Jessica Blue

reacted to

The exciting annual festival of the moomoo community is beginning!![]()

![]()

![]() As 2021 draws to a close, we review how the ever-changing market unfolded and how mooers grew over the year. Welcome to the grand ceremony, and "grow together to the moo"!

As 2021 draws to a close, we review how the ever-changing market unfolded and how mooers grew over the year. Welcome to the grand ceremony, and "grow together to the moo"!

Let's dive right into the ceremony schedule:

● 2021 in Review: My Trading Journey Forges Ahead

● Words of the year

● Events of the year

● Concepts of the year

● Hot stocks on moomoo

● Mooers' 2021 Trading Journey

● Mooers of the year

● Features of the year

Kick off the ceremony with " 2021 in Review: My Trading Journey Forges Ahead" now, and please stay tuned for more spotlights coming soon!![]()

Let's dive right into the ceremony schedule:

● 2021 in Review: My Trading Journey Forges Ahead

● Words of the year

● Events of the year

● Concepts of the year

● Hot stocks on moomoo

● Mooers' 2021 Trading Journey

● Mooers of the year

● Features of the year

Kick off the ceremony with " 2021 in Review: My Trading Journey Forges Ahead" now, and please stay tuned for more spotlights coming soon!

48

1

Jessica Blue

reacted to

I just start this investment journey mid of this year. Throughout these months, I see , study, follow and learnt a lot of knowledge on investment, and I know there is still a long long way to go. As I want to be a long term investor, I invested in those well-known company like $Meta Platforms (FB.US)$ and $Apple (AAPL.US)$ bit by bit, within my capability. I also hold $Vanguard S&P 500 ETF (VOO.US)$ to manage the risk. For a beginner, I not dare to look for fast money through stock market. I would like "time" to be my friend and help to grow my wealth steadily. Looking forward to 2022 and I know there will also be a chance no matter how the market perform, just whether we can grab it or not, or we have the patience to endure it or not. Cheers![]()

52

Jessica Blue

commented on

Against the backdrop of the global covid-19 pandemic, 2021 has brought new challenges and opportunities to this year's trading. We responded with laughter and tears. ![]() This post compiles six stories that present a vivid picture of mooers' investing experiences. We sincerely hope that you will enjoy the stories!

This post compiles six stories that present a vivid picture of mooers' investing experiences. We sincerely hope that you will enjoy the stories!

Spoiler: There's a chance to get a bonus if you read till the end.

![]() "Never forget why you started, so your mission can be completed."

"Never forget why you started, so your mission can be completed."

Every incredible adventure started with a baby step. When we look back to the very beginning of our trading journey, we ask ourselves why we got started in the first place? Realistically speaking, money is what we all are after, but what made us brave enough to take the first step? Here is one of the most satisfying answers.

"She Has Inspired Me" said by @HuatLady. His trading journey started with his 21 birthday gift – a $100 saving bank account book from his parents.

"I was touched because that was her virtuous desire for me to be independent, and to make effective decisions, not only for the trading field but throughout my life for a better Future."

![]() Making profits is not the ultimate goal of investing. What you can learn in the process will get you further in life.

Making profits is not the ultimate goal of investing. What you can learn in the process will get you further in life.

"The only way to overcome bad luck is working hard."

Novices deserve a bit of "beginner's luck." "Did I have beginner's luck when I first started trading?" @cowabangawas quite confident at first because of the money he made in the market. After that, there're setbacks, and there's luck again.

"As I trade along, the results are certainly compelling! I dare say I have one of the finest beginner's luck out there for my first few wins at the market provided trading returns in folds. It was truly an amazing experience given the confidence it spurs in you. But like what the market veterans would say 'the market giveth, the market taketh'..."

![]() The truth is that luck is the combination of skills and opportunities. Many things that look like luck at first blush are part of a cycle.

The truth is that luck is the combination of skills and opportunities. Many things that look like luck at first blush are part of a cycle.

After investing for some time, many mooers might feel anxious and regretful. Some of us can't stop thinking about what we should've done when we were younger and what could've been achieved if we'd chosen differently. @aoimizushared his advice with the younger ones at "I hate finance ... but I'm here"

"I support young people who want to begin their investment journey early. As mentioned in a previous post (Gen Z and debt), I'd put aside my part-time job earnings as the capital for investments. I'd be more proactive in scanning the news and be updated on the overall environment. I'd become more curious about the companies that make the products I use, and study them more closely."

@小虎发大财wrote something about his words to himself if he can travel back in time at his post "I started my investment journey in 2017."

"I entered the market without any knowledge and purely by rumors, ended up suffering a loss.From there onwards, i started reading and watching video on youtube to educate myself, even till now hungry for knowledge. If I can return back time, i will tell myself to start off investment way earlier."

