K来买

liked

The Week Ahead in Focus

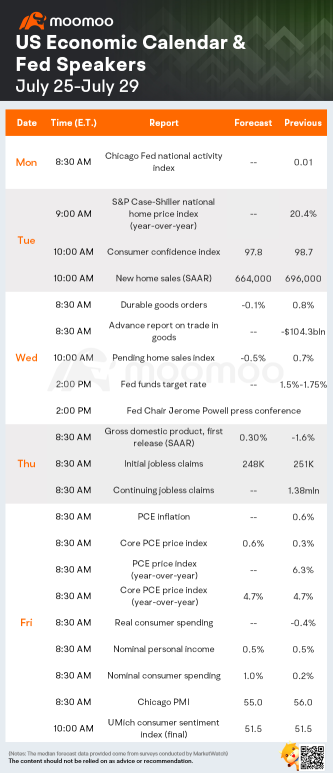

It will be a busy week on both the micro and macro fronts. Second-quarter earnings season ramps up, as more than 150 S&P 500 firms report, including Big Tech. The Federal Reserve's policy committee will announce an interest-rate decision on Wednesday afternoon, and economists will get a look at a bevy of new data.

The Federal Open Market Committee meets on Tuesday and Wednesday. The central bank is certain to ra...

It will be a busy week on both the micro and macro fronts. Second-quarter earnings season ramps up, as more than 150 S&P 500 firms report, including Big Tech. The Federal Reserve's policy committee will announce an interest-rate decision on Wednesday afternoon, and economists will get a look at a bevy of new data.

The Federal Open Market Committee meets on Tuesday and Wednesday. The central bank is certain to ra...

+3

56

5

60

K来买

liked

$NIO Inc (NIO.US)$ what to expect for nio? Up or down? Red pre market after NIO day! Where are your entry points? Divergences spotted on NIO! bull or bear signal? Watch the video to find out!

As always trade safe and invest wise!

As always trade safe and invest wise!

2

8

K来买

liked

Rookie mistakes can often leave a sour taste and reduce your confidence in your investment journey. Get started the right way by learning how to avoid these costly pitfalls when you download moomoo! What are some of the trader blunders you've made? Share 'em in the comments so we can help each other thrive within our com-moo-inity!

Disclaimer: This content is illustrated for informational and educational purposes only.

Connect, follow and have a c...

Disclaimer: This content is illustrated for informational and educational purposes only.

Connect, follow and have a c...

+3

171

32

15

K来买

liked

In 2021, moomoo became the place where investors could share their opinions and communicate freely with each other. The frequent interactions between the enthusiastic mooers have positively impacted the community.![]()

![]()

![]() Mooers are moving in the same direction: making profits and improving themselves. It would take a long time and great effort for our dear mooers to achieve these goals. Why don't we take a look at ten of the year's valuable market insights and investing tips?

Mooers are moving in the same direction: making profits and improving themselves. It would take a long time and great effort for our dear mooers to achieve these goals. Why don't we take a look at ten of the year's valuable market insights and investing tips?

Spoiler: There's a chance to get points if you read till the end.

*The selected articles are listed randomly.

![]() ONE: Is investing in Trump's new merger a good idea?

ONE: Is investing in Trump's new merger a good idea?

@HuatLadywrote about his concerns on the merger of Trump's company and a SPAC called the Digital World Acquisition Corp. We have to admit that he has a point!

"Forgive me for predicting that most likely his company's stock will not be viable for long term investment goal."

View more: Will Donald be able to deal his Trump Card?

![]() TWO: What do you think of meme stocks?

TWO: What do you think of meme stocks?

@Machiavellis3rdEyeused vivid language to call for rational investing and remind mooers to watch out for media manipulations. Do you agree with him?

"You ARE ALL MY ALLIES, regardless of your investment choices, politics, religions, colors, sex, or anything else! I say we start learning and adapting to their constantly evolving illegal games (media manipulation, PFOF, CB's) together. Then we will all figure out how to take that cheese - without getting TRAPPED."

