Kelvin92

liked

Merdeka Bersama MooFest, Moomoo MY's epic financial festival, has officially started! RSVP now if you haven't>>

Unlock Surprises with Gifts Galore at the Event!

1. Show RSVP to get your Touch n Go stick and Moo-deka Passport at reception (first 1,000 users only). Collect at least 5 stamps on your Moo-deka Passport to win a lucky draw - you may walk away with a free Cisco share!

Here's how to find your RSVP - moomoo app > m...

Unlock Surprises with Gifts Galore at the Event!

1. Show RSVP to get your Touch n Go stick and Moo-deka Passport at reception (first 1,000 users only). Collect at least 5 stamps on your Moo-deka Passport to win a lucky draw - you may walk away with a free Cisco share!

Here's how to find your RSVP - moomoo app > m...

+7

240

94

40

Kelvin92

liked

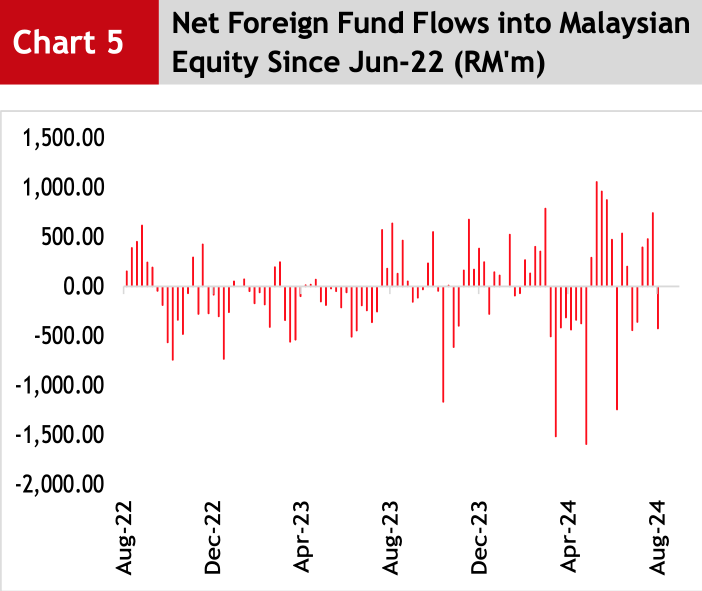

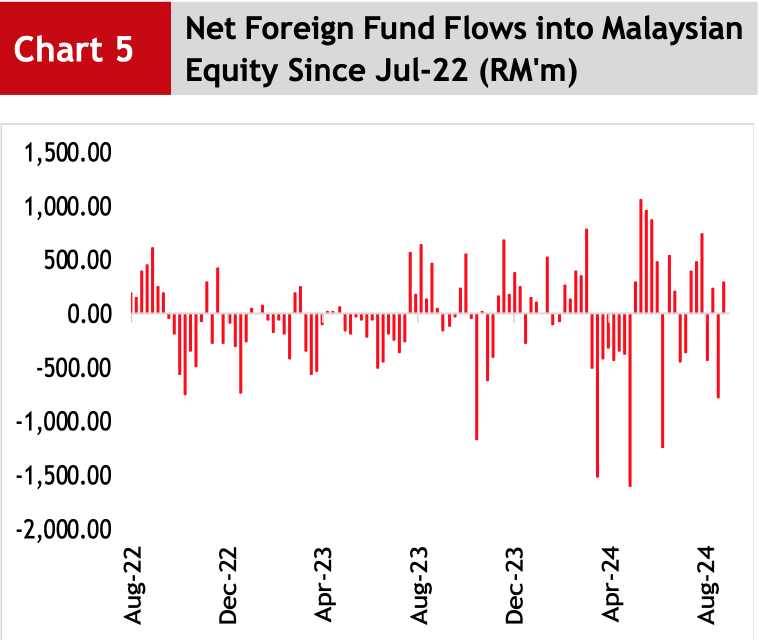

Columns Capital trend: Foreign net buy 1.5 billion Malaysian shares, the largest net buy in 8 years.

