Impressive Moo

reacted to

Good morning mooers! Here are things you need to know about today's Singapore:

●Singapore shares opened lower on Monday; STI down 1.01%

●Commodities face tough week as Fed angst builds

●Stocks and REITs to watch: Singtel, SPH Reit, Aspen

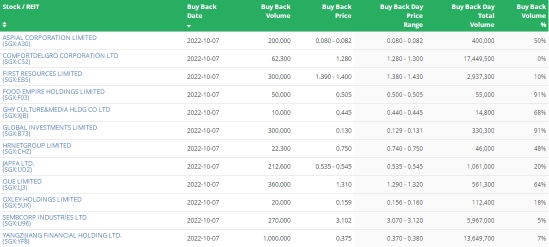

●Latest share buy back transactions

-moomoo News SG

Market Trend

Singapore shares opened lower on Monday. The $FTSE Singapore Straits Time Index (.STI.SG)$ decreased 1.01 per cent to 3,114.16 ...

●Singapore shares opened lower on Monday; STI down 1.01%

●Commodities face tough week as Fed angst builds

●Stocks and REITs to watch: Singtel, SPH Reit, Aspen

●Latest share buy back transactions

-moomoo News SG

Market Trend

Singapore shares opened lower on Monday. The $FTSE Singapore Straits Time Index (.STI.SG)$ decreased 1.01 per cent to 3,114.16 ...

1447

1387

Impressive Moo

reacted to and commented on

The past week has been a dark period in the history of crypto, with the total market capitalization of this industry dipping as low as $1.2 trillion for the first time since July 2021. ![]()

![]()

![]() The turmoil, in large part, has been due to the real-time disintegration of $Terra (LUNA.CC)$.

The turmoil, in large part, has been due to the real-time disintegration of $Terra (LUNA.CC)$.

Last week, Terra has officially stopped block production as the blockchain's native token hit a low of $0.0003, near zero.![]()

![]()

![]()

In a tumble start...

Last week, Terra has officially stopped block production as the blockchain's native token hit a low of $0.0003, near zero.

In a tumble start...

1093

961

Impressive Moo

reacted to

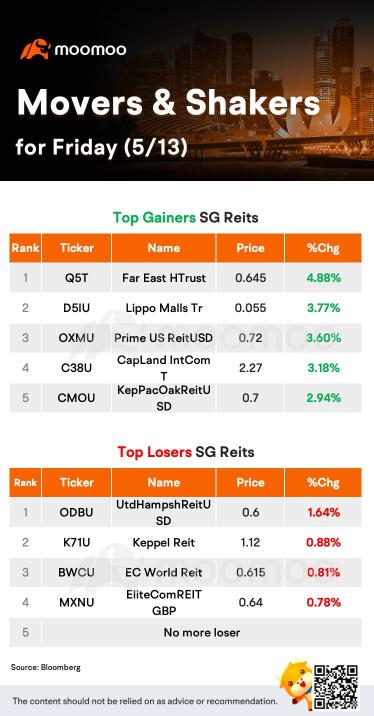

Singapore real estate investment trusts can benefit from their safe-haven status during a time of market volatility as the U.S. Fed raises interest rates, analysts from DBS say in a research note.

The Fed's clarity on its rate-rise trajectory will likely lead to more price stability for Singapore REITs, they say.

What are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are funds that invest in a port...

The Fed's clarity on its rate-rise trajectory will likely lead to more price stability for Singapore REITs, they say.

What are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are funds that invest in a port...

1537

1277

Impressive Moo

commented on

New energy & New trend

Countries have advocated low-carbon plans to avoid damaging the environment in recent years.

Do you support low-carbon living?

As investors become more environmentally conscious, there is a growing trend in green investing.

Have you ever considered buying a low-carbon ETF to do good for the planet?

![]()

![]()

![]() Take the trading quiz & get prize!

Take the trading quiz & get prize!

Start by learning "What is an ETF?" and then judge if it really does good to your portf...

Countries have advocated low-carbon plans to avoid damaging the environment in recent years.

Do you support low-carbon living?

As investors become more environmentally conscious, there is a growing trend in green investing.

Have you ever considered buying a low-carbon ETF to do good for the planet?

Start by learning "What is an ETF?" and then judge if it really does good to your portf...

95

988

Impressive Moo

commented on

Notice: all mooers commented “sign up” before Feb 25th 15:00 (SGT) will be invited into our study group by this Sunday!![]()

![]()

![]()

Hi mooers, welcome to join our learning camp!![]()

Did you notice that the cost of living is getting higher since the outbreak of COVID-19 pandemic?

As inflation can eat away at our money, we become anxious and start to make extra income.![]()

Investing in stock becomes popular among the public with its high h...

Hi mooers, welcome to join our learning camp!

Did you notice that the cost of living is getting higher since the outbreak of COVID-19 pandemic?

As inflation can eat away at our money, we become anxious and start to make extra income.

Investing in stock becomes popular among the public with its high h...