View more: When will we get off this bus to CRAZYTOWN?

![]() THREE: What can we learn from the big picture?

THREE: What can we learn from the big picture?

@WYCKOFFPROanalyzed the trend of the Russell 2020 with technical tools. Has the market proved his assumptions?

"The breakout of the Russell 2000 gives the first confirmation of the scenario of possible rotation from big cap stocks to small cap stocks."

View more: A Bargain you can't Ignore — This Laggard Breaks All Time High Last Week

![]() FOUR: Will the strong momentum of recovery stocks fade?

FOUR: Will the strong momentum of recovery stocks fade?

On Nov 5, Pfizer introduced a new COVID-19 antiviral pill that is expected to treat 89% of acutely hospitalized patients and thus reduce the risk of death. @HuatEveranticipated that Pfizer's share price would continue to climb once the FDA approved the new antiviral pill. What do you think?

"They hold the promise of cutting down the risk of severe Covid 19 ailments, hospitalisation stays and even deaths, and if being taken at the early onsets of infection. "

View more: A Breakthrough in Covid 19 Antiviral Pills

![]()

![]() FIVE: EV stocks skyrocketing: Good buy or goodbye?

FIVE: EV stocks skyrocketing: Good buy or goodbye?

@Deviltonconducted an in-depth analysis on one of the most popular stocks, $Rivian, and pointed out that patience is a virtue in trading.

"Human are always impatient, we will always have FOMO if we sit and wait till Friday, scared that it stops falling and starts to rise again. Yet buying all tomo may not allow you to buy at the best price." View more here.

![]() SIX: How do you decide when to buy/sell?

SIX: How do you decide when to buy/sell?

@HopeAlwayssaid that there is no best way to determine when to buy and when to sell the stocks of indexes. The timings depend on investing goals, philosophies, and personal preferences.

"The three main risks are company, valuation and earnings risks. Once we are able to find a stock that that signals low risk based on these three conditions, it is time to buy. Whenever a negative change happens to any of the three conditions, it is time to sell."

View more: Buying and Selling Stocks

![]() SEVEN: How do you know when to stop loss / take profit?

SEVEN: How do you know when to stop loss / take profit?

@Powerhousehas three underlying principles in stopping losses and taking profits. All investors should stay informed and closely observe trends to set price targets.

"For micro, there is a need to determine your present financial risk appetite figuratively. On the macro level, situations may have changed. Determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult."

View more: Stop the pain, take the happiness

![]() EIGHT: What urges you to press the "trade" button?

EIGHT: What urges you to press the "trade" button?

@Panda2102has done macro research to sort out a list of companies and ranks them from different dimensions.

"The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company."

View more: Best time to press the trade button

![]() NINE: How to build a portfolio with a windfall of $1 million?

NINE: How to build a portfolio with a windfall of $1 million?

@Mars Mooothinks that the Squid Game Multi-Portfolio comprises four parts: player 456, player 218, player 067, and a liquid one.

"The first portfolio is aimed at potential sectors for diversification and profits. The second is designed to high risk lead high returns. The next one intent on helping on thr way. While the last one shows that cash is king."

View more: The Squid Game Multi-Portfolios Portfolio

![]() TEN: How to profit from short-selling?

TEN: How to profit from short-selling?

@Mcsnacks H Tupackshared that short-selling is highly popular on Wall Street and often carried out by aggressive hedge funds.

"Hedge funds acting through collaborating market makers can create huge numbers of counterfeit shares that can overwhelm buying demand. They have turned it into a casino and everyone knows the house always wins in that scenario."

View more: The only way for short selling to be profitable is by cheating

This recap takes a deep dive into the market insights and investing tips that inspire us to become better investors. Did you find anything interesting or helpful?

![]() Bonus

Bonus![]()

Please Leave your comments below and @ the mooer whose opinions impress you the most, and explain why they are attractive. The 1st, 10th, 20th, 30th, 40th...(multiples of 10) mooers will be rewarded with 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

Spoiler: There's a chance to get points if you read till the end.

