i2nS0RpX9F

liked

The $NASDAQ 100 Index (.NDX.US)$-1.3% falls the most among the three broad stock market indexes at Monday's close, struggling as a rebound in rates hit growth names and megacaps also face selling pressure.

Names like $DoorDash (DASH.US)$and $Peloton Interactive (PTON.US)$and other shares that gained during the pandemic are sliding.

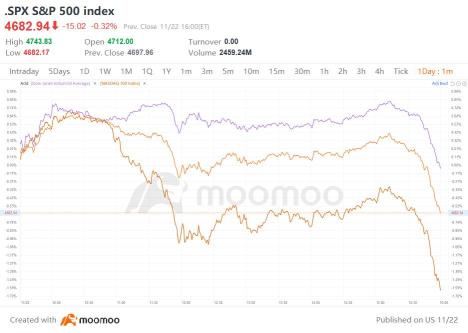

The $S&P 500 Index (.SPX.US)$-0.3% finishes the session lower, while the $Dow Jones Industrial Average (.DJI.US)$+0.1% performs the best thanks to price gains from $Goldman Sachs (GS.US)$and $JPMorgan (JPM.US)$.

Six of the 11 S&P sectors are higher, led by Energy and Financials. Communication Services fall the most.

The megacaps are mostly lower, with $Amazon (AMZN.US)$the worst performer.

"The SPX continues to consolidate within a bullish pennant formation," Craig Johnson, technical market strategist at Piper Sandler says. "A close above 4,705 would validate a topside breakout. While last week’s advance lacked participation, the bullish breakouts and/or improving technical setups among its mega-caps is encouraging."

The $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$yield is up 8 basis points to 1.62%, while the $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$is also up 8 points to 0.59%.

Rates rose after news hit that the White House is renominating Chairman Jerome Powell, while naming Lael Brainard as vice chair.

"This decision also removes uncertainty with Powell’s current term ending in February," ING says. "Had there been any delay in appointing a new Chair due to a lack of political support this could have caused significant financial market nervousness, particularly if we are right and the economy is soaring, inflation is above 6% and the Fed is still stimulating the economy with QE."

October existing home sales rose unexpectedly to 6.34M.

"Another upside surprise relative to both the mortgage applications numbers and the pending sales index, leaving sales at a nine-month high, after reversing about three-fifths of the drop in the first half of the year," Pantheon Macro's Ian Shepherdson writes. "Most of the increase in recent months, and all the October gain, is in the core single-family home component; condo/co-op sales dipped last month."

On the M&A front Monster Beverage is reportedly looking for a deal with Constellation.

Names like $DoorDash (DASH.US)$and $Peloton Interactive (PTON.US)$and other shares that gained during the pandemic are sliding.

The $S&P 500 Index (.SPX.US)$-0.3% finishes the session lower, while the $Dow Jones Industrial Average (.DJI.US)$+0.1% performs the best thanks to price gains from $Goldman Sachs (GS.US)$and $JPMorgan (JPM.US)$.

Six of the 11 S&P sectors are higher, led by Energy and Financials. Communication Services fall the most.

The megacaps are mostly lower, with $Amazon (AMZN.US)$the worst performer.

"The SPX continues to consolidate within a bullish pennant formation," Craig Johnson, technical market strategist at Piper Sandler says. "A close above 4,705 would validate a topside breakout. While last week’s advance lacked participation, the bullish breakouts and/or improving technical setups among its mega-caps is encouraging."

The $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$yield is up 8 basis points to 1.62%, while the $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$is also up 8 points to 0.59%.

Rates rose after news hit that the White House is renominating Chairman Jerome Powell, while naming Lael Brainard as vice chair.

"This decision also removes uncertainty with Powell’s current term ending in February," ING says. "Had there been any delay in appointing a new Chair due to a lack of political support this could have caused significant financial market nervousness, particularly if we are right and the economy is soaring, inflation is above 6% and the Fed is still stimulating the economy with QE."