![Sign-up to Learn Stock Picking and Win 1000 Points! [Registration Ends]](https://sgsnsimg.moomoo.com/moo-1645617135-71220648-iPhone-2-org.gif/thumb)

![Sign-up to Learn Stock Picking and Win 1000 Points! [Registration Ends]](https://sgsnsimg.moomoo.com/moo-1645616562-71220648-iPhone-1-org.jpg/thumb)

![Sign-up to Learn Stock Picking and Win 1000 Points! [Registration Ends]](https://sgsnsimg.moomoo.com/7436745710015408638.gif/thumb)

+1

107

703

Impressive Moo

reacted to

$Nasdaq Composite Index (.IXIC.US)$

$Invesco QQQ Trust (QQQ.US)$

The touch of technology in business and health communications will be felt in 2022 too as uncertainties prevail. Moreover, with the global economy striving to bounce back from the virus-led slump, corporate and social efforts to save the cost structure will be a priority. Travels will likely be less in the post-COVID world and e-payments will gain precedence.

Biotechnology is another great area with genomics grabbing limelight. These two segments — tech and biotech — should continue to march ahead in 2022 with or without virus scare. Since the Nasdaq-100 has 70% focus on technology and about 5% exposure to biotech, 2022 has high chances of being a rewarding year for the index.

Plus, the Nasdaq-100 has about 16% focus on the Consumer Discretionary sector, which is in fine fettle currently thanks to a solid jobs market and higher pent-up demand. This cyclical sector also tends to perform well in a rising-rate environment.

In fact, the Nasdaq’s relatively restrained gains in 2021 may open up some great opportunities in early 2022. Against this backdrop, investors can very well play the Nasdaq ETFs right now.

$Invesco QQQ Trust (QQQ.US)$

The touch of technology in business and health communications will be felt in 2022 too as uncertainties prevail. Moreover, with the global economy striving to bounce back from the virus-led slump, corporate and social efforts to save the cost structure will be a priority. Travels will likely be less in the post-COVID world and e-payments will gain precedence.

Biotechnology is another great area with genomics grabbing limelight. These two segments — tech and biotech — should continue to march ahead in 2022 with or without virus scare. Since the Nasdaq-100 has 70% focus on technology and about 5% exposure to biotech, 2022 has high chances of being a rewarding year for the index.

Plus, the Nasdaq-100 has about 16% focus on the Consumer Discretionary sector, which is in fine fettle currently thanks to a solid jobs market and higher pent-up demand. This cyclical sector also tends to perform well in a rising-rate environment.

In fact, the Nasdaq’s relatively restrained gains in 2021 may open up some great opportunities in early 2022. Against this backdrop, investors can very well play the Nasdaq ETFs right now.

27

2

Impressive Moo

reacted to

$Sea (SE.US)$ What a difference a day makes. Another solidly green market day but a different result. Let's see if this can turn around and follow through with yesterday's terrific movement.

14

1

Impressive Moo

liked

Hi, mooers.

Welcome to the 2021 Growing Stars of the Year award ceremony. We are thrilled to announce the 9 shining stars of the Moo community for you!

When we look back, we can see our mooers' glittering badges, fruitful transactions, and active interactions in 2021. We truly appreciate their hard work on building wealth and reviewing their investment during the investing journey.![]() Today, our awards go to the 9 outstanding mooers who made sign...

Today, our awards go to the 9 outstanding mooers who made sign...

Welcome to the 2021 Growing Stars of the Year award ceremony. We are thrilled to announce the 9 shining stars of the Moo community for you!

When we look back, we can see our mooers' glittering badges, fruitful transactions, and active interactions in 2021. We truly appreciate their hard work on building wealth and reviewing their investment during the investing journey.

+1

142

62

Impressive Moo

reacted to

$AMC Entertainment (AMC.US)$ Ok be honest after $AMC squeezes how many of you going to be like me and hire someone to troll all the AMC haters harder than they trolled us for the past year? 😆

#IMSTILLHOLDING #AMC

💎🙌🦍

#IMSTILLHOLDING #AMC

💎🙌🦍

18

4

Impressive Moo

reacted to

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$

If 2022 is as bad for the stock market as many people make it seem, what will your moves be going forward? I began investing during COVID and I know many others did as well, we have not truly experienced a downturn or sideways moving market since then and many of us are likely unsure of what to expect. What do you plan on doing if the market tanks? Buy the dip, or hold cash until there’s a deeper dip? What should all the newbie investors be watching to not lose capital if this is in fact the start of a downturn in the market?

If 2022 is as bad for the stock market as many people make it seem, what will your moves be going forward? I began investing during COVID and I know many others did as well, we have not truly experienced a downturn or sideways moving market since then and many of us are likely unsure of what to expect. What do you plan on doing if the market tanks? Buy the dip, or hold cash until there’s a deeper dip? What should all the newbie investors be watching to not lose capital if this is in fact the start of a downturn in the market?

15

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)