*The selected articles are listed randomly.

@HuatLadywrote about his concerns on the merger of Trump's company and a SPAC called the Digital World Acquisition Corp. We have to admit that he has a point!

"Forgive me for predicting that most likely his company's stock will not be viable for long term investment goal."

View more: Will Donald be able to deal his Trump Card?

@Machiavellis3rdEyeused vivid language to call for rational investing and remind mooers to watch out for media manipulations. Do you agree with him?

"You ARE ALL MY ALLIES, regardless of your investment choices, politics, religions, colors, sex, or anything else! I say we start learning and adapting to their constantly evolving illegal games (media manipulation, PFOF, CB's) together. Then we will all figure out how to take that cheese - without getting TRAPPED."

View more: When will we get off this bus to CRAZYTOWN?

@WYCKOFFPROanalyzed the trend of the Russell 2020 with technical tools. Has the market proved his assumptions?

"The breakout of the Russell 2000 gives the first confirmation of the scenario of possible rotation from big cap stocks to small cap stocks."

View more: A Bargain you can't Ignore — This Laggard Breaks All Time High Last Week

On Nov 5, Pfizer introduced a new COVID-19 antiviral pill that is expected to treat 89% of acutely hospitalized patients and thus reduce the risk of death. @HuatEveranticipated that Pfizer's share price would continue to climb once the FDA approved the new antiviral pill. What do you think?

"They hold the promise of cutting down the risk of severe Covid 19 ailments, hospitalisation stays and even deaths, and if being taken at the early onsets of infection. "

View more: A Breakthrough in Covid 19 Antiviral Pills

@Deviltonconducted an in-depth analysis on one of the most popular stocks, $Rivian, and pointed out that patience is a virtue in trading.

"Human are always impatient, we will always have FOMO if we sit and wait till Friday, scared that it stops falling and starts to rise again. Yet buying all tomo may not allow you to buy at the best price." View more here.

@HopeAlwayssaid that there is no best way to determine when to buy and when to sell the stocks of indexes. The timings depend on investing goals, philosophies, and personal preferences.

"The three main risks are company, valuation and earnings risks. Once we are able to find a stock that that signals low risk based on these three conditions, it is time to buy. Whenever a negative change happens to any of the three conditions, it is time to sell."

View more: Buying and Selling Stocks

@Powerhousehas three underlying principles in stopping losses and taking profits. All investors should stay informed and closely observe trends to set price targets.

"For micro, there is a need to determine your present financial risk appetite figuratively. On the macro level, situations may have changed. Determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult."

View more: Stop the pain, take the happiness

@Panda2102has done macro research to sort out a list of companies and ranks them from different dimensions.

"The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company."

View more: Best time to press the trade button

@Mars Mooothinks that the Squid Game Multi-Portfolio comprises four parts: player 456, player 218, player 067, and a liquid one.

"The first portfolio is aimed at potential sectors for diversification and profits. The second is designed to high risk lead high returns. The next one intent on helping on thr way. While the last one shows that cash is king."

View more: The Squid Game Multi-Portfolios Portfolio

@Mcsnacks H Tupackshared that short-selling is highly popular on Wall Street and often carried out by aggressive hedge funds.

"Hedge funds acting through collaborating market makers can create huge numbers of counterfeit shares that can overwhelm buying demand. They have turned it into a casino and everyone knows the house always wins in that scenario."

View more: The only way for short selling to be profitable is by cheating

This recap takes a deep dive into the market insights and investing tips that inspire us to become better investors. Did you find anything interesting or helpful?

