Kenneth Chee

commented on

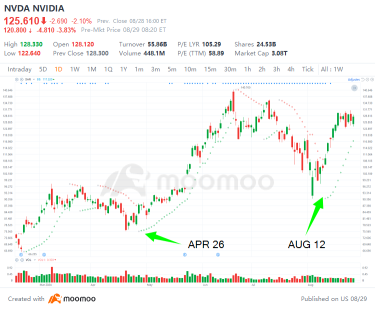

Star stocks often show strong performance, tempting many investors who may hesitate due to perceived risks.

However, history shows that even the hottest stocks experience pullbacks, offering prime "buying the dip" opportunities. These chances, though rare, typically occur two or three times a year and may yield significant short-term gains if seized.

Take $NVIDIA (NVDA.US)$ , for example. In 2024 alone, there were three such buying opportunities....

However, history shows that even the hottest stocks experience pullbacks, offering prime "buying the dip" opportunities. These chances, though rare, typically occur two or three times a year and may yield significant short-term gains if seized.

Take $NVIDIA (NVDA.US)$ , for example. In 2024 alone, there were three such buying opportunities....

+2

479

172

174

Kenneth Chee

commented on

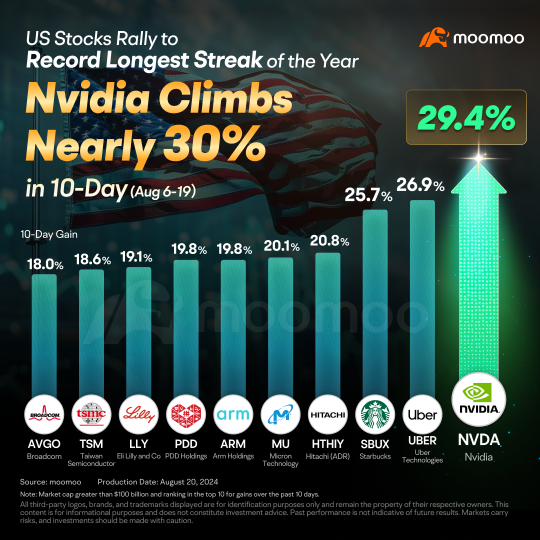

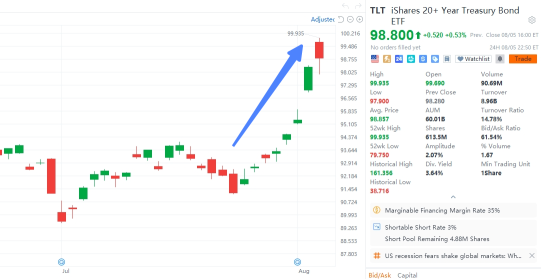

$NVIDIA (NVDA.US)$ will announce its Q2 earnings on August 28th, and this could be a major event for global markets. Why? Because this report might significantly impact the AI sector and set the tone for U.S. tech stocks going forward. With recent market volatility, its importance can't be overstated.

So, let's break down the current landscape and explore how investors can get ready.

Recap: What has Nvidia experienced recently?

I. Stock price rec...

So, let's break down the current landscape and explore how investors can get ready.

Recap: What has Nvidia experienced recently?

