23

14

Huat made

voted

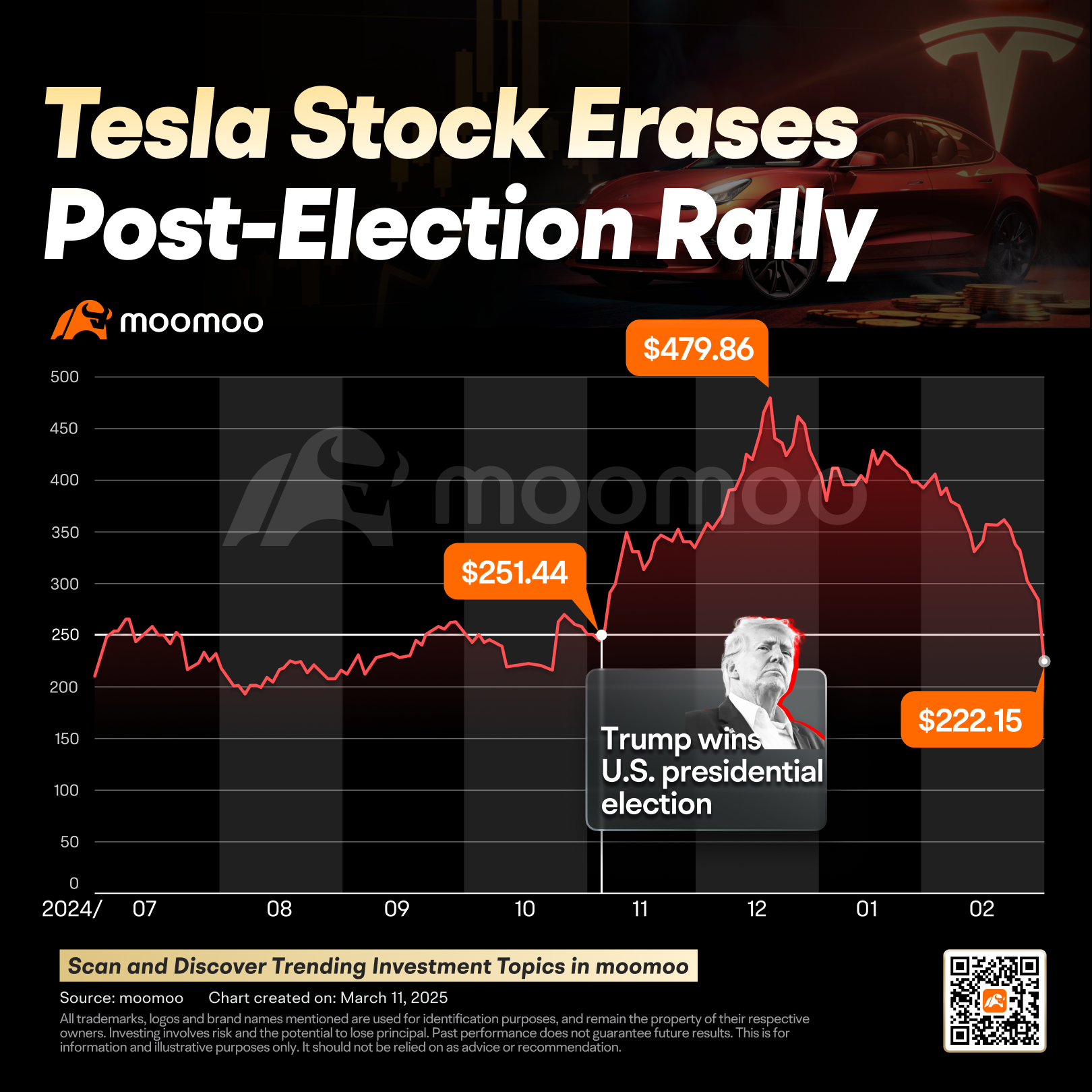

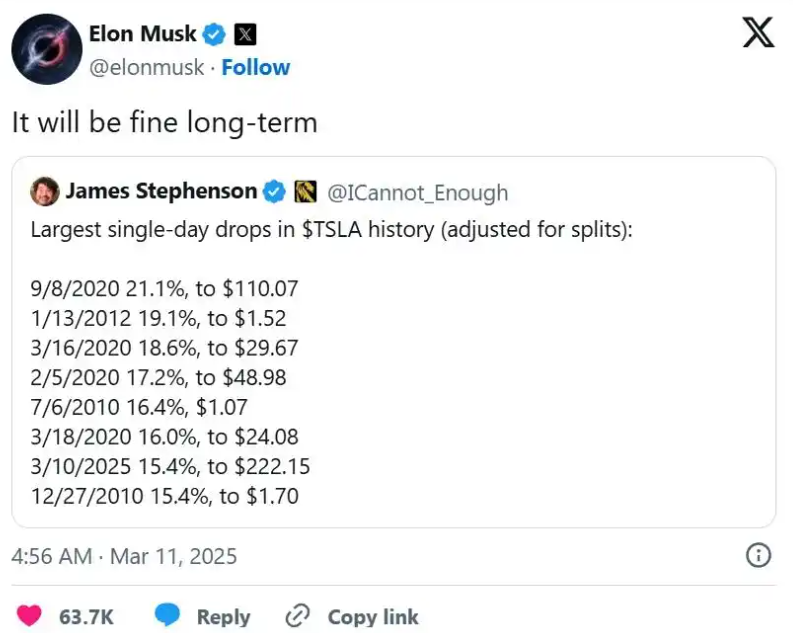

On March 10th, $Tesla (TSLA.US)$'s stock faced a “Black Monday,” plunging 15.4% to close at $222.15, the worst single day drop since September 2020.

Overnight, it shed $130 billion in market value, equivalent to erasing $Ford Motor (F.US)$ and $General Motors (GM.US)$'s combined worth. This rout dragged the Nasdaq down 4% and sliced Tesla’s valuation in HALF from its December 2024 peak ($479.86).

Bounce or Bust?

We'll see endless analysis on...

Overnight, it shed $130 billion in market value, equivalent to erasing $Ford Motor (F.US)$ and $General Motors (GM.US)$'s combined worth. This rout dragged the Nasdaq down 4% and sliced Tesla’s valuation in HALF from its December 2024 peak ($479.86).

Bounce or Bust?

We'll see endless analysis on...

38

10

22

Huat made

voted

The Malaysian stock market has seen a notable adjustment this year. $FTSE Bursa Malaysia KLCI Index (.KLSE.MY)$ has dropped by 4.74% and recently hit a one-month low of 1,555.66 points.

Wednesday, the market ended its four-day losing streak, buoyed by selective bargain hunting in the domestic market.

What happened recently?

Global trade tensions

With affected countries imposing retaliatory tariffs, global market volatility has surged. In...

Wednesday, the market ended its four-day losing streak, buoyed by selective bargain hunting in the domestic market.

What happened recently?

Global trade tensions

With affected countries imposing retaliatory tariffs, global market volatility has surged. In...