Regrets are common in trade because they occur both when you make a move or do absolutely nothing. How to deal with "regrets" when you want to start with "if only"? @Powerhouseresponded with "Really? Then you are not playing big enough!!"

"Investment is like this. You lost some here; you better wake up your idea to earn more somewhere else...Play within your means. That is how I consoled myself. Lose, never mind, just don't lose your mind and spirit. Miss the boat, try the other boat beside it!"

![]() "The minute you appreciate what you have, joyfulness overcomes suffering."

"The minute you appreciate what you have, joyfulness overcomes suffering."

2021 may not be the best in your life, but it couldn't be worse than 2020. Could it? We survived 2020, so when we start to appreciate what we have, 2021 could be a year full of joyfulness.

Do you agree with @Syueeat her post "Birds of a Feather, Flock Together!"?

"I believe in following the practice of gratitude, giving and sharing with the less fortunate. Not everyone is as lucky to have a roof over their heads, clothes to cover their bodies and food to fill their stomachs...Happiness keeps you sweet. Trials keep you strong. Sorrows keep you human. Failure keeps you humble. Success keeps you glowing. FAMILY keeps you GOING."

![]() Moo community is committed to accompanying you throughout your trading journey and offering as much support as we can.

Moo community is committed to accompanying you throughout your trading journey and offering as much support as we can.

2021 might be the start of the trading journey for many mooers. We've seen many mooers saying that moomoo is what gets them started in trading. That is AWESOME!

@aoimizusaid in one of his posts, "There is a sense of camaraderie in the moomoo community, making me feel that this is not a lonely journey and I can always ask for help". This is exactly what moomoo wants to bring to all of you! We will always be there for you. Wish you all a very happy 2022 ahead!

![]() Bonus

Bonus![]()

What's the most inspiring investing story you've heard this year? Comment under this post and tell us the story now! We will select the 1st, 10th, 20th, 30th, 40th...(multiples of 10) comments to give away 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

![]()

![]()

![]() moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

Spoiler: There's a chance to get a bonus if you read till the end.

Every incredible adventure started with a baby step. When we look back to the very beginning of our trading journey, we ask ourselves why we got started in the first place? Realistically speaking, money is what we all are after, but what made us brave enough to take the first step? Here is one of the most satisfying answers.

"She Has Inspired Me" said by @HuatLady. His trading journey started with his 21 birthday gift – a $100 saving bank account book from his parents.

"I was touched because that was her virtuous desire for me to be independent, and to make effective decisions, not only for the trading field but throughout my life for a better Future."

"The only way to overcome bad luck is working hard."

Novices deserve a bit of "beginner's luck." "Did I have beginner's luck when I first started trading?" @cowabangawas quite confident at first because of the money he made in the market. After that, there're setbacks, and there's luck again.

"As I trade along, the results are certainly compelling! I dare say I have one of the finest beginner's luck out there for my first few wins at the market provided trading returns in folds. It was truly an amazing experience given the confidence it spurs in you. But like what the market veterans would say 'the market giveth, the market taketh'..."

After investing for some time, many mooers might feel anxious and regretful. Some of us can't stop thinking about what we should've done when we were younger and what could've been achieved if we'd chosen differently. @aoimizushared his advice with the younger ones at "I hate finance ... but I'm here"

"I support young people who want to begin their investment journey early. As mentioned in a previous post (Gen Z and debt), I'd put aside my part-time job earnings as the capital for investments. I'd be more proactive in scanning the news and be updated on the overall environment. I'd become more curious about the companies that make the products I use, and study them more closely."

@小虎发大财wrote something about his words to himself if he can travel back in time at his post "I started my investment journey in 2017."

"I entered the market without any knowledge and purely by rumors, ended up suffering a loss.From there onwards, i started reading and watching video on youtube to educate myself, even till now hungry for knowledge. If I can return back time, i will tell myself to start off investment way earlier."

Regrets are common in trade because they occur both when you make a move or do absolutely nothing. How to deal with "regrets" when you want to start with "if only"? @Powerhouseresponded with "Really? Then you are not playing big enough!!"

"Investment is like this. You lost some here; you better wake up your idea to earn more somewhere else...Play within your means. That is how I consoled myself. Lose, never mind, just don't lose your mind and spirit. Miss the boat, try the other boat beside it!"

2021 may not be the best in your life, but it couldn't be worse than 2020. Could it? We survived 2020, so when we start to appreciate what we have, 2021 could be a year full of joyfulness.

Do you agree with @Syueeat her post "Birds of a Feather, Flock Together!"?

