Joel Moo Moo

liked

$IFAST (AIY.SG)$ broke down below 3.69 support. May fall to supports around 3.16 and 3.06.

$SIA (C6L.SG)$ $AEM SGD (AWX.SG)$ $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $SamuderaShipping (S56.SG)$ $Jiutian Chemical (C8R.SG)$ $Rex Intl (5WH.SG)$ $RH PetroGas (T13.SG)$ $Geo Energy Res (RE4.SG)$ $Golden Energy (AUE.SG)$

$SIA (C6L.SG)$ $AEM SGD (AWX.SG)$ $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $SamuderaShipping (S56.SG)$ $Jiutian Chemical (C8R.SG)$ $Rex Intl (5WH.SG)$ $RH PetroGas (T13.SG)$ $Geo Energy Res (RE4.SG)$ $Golden Energy (AUE.SG)$

5

Joel Moo Moo

commented on

$Frencken (E28.SG)$ if non stop, next stop will be 0.94 😱😱😱

3

11

Joel Moo Moo

commented on

I just purged 200 saved charts, so let's start fresh and see where we are. I'm going to do it a little differently, I'm going to start with my favorites and end with NQ. This also allows for futures to continue so I can get more information.

$ChemoCentryx (CCXI.US)$ Is it just an oversold bounce, or recovery? Bouncing off of the lower bollinger band, have we found support? If we rebound the upper bollinger band us just below the gap to fill around 27. Look how far CCXI was sold down on ...

$ChemoCentryx (CCXI.US)$ Is it just an oversold bounce, or recovery? Bouncing off of the lower bollinger band, have we found support? If we rebound the upper bollinger band us just below the gap to fill around 27. Look how far CCXI was sold down on ...

+17

27

63

Joel Moo Moo

commented on

Volatility for technology sector, the rest of the market is up.

I took the opportunity to buy $ProShares UltraPro QQQ ETF (TQQQ.US)$ & $Invesco QQQ Trust (QQQ.US)$ which has a positive correlation with nasdaq. I also double my stake on $UP Fintech (TIGR.US)$ pulling down my losses from 68% to 28%.

My watchlist (might average in)

$Alibaba (BABA.US)$

$Baidu (BIDU.US)$

$PayPal (PYPL.US)$

I took the opportunity to buy $ProShares UltraPro QQQ ETF (TQQQ.US)$ & $Invesco QQQ Trust (QQQ.US)$ which has a positive correlation with nasdaq. I also double my stake on $UP Fintech (TIGR.US)$ pulling down my losses from 68% to 28%.

My watchlist (might average in)

$Alibaba (BABA.US)$

$Baidu (BIDU.US)$

$PayPal (PYPL.US)$

38

4

Joel Moo Moo

commented on

$PayPal (PYPL.US)$ What happened?

Translated

2

Joel Moo Moo

liked

Ten times in two years! The market value of "Southeast Asian Tencent" $Sea (SE.US) $ is approaching 200 billion U.S. dollars. Earlier news, its e-commerce platform Shopee plans to launch Spanish websites and applications to enter the Spanish market.

$Sea (SE.US)$ $Shopify (SHOP.US)$

$Sea (SE.US)$ $Shopify (SHOP.US)$

12

Joel Moo Moo

liked

By Melody

A company's most important goal is to make money and keep it. When a company no longer has the ability to keep making money, its share price will drop significantly.

Does this mean we can only buy into companies with positive net income?

NO.

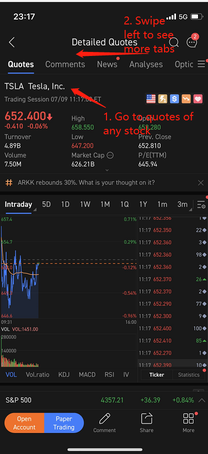

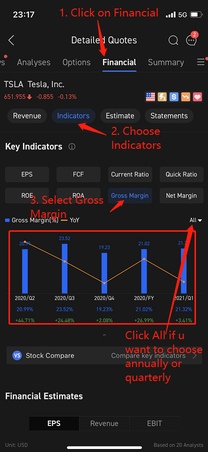

$Tesla (TSLA.US)$would be a perfect example. Tesla was listed in 2009, but the company didn't break even till 2020. Not having a positive net income did not stop Tesla shares from skyrocketing. This is because the share price does not simply reflect a company's net income, but rather its profitability.

...

A company's most important goal is to make money and keep it. When a company no longer has the ability to keep making money, its share price will drop significantly.

Does this mean we can only buy into companies with positive net income?

NO.

$Tesla (TSLA.US)$would be a perfect example. Tesla was listed in 2009, but the company didn't break even till 2020. Not having a positive net income did not stop Tesla shares from skyrocketing. This is because the share price does not simply reflect a company's net income, but rather its profitability.

...

+6

177

32

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)