24

3

18

Huat made

voted

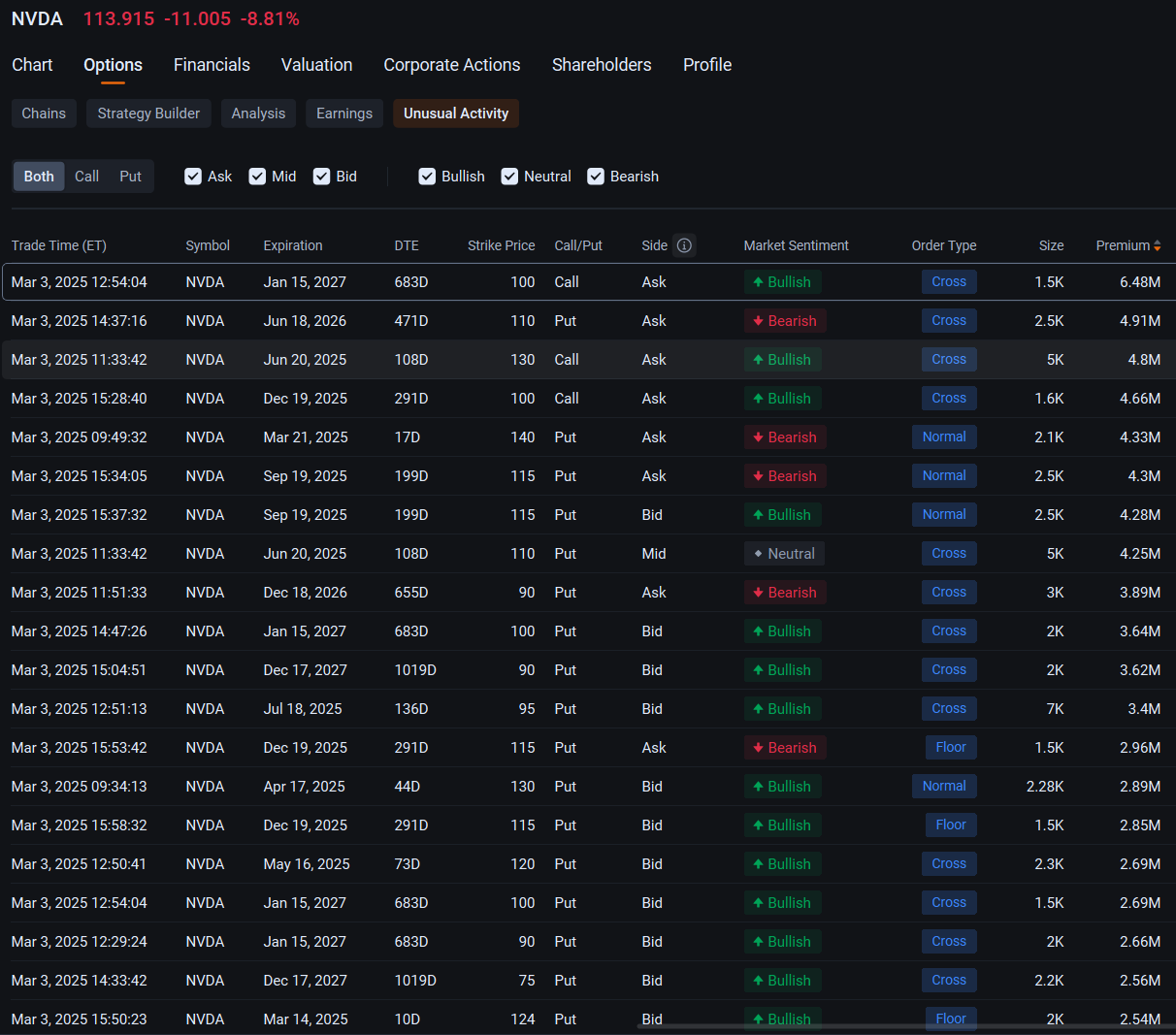

$NVIDIA (NVDA.US)$ bulls piled onto bullish block trades of options Monday, undeterred by the stock slump that sent the chip giant’s market capital to its lowest level in almost six months.

Shares of Nvidia tumbled 8.8% to close at $113.92 in New York, taking its market capital to $2.78 trillion, the lowest level since September. The slump came amid concerns that escalating trade tensions could trigger a downturn for the...

Shares of Nvidia tumbled 8.8% to close at $113.92 in New York, taking its market capital to $2.78 trillion, the lowest level since September. The slump came amid concerns that escalating trade tensions could trigger a downturn for the...

40

2

28

Huat made

voted

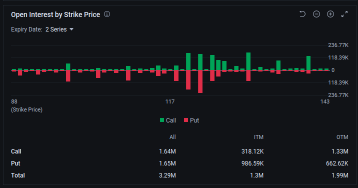

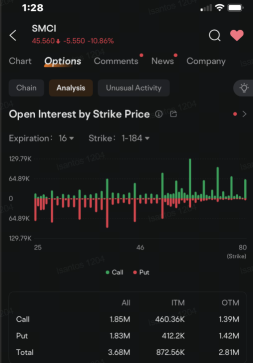

$Super Micro Computer (SMCI.US)$ investors and speculators have piled onto put options that could shield the holder against continued stock slump as Wall Street awaits the full implementation of remedies to financial controls that caused the company's troubles over the past few months.

The outstanding put options, also known as open interest, climbed to 1.83 million Wednesday as the stock jumped 12% after fil...

The outstanding put options, also known as open interest, climbed to 1.83 million Wednesday as the stock jumped 12% after fil...

10

8

14

Huat made

voted

NVDA options flow data provides key insights into market sentiment, potential institutional positioning, and possible future price action. Let’s break it down and identify how to trade smartly based on this data. ![]()

🚀 Key Observations![]()

1️⃣ Trade Snapshot – Bullish or Bearish Bias?

• PUT/CALL Volume Ratio → 42.84% (Put) vs. 57.16% (Call)

• More call buying than put buying, suggesting a bullish bias.

• Total volume: 7.78M → 182.78% of the 30-day average → HU...

🚀 Key Observations

1️⃣ Trade Snapshot – Bullish or Bearish Bias?

• PUT/CALL Volume Ratio → 42.84% (Put) vs. 57.16% (Call)

• More call buying than put buying, suggesting a bullish bias.

• Total volume: 7.78M → 182.78% of the 30-day average → HU...

18

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)