Jerrytkc

voted

$Tesla (TSLA.US)$ $AMC Entertainment (AMC.US)$ $SPDR S&P 500 ETF (SPY.US)$ $NIO Inc (NIO.US)$ $AMC Preferred Equity Unit (APE.US)$ $Mullen Automotive (MULN.US)$ $Vinco Ventures (BBIG.US)$ $Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$ $Direxion Daily Semiconductor Bear 3x Shares ETF (SOXS.US)$ $Meta Materials (MMAT.US)$ $Cardio Diagnostics (CDIO.US)$ $Apple (AAPL.US)$ $Enzo Biochem (ENZ.US)$ $Science 37 (SNCE.US)$ $Histogen (HSTO.US)$ $Riot Platforms (RIOT.US)$ $Boxed (BOXD.US)$ $First Republic Bank (FRC.US)$ $National CineMedia (NCMI.US)$

���������...

���������...

34

2

1

Jerrytkc

liked

Even beyond the launch of the first U.S. Bitcoin futures ETF, cryptocurrency funds notched some notable global milestones in 2021.

The number of crypto-tracking investment vehicles worldwide more than doubled to 80 from just 35 at the end of 2020. Assets soared to $63 billion, compared to $24 billion at the start of the year.

--- according to Bloomberg Intelligence data

Globally, it's obviously a phenomenon that's starting to take off. If you look at inflows on a volume perspective, not only has it been steady even with the price corrections that Bitcoin is notoriously famous for, but you're seeing a lot of institutions jump in.”

--- Leah Wald, chief executive of crypto asset manager Valkyrie Investments, said on Bloomberg's "QuickTake Stock" streaming program.

Grayscale Investments LLC is the largest asset manager in the digital-assets space, with the $30 billion $Grayscale Bitcoin Trust (GBTC.US)$ ranking as the world's largest crypto fund.

The First U.S. bitcoin-linked ETF $ProShares Bitcoin ETF (BITO.US)$ incepted in October, which recevied a lot of attention. It only took two days for the fund to accumulate $1 billion.

Unlike an ETF directly connected to spot Bitcoin, the futures-backed products such as BITO are vulnerable to so-called associated with managing contracts. It's likely that investor demand would be even higher if physically backed funds were allowed to launch in the U.S., according to Bloomberg Intelligence.

I can't help but think that the assets in this space would be even larger if we had more efficient structures, like spot ETFs, in the U.S.”

--- said James Seyffart, Bloomberg Intelligence ETF analyst.

Watch now: What crypto's breakout year means for the market in 2022

Indeed, flows into the ProShares fund have stalled, with the ETF down more than 30% since its mid-October launch. Meanwhile, similar products from Valkyrie and VanEck have less than $70 million in assets combined.

Valkyrie's Wald is optimistic that flows will pick up in 2022. Institutional money managers are likely waiting to see how the U.S. futures-backed ETF handle the roll costs, she said.

That specific vehicle, I think a lot of money managers want to look at the metrics before jumping in. We're excited about what next year has to hold.”

--- Wald said.

Source: Bloomberg

The number of crypto-tracking investment vehicles worldwide more than doubled to 80 from just 35 at the end of 2020. Assets soared to $63 billion, compared to $24 billion at the start of the year.

--- according to Bloomberg Intelligence data

Globally, it's obviously a phenomenon that's starting to take off. If you look at inflows on a volume perspective, not only has it been steady even with the price corrections that Bitcoin is notoriously famous for, but you're seeing a lot of institutions jump in.”

--- Leah Wald, chief executive of crypto asset manager Valkyrie Investments, said on Bloomberg's "QuickTake Stock" streaming program.

Grayscale Investments LLC is the largest asset manager in the digital-assets space, with the $30 billion $Grayscale Bitcoin Trust (GBTC.US)$ ranking as the world's largest crypto fund.

The First U.S. bitcoin-linked ETF $ProShares Bitcoin ETF (BITO.US)$ incepted in October, which recevied a lot of attention. It only took two days for the fund to accumulate $1 billion.

Unlike an ETF directly connected to spot Bitcoin, the futures-backed products such as BITO are vulnerable to so-called associated with managing contracts. It's likely that investor demand would be even higher if physically backed funds were allowed to launch in the U.S., according to Bloomberg Intelligence.

I can't help but think that the assets in this space would be even larger if we had more efficient structures, like spot ETFs, in the U.S.”

--- said James Seyffart, Bloomberg Intelligence ETF analyst.

Watch now: What crypto's breakout year means for the market in 2022

Indeed, flows into the ProShares fund have stalled, with the ETF down more than 30% since its mid-October launch. Meanwhile, similar products from Valkyrie and VanEck have less than $70 million in assets combined.