I. Stock price rec...

+2

487

155

96

Kenneth Chee

commented on

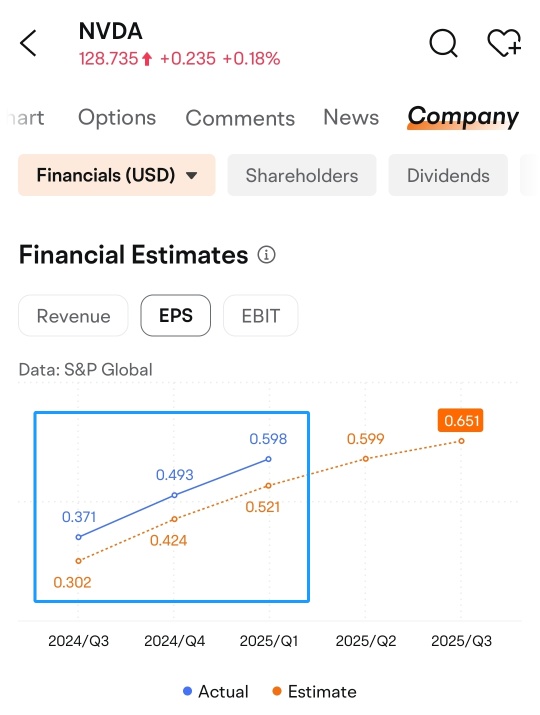

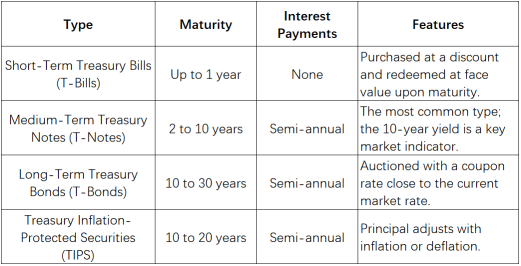

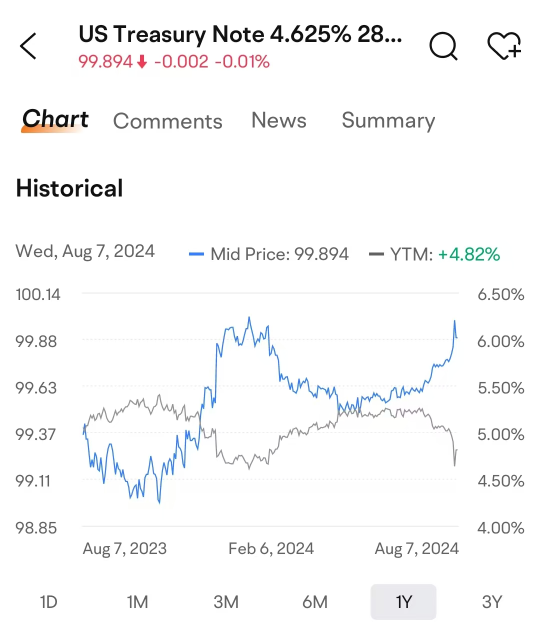

In early August, global stock markets plummeted, sparking fears of an economic recession and a looming bear market. Meanwhile, the bond market quietly surged, with the $iShares 20+ Year Treasury Bond ETF (TLT.US)$ achieving an eight-day winning streak by August 5th.

Data is as of August 8 and is for illustrative purposes only and does not constitute any investment advice or guarantee.

Why did bonds attract investment while stocks were falling? Bonds benefi...

Data is as of August 8 and is for illustrative purposes only and does not constitute any investment advice or guarantee.

Why did bonds attract investment while stocks were falling? Bonds benefi...

+5

285

79

111

Kenneth Chee

commented on

Hi everyone! It's the start of a new week, and I'm here with this week's dealer's insights. Recently, moomoo MY has started supporting trading in Singapore stocks. For those of you who frequently trade REITs, i believe this is exciting news! Now, in addition to Malaysian REITs, you can also buy Singaporean REITs to diversify your portfolio.😎

However, some of you might not be familiar with REITs. So today, let's...

However, some of you might not be familiar with REITs. So today, let's...

211

49

26

Kenneth Chee

commented on

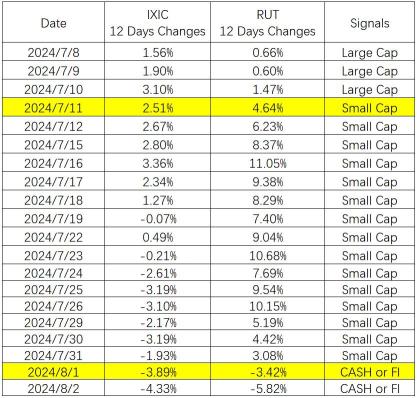

Updated on October 17, 2024

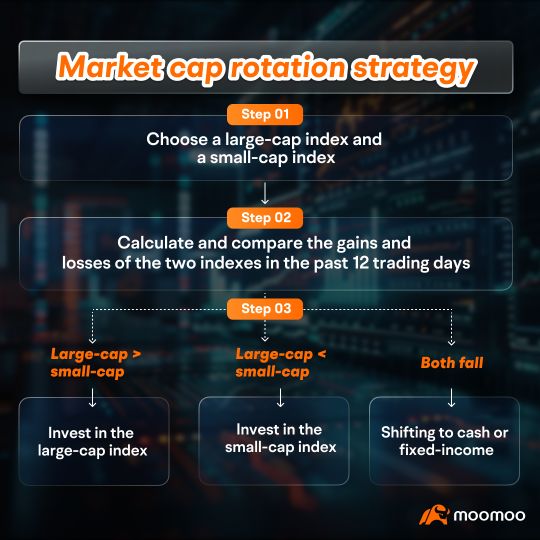

Since the beginning of 2023, the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ have surged, leaving the U.S. small-cap stocks lagging behind. However, as the U.S. markets enter a new cycle of rate cuts, there has been a noticeable shift in capital towards small-cap stocks.

The $Russell 2000 Index (.RUT.US)$ , which tracks small-cap companies, has experienced four consecutive da...

Since the beginning of 2023, the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ have surged, leaving the U.S. small-cap stocks lagging behind. However, as the U.S. markets enter a new cycle of rate cuts, there has been a noticeable shift in capital towards small-cap stocks.

The $Russell 2000 Index (.RUT.US)$ , which tracks small-cap companies, has experienced four consecutive da...