As the performance of the banking industry shines, foreign investors have been actively buying Malaysian shares for the third consecutive week, with a net purchase of up to 1.5 billion Malaysian ringgit, the highest net purchase since March 18, 2016.

According to the MIDF research on capital trends, foreign investors continued to flow into Malaysian shares significantly last week. The three favored sectors were financial services (1.3 billion Malaysian ringgit), utilities (0.2 billion 59.7 million Malaysian ringgit), and construction (88.7 million Malaysian ringgit).

At the same time, the three sectors with the net selling by foreign investors were technology (-60.4 million Malaysian ringgit), transportation and logistics (-57.2 million Malaysian ringgit), and industrial products and services (-41 million Malaysian ringgit).

Local institutions sold Malaysian shares throughout the week, with a net selling total of 1.2 billion 60 million Malaysian ringgit, the largest net selling since March 4, 2022. Local institutions net bought 13.9 million Malaysian ringgit of shares on Monday, but they were net sellers from Tuesday to Friday.

As for retail investors, except for buying on Thursday, they were selling on other trading days, with a total net selling of 0.2 billion 45.4 million Malaysian ringgit of shares.

As for the level of participation, all three parties experienced growth. Among them, foreign investors were the most active in trading, with the average daily trading volume (ADTV) increasing by 49.9%, while local institutions and retail investors decreased by 0.4% and 2.8% respectively.

Foreign funds net bought stocks last week.

$PBBANK (1295.MY)$

$MAYBANK (1155.MY)$

$RHBBANK (1066.MY)$

$CIMB (1023.MY)$

���������...

According to the MIDF research on capital trends, foreign investors continued to flow into Malaysian shares significantly last week. The three favored sectors were financial services (1.3 billion Malaysian ringgit), utilities (0.2 billion 59.7 million Malaysian ringgit), and construction (88.7 million Malaysian ringgit).

At the same time, the three sectors with the net selling by foreign investors were technology (-60.4 million Malaysian ringgit), transportation and logistics (-57.2 million Malaysian ringgit), and industrial products and services (-41 million Malaysian ringgit).

Local institutions sold Malaysian shares throughout the week, with a net selling total of 1.2 billion 60 million Malaysian ringgit, the largest net selling since March 4, 2022. Local institutions net bought 13.9 million Malaysian ringgit of shares on Monday, but they were net sellers from Tuesday to Friday.

As for retail investors, except for buying on Thursday, they were selling on other trading days, with a total net selling of 0.2 billion 45.4 million Malaysian ringgit of shares.

As for the level of participation, all three parties experienced growth. Among them, foreign investors were the most active in trading, with the average daily trading volume (ADTV) increasing by 49.9%, while local institutions and retail investors decreased by 0.4% and 2.8% respectively.

Foreign funds net bought stocks last week.

$PBBANK (1295.MY)$

$MAYBANK (1155.MY)$

$RHBBANK (1066.MY)$

$CIMB (1023.MY)$

���������...

Translated

29

1

3

Kelvin92

liked

S&P: Closed

DJIA: Closed

Nasdaq-100: Closed

Eurostoxx: 4,973.07 (+0.3%)

U.S. crude futures: 73.89 (+0.5%)

U.S. stock markets were closed on Monday in conjunction with the Labor Day Holiday. Meanwhile, U.S. index futures are trading approximately 0.1% lower to kick start the new trading month on Tuesday.

📌 Visit our Live Matrix to see how Macquarie's warrants move alongside their respective US index futures: https://www.warrants.com.sg/tools/livematrix/51AW

���������...

DJIA: Closed

Nasdaq-100: Closed

Eurostoxx: 4,973.07 (+0.3%)

U.S. crude futures: 73.89 (+0.5%)

U.S. stock markets were closed on Monday in conjunction with the Labor Day Holiday. Meanwhile, U.S. index futures are trading approximately 0.1% lower to kick start the new trading month on Tuesday.

📌 Visit our Live Matrix to see how Macquarie's warrants move alongside their respective US index futures: https://www.warrants.com.sg/tools/livematrix/51AW

���������...

2

Kelvin92

liked

$Microsoft (MSFT.US)$

The Analyst Recommendation Rate for MSFT did not change last 24 hours from Buy 95.7%, and Hold 4.3%, The average Target Price also stayed the same as $501.65

The stock market did not open yesterday, so there was no price change.