Valkyrie's Wald is optimistic that flows will pick up in 2022. Institutional money managers are likely waiting to see how the U.S. futures-backed ETF handle the roll costs, she said.

That specific vehicle, I think a lot of money managers want to look at the metrics before jumping in. We're excited about what next year has to hold.”

--- Wald said.

Source: Bloomberg

46

7

7

Jerrytkc

liked

Translated

4

7

Jerrytkc

liked

$Insignia Systems (ISIG.US)$ whats going on ?

4

1

Jerrytkc

liked

9

2

Jerrytkc

liked

$Alibaba (BABA.US)$ baba closed at 122 again. 2 weeks and never fell below 120. My put spreads sold during 117.80 low gave me a good 30% profit in 3 days as I sold it ATM during that huge drop. I had confidence it will not close below 117 by Friday based on my technical analysis.

Support at 118 and 120 holding very well and bband is entering squeeze soon. We should see some huge movements either next week or the week after. Could be to the up or down side. But based on price action, seems more probability to the upside.

As always, trade safe & invest wise!

Stay tune to my weekly videos on YouTube coming out over the weekends!

https://www.youtube.com/c/investing101channel

Support at 118 and 120 holding very well and bband is entering squeeze soon. We should see some huge movements either next week or the week after. Could be to the up or down side. But based on price action, seems more probability to the upside.

As always, trade safe & invest wise!

Stay tune to my weekly videos on YouTube coming out over the weekends!

https://www.youtube.com/c/investing101channel

43

1

Jerrytkc

liked

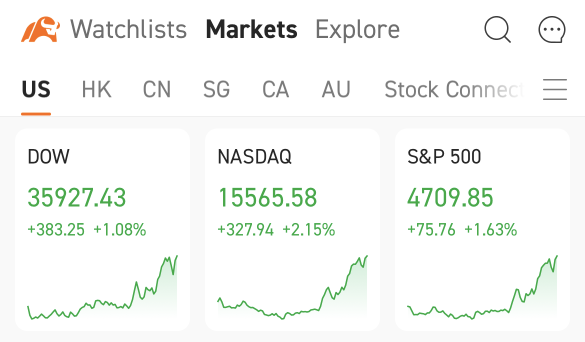

Here is what happened on Wednesday in the U.S. stocks market.

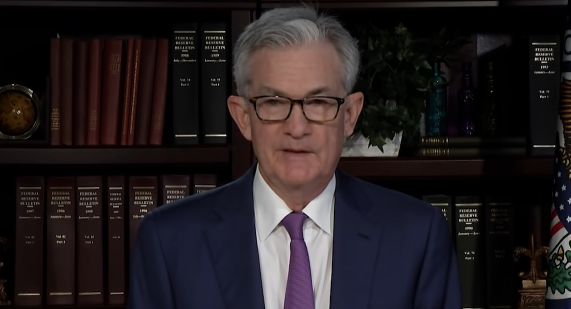

The stock market was subdued ahead of the year-end FOMC meeting. In the late-day trading session, stocks rallied when the Fed statement came out, which injected faith into investors because it showed the determination to fight inflation without restraining economic growth.

Key takeaways - Hawkish talk, dovish action

1. Speed up tapering, on track to end bond buying mid-March

2. Keep the federal funds rate in a target range of 0% to 0.25%

3. Fed forecasts three rate hikes in 2022 and three more in 2023

4. Interest rates policies are closely related to employment data

Why did the market jump on the Fed's decision?

1. Traders have prepared for the worst. It could be an explanation to the rally on a Fed hawkish decision. Since the last Fed meeting, the market already expected hawkish decisions such as tapering speed up and interest hikes.

2. Federal Reserve Chairman Jerome Powell balanced his rates outlook with a positive outlook of the economy.

3. Investors are somewhat encouraged by the Fed's recognition and determination to fight inflation.

“It seemed like there was some hedging demand into the event, perhaps relief that the event has happened, regardless of outcome,” said Danny Kirsch, head of options at Cornerstone Macro LLC. “The event is gone, sell your hedge and move on.”

The bottom line

Daily fluctuations of the stock markets are directly or indirectly affected by the changes in macroeconomic factors.

Therefore, knowing more about the Federal Reserve is helpful for your trading. Click to access the free course:

[Weekly Wins]

For more investment knowledge and trends, welcome to Courses in the Community.

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

The stock market was subdued ahead of the year-end FOMC meeting. In the late-day trading session, stocks rallied when the Fed statement came out, which injected faith into investors because it showed the determination to fight inflation without restraining economic growth.