"I believe in following the practice of gratitude, giving and sharing with the less fortunate. Not everyone is as lucky to have a roof over their heads, clothes to cover their bodies and food to fill their stomachs...Happiness keeps you sweet. Trials keep you strong. Sorrows keep you human. Failure keeps you humble. Success keeps you glowing. FAMILY keeps you GOING."

2021 might be the start of the trading journey for many mooers. We've seen many mooers saying that moomoo is what gets them started in trading. That is AWESOME!

@aoimizusaid in one of his posts, "There is a sense of camaraderie in the moomoo community, making me feel that this is not a lonely journey and I can always ask for help". This is exactly what moomoo wants to bring to all of you! We will always be there for you. Wish you all a very happy 2022 ahead!

What's the most inspiring investing story you've heard this year? Comment under this post and tell us the story now! We will select the 1st, 10th, 20th, 30th, 40th...(multiples of 10) comments to give away 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

+2

195

31

Jessica Blue

liked and commented on

Welcome to the shining moments of the moomoo community. It's time to collect the unforgettable fragments of 2021.![]() In a year of volatility, WallStreetBets stocks are resilient, with $AMC Entertainment (AMC.US)$ regaining its momentum. Trump Concept stocks are on the rise, with $Phunware (PHUN.US)$ leading the way. The pandemic-induced booming of vaccine stocks provides mooers with unique opportunities to make money.

In a year of volatility, WallStreetBets stocks are resilient, with $AMC Entertainment (AMC.US)$ regaining its momentum. Trump Concept stocks are on the rise, with $Phunware (PHUN.US)$ leading the way. The pandemic-induced booming of vaccine stocks provides mooers with unique opportunities to make money.

This post presents some essential trading orders and calls for our dear mooers to compete. It starts with an outstanding one that yielded up to 69900%. We found some mooers highly concentrated. They only invested in one stock but grasped the entry and exit points well and recorded the moves using the trading marking feature of moomoo. Besides, there is a frequent trader who trades 156 times a quarter. It seems that our dear mooers have acquired diverse trading skills and experienced some ups and downs in 2021. Let's review and compete now!![]()

1. The highest rate of return reaching 69900.00%

@值得拥有伱 Average Cost down to 0.0019

![]() Challenging $Camber Energy (CEI.US)$ , my power +69900.00%. The success lies in the accurate grasping of buying and selling points.

Challenging $Camber Energy (CEI.US)$ , my power +69900.00%. The success lies in the accurate grasping of buying and selling points.

If you have a higher rate of return, please leave your comment to compete with others.

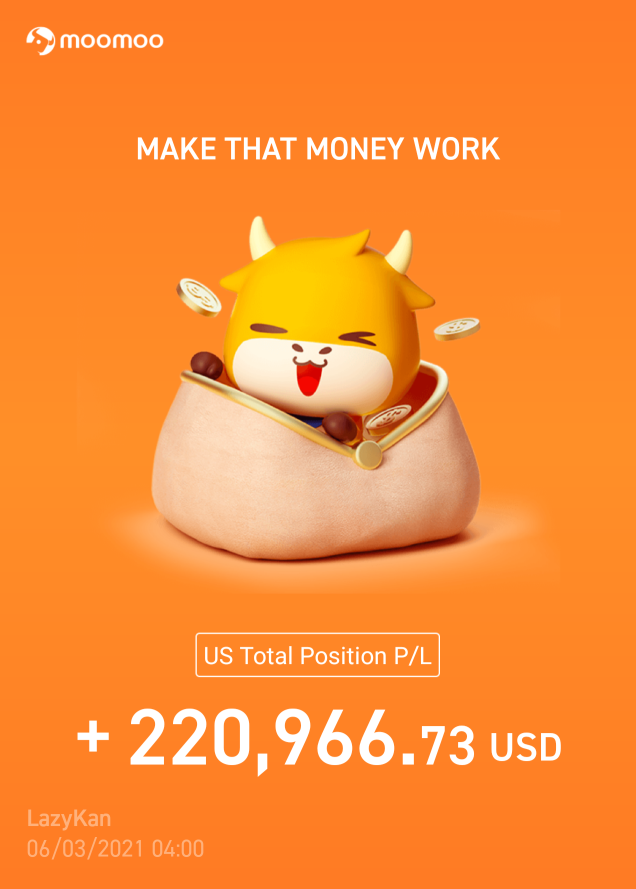

2. The highest daily return: $220966.73

@burger1010 Make that money work!

![]() The gain of $220966.73 belongs to a college kid who works at a grocery store and earns the minimum wage. Two weeks ago, what I had was 10K. However, the profits soared because options were wild.

