$NVIDIA (NVDA.US)$ And $iShares Semiconductor ETF (SOXX.US)$ Be $Advanced Micro Devices (AMD.US)$ Daring to fly once, even if it's just a temporary rebound.

Translated

1

Whoops, this look exactly like a typical false breakout follow by a trend reverse. Looking at closest support band 453-460. if it’s lost, looking for 421-426. Zuck, can’t wait longer on AI if you don’t want Metaverse to become Metafall. See you in 2 weeks.

$Meta Platforms (META.US)$

$Meta Platforms (META.US)$

4

$Intel (INTC.US)$ is it a fomo play here? Been trading sideways since late Apr with strong support on $30. Daily support $32, resistence $36.70 (seems thin enough to break through) by close today. Hopefully momentum retains till volume dies out & RSI confirms dropping through 70. SR and NINE signals are bullish by far. But watchout for the 9th candle, (or when it fails to form a complete NINE stroke)

9

$Tesla (TSLA.US)$ Can add positions when the callback is in place. Daily gap support.

Translated

4

3

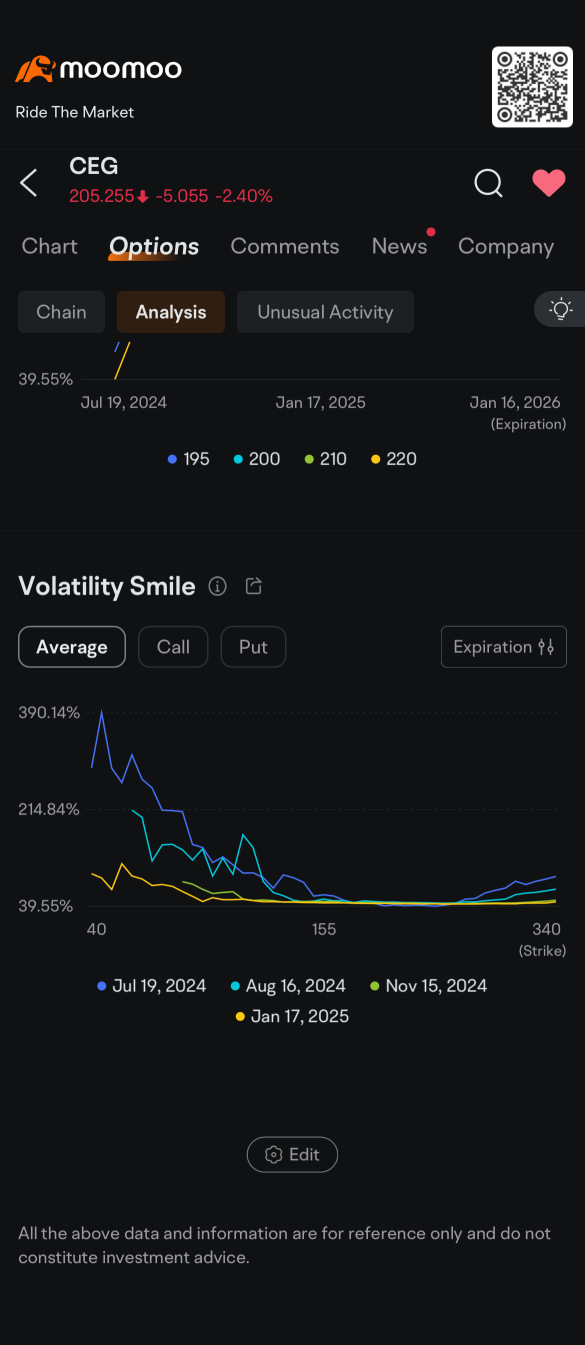

The long-term rise in AI energy demand is a reasonable bullish logic, with a PE ratio of 27.36 belonging to the industry leader, slightly premium to the sector but not excessive. However, recent options indicate a put market before July 19, with a PCRatio as high as 4.77. From a technical perspective, there is support near 197, with resistance above at 212, 220, and then looking at the previous high of 230.

Translated

5

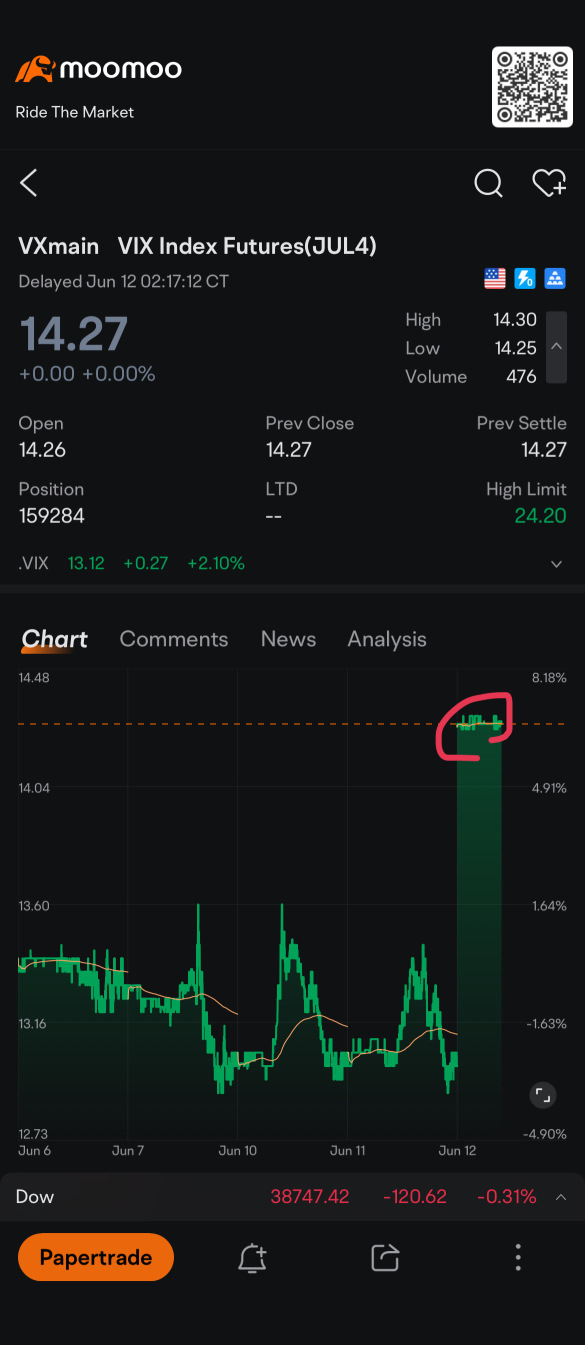

what does VIX index future gap up imply? it’s looking concerning.

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)