Key takeaways - Hawkish talk, dovish action

1. Speed up tapering, on track to end bond buying mid-March

2. Keep the federal funds rate in a target range of 0% to 0.25%

3. Fed forecasts three rate hikes in 2022 and three more in 2023

4. Interest rates policies are closely related to employment data

Why did the market jump on the Fed's decision?

1. Traders have prepared for the worst. It could be an explanation to the rally on a Fed hawkish decision. Since the last Fed meeting, the market already expected hawkish decisions such as tapering speed up and interest hikes.

2. Federal Reserve Chairman Jerome Powell balanced his rates outlook with a positive outlook of the economy.

3. Investors are somewhat encouraged by the Fed's recognition and determination to fight inflation.

“It seemed like there was some hedging demand into the event, perhaps relief that the event has happened, regardless of outcome,” said Danny Kirsch, head of options at Cornerstone Macro LLC. “The event is gone, sell your hedge and move on.”

The bottom line

Daily fluctuations of the stock markets are directly or indirectly affected by the changes in macroeconomic factors.

Therefore, knowing more about the Federal Reserve is helpful for your trading. Click to access the free course:

[Weekly Wins]

For more investment knowledge and trends, welcome to Courses in the Community.

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

+2

63

48

17

Jerrytkc

liked

Hi, mooers! ![]()

![]()

Has this ever happened to you?![]() After you bought a stock, its price started to go down. The price bounced back right after you let go of it. It seems like we are somewhat being cursed because the market goes against our moves. Have you ever thought of why this happened and how to avoid it? This article might help!

After you bought a stock, its price started to go down. The price bounced back right after you let go of it. It seems like we are somewhat being cursed because the market goes against our moves. Have you ever thought of why this happened and how to avoid it? This article might help!

Spoiler: There's a chance for you to win points if you read till the end.![]()

![]()

![]() Why should we review our trades?

Why should we review our trades?

Writing reviews is one of the most effective ways to evaluate our past performance. A comprehensive review should include the assessment and analysis of your progress and mistakes. Reviews could be the basis for better planning and decision-making in the long run.

Please take a look at what @Jamesimsaid about reviewing trades: WHY DO YOU WANT TO REVIEW?

![]() How to review your trades?

How to review your trades?

Tip 1: Record the actions and results![]()

You can write down your trading ticker, the P/L, transaction details like entry and exit points, order details like buying and selling prices, etc. Details of your actions and results are essential to the reviews and analysis afterward.

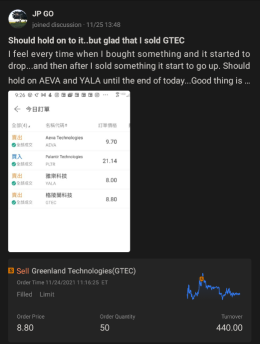

Check out the examples below:

Tip 2: Write down your observations![]()

Apart from the records of your actions, reviews can also include observations. You can always reflect on yourself, the companies you are watching, or the overall stock market. If you are a daytrader, you can take screenshots of intraday charts and comment on them. Besides, technical indicators are helpful when you are trying to uncover patterns. We've found that most trading reviews concentrate on self-analysis and include little about the related companies and market sentiments. Let's see how to do it appropriately below.

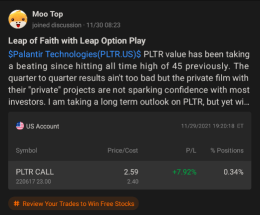

"Leap of Faith with Leap Option Play" by @Moo Top

"Era of electronic car competition" by @Jamesim

Tip 3: Accept your mistakes and celebrate your progress![]()

With the records of actions and observations mentioned above, you can dig deeper to uncover the mistakes and progress you've made. In this process, there shouldn't be any hard feelings. We can celebrate and learn from both failures and successes. Reviews enable you to keep tabs on your growth as a trader and the weak links of your trade. Only by constantly improving yourself can you become more confident. An excellent example is as follows: Watch out Trailing Stop!!

Tip 4: Monitor and control your emotions![]()

Being indulged in emotions, negative or positive, could lead to impulsive actions. A review of your trade allows you to note down how you feel when encountering a specific situation. This practice enables you to accept and acknowledge the emotions behind every transaction.

Example to review your emotion "Lost by not entering, won by not entering too." @Moo to Moon FTW, and @Ganar Poco

Trading reviews are powerful learning tools. Writing them is part of the excellent mechanism that helps you discover what you want and what suits you the best. A couple of months later, you may start to uncover the patterns of your trades, which means your trading system is taking shape!

![]() How can moomoo empower your review?

