John the champion

commented on

$Listed Fund Trust Wahed Ftse Usa Shariah Etf (HLAL.US)$ SPTE is another shariah compliant etf alternative to hlal with better return. it also has nvda and tsmc in it's fund. $SP FUNDS S&P GLOBAL TECHNOLOGY ETF (SPTE.US)$

13

7

John the champion

voted

Hi, mooers!![]()

$Shopify (SHOP.US)$ is releasing its Q4 2024 earnings on February 11 before the bell. Unlock insights with SHOP Earnings Hub>>

Don't want to miss first-hand information? Subscribe to @Moo Live and book the earnings conference live stream NOW!

For the details of indicator sentiment, please tap the link and check.

Since its Q3 2024 earnings release, shares of $Shopify (SHOP.US)$ have a increase of 30.47%. How will the...

$Shopify (SHOP.US)$ is releasing its Q4 2024 earnings on February 11 before the bell. Unlock insights with SHOP Earnings Hub>>

Don't want to miss first-hand information? Subscribe to @Moo Live and book the earnings conference live stream NOW!

For the details of indicator sentiment, please tap the link and check.

Since its Q3 2024 earnings release, shares of $Shopify (SHOP.US)$ have a increase of 30.47%. How will the...

78

114

9

John the champion

liked

Certain stocks and industries are often considered more resilient to the uncertainties of U.S. elections, as their performance tends to be less impacted by the outcome of the election or political shifts. These sectors often include:

1. Consumer Staples: Companies that produce essential goods, such as food, beverages, household products, and personal care items, tend to be more stable because demand for these products remains consistent regardless of the poli...

1. Consumer Staples: Companies that produce essential goods, such as food, beverages, household products, and personal care items, tend to be more stable because demand for these products remains consistent regardless of the poli...

27

3

John the champion

voted

Hello Mooers! ![]()

Today, in pre-market hours, many AI stocks are in the red. Microsoft ( $Microsoft (MSFT.US)$ ) and Meta Platforms ( $Meta Platforms (META.US)$ ) -3% to -4%, Apple ( $Apple (AAPL.US)$ ) around -1%, Super Micro Computer ( $Super Micro Computer (SMCI.US)$ ) -4% to -5%, NVIDIA ( $NVIDIA (NVDA.US)$ ), Amazon ( $Amazon (AMZN.US)$ ), Broadcom ( $Broadcom (AVGO.US)$ ) and Advanced Micro Devices ( $Advanced Micro Devices (AMD.US)$ ) -1% to -2%.

Would Mooers take ...

Today, in pre-market hours, many AI stocks are in the red. Microsoft ( $Microsoft (MSFT.US)$ ) and Meta Platforms ( $Meta Platforms (META.US)$ ) -3% to -4%, Apple ( $Apple (AAPL.US)$ ) around -1%, Super Micro Computer ( $Super Micro Computer (SMCI.US)$ ) -4% to -5%, NVIDIA ( $NVIDIA (NVDA.US)$ ), Amazon ( $Amazon (AMZN.US)$ ), Broadcom ( $Broadcom (AVGO.US)$ ) and Advanced Micro Devices ( $Advanced Micro Devices (AMD.US)$ ) -1% to -2%.

Would Mooers take ...

4

6

John the champion

voted

I feel that this rate cut against an uncertain recessionary and un/under-employment backdrop, on top other bad govermental policies = volatility. To add to this, there is too much hot money in the market, not just from US investors/ traders, but from all over the world, further contributing to the chaos.

My current strategy is defensive.

1) 50% of my portfolio is high dividend stock such as:

$Stellantis NV (STLA.US)$

$GlaxoSmithKline (GSK.US)$

$Ecopetrol (EC.US)$

���������...

My current strategy is defensive.

1) 50% of my portfolio is high dividend stock such as:

$Stellantis NV (STLA.US)$

$GlaxoSmithKline (GSK.US)$

$Ecopetrol (EC.US)$

���������...

12

2

John the champion

voted

If you've ever wondered how to navigate the world of dividend investing, our recent live session with Steven "Sarge" Guilfoyle could be helpful! 🌟 If you missed it, here’s a recap that could enhance your investment strategy, whether you're planning for retirement or looking to diversify your portfolio. 💡

Follow Stephen “Sarge” Guilfoyle on moomoo

🔍 Why Do Dividends Matter?

Dividends are a share of a company's profits paid out to share...

60

18

7

John the champion

commented on

$NVIDIA (NVDA.US)$ bankruptcy tomorrow

3

1

John the champion

voted

Hey, mooers!

$NVIDIA (NVDA.US)$ released the Q2 FY25 results on August 28 after the bell. The overall data is strong and still hit a new record high. However, the Q3 revenue guidance fell short of the highest optimistic expectations, which triggered a huge after-hours shock in the stock market and ultimately regrettable to the end of the day with the decline of more than 6%.