Please Leave your comments below and @ the mooer whose opinions impress you the most, and explain why they are attractive. The 1st, 10th, 20th, 30th, 40th...(multiples of 10) mooers will be rewarded with 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

445

39

20

K来买

liked

Having a supportive family and strong family bonding that I am grateful for help to foster a free spirit in me to pursue my own investing journey. Before I start investing, the initial question that comes into my mind is whether or not it will be a great investment. Almost always I would wonder if I could make any gains from it. While these are useful questions, they may not necessarily be the most important ones. Instead I am able to embark on my investing journey by asking these questions. My approach to investing prioritises buying and holding high quality stocks for the long haul. Rather than letting any short term price fluctuations affect my investing decisions, I focus the most on the business fundamentals of those companies which I invest in. By examining my risk tolerance, I am able to understand how much volatility I am comfortable with. In view of market uncertainty, I am prepared to hold my stock picks through market volatility and target more on long term returns. Without a doubt, it is impossible that all my stock picks will be winners. Instead, I remain vested in the winning stocks as winning companies normally continue winning. I am grateful that I have the opportunity to spend enough time investing and reflecting on my experiences, which have helped me to learn more along the way. One of the most valuable things I have learnt is the importance of patience in deciding when to buy and sell a stock. Investing is not a race for me as I am looking more to capture reasonable returns over the long term. I am grateful that I could take my time and pay close attention to what I am thinking along the way.

$Alphabet-A (GOOGL.US)$

$Amazon (AMZN.US)$

$Apple (AAPL.US)$

$Bank of America (BAC.US)$

$Meta Platforms (FB.US)$

$Microsoft (MSFT.US)$

$Netflix (NFLX.US)$

$NVIDIA (NVDA.US)$

$Salesforce (CRM.US)$

$Shopify (SHOP.US)$

$Block (SQ.US)$

$Tesla (TSLA.US)$

$Alphabet-A (GOOGL.US)$

$Amazon (AMZN.US)$

$Apple (AAPL.US)$

$Bank of America (BAC.US)$

$Meta Platforms (FB.US)$

$Microsoft (MSFT.US)$

$Netflix (NFLX.US)$

$NVIDIA (NVDA.US)$

$Salesforce (CRM.US)$

$Shopify (SHOP.US)$

$Block (SQ.US)$

$Tesla (TSLA.US)$

115

94

11

K来买

liked

$Warren Buffett Portfolio (LIST2999.US)$

$Soros Holdings (LIST2120.US)$

$Tiger Global Holdings (LIST2121.US)$

$Brigewater Holdings (LIST2122.US)$

$Vanguard Group Holdings (LIST2599.US)$

$Microsoft (MSFT.US)$

$Apple (AAPL.US)$

$Amazon (AMZN.US)$

$Alphabet-A (GOOGL.US)$

$Johnson & Johnson (JNJ.US)$

$JPMorgan (JPM.US)$

$Meta Platforms (FB.US)$

$Alphabet-C (GOOG.US)$

$Disney (DIS.US)$

$Visa (V.US)$

126

86

12

K来买

liked

Welcome to the shining moments of the moomoo community. It's time to collect the unforgettable fragments of 2021.![]() In a year of volatility, WallStreetBets stocks are resilient, with $AMC Entertainment (AMC.US)$ regaining its momentum. Trump Concept stocks are on the rise, with $Phunware (PHUN.US)$ leading the way. The pandemic-induced booming of vaccine stocks provides mooers with unique opportunities to make money.

In a year of volatility, WallStreetBets stocks are resilient, with $AMC Entertainment (AMC.US)$ regaining its momentum. Trump Concept stocks are on the rise, with $Phunware (PHUN.US)$ leading the way. The pandemic-induced booming of vaccine stocks provides mooers with unique opportunities to make money.

This post presents some essential trading orders and calls for our dear mooers to compete. It starts with an outstanding one that yielded up to 69900%. We found some mooers highly concentrated. They only invested in one stock but grasped the entry and exit points well and recorded the moves using the trading marking feature of moomoo. Besides, there is a frequent trader who trades 156 times a quarter. It seems that our dear mooers have acquired diverse trading skills and experienced some ups and downs in 2021. Let's review and compete now!![]()

1. The highest rate of return reaching 69900.00%

@值得拥有伱 Average Cost down to 0.0019

![]() Challenging $Camber Energy (CEI.US)$ , my power +69900.00%. The success lies in the accurate grasping of buying and selling points.