October existing home sales rose unexpectedly to 6.34M.

"Another upside surprise relative to both the mortgage applications numbers and the pending sales index, leaving sales at a nine-month high, after reversing about three-fifths of the drop in the first half of the year," Pantheon Macro's Ian Shepherdson writes. "Most of the increase in recent months, and all the October gain, is in the core single-family home component; condo/co-op sales dipped last month."

On the M&A front Monster Beverage is reportedly looking for a deal with Constellation.

39

11

1

i2nS0RpX9F

liked

Lessons learned:

1. When you have a dream, especially if you're an entrepreneur, invest in yourself before investing in others.

2. Stop the FOMO.

3. Be an innovator, not a sheep.

4. No phones in the bedroom, especially until you've been awake for at least an hour in the morning.

5. No big decisions before 11:00 A.M.

6. Make a friend to talk about investments with.

7. Money should flow like water, don't let it be stagnant.

8. Pay attention to the signs, omens, and God winks around you.

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

1. When you have a dream, especially if you're an entrepreneur, invest in yourself before investing in others.

2. Stop the FOMO.

3. Be an innovator, not a sheep.

4. No phones in the bedroom, especially until you've been awake for at least an hour in the morning.

5. No big decisions before 11:00 A.M.

6. Make a friend to talk about investments with.

7. Money should flow like water, don't let it be stagnant.

8. Pay attention to the signs, omens, and God winks around you.

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

17

1

i2nS0RpX9F

liked

$Novavax (NVAX.US)$ shares has approached a two-month high extending its recent gains to the fourth straight session.

Just last week, an Indian manufacturer of the company’s protein-based COVID-19 shot was allowed by the government there to export 20M doses of the vaccine to Indonesia.

The upward momentum of Novavax has also coincided with the regulatory clearance for the COVID-19 booster shots in the U.S. allowing their use in a wider segment of vaccine recipients last week.

However, among vaccine makers, $Moderna (MRNA.US)$ and $BioNTech (BNTX.US)$ have led the gainers.

Rising more than a tenth in value, BioNTech, the partner of $Pfizer (PFE.US)$ in COVID-19 vaccine development has gained for the ninth consecutive session.

Meanwhile, Moderna has added the biggest intraday gain since early September paring back the losses made this month after revising down the sales projection for its COVID-19 vaccine.

Just last week, an Indian manufacturer of the company’s protein-based COVID-19 shot was allowed by the government there to export 20M doses of the vaccine to Indonesia.

The upward momentum of Novavax has also coincided with the regulatory clearance for the COVID-19 booster shots in the U.S. allowing their use in a wider segment of vaccine recipients last week.

However, among vaccine makers, $Moderna (MRNA.US)$ and $BioNTech (BNTX.US)$ have led the gainers.

Rising more than a tenth in value, BioNTech, the partner of $Pfizer (PFE.US)$ in COVID-19 vaccine development has gained for the ninth consecutive session.

Meanwhile, Moderna has added the biggest intraday gain since early September paring back the losses made this month after revising down the sales projection for its COVID-19 vaccine.

30

6

1

i2nS0RpX9F

liked

Columns Grateful for the stock market

$Tesla (TSLA.US)$ $Zoom Communications (ZM.US)$ $Moderna (MRNA.US)$ $Netflix (NFLX.US)$ My friend tweeted a joke in April last year, and he meant this 100% tongue-in-cheek. He said, we're all going to be surprised when the market hits new all-time highs this Summer, and he was 100% joking back in April, but that's exactly what happened. So, the surprise is on both ends, both, the pandemic that hit us and the rally afterwards. Like, if that doesn't humble you as someone trying to make sense of looking ahead at the economy or the stock market, trying to figure out what's going to go, what's going to happen next, then I think nothing will.

