Ken Kee

voted

Wondering if you can use financing for IPO subscriptions? Curious about interest charges? We've got you covered!

With Moomoo's IPO Financing, you can amplify your chances of getting new stock allocations. Here’s how it works:

💡 If you want to subscribe to more IPO shares, you can use moomoo's margin financing feature to enhance your subscription. This means you can use NOT ONLY CASH but also the buying power generated from your eligible ...

With Moomoo's IPO Financing, you can amplify your chances of getting new stock allocations. Here’s how it works:

💡 If you want to subscribe to more IPO shares, you can use moomoo's margin financing feature to enhance your subscription. This means you can use NOT ONLY CASH but also the buying power generated from your eligible ...

138

80

50

Ken Kee

liked and set a live reminder

Oriental Kopi Holdings Berhad $KOPI (0338.MY)$, a cafe chain operator is targeting to debut on the Bursa ACE Market. The IPO subscription takes place from 6/1/2025 to 10/1/2025!

To provide investors with a better understanding of the company's development and future plans, Moomoo Malaysia has the opportunity to conduct a live interview session with Dato' Calvin Chan the Managing Director of Oriental Kopi on 9th Jan 2025 T...

To provide investors with a better understanding of the company's development and future plans, Moomoo Malaysia has the opportunity to conduct a live interview session with Dato' Calvin Chan the Managing Director of Oriental Kopi on 9th Jan 2025 T...

Moo Live: Exclusive IPO Investor Briefing With Oriental Kopi

Jan 9 20:00

Book

Book 180

104

32

Ken Kee

liked

Investors should consider opportunities in utilities and construction stocks related to energy transition and infrastructure, such as TNB, GAM, and IJM; tech stocks benefiting from AI developments, like NATGATE; healthcare stocks with defensive growth, such as IHH; and recovering glove manufacturers, like TOPG. REITs like IGB REIT and KLCC offer long-term investment value.(JP Morgan)

The Malaysian market closed out 2024 wit...

The Malaysian market closed out 2024 wit...

374

137

139

Ken Kee

voted

The $S&P 500 Index (.SPX.US)$ took a sharp dive today dropping -1.32%, reflecting widespread selling pressure across sectors., with the Magnificent 7 experiencing significant losses across the board. ![]() Everyone are left wondering if this is the start of a deeper correction or just a pullback after recent rallies.

Everyone are left wondering if this is the start of a deeper correction or just a pullback after recent rallies. ![]()

Key Decliners![]()

• Tesla ( $Tesla (TSLA.US)$): The biggest loser today, dropping a hefty -4.81%, possibly driven by profit-taking or concerns over valuation.

• Nv...

Key Decliners

• Tesla ( $Tesla (TSLA.US)$): The biggest loser today, dropping a hefty -4.81%, possibly driven by profit-taking or concerns over valuation.

• Nv...

+1

11

3

1

Ken Kee

voted

The rise of artificial intelligence (AI) has placed the semiconductor ecosystem at the core of this technological revolution. While AI demonstrates boundless potential, its advancement depends heavily on the support of semiconductor technology. The semiconductor industry is not just about providing chips—it serves as the foundation of AI development, transforming visionary concepts into tangible reality ✨.

At the heart of AI lies its com...

At the heart of AI lies its com...