The gain of $220966.73 belongs to a college kid who works at a grocery store and earns the minimum wage. Two weeks ago, what I had was 10K. However, the profits soared because options were wild.

If you have a higher daily return, please leave your comment to compete with others.

3. The worst losses running to 98.43%

@skytrade What would you do if you were me?

![]() Despite that the Trump Concept stock, $PHUN is hot, my losses are down to a record low of 98.43%. I am confused and helpless.

Despite that the Trump Concept stock, $PHUN is hot, my losses are down to a record low of 98.43%. I am confused and helpless.

If you have a lower loss rate, please leave your comment to compete with others.

4. An unexpected loss of $22909 by investing in $AMC

@bentbb This is a reminder to all mooers

![]() For one hour, the decline of $AMC made me cry. Please keep in mind that you must band together and hold whatever position you're in. We are only as strong as our weakest link.

For one hour, the decline of $AMC made me cry. Please keep in mind that you must band together and hold whatever position you're in. We are only as strong as our weakest link.

If you've lost more money in a single stock, please leave your comment to compete with others.

5. Focusing on one stock at a time

@Machiavellis3rdEye When will we get off the bus to the crazy town?

![]() Stop being distracted. I conducted high-frequency trading on $Biora Therapeutics (PROG.US)$ , hoping to earn huge profits from this stock and become richer!

Stop being distracted. I conducted high-frequency trading on $Biora Therapeutics (PROG.US)$ , hoping to earn huge profits from this stock and become richer!

If you've traded more frequently of a specific stock than this mooer, please leave your comment to compete with others.

6. The most diverse high-frequency trading

@Austin Anderson What a blast it has been

![]() In one quarter, I trade 156 times for 58 objects. Please learn from our mistakes and don't get emotionally involved!

In one quarter, I trade 156 times for 58 objects. Please learn from our mistakes and don't get emotionally involved!

If you've traded more frequently a quarter than this mooer, please leave your comment to compete with others.

7. Building a diverse but profitable portfolio

@10664788 Be satisfied with the winning percentage.

![]() Eight out of eleven stocks in my portfolio are making profits! $New Gold, $Globalstar, and $NIO Inc (NIO.US)$ are all my lucky stocks.

Eight out of eleven stocks in my portfolio are making profits! $New Gold, $Globalstar, and $NIO Inc (NIO.US)$ are all my lucky stocks.

If the proportion of stocks earning profits in your portfolio is higher than this mooer, please leave your comment to compete with others.

After seeing the stunning orders above, would you like to share your orders and achievements with us?

![]() How's your P/L in 2021?

How's your P/L in 2021?

![]() How frequently did you trade?

How frequently did you trade?

![]() How did you build your portfolio?

How did you build your portfolio?

I bet you've had "better" results!

If you want to challenge the orders above, leave your P/L in the comments. Let's see what you've got. You could be the KING of trading in 2021!![]()

![]()

![]()

![]()

![]()

![]() moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

This post presents some essential trading orders and calls for our dear mooers to compete. It starts with an outstanding one that yielded up to 69900%. We found some mooers highly concentrated. They only invested in one stock but grasped the entry and exit points well and recorded the moves using the trading marking feature of moomoo. Besides, there is a frequent trader who trades 156 times a quarter. It seems that our dear mooers have acquired diverse trading skills and experienced some ups and downs in 2021. Let's review and compete now!

1. The highest rate of return reaching 69900.00%

@值得拥有伱 Average Cost down to 0.0019

If you have a higher rate of return, please leave your comment to compete with others.

2. The highest daily return: $220966.73

@burger1010 Make that money work!

If you have a higher daily return, please leave your comment to compete with others.

3. The worst losses running to 98.43%

@skytrade What would you do if you were me?

If you have a lower loss rate, please leave your comment to compete with others.

4. An unexpected loss of $22909 by investing in $AMC

@bentbb This is a reminder to all mooers

If you've lost more money in a single stock, please leave your comment to compete with others.

5. Focusing on one stock at a time

@Machiavellis3rdEye When will we get off the bus to the crazy town?

If you've traded more frequently of a specific stock than this mooer, please leave your comment to compete with others.

6. The most diverse high-frequency trading

@Austin Anderson What a blast it has been

If you've traded more frequently a quarter than this mooer, please leave your comment to compete with others.

7. Building a diverse but profitable portfolio

@10664788 Be satisfied with the winning percentage.

If the proportion of stocks earning profits in your portfolio is higher than this mooer, please leave your comment to compete with others.

After seeing the stunning orders above, would you like to share your orders and achievements with us?

I bet you've had "better" results!

If you want to challenge the orders above, leave your P/L in the comments. Let's see what you've got. You could be the KING of trading in 2021!

+5

245

14

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)