Investwithdason

voted

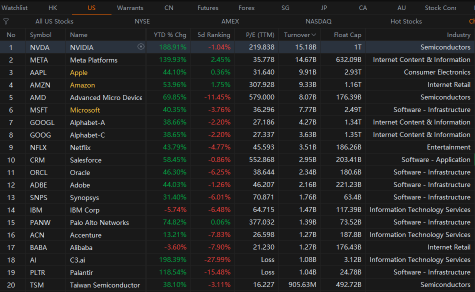

Last week's most important AI news![]() :

:

1. AI concept stocks fell last week most, from now on to pay attention to the Federal Reserve

2.Investors may be fleeing U.S. technology stocks, AI industry "wave of reduction" has also appeared

3.against Microsoft Google, Amazon cloud smashed 100 million dollars to launch a generative AI innovation center

4.AI may enhance than to replace existing industry vertical applications, Adobe may benefit.

5. "Chi...

1. AI concept stocks fell last week most, from now on to pay attention to the Federal Reserve

2.Investors may be fleeing U.S. technology stocks, AI industry "wave of reduction" has also appeared

3.against Microsoft Google, Amazon cloud smashed 100 million dollars to launch a generative AI innovation center

4.AI may enhance than to replace existing industry vertical applications, Adobe may benefit.

5. "Chi...