How can moomoo empower your review?

moomoo's trading notes allow you to record the details of your current position target and the profits and losses. It also records the number of stocks and the frequency of your trades within a certain period. Your review could become much more straightforward and precise with the trading notes. Let's take a look at how to use the "review" features on moomoo!

In addition, by reviewing your trade with moomoo, you will be able to exchange notes with other mooers. A friendly community vibe is what we encourage and appreciate. If you have any suggestions, please feel free to comment!

![]() Final Words

Final Words

Nothing is too silly to be recorded in your review. Just write down what happened when you missed a trade because you were watching the latest episode of a Netflix series or you were busy talking to your sweetheart. Remember that the best time to start writing is now! Over time, writing reviews would improve your trading efficiency. The reviews could be your key to favorable trades if they're consistently and constantly updated.

Share your tips for reviewing trades and comment below, and we will select the top 10 users with the most likes to give away 88 points reward!![]()

![]()

Has this ever happened to you?

Spoiler: There's a chance for you to win points if you read till the end.

Writing reviews is one of the most effective ways to evaluate our past performance. A comprehensive review should include the assessment and analysis of your progress and mistakes. Reviews could be the basis for better planning and decision-making in the long run.

Please take a look at what @Jamesimsaid about reviewing trades: WHY DO YOU WANT TO REVIEW?

Tip 1: Record the actions and results

You can write down your trading ticker, the P/L, transaction details like entry and exit points, order details like buying and selling prices, etc. Details of your actions and results are essential to the reviews and analysis afterward.

Check out the examples below:

Tip 2: Write down your observations

Apart from the records of your actions, reviews can also include observations. You can always reflect on yourself, the companies you are watching, or the overall stock market. If you are a daytrader, you can take screenshots of intraday charts and comment on them. Besides, technical indicators are helpful when you are trying to uncover patterns. We've found that most trading reviews concentrate on self-analysis and include little about the related companies and market sentiments. Let's see how to do it appropriately below.

"Leap of Faith with Leap Option Play" by @Moo Top

"Era of electronic car competition" by @Jamesim

Tip 3: Accept your mistakes and celebrate your progress

With the records of actions and observations mentioned above, you can dig deeper to uncover the mistakes and progress you've made. In this process, there shouldn't be any hard feelings. We can celebrate and learn from both failures and successes. Reviews enable you to keep tabs on your growth as a trader and the weak links of your trade. Only by constantly improving yourself can you become more confident. An excellent example is as follows: Watch out Trailing Stop!!

Tip 4: Monitor and control your emotions

Being indulged in emotions, negative or positive, could lead to impulsive actions. A review of your trade allows you to note down how you feel when encountering a specific situation. This practice enables you to accept and acknowledge the emotions behind every transaction.

Example to review your emotion "Lost by not entering, won by not entering too." @Moo to Moon FTW, and @Ganar Poco

Trading reviews are powerful learning tools. Writing them is part of the excellent mechanism that helps you discover what you want and what suits you the best. A couple of months later, you may start to uncover the patterns of your trades, which means your trading system is taking shape!

moomoo's trading notes allow you to record the details of your current position target and the profits and losses. It also records the number of stocks and the frequency of your trades within a certain period. Your review could become much more straightforward and precise with the trading notes. Let's take a look at how to use the "review" features on moomoo!

In addition, by reviewing your trade with moomoo, you will be able to exchange notes with other mooers. A friendly community vibe is what we encourage and appreciate. If you have any suggestions, please feel free to comment!

Nothing is too silly to be recorded in your review. Just write down what happened when you missed a trade because you were watching the latest episode of a Netflix series or you were busy talking to your sweetheart. Remember that the best time to start writing is now! Over time, writing reviews would improve your trading efficiency. The reviews could be your key to favorable trades if they're consistently and constantly updated.

Share your tips for reviewing trades and comment below, and we will select the top 10 users with the most likes to give away 88 points reward!

+6

147

22

27

Jerrytkc

liked

$Petros Pharmaceuticals (PTPI.US)$ have you guys taken profit and exited?

3

4

Jerrytkc

liked

$Cenntro Electric (NAKD.US)$ Big big week for Naked. A lot of us have already gotten a chance to vote up or down on the merger. It's looking great for the merger on the 21st. if you have not looked into the stock. now is the time to buy. a 55 cent EV stock that already has 3300 delivered units... Cenntro is already selling in five different countries, Vegas wants units for billboards. Red Cross wants units for Blood drives... Any company that wants to cut their bottom line is going to go with an EV fleet. cities in localities are going to be replacing there current fleets with electric. This is it, your 2021 Diamond in the rough. Good luck and buy the future responsibility.

19

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)