Find out more about Microsoft and other Magnificent Seven stocks at the weekly newsletter below!

https://vestway.substack.com/p/magnificent-seven-update-fresh-insights?utm_source=moomoo&utm_medium=sharing&utm_campaign=MSFT&utm_id=240903

The Analyst Recommendation Rate for MSFT did not change last 24 hours from Buy 95.7%, and Hold 4.3%, The average Target Price also stayed the same as $501.65

The stock market did not open yesterday, so there was no price change.

Find out more about Microsoft and other Magnificent Seven stocks at the weekly newsletter below!

https://vestway.substack.com/p/magnificent-seven-update-fresh-insights?utm_source=moomoo&utm_medium=sharing&utm_campaign=MSFT&utm_id=240903

2

Kelvin92

liked

😊Hi, Malaysian mooers!

Malaysia Airports is estimated to release its next earnings report on May 30. How will the market react to the company's quarterly results? Vote your answer to participate!

🎁 Rewards

●👌 An equal share of 1,000 points: For mooers who correctly guess the price range of $AIRPORT(Delisted) (5014.MY)$'s closing price on its earnings release date (e.g., If 50 mooers make a correct guess, each of them wil...

Malaysia Airports is estimated to release its next earnings report on May 30. How will the market react to the company's quarterly results? Vote your answer to participate!

🎁 Rewards

●👌 An equal share of 1,000 points: For mooers who correctly guess the price range of $AIRPORT(Delisted) (5014.MY)$'s closing price on its earnings release date (e.g., If 50 mooers make a correct guess, each of them wil...

392

117

16

Kelvin92

liked

Tai Sai Retail collaborates with Hong Kong companies to introduce the "Tan Zai International" brand.

Dazhi Retail collaborates with Hong Kong enterprises to introduce the "Tammy International" brand.

Dazhi Retail $HEXRTL (7202.MY)$ in collaboration with Hong Kong-listed company - Tammy International, $TAM JAI INTL (02217.HK)$ collaborates to introduce the well-known chain restaurant brand of the latter in China.

According to yesterday's press release, the two parties signed a strategic cooperation agreement. Dazhi Retail will be responsible for introducing the brand of Tammy International, with the first branch expected to open in the first quarter of 2025, and looking forward to opening more branches in various major cities in the future.

This partnership also signifies Dazil Retail's commitment to bringing diversity to the local community, and it is an important milestone in the development of both parties' businesses.

Dazil Retail's main shareholder, Wang Ziming, stated: "Tanzi International is renowned for quality and innovation, which aligns with our strategic objectives."

"Introducing Tanzi International in China will also help expand the company's market influence."

Tanzi International is a leading and well-known chain restaurant operator, responsible for operating and managing the "Tanzi Yunnan Rice Noodle" and "Tanzi Sanggie Rice Noodle" two noodle specialty store brands, with operations in Hong Kong, China, and Singapore.

Tan Zai International's Chief Executive Officer, Liu Damin, stated that Malaysia is an important growth market for the company, and believes that leveraging Dazai's retail understanding and expertise in the local market is an ideal partner to promote the company's brand.

Also present at the signing of the agreement were Tai Sai Retail's Managing Director, Wu Yiyu, and Chief Operating Officer, Huang Weika (all names are transliterations).

Source: Nanyang Business Report...

Dazhi Retail $HEXRTL (7202.MY)$ in collaboration with Hong Kong-listed company - Tammy International, $TAM JAI INTL (02217.HK)$ collaborates to introduce the well-known chain restaurant brand of the latter in China.

According to yesterday's press release, the two parties signed a strategic cooperation agreement. Dazhi Retail will be responsible for introducing the brand of Tammy International, with the first branch expected to open in the first quarter of 2025, and looking forward to opening more branches in various major cities in the future.

This partnership also signifies Dazil Retail's commitment to bringing diversity to the local community, and it is an important milestone in the development of both parties' businesses.

Dazil Retail's main shareholder, Wang Ziming, stated: "Tanzi International is renowned for quality and innovation, which aligns with our strategic objectives."