13

7

Investwithdason

liked

3

Investwithdason

liked

1

Investwithdason

liked

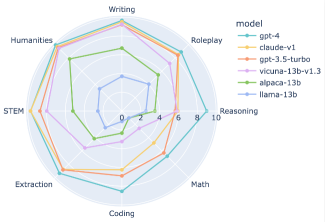

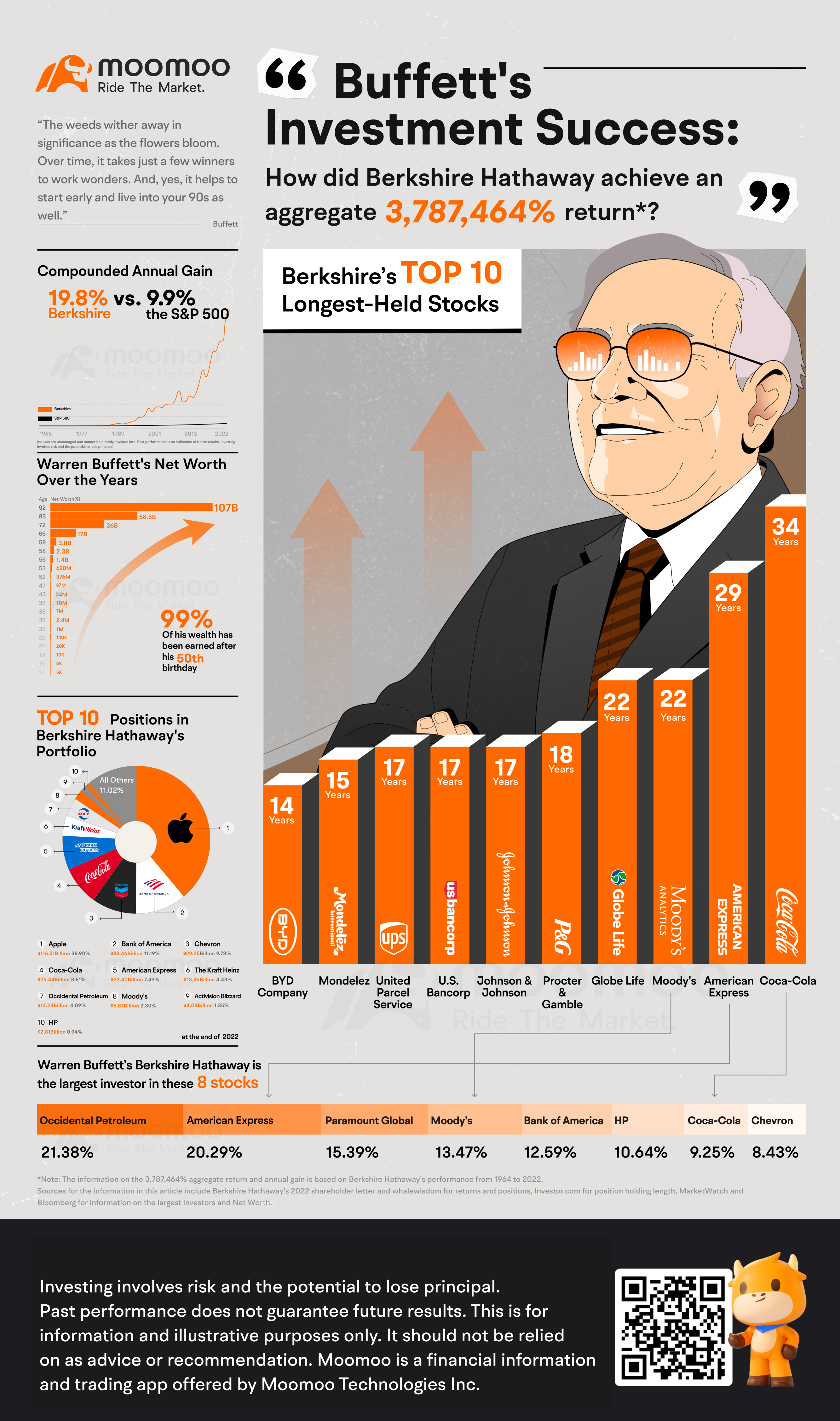

In 2022, the U.S. stock market was in turmoil, but in the midst of the storm, 92-year-old Warren Buffett still wears the "crown" - in the year the S&P 500 fell 18.1%, Warren Buffett's Berkshire gained 4% positive return, for the stock god Warren Buffett is still "a good year". ![]()

On a longer timeline, from 1965-2022, Berkshire's annualized return was 19.8%, significantly outpacing the S&P 500's 9.9%, for a cumulative ...

On a longer timeline, from 1965-2022, Berkshire's annualized return was 19.8%, significantly outpacing the S&P 500's 9.9%, for a cumulative ...

130

12

49

Investwithdason

commented on and voted

Recently, major institutions filed 13F reports with the U.S. Securities and Exchange Commission (SEC), disclosing their holdings and the size of their positions in U.S. stocks during the fourth quarter.

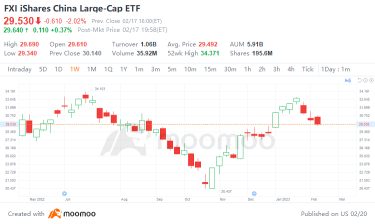

It is worth noting that large Wall Street private equity funds are buying Chinese stocks on a large scale, and the allocation strategy for Chinese stocks has gradually shifted from [underweight] to [Neutral]!![]()

Michael ...

It is worth noting that large Wall Street private equity funds are buying Chinese stocks on a large scale, and the allocation strategy for Chinese stocks has gradually shifted from [underweight] to [Neutral]!

Michael ...

56

6

30

Investwithdason

liked

Sillicon Valley bank has collapsed after being forced to sell assets for pennies on the dollar. This is the largest bank to collapse in the U.S since the recession of 2008. The collapse could be a indicator that we are nearing the bottom of the market… Other banks such as PacWest Bancorp dropped 38% and Western Alliance Bancorp fell 21%.

3

Investwithdason

reacted to

I added Li Auto to the watchlist.

Li Auto is the biggest hybrid electric automotive manufactuer founded in china, i think that this would be a good diversification play in the electric vehicle market as some consumers may want to more slowly intergate into the EV space with hybrid cars that can use traditional gasoline as well as an electric battery to power their vehicles. This comes with the massive influx of EV cars that will only continue to grow over the next century and most likely the ...

Li Auto is the biggest hybrid electric automotive manufactuer founded in china, i think that this would be a good diversification play in the electric vehicle market as some consumers may want to more slowly intergate into the EV space with hybrid cars that can use traditional gasoline as well as an electric battery to power their vehicles. This comes with the massive influx of EV cars that will only continue to grow over the next century and most likely the ...

3

1

Investwithdason

reacted to

i have added coinbase to my watchlist,

this comes as coinbase is diversifying its revenue streams from primarily fee income from trades of users on its platforms which is heavily dependent on the pouplarity and success of the crypto market as a whole. Now Coinbase is positioning strategically in purchasing itself a hedge fund which will allow for more predicatble revnue and growth in such a volitaile industry as crypto. However take caution, the benefits of this acquisiton may not be reveal...

this comes as coinbase is diversifying its revenue streams from primarily fee income from trades of users on its platforms which is heavily dependent on the pouplarity and success of the crypto market as a whole. Now Coinbase is positioning strategically in purchasing itself a hedge fund which will allow for more predicatble revnue and growth in such a volitaile industry as crypto. However take caution, the benefits of this acquisiton may not be reveal...

3

post

post![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)