But I guess the takeaway from what, like, what is the big, broad lesson from 2020, is that we need humility and therefore room for error in our finances, because if everyone knew exactly what the economy and the stock market was going to do next, which is broadly what it was going to do next, we could be able to have, you know, quite a bit of leverage in our finances in terms of we would have most of our assets in stocks, we would know when to get in, when to get out, but we don't, and no one does and no one ever will. The most important events that move the stock market or the economy are always the things that no one can see coming, it's not that they didn't see it coming because they weren't smart enough, it's that things that are just literally impossible to see coming, like, say, the timing of a pandemic or things like Sept. 11th, like, the timing of the financial crisis in 2008, no one could have known when those things were going to come, and therefore, it's just so important to have room for error.

And what I mean by that is just, by and large, a sufficient level of cash and bonds in your portfolio. So that when the market does go through something like this, when the market falls 35% in a month like it did in March, that you are reducing the odds as low as you can of having to sell stocks at an inopportune time. That single thing, I think, is the most important variable for how you would do as an investor over the course of your lifetime is how low can you keep the odds that you'll ever be forced to sell the stocks you own to as low as possible.

Charlie Munger has a great quote that I love about this, he says, the first rule of compounding is to never interrupt it unnecessarily. And that's what I think this is all about, it's like, you want room for error in your finances. And, yes, the cash and the bonds that you own are going to earn a lower return than stocks that you own most of the time. But if those cash and bonds can prevent you from being forced to sell in inopportune times, whether that is a job loss or a medical emergency or you just get scared during a recession or during a pandemic than that is going to allow the stocks that you do own to compound over time to the greatest degree.

So, that's when you get into, like, this barbell personality of, I want to be a pessimist in the short run, but an optimist in the long run. And that seems like it's a contradiction, but it's not. I want to be so pessimistic about the short run that I have cash and room for error that is going to make sure, and it's going to allow me to be an optimist in the long run and never be forced to sell the stocks that I do own.

But I guess the takeaway from what, like, what is the big, broad lesson from 2020, is that we need humility and therefore room for error in our finances, because if everyone knew exactly what the economy and the stock market was going to do next, which is broadly what it was going to do next, we could be able to have, you know, quite a bit of leverage in our finances in terms of we would have most of our assets in stocks, we would know when to get in, when to get out, but we don't, and no one does and no one ever will. The most important events that move the stock market or the economy are always the things that no one can see coming, it's not that they didn't see it coming because they weren't smart enough, it's that things that are just literally impossible to see coming, like, say, the timing of a pandemic or things like Sept. 11th, like, the timing of the financial crisis in 2008, no one could have known when those things were going to come, and therefore, it's just so important to have room for error.

And what I mean by that is just, by and large, a sufficient level of cash and bonds in your portfolio. So that when the market does go through something like this, when the market falls 35% in a month like it did in March, that you are reducing the odds as low as you can of having to sell stocks at an inopportune time. That single thing, I think, is the most important variable for how you would do as an investor over the course of your lifetime is how low can you keep the odds that you'll ever be forced to sell the stocks you own to as low as possible.

Charlie Munger has a great quote that I love about this, he says, the first rule of compounding is to never interrupt it unnecessarily. And that's what I think this is all about, it's like, you want room for error in your finances. And, yes, the cash and the bonds that you own are going to earn a lower return than stocks that you own most of the time. But if those cash and bonds can prevent you from being forced to sell in inopportune times, whether that is a job loss or a medical emergency or you just get scared during a recession or during a pandemic than that is going to allow the stocks that you do own to compound over time to the greatest degree.

So, that's when you get into, like, this barbell personality of, I want to be a pessimist in the short run, but an optimist in the long run. And that seems like it's a contradiction, but it's not. I want to be so pessimistic about the short run that I have cash and room for error that is going to make sure, and it's going to allow me to be an optimist in the long run and never be forced to sell the stocks that I do own.

28

4

2

i2nS0RpX9F

liked

$Zoom Communications (ZM.US)$ Q3 Non-GAAP EPS of $1.11 beats by $0.01; GAAP EPS of $1.11 beats by $0.37.

Revenue of $1.05B (+35.1% Y/Y) beats by $30M.