"Introducing Tanzi International in China will also help expand the company's market influence."

Tanzi International is a leading and well-known chain restaurant operator, responsible for operating and managing the "Tanzi Yunnan Rice Noodle" and "Tanzi Sanggie Rice Noodle" two noodle specialty store brands, with operations in Hong Kong, China, and Singapore.

Tan Zai International's Chief Executive Officer, Liu Damin, stated that Malaysia is an important growth market for the company, and believes that leveraging Dazai's retail understanding and expertise in the local market is an ideal partner to promote the company's brand.

Also present at the signing of the agreement were Tai Sai Retail's Managing Director, Wu Yiyu, and Chief Operating Officer, Huang Weika (all names are transliterations).

Source: Nanyang Business Report...

Translated

19

1

Kelvin92

reacted to

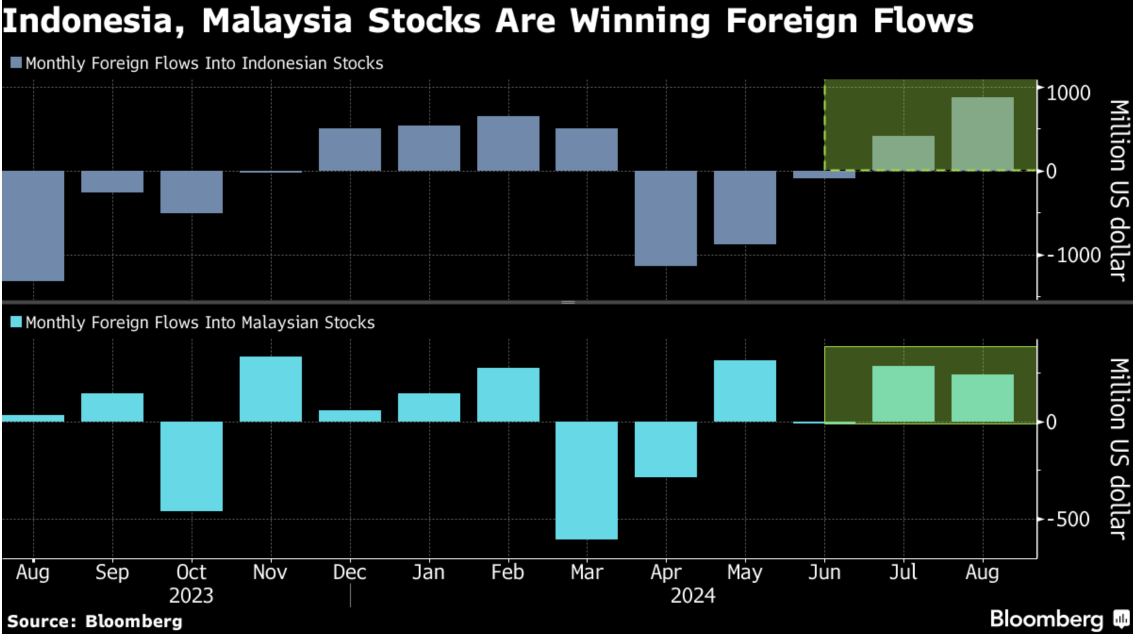

Another major international investment bank is bullish on the prospects of the Chinese stock market. Japan's Nomura Securities believes that investors should reduce their holdings of Chinese stocks and instead invest in Malaysian and Indonesian stocks.

According to analysts from Nomura Securities, including Chettan Setti and others, in a recent report, Malaysian and Indonesian stock markets are expected to benefit from the trend of accelerated rate cuts in the United States, one of the reasons for upgrading the stock market ratings of both countries from "neutral" to "buy."

Nomura Securities has also downgraded the rating of the MSCI China Index from "buy" to "neutral."

"Now is the time to make a major move into the ASEAN stock market. With the Federal Reserve about to cut interest rates and investors reigniting their interest in emerging markets, investing in the Indonesian stock market may be the best bet."

Last week, Federal Reserve Chairman Powell has issued a clear signal of interest rate cuts starting in September.

