Jeff Lewis725

voted

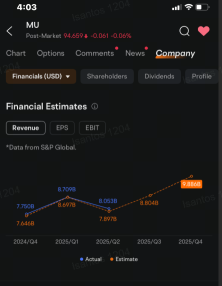

$Micron Technology (MU.US)$’s options volume doubled, boosted by a surge in put options trading after the chipmaker painted a less rosy outlook than analysts had expected, sending shares lower.

Shares slumped 8% to close at $94.72 Friday after the company said late Thursday that its adjusted gross margin for fiscal third quarter ending in May will be between 35.5% to 37.5%. The midpoint of that forecast missed analys...

Shares slumped 8% to close at $94.72 Friday after the company said late Thursday that its adjusted gross margin for fiscal third quarter ending in May will be between 35.5% to 37.5%. The midpoint of that forecast missed analys...

28

4

11

Jeff Lewis725

voted

Last week, the markets were dominated by escalating trade tensions, with tariffs on steel and aluminum imports sparking fears of a global trade war. The European Union retaliated with counter-tariffs on $28 billion worth of U.S. goods, further spooking investors. Meanwhile, concerns over valuations and earnings continued to weigh on the tech sector, with $Adobe (ADBE.US)$ and $Intel (INTC.US)$ making headlines f...

+13

2072

359

23

Jeff Lewis725

voted

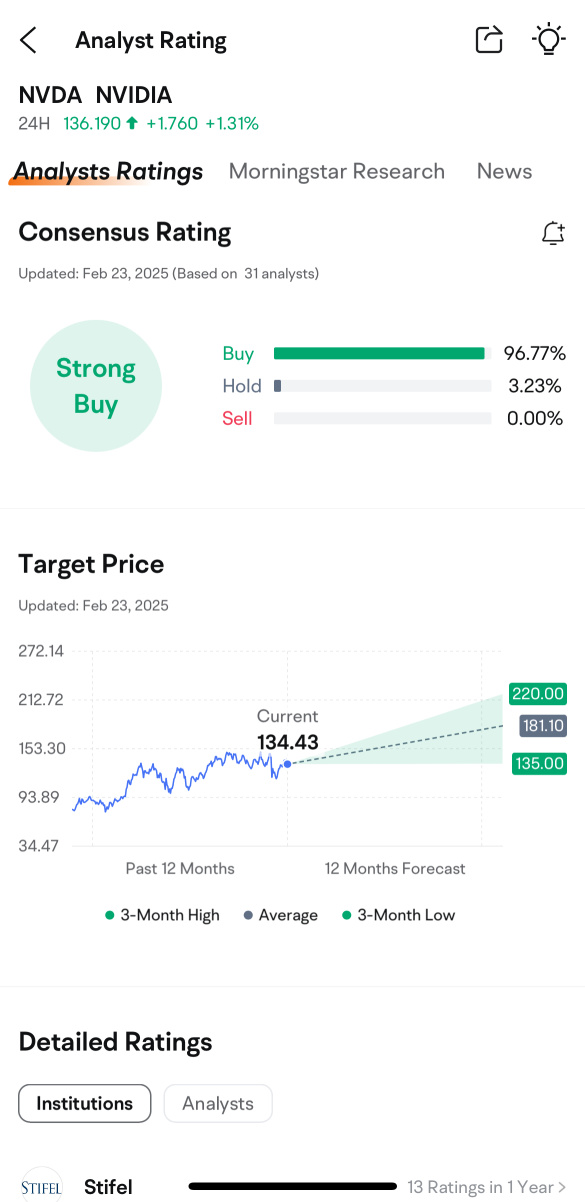

Given the extensive updates and technological innovations expected at NVIDIA's GTC 2025, coupled with historical data suggesting a high likelihood of $NVIDIA (NVDA.US)$'s stock price increasing during such events, a strategic approach to options trading can be particularly beneficial. Here's an integrated strategy that leverages both the expected technological announcements and historical stock performance.

Introduction

$NVIDIA (NVDA.US)$'s premier...

+6

108

23

14

Jeff Lewis725

liked

$Ethereum (ETH.CC)$ Would somebody please just me out of my misery

This is what I've invested in.... are you fucking kidding me

I am so screwed

https://x.com/Jeremyybtc/status/1898417877029416980?t=r1k9LvU3iwkwr9TgY5hDiQ&s=19

This is what I've invested in.... are you fucking kidding me

I am so screwed

https://x.com/Jeremyybtc/status/1898417877029416980?t=r1k9LvU3iwkwr9TgY5hDiQ&s=19

4

Jeff Lewis725

voted

We've been riding the wave from 34 St—Herald Sq to Grand Central Station, and we captured all the moo-mania at our new location! Dive into the excitement with our latest video 🎥 showcasing the vibrant energy and spirit of our NYC subway takeover at Grand Central 📍.

Here's how to keep the wave rolling

🎁 Score Rewards!

Fin...