Challenging $Camber Energy (CEI.US)$ , my power +69900.00%. The success lies in the accurate grasping of buying and selling points.

If you have a higher rate of return, please leave your comment to compete with others.

2. The highest daily return: $220966.73

@burger1010 Make that money work!

![]() The gain of $220966.73 belongs to a college kid who works at a grocery store and earns the minimum wage. Two weeks ago, what I had was 10K. However, the profits soared because options were wild.

The gain of $220966.73 belongs to a college kid who works at a grocery store and earns the minimum wage. Two weeks ago, what I had was 10K. However, the profits soared because options were wild.

If you have a higher daily return, please leave your comment to compete with others.

3. The worst losses running to 98.43%

@skytrade What would you do if you were me?

![]() Despite that the Trump Concept stock, $PHUN is hot, my losses are down to a record low of 98.43%. I am confused and helpless.

Despite that the Trump Concept stock, $PHUN is hot, my losses are down to a record low of 98.43%. I am confused and helpless.

If you have a lower loss rate, please leave your comment to compete with others.

4. An unexpected loss of $22909 by investing in $AMC

@bentbb This is a reminder to all mooers

![]() For one hour, the decline of $AMC made me cry. Please keep in mind that you must band together and hold whatever position you're in. We are only as strong as our weakest link.

For one hour, the decline of $AMC made me cry. Please keep in mind that you must band together and hold whatever position you're in. We are only as strong as our weakest link.

If you've lost more money in a single stock, please leave your comment to compete with others.

5. Focusing on one stock at a time

@Machiavellis3rdEye When will we get off the bus to the crazy town?

![]() Stop being distracted. I conducted high-frequency trading on $Biora Therapeutics (PROG.US)$ , hoping to earn huge profits from this stock and become richer!

Stop being distracted. I conducted high-frequency trading on $Biora Therapeutics (PROG.US)$ , hoping to earn huge profits from this stock and become richer!

If you've traded more frequently of a specific stock than this mooer, please leave your comment to compete with others.

6. The most diverse high-frequency trading

@Austin Anderson What a blast it has been

![]() In one quarter, I trade 156 times for 58 objects. Please learn from our mistakes and don't get emotionally involved!

In one quarter, I trade 156 times for 58 objects. Please learn from our mistakes and don't get emotionally involved!

If you've traded more frequently a quarter than this mooer, please leave your comment to compete with others.

7. Building a diverse but profitable portfolio

@10664788 Be satisfied with the winning percentage.

![]() Eight out of eleven stocks in my portfolio are making profits! $New Gold, $Globalstar, and $NIO Inc (NIO.US)$ are all my lucky stocks.

Eight out of eleven stocks in my portfolio are making profits! $New Gold, $Globalstar, and $NIO Inc (NIO.US)$ are all my lucky stocks.

If the proportion of stocks earning profits in your portfolio is higher than this mooer, please leave your comment to compete with others.

After seeing the stunning orders above, would you like to share your orders and achievements with us?

![]() How's your P/L in 2021?

How's your P/L in 2021?

![]() How frequently did you trade?

How frequently did you trade?

![]() How did you build your portfolio?

How did you build your portfolio?

I bet you've had "better" results!

If you want to challenge the orders above, leave your P/L in the comments. Let's see what you've got. You could be the KING of trading in 2021!![]()

![]()

![]()

![]()

![]()

![]() moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

This post presents some essential trading orders and calls for our dear mooers to compete. It starts with an outstanding one that yielded up to 69900%. We found some mooers highly concentrated. They only invested in one stock but grasped the entry and exit points well and recorded the moves using the trading marking feature of moomoo. Besides, there is a frequent trader who trades 156 times a quarter. It seems that our dear mooers have acquired diverse trading skills and experienced some ups and downs in 2021. Let's review and compete now!