Bloomberg pointed out that before Nomura Securities raised its ratings on Malaysia's and Indonesia's stock markets, foreign capital had shown increased interest in the two countries' stock markets, with two consecutive months of inflow of foreign capital.

"Investors have good reasons to take Nomura Securities' comments seriously. In December last year, they upgraded the Taiwan stock market, and the Taiwan Weighted Index has risen by 25% this year, while the MSCI Asia Pacific Index has increased by 9.8% during the same period."

Before Nomura Securities, many internationally renowned investment banks or financial media, including JP Morgan Chase, Goldman Sachs, and Forbes, had already turned optimistic about the Malaysian market outlook.

$FTSE Taiwan50 Index (.FTTW50.TW)$

���������...

According to analysts from Nomura Securities, including Chettan Setti and others, in a recent report, Malaysian and Indonesian stock markets are expected to benefit from the trend of accelerated rate cuts in the United States, one of the reasons for upgrading the stock market ratings of both countries from "neutral" to "buy."

Nomura Securities has also downgraded the rating of the MSCI China Index from "buy" to "neutral."

"Now is the time to make a major move into the ASEAN stock market. With the Federal Reserve about to cut interest rates and investors reigniting their interest in emerging markets, investing in the Indonesian stock market may be the best bet."

Last week, Federal Reserve Chairman Powell has issued a clear signal of interest rate cuts starting in September.

Bloomberg pointed out that before Nomura Securities raised its ratings on Malaysia's and Indonesia's stock markets, foreign capital had shown increased interest in the two countries' stock markets, with two consecutive months of inflow of foreign capital.

"Investors have good reasons to take Nomura Securities' comments seriously. In December last year, they upgraded the Taiwan stock market, and the Taiwan Weighted Index has risen by 25% this year, while the MSCI Asia Pacific Index has increased by 9.8% during the same period."

Before Nomura Securities, many internationally renowned investment banks or financial media, including JP Morgan Chase, Goldman Sachs, and Forbes, had already turned optimistic about the Malaysian market outlook.

$FTSE Taiwan50 Index (.FTTW50.TW)$

���������...

Translated

30

5

6

Kelvin92

liked

Exclusive Interview with Minister of Digital, Brother Garvin

Exclusive Report: Lim Siew Fung

Technological advancements have alleviated the issue of datacenters being heavy water and electricity consumers. The government is focusing on improving the infrastructure development of industrial zones and exploring the installation of integrated datacenters in commercial buildings to encourage widespread adoption of cutting-edge technology in the business sector, effectively unlocking the economic value of 5G.

Datacenters, described as 'water and electricity monsters' due to their massive consumption, have raised public concerns about their management, water and electricity supply, and sustainable operation.

Minister of Technology Ge Binxing pointed out in an interview with《Senior stockbroker Lu Wen Hao also stated that it is normal to see a certain arbitrage wave in July. However, as the Malaysian Ringgit began to strengthen against the US Dollar, it is believed that more foreign capital will flow into the Malaysian stock market, boosting its performance.》that with the development of technology, the operational efficiency of datacenters is also improving. The latest technology chips not only have stronger performance, but the facilities also come with cooling functions, reducing the consumption of water and electricity.

Recently, a technology delegation from Shenzhen, China, recommended a small datacenter to the Ministry of Technology during their visit to Malaysia. Ge Binxing mentioned that the facility has built-in functions, is easy to install, cost-effective, and easy to upgrade and migrate, with the added benefit of lower water and electricity consumption.

He openly stated that 5G infrastructure supports datacenters in boosting industrial and commercial capacity. However, our country currently lacks built-in datacenter systems. If such a system can be promoted, it will help expand the industrial and commercial sectors' application of 5G, especially promoting the adoption of cutting-edge technology by micro, small, and medium enterprises to enhance production capacity.

Cobainstar: Meeting the needs of various industries

Exploring datacenter performance

Digital Minister Cobainstar emphasized the acceleration of datacenter construction...

Exclusive Report: Lim Siew Fung

Technological advancements have alleviated the issue of datacenters being heavy water and electricity consumers. The government is focusing on improving the infrastructure development of industrial zones and exploring the installation of integrated datacenters in commercial buildings to encourage widespread adoption of cutting-edge technology in the business sector, effectively unlocking the economic value of 5G.