+4

324

64

89

Kenneth Chee

commented on

$NVIDIA (NVDA.US)$

Statement: Predicting the trend of stock prices is only for the convenience of having a buying and selling mindset during trading. Even if the stock price prediction is accurate, improper trading strategies can still result in losses. Therefore, the accuracy of predicting stock prices is not very meaningful. What is more important is to make timely adjustments to the buying and selling mindset according to the market conditions.

First, let's review the market conditions.

The NASDAQ Index has already reached a bottoming out and stabilization state. It is expected to have a small rebound in the next week (August 9th - August 16th), and then continue to decline.

After NVIDIA's breakdown and decline on July 30th, it has now shown signs of stabilization. The target price for a small rebound is expected to return to the range of 115. The time period is from August 9th to August 16th. In late August, NVIDIA is estimated to continue to decline below 90 yuan and enter the 80-90 range.

Second, let's analyze the stock market situation of NVIDIA.

Reviewing the market conditions of the week starting from July 30th, after the breakdown and subsequent strong rebound on the next day, there was a continuous decline, with the Friday closing near the lowest point of 100. This is considering the weak performance of the technology stocks at that time. NVIDIA has already broken through the support level, and the downward trend has begun.

1. Looking at the feedback from our custom indicator DKW, there was no obvious breakthrough decline in the market on July 30th and 31st, especially on the 31st, where the candlestick chart showed a blue line, which is a signal of a trend reversal. However, the specific direction of the reversal...

Statement: Predicting the trend of stock prices is only for the convenience of having a buying and selling mindset during trading. Even if the stock price prediction is accurate, improper trading strategies can still result in losses. Therefore, the accuracy of predicting stock prices is not very meaningful. What is more important is to make timely adjustments to the buying and selling mindset according to the market conditions.

First, let's review the market conditions.

The NASDAQ Index has already reached a bottoming out and stabilization state. It is expected to have a small rebound in the next week (August 9th - August 16th), and then continue to decline.

After NVIDIA's breakdown and decline on July 30th, it has now shown signs of stabilization. The target price for a small rebound is expected to return to the range of 115. The time period is from August 9th to August 16th. In late August, NVIDIA is estimated to continue to decline below 90 yuan and enter the 80-90 range.

Second, let's analyze the stock market situation of NVIDIA.

Reviewing the market conditions of the week starting from July 30th, after the breakdown and subsequent strong rebound on the next day, there was a continuous decline, with the Friday closing near the lowest point of 100. This is considering the weak performance of the technology stocks at that time. NVIDIA has already broken through the support level, and the downward trend has begun.

1. Looking at the feedback from our custom indicator DKW, there was no obvious breakthrough decline in the market on July 30th and 31st, especially on the 31st, where the candlestick chart showed a blue line, which is a signal of a trend reversal. However, the specific direction of the reversal...

Translated

+3

24

11

9

Kenneth Chee

commented on

Global hedge funds went on a buying spree Monday, capitalizing on a massive sell-off in U.S. equities to hunt for bargains. This activity marked the largest one-day buying frenzy in five months, according to a note from Goldman Sachs. Hedge funds snapped up individual U.S. stocks at the fastest pace since March, reversing a prolonged selling trend. Despite a sharp drop of 3% in the $S&P 500 Index (.SPX.US)$, institutional investors p...

36

6

61

Kenneth Chee

commented on

Since Federal Reserve Chairman testified on Capitol Hill on July 11, the U.S. stock market has been unstable.

On July 24, we saw a 'Black Wednesday' with the S&P 500 dropping 2.3% and the Nasdaq plunging 3.64%—the worst since the AI boom began.![]()

After a brief stabilization this week, the U.S. stock market resumed its downward trend on Thursday, August 1, with the Nasdaq index falling more than 2%.

Many investors are feeling blindsided and unsure of h...

On July 24, we saw a 'Black Wednesday' with the S&P 500 dropping 2.3% and the Nasdaq plunging 3.64%—the worst since the AI boom began.

After a brief stabilization this week, the U.S. stock market resumed its downward trend on Thursday, August 1, with the Nasdaq index falling more than 2%.

Many investors are feeling blindsided and unsure of h...

+1

444

155

211

Kenneth Chee

commented on

The VIX fell 28%, or 10 points today, as the market simmered down from fear and fright mode. Just the close, the $S&P 500 Index (.SPX.US)$ climbed back 1.04% , the $Dow Jones Industrial Average (.DJI.US)$ climbed 0.76%, and the $Nasdaq Composite Index (.IXIC.US)$ climbed 1.03%, after falling 4% Monday.

MACRO

The turbulence began last week after multiple earnings reports from the largest companies did not meet estimates. Japan's head Bank considered raising rates Friday, sending the $Nikkei 225 (.N225.JP)$ down 12%,...

MACRO

The turbulence began last week after multiple earnings reports from the largest companies did not meet estimates. Japan's head Bank considered raising rates Friday, sending the $Nikkei 225 (.N225.JP)$ down 12%,...

26

6

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)