What are the key highlights of the earnings report? Unlock insights with NVDA Earnings Hub>>

���������...

$NVIDIA (NVDA.US)$ released the Q2 FY25 results on August 28 after the bell. The overall data is strong and still hit a new record high. However, the Q3 revenue guidance fell short of the highest optimistic expectations, which triggered a huge after-hours shock in the stock market and ultimately regrettable to the end of the day with the decline of more than 6%.

What are the key highlights of the earnings report? Unlock insights with NVDA Earnings Hub>>

���������...

30

2

John the champion

voted

Hi mooers!

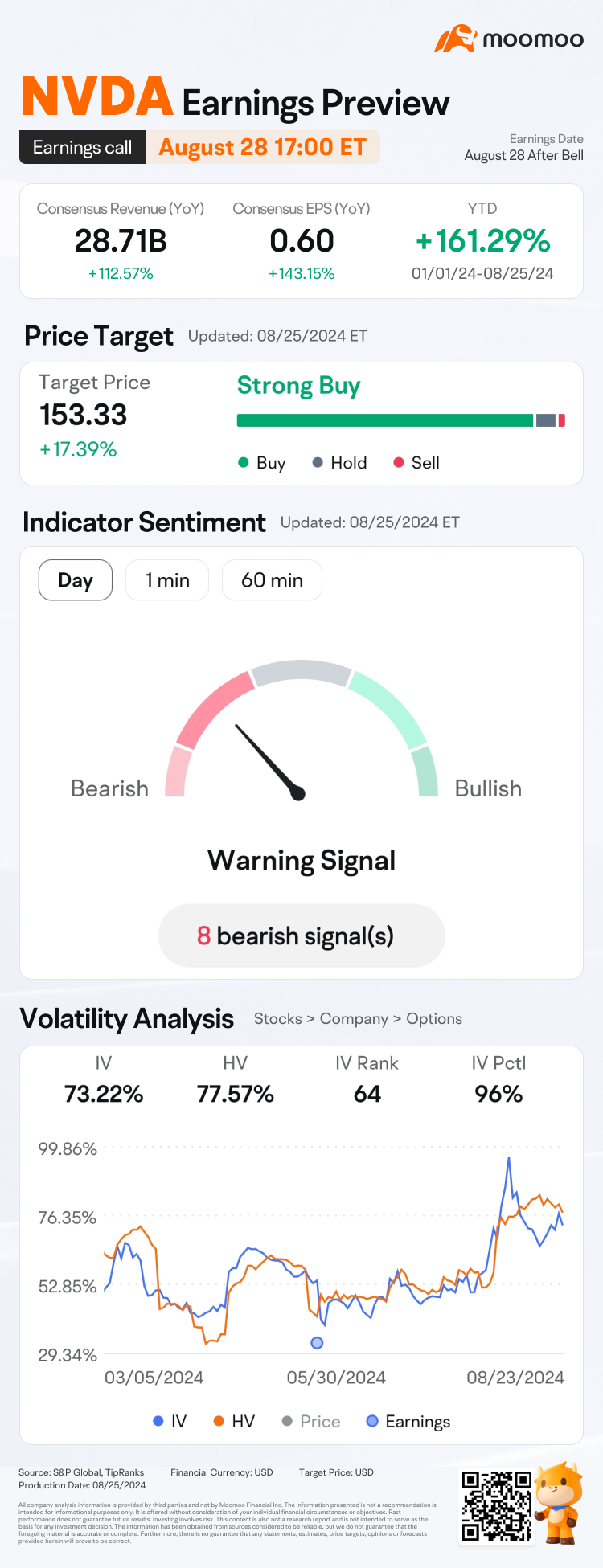

$NVIDIA (NVDA.US)$ is releasing its Q2 earnings on August 28 after the bell. Unlock insights with NVDA Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its last earnings release, shares of $NVIDIA (NVDA.US)$ have seen an increase of 35.64%. What do you think of this earnings report? Let's see if you can be motivated by the following information!

![]() Mooer's insights:

Mooer's insights:

· @Mr Long Te...

$NVIDIA (NVDA.US)$ is releasing its Q2 earnings on August 28 after the bell. Unlock insights with NVDA Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its last earnings release, shares of $NVIDIA (NVDA.US)$ have seen an increase of 35.64%. What do you think of this earnings report? Let's see if you can be motivated by the following information!

· @Mr Long Te...

+8

102

116

22

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

John the champion OP Ts HjZ : SPTE is issues by same company that issues SPUS, I have done few checks on UMC & keyence stocks it's shariah compliant by ZOYA but not labelled as it is on moomoo same goes to AMZN. There's many reading online about SPTE about being shariah, perhaps you can point up what's lacking in this etf. it's is important as it involve halal & haram. Thank you for your concern.

John the champion OP M4S : Sure this is the official information from the issuer company.

SPTE – SP FUNDS