Datacenters, described as 'water and electricity monsters' due to their massive consumption, have raised public concerns about their management, water and electricity supply, and sustainable operation.

Minister of Technology Ge Binxing pointed out in an interview with《Senior stockbroker Lu Wen Hao also stated that it is normal to see a certain arbitrage wave in July. However, as the Malaysian Ringgit began to strengthen against the US Dollar, it is believed that more foreign capital will flow into the Malaysian stock market, boosting its performance.》that with the development of technology, the operational efficiency of datacenters is also improving. The latest technology chips not only have stronger performance, but the facilities also come with cooling functions, reducing the consumption of water and electricity.

Recently, a technology delegation from Shenzhen, China, recommended a small datacenter to the Ministry of Technology during their visit to Malaysia. Ge Binxing mentioned that the facility has built-in functions, is easy to install, cost-effective, and easy to upgrade and migrate, with the added benefit of lower water and electricity consumption.

He openly stated that 5G infrastructure supports datacenters in boosting industrial and commercial capacity. However, our country currently lacks built-in datacenter systems. If such a system can be promoted, it will help expand the industrial and commercial sectors' application of 5G, especially promoting the adoption of cutting-edge technology by micro, small, and medium enterprises to enhance production capacity.

Cobainstar: Meeting the needs of various industries

Exploring datacenter performance

Digital Minister Cobainstar emphasized the acceleration of datacenter construction...

Translated

52

3

16

Kelvin92

liked

The Ringgit experienced a major rebound on Friday.

The recent economic data released by the USA has been mixed, coupled with the just concluded Federal Open Market Committee (FOMC) meeting, indicating no more rate hikes between the lines, increasing investors' expectations of a rate cut by the Federal Reserve. The Ringgit against the US dollar even temporarily rose to 4.7327.

Malaysian Muamalat Bank's Chief Economist, Mohamad Afzanizam Abdul Rashid, pointed out that since the FOMC meeting earlier this week, US bond yields have been continuously declining, indicating a strengthening expectation of a rate cut in the USA.

He pointed out, $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$The yield on the 2-year US Treasury bonds fell by 9 basis points to 4.87%; while $USD (USDindex.FX)$the US dollar index also fell by 0.43%, to 105.499 points.

He stated that with the current signs indicating, the ringgit and other emerging market currencies are expected to further rebound today.

Regarding the economic data of the USA, he pointed out that investors are currently digesting a series of economic data released by the USA, while also waiting for non-farm employment data and unemployment data before taking further action.

In April, manufacturing in the USA experienced a contraction, with ISM manufacturing PMI falling below the 50 level to 49.2, job vacancies dropping to a new low in 3 years, and a decrease in resignations, indicating a slowdown in labor demand.

However, there are still some strong economic...

The recent economic data released by the USA has been mixed, coupled with the just concluded Federal Open Market Committee (FOMC) meeting, indicating no more rate hikes between the lines, increasing investors' expectations of a rate cut by the Federal Reserve. The Ringgit against the US dollar even temporarily rose to 4.7327.

Malaysian Muamalat Bank's Chief Economist, Mohamad Afzanizam Abdul Rashid, pointed out that since the FOMC meeting earlier this week, US bond yields have been continuously declining, indicating a strengthening expectation of a rate cut in the USA.

He pointed out, $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$The yield on the 2-year US Treasury bonds fell by 9 basis points to 4.87%; while $USD (USDindex.FX)$the US dollar index also fell by 0.43%, to 105.499 points.

He stated that with the current signs indicating, the ringgit and other emerging market currencies are expected to further rebound today.

Regarding the economic data of the USA, he pointed out that investors are currently digesting a series of economic data released by the USA, while also waiting for non-farm employment data and unemployment data before taking further action.

In April, manufacturing in the USA experienced a contraction, with ISM manufacturing PMI falling below the 50 level to 49.2, job vacancies dropping to a new low in 3 years, and a decrease in resignations, indicating a slowdown in labor demand.

However, there are still some strong economic...

Translated

12

2

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)