Shares +7%.

Q4 Guidance: Total revenue is expected to be between $1.051 billion and $1.053 billion vs. consensus of $1.02 billion; Non-GAAP income from operations is expected to be between $361.0 million and $363.0 million. Non-GAAP diluted EPS is expected to be between $1.06 and $1.07 vs. consensus of $1.06.

Full Fiscal Year 2022: Total revenue is expected to be between $4.079 billion and $4.081 billion vs. consensus of $4.01 billion. Non-GAAP income from operations is expected to be between $1.598 billion and $1.600 billion. Non-GAAP diluted EPS is expected to be between $4.84 and $4.85 vs. consensus of $4.83.

Revenue of $1.05B (+35.1% Y/Y) beats by $30M.

Shares +7%.

Q4 Guidance: Total revenue is expected to be between $1.051 billion and $1.053 billion vs. consensus of $1.02 billion; Non-GAAP income from operations is expected to be between $361.0 million and $363.0 million. Non-GAAP diluted EPS is expected to be between $1.06 and $1.07 vs. consensus of $1.06.

Full Fiscal Year 2022: Total revenue is expected to be between $4.079 billion and $4.081 billion vs. consensus of $4.01 billion. Non-GAAP income from operations is expected to be between $1.598 billion and $1.600 billion. Non-GAAP diluted EPS is expected to be between $4.84 and $4.85 vs. consensus of $4.83.

36

14

i2nS0RpX9F

liked

The quickest and the most powerful way to feel gratitude for anything is "to create the sense of losing that particular thing" For instance, if you want to create gratitude for money, you have to consciously think how your life and days would be if you lost it. In your mind, create the scenes where you have lost money, feel the hardships, unease, shame, powerlessness. Think how you would be begging people for loans and financial aids. This little excercise can be done best by keeping a gratitude journal where you can write "what your life would be like without this "particular" blessing/thing (money, health, country, parents, peace etc) $Tesla (TSLA.US)$ $PayPal (PYPL.US)$ $Apple (AAPL.US)$

21

7

1

i2nS0RpX9F

liked

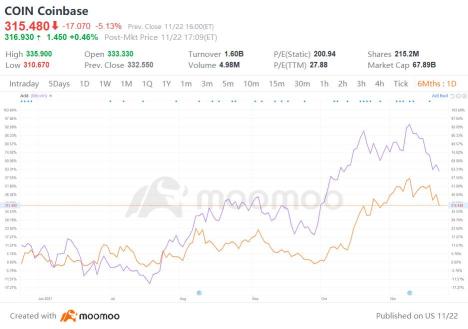

Shares of cryptocurrency exchange $Coinbase (COIN.US)$wraps up Monday with a 5.1% decline as the world's largest digital token, $Bitcoin (BTC.CC)$, -6.3% drifts lower to $55.7K per token.

Shares of COIN slightly rises 0.2% in after-hours trading.

Coinbase's price outpaces Bitcoin by a wide margin since the day the company started trading on the Nasdaq. But the two trends appear to move similarly, as seen in the chart below

Last Friday, Hayden Capital disclosed to investors that the firm opened a position in Coinbase as crypto hits the mainstream.

Most crypto-related exchange/platform stocks, including $NET SAVINGS LINK INC (NSAV.US)$-6.8%, $Robinhood (HOOD.US)$-4%, Plus500 (OTC:PLSQF) -2%, $BIGG DIGITAL ASSETS INC (BBKCF.US)$-8.5% fall on Monday amid Bitcoin's continued weakness.

Previously, (Nov. 10) Coinbase shares fell on disappointing Q3.

Shares of COIN slightly rises 0.2% in after-hours trading.

Coinbase's price outpaces Bitcoin by a wide margin since the day the company started trading on the Nasdaq. But the two trends appear to move similarly, as seen in the chart below

Last Friday, Hayden Capital disclosed to investors that the firm opened a position in Coinbase as crypto hits the mainstream.