1802

573

469

Jeff Lewis725

voted

There are 3 methods in the analysis of stocks - technical analysis, fundamental analysis and capital flow analysis.

Capital flow analysis

- It provides insights into the direction of investor sentiment and can indicate potential future price movements by showing where large amounts of capital are flowing into or out of a stock.

- Capital flows are often considered a leading indicator. They can signal potential price changes before they happen.

- When ther...

Capital flow analysis

- It provides insights into the direction of investor sentiment and can indicate potential future price movements by showing where large amounts of capital are flowing into or out of a stock.

- Capital flows are often considered a leading indicator. They can signal potential price changes before they happen.

- When ther...

+2

122

43

117

Jeff Lewis725

liked

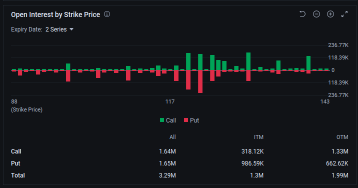

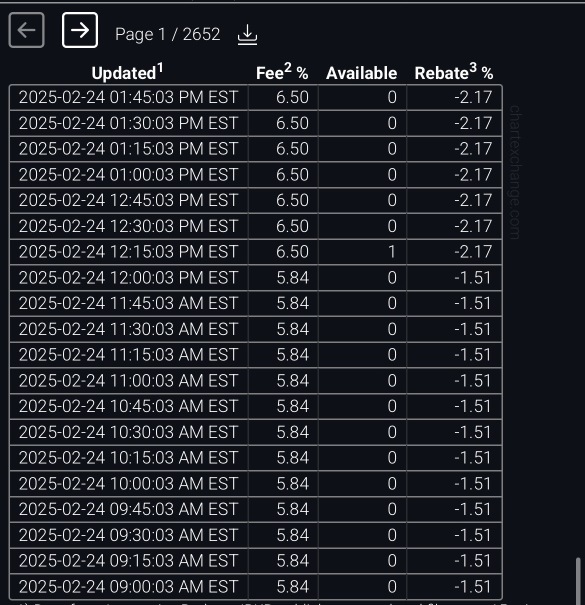

$Rigetti Computing (RGTI.US)$ 🚨🚨🚨🚨🚨🚨🚨🚨SHORT SQUEEZE UPDATE

Updated Short Squeeze Analysis for RGTI – Increased Short Pressure

1. Latest Developments Strengthening the Short Squeeze Potential

📌 Borrow Fee (CTB) Increased to 6.50%

• The borrow fee jumped from 5.84% to 6.50% as of 1:00 PM - 1:45 PM EST.

• A rising borrow fee suggests that short sellers are facing higher costs to maintain their positions.

• If this rate continues rising (above 10%+), it increases short pressure significantly.

...

Updated Short Squeeze Analysis for RGTI – Increased Short Pressure

1. Latest Developments Strengthening the Short Squeeze Potential

📌 Borrow Fee (CTB) Increased to 6.50%

• The borrow fee jumped from 5.84% to 6.50% as of 1:00 PM - 1:45 PM EST.

• A rising borrow fee suggests that short sellers are facing higher costs to maintain their positions.

• If this rate continues rising (above 10%+), it increases short pressure significantly.

...

21

7

Jeff Lewis725

Set a live reminder

$NVIDIA (NVDA.US)$

NVIDIA Q4 FY2025 earnings conference call is scheduled for February 26 at 5:00 PM EDT /February 27 at 6:00 AM SGT /February 27 at 9:00 AM AEDT. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from NVIDIA's Q4 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what management has to say!

Disclaimer:

This presentation is for information ...

NVIDIA Q4 FY2025 earnings conference call is scheduled for February 26 at 5:00 PM EDT /February 27 at 6:00 AM SGT /February 27 at 9:00 AM AEDT. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from NVIDIA's Q4 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what management has to say!

Disclaimer:

This presentation is for information ...

NVIDIA Q4 FY2025 earnings conference call

Feb 27 06:00

1108

573

55

Jeff Lewis725

voted

Hi, mooers! 👋

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

645

1022

40

Jeff Lewis725

reacted to

$YieldMax MSTR Option Income Strategy ETF (MSTY.US)$

Got this from grok :

Comparing the returns from executing a weekly covered call strategy on MicroStrategy (MSTR) stock versus investing an equal amount in the YieldMax MSTR Option Income Strategy ETF (MSTY) involves several nuances:

Covered Call Strategy on MSTR:

Pros:

Customization: You control the strike prices, expiration dates, and can adjust your positions based on market movements.

Potential for...

Got this from grok :

Comparing the returns from executing a weekly covered call strategy on MicroStrategy (MSTR) stock versus investing an equal amount in the YieldMax MSTR Option Income Strategy ETF (MSTY) involves several nuances:

Covered Call Strategy on MSTR:

Pros:

Customization: You control the strike prices, expiration dates, and can adjust your positions based on market movements.

Potential for...

21

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)