37

9

19

Ken Kee

liked

News Highlights

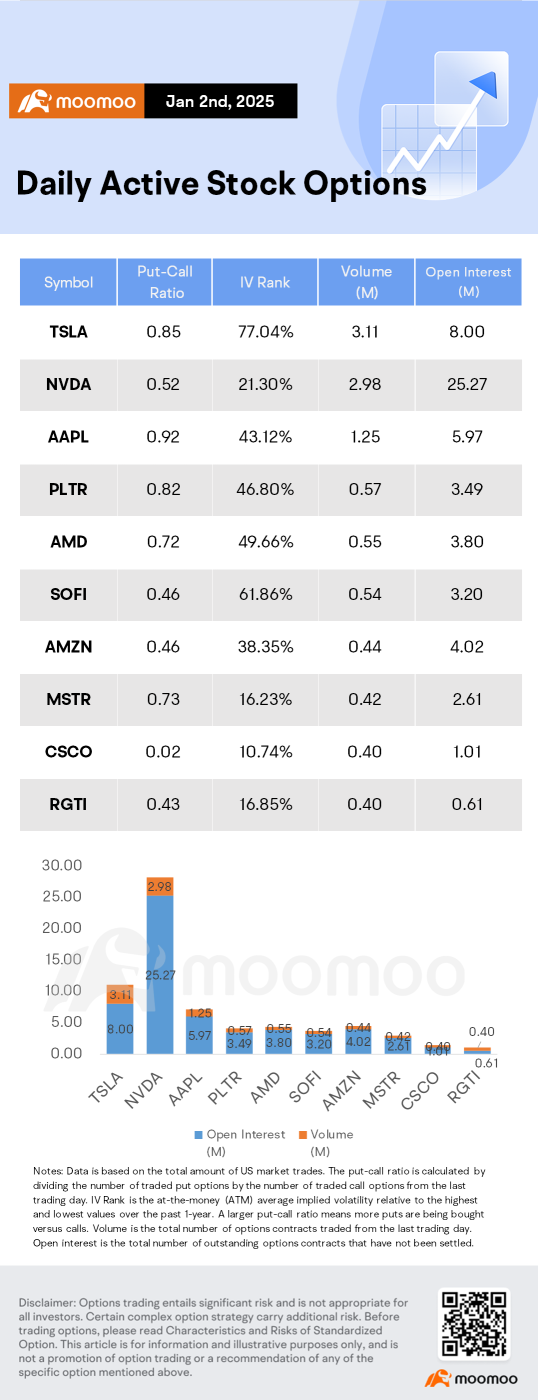

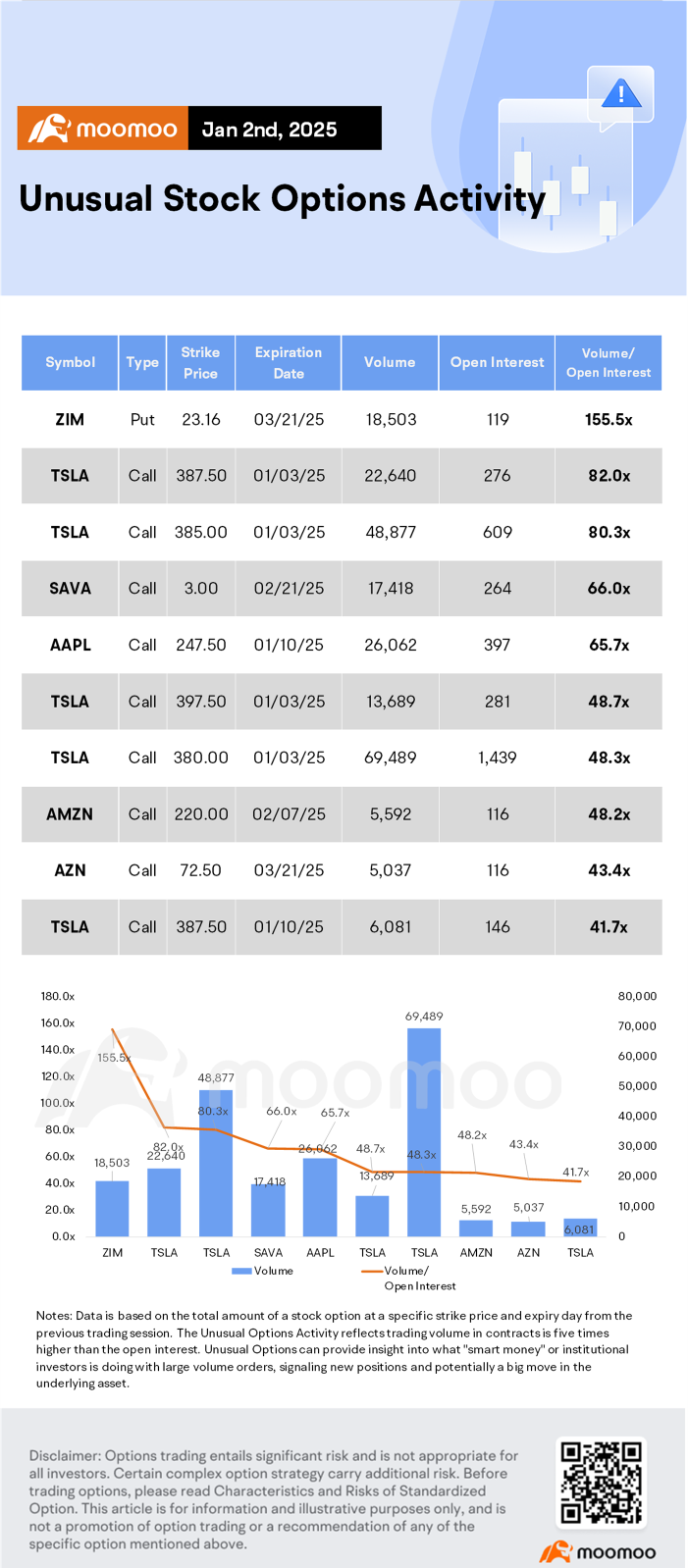

1. $Tesla (TSLA.US)$'s stock fell 6% in Thursday's trading, with an option volume of 3.11 million, and calls accounted for 54.2% of the volume. The $367.5 calls expiring January 3rd were traded most actively.

Tesla put options rose amid increasing demand for protection against a further share slump after the electric vehicle maker missed analysts' estimates for fourth-quarter del...

1. $Tesla (TSLA.US)$'s stock fell 6% in Thursday's trading, with an option volume of 3.11 million, and calls accounted for 54.2% of the volume. The $367.5 calls expiring January 3rd were traded most actively.

Tesla put options rose amid increasing demand for protection against a further share slump after the electric vehicle maker missed analysts' estimates for fourth-quarter del...

32

3

23

Ken Kee

liked

Amid global economic uncertainty, high dividend investment strategies have become highly coveted by investors. This strategy can bring relatively stable cash flow returns and reflects the company's concept of attaching importance to shareholders. In 2024, bank stocks and REITs are two prominent representatives of high-dividend investments, performing quite well in terms of both stock prices and dividends.

Real Estate Investment Trust...

Real Estate Investment Trust...

295

86

122

Ken Kee

voted

As 2024 draws to a close, have you participated in the bustling Bursa Malaysian IPO on moomoo this year? Almost 90% IPO surged on debut, rally up to 189%. Here are 7 facts worth your attention!

1. 55 stocks were listed on Bursa Malaysia this year (11 on Main Market, 40 on ACE Market and 4 on Leap Market), setting a record since 2006.

2. This achievement represents a significant 72% increase compared to the 32 companies that had their IPO in 2023...

1. 55 stocks were listed on Bursa Malaysia this year (11 on Main Market, 40 on ACE Market and 4 on Leap Market), setting a record since 2006.

2. This achievement represents a significant 72% increase compared to the 32 companies that had their IPO in 2023...

216

95

54

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)