Most crypto-related exchange/platform stocks, including $NET SAVINGS LINK INC (NSAV.US)$-6.8%, $Robinhood (HOOD.US)$-4%, Plus500 (OTC:PLSQF) -2%, $BIGG DIGITAL ASSETS INC (BBKCF.US)$-8.5% fall on Monday amid Bitcoin's continued weakness.

Previously, (Nov. 10) Coinbase shares fell on disappointing Q3.

65

9

i2nS0RpX9F

liked

Columns Trading & Being Grateful

Gratitude? What on earth does it have to do with trading?

Well, what if I told you that being grateful can have a real positive impact on both your trading results and on your life?

Being Grateful & Trading

Two of the states of mind that cause us to make many mistakes in trading are fear and anger.

When you are truly feeling grateful for what you have, you are not feeling fearful or angry. You can’t be both grateful and scared. You can’t be both grateful and angry.

Being grateful makes you less scared of losing money. If you are less afraid of losing, it is easier to respect your stop and accept a small loss. It is also easier to just stay in a trade as long as your strategy doesn’t trigger a sell signal.

Being grateful makes you focus on what you already have as opposed to what you lack. So it makes it easier for you to wait patiently for the next trade and avoid FOMO (Fear Of Missing Out) trades.

Being grateful for what you already have will make you less likely to get angry when you incur a loss and/or when you got shaken out of a stock and the stock is now turning around. So you are less likely to take a revenge trade.

Being genuinely grateful for what you have basically makes it much easier to just focus on the process of following your plan.

How to Develop an Attitude of Gratitude

The most efficient way I found to develop gratitude was to integrate it into my daily routine, right before the start of the trading day.

So everyday, before the market opens, I take 5 minutes to write down in a journal 3 things I’m grateful for in my life, and take the time to reflect on each things.

Nothing is too big or too small to be grateful for. You can be grateful for absolutely anything you have in life, from the people in your life to the pen and paper you’re using to write down what you’re grateful for. From your trading knowledge and skills, to having a bed to sleep in every night. From being born in a nice country, to having access to electricity and water. From general things in your life, to small events that happened the day before…

I strongly suggest you try it for 21 days in a row, the time needed to form a new habit.

Studies show that this very simple exercise will rewire your brain and help you focus more on positive things in your life. It will not only make you better trader, but it will also have a positive impact on your everyday level of happiness, on your relationships, and on your health.

“Without gratitude and appreciation for what we already have, we’ll never know true fulfillment” – Tony Robbins

$NASDAQ 100 Index (.NDX.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$

Well, what if I told you that being grateful can have a real positive impact on both your trading results and on your life?

Being Grateful & Trading

Two of the states of mind that cause us to make many mistakes in trading are fear and anger.

When you are truly feeling grateful for what you have, you are not feeling fearful or angry. You can’t be both grateful and scared. You can’t be both grateful and angry.

Being grateful makes you less scared of losing money. If you are less afraid of losing, it is easier to respect your stop and accept a small loss. It is also easier to just stay in a trade as long as your strategy doesn’t trigger a sell signal.

Being grateful makes you focus on what you already have as opposed to what you lack. So it makes it easier for you to wait patiently for the next trade and avoid FOMO (Fear Of Missing Out) trades.

Being grateful for what you already have will make you less likely to get angry when you incur a loss and/or when you got shaken out of a stock and the stock is now turning around. So you are less likely to take a revenge trade.

Being genuinely grateful for what you have basically makes it much easier to just focus on the process of following your plan.

How to Develop an Attitude of Gratitude

The most efficient way I found to develop gratitude was to integrate it into my daily routine, right before the start of the trading day.

So everyday, before the market opens, I take 5 minutes to write down in a journal 3 things I’m grateful for in my life, and take the time to reflect on each things.