1. The highest rate of return reaching 69900.00%

@值得拥有伱 Average Cost down to 0.0019

If you have a higher rate of return, please leave your comment to compete with others.

2. The highest daily return: $220966.73

@burger1010 Make that money work!

If you have a higher daily return, please leave your comment to compete with others.

3. The worst losses running to 98.43%

@skytrade What would you do if you were me?

If you have a lower loss rate, please leave your comment to compete with others.

4. An unexpected loss of $22909 by investing in $AMC

@bentbb This is a reminder to all mooers

If you've lost more money in a single stock, please leave your comment to compete with others.

5. Focusing on one stock at a time

@Machiavellis3rdEye When will we get off the bus to the crazy town?

If you've traded more frequently of a specific stock than this mooer, please leave your comment to compete with others.

6. The most diverse high-frequency trading

@Austin Anderson What a blast it has been

If you've traded more frequently a quarter than this mooer, please leave your comment to compete with others.

7. Building a diverse but profitable portfolio

@10664788 Be satisfied with the winning percentage.

If the proportion of stocks earning profits in your portfolio is higher than this mooer, please leave your comment to compete with others.

After seeing the stunning orders above, would you like to share your orders and achievements with us?

I bet you've had "better" results!

If you want to challenge the orders above, leave your P/L in the comments. Let's see what you've got. You could be the KING of trading in 2021!

+5

245

14

16

K来买

liked

$Alibaba (BABA.US)$ whats up with u lol

5

5

K来买

liked

Last time I selected 10 high-dividend stocks in S&P 500. And this time I choose S&P 500 stocks with market cap higher than 200bn because mature companies are the most likely to pay dividends.

$Exxon Mobil (XOM.US)$ $Verizon (VZ.US)$ $Chevron (CVX.US)$ $AbbVie (ABBV.US)$ $Coca-Cola (KO.US)$

$Exxon Mobil (XOM.US)$ $Verizon (VZ.US)$ $Chevron (CVX.US)$ $AbbVie (ABBV.US)$ $Coca-Cola (KO.US)$

103

3

11

K来买

liked

It can be challenging to know how best to invest in Chinese stocks right now with the recent biggest jump and the higher risks associated with the market. While Chinese stocks may offer huge growth opportunities in a massive market, it is more suited for investors with a generous appetite for risk. Even then, greater caution needs to be exercised when picking Chinese stocks as they tend to be highly volatile with greater regulatory challenges. One good way is perhaps to invest only in high quality Chinese companies $Alibaba (BABA.US)$, $JD.com (JD.US)$, $PDD Holdings (PDD.US)$, $Tencent (TCEHY.US)$ that are both big and visible with the most solid standing. Still, it might be challenging for many to invest calmly in Chinese stocks as China's business market is comparatively opaque and more prone to regulatory pressures. Furthermore, it may not be easy to digest the news coming out of China these days. For those investors who are concerned that Chinese stocks are too vulnerable to ever-present risks and uncertainties, investing in the larger ones with economic moats to succeed in the longer term would be a safer choice.

$Baidu (BIDU.US)$

$Bilibili (BILI.US)$

$BYD Co. (BYDDF.US)$

$DiDi Global (Delisted) (DIDI.US)$

$Futu Holdings Ltd (FUTU.US)$

$Li Auto (LI.US)$

$NetEase (NTES.US)$

$NIO Inc (NIO.US)$

$Weibo (WB.US)$

$XPeng (XPEV.US)$

$Baidu (BIDU.US)$

$Bilibili (BILI.US)$

$BYD Co. (BYDDF.US)$

$DiDi Global (Delisted) (DIDI.US)$

$Futu Holdings Ltd (FUTU.US)$

$Li Auto (LI.US)$

$NetEase (NTES.US)$

$NIO Inc (NIO.US)$

$Weibo (WB.US)$

$XPeng (XPEV.US)$

140

94

9

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)