Nothing is too big or too small to be grateful for. You can be grateful for absolutely anything you have in life, from the people in your life to the pen and paper you’re using to write down what you’re grateful for. From your trading knowledge and skills, to having a bed to sleep in every night. From being born in a nice country, to having access to electricity and water. From general things in your life, to small events that happened the day before…

I strongly suggest you try it for 21 days in a row, the time needed to form a new habit.

Studies show that this very simple exercise will rewire your brain and help you focus more on positive things in your life. It will not only make you better trader, but it will also have a positive impact on your everyday level of happiness, on your relationships, and on your health.

“Without gratitude and appreciation for what we already have, we’ll never know true fulfillment” – Tony Robbins

$NASDAQ 100 Index (.NDX.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$

11

2

i2nS0RpX9F

reacted to and commented on

I have never been the type to spend money. I go cheap on dates. I don’t drink. I don’t shop. I don’t eat out. I don’t party. I hardly spend money.

If there’s one thing to be thankful for from the stock market experience, is it has elevated my spending habits. Given the amount of money I have lost with Options trading, I don’t even flinch anymore when it comes to spending money. Now I fly mostly business or first class, I buy things without second thoughts, I eat out more often than not, and I spend on just about anything that peaks my interest.

What do I have to loose.. After all, I have lost more simply at the click of a mouse.

$Tesla (TSLA.US)$ $AMC Entertainment (AMC.US)$ $Dogecoin (DOGE.CC)$

If there’s one thing to be thankful for from the stock market experience, is it has elevated my spending habits. Given the amount of money I have lost with Options trading, I don’t even flinch anymore when it comes to spending money. Now I fly mostly business or first class, I buy things without second thoughts, I eat out more often than not, and I spend on just about anything that peaks my interest.

What do I have to loose.. After all, I have lost more simply at the click of a mouse.

$Tesla (TSLA.US)$ $AMC Entertainment (AMC.US)$ $Dogecoin (DOGE.CC)$

29

12

3

i2nS0RpX9F

liked

Payment stocks are taking a hit from renewed COVID fears and due to possible regulatory changes after Jerome Powell is nominated for a second term, Mizuho analyst Dan Dolev said.

"It's kind of like a perfect storm for some of these [payment] names," he told Bloomberg News in an interview.

The Bloomberg Digital Payments Index dropped as much as 2.7% to its lowest level since December. $MasterCard (MA.US)$ sank 5.4%, $Visa (V.US)$ slipped 2.6%, $American Express (AXP.US)$ dipped 1.5% in Monday trading.

$DLocal (DLO.US)$, which went public through an IPO in June, dropped 13%, and $Blend Labs (BLND.US)$, which started trading in July after its IPO slid 6.7%, reaching a post-IPO low.

Fintechs, too, weren't spared, with $Block (SQ.US)$ falling 6.1%, $Robinhood (HOOD.US)$ off 4.0%, and $PayPal (PYPL.US)$ down 2.1%. PyPal hit a 52-week low earlier in the session. Those could also be hurt by the 6.3% drop in $Bitcoin (BTC.CC)$, since all three have businesses that generate revenue from the world's largest cryptocurrency.

"It's kind of like a perfect storm for some of these [payment] names," he told Bloomberg News in an interview.

The Bloomberg Digital Payments Index dropped as much as 2.7% to its lowest level since December. $MasterCard (MA.US)$ sank 5.4%, $Visa (V.US)$ slipped 2.6%, $American Express (AXP.US)$ dipped 1.5% in Monday trading.

$DLocal (DLO.US)$, which went public through an IPO in June, dropped 13%, and $Blend Labs (BLND.US)$, which started trading in July after its IPO slid 6.7%, reaching a post-IPO low.

Fintechs, too, weren't spared, with $Block (SQ.US)$ falling 6.1%, $Robinhood (HOOD.US)$ off 4.0%, and $PayPal (PYPL.US)$ down 2.1%. PyPal hit a 52-week low earlier in the session. Those could also be hurt by the 6.3% drop in $Bitcoin (BTC.CC)$, since all three have businesses that generate revenue from the world's largest cryptocurrency.

38

8

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)