kenny103827823

liked and commented on

The stock market, as a barometer of the modern economy, attracts countless investors seeking opportunities. However, success in the market is not solely about luck; it requires a solid foundation of knowledge, meticulous preparation, and the alignment of favorable circumstances: the right timing, opportunities, and human factors.

1. Learning as the Foundation

Investing in the s...

1. Learning as the Foundation

Investing in the s...

kenny103827823

voted

Hello mooers,

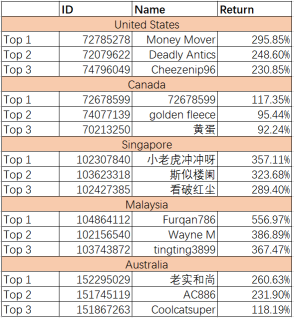

What an incredible journey it has been! Our Global Paper Trading Challenge has officially concluded, and the results are nothing short of spectacular. With participants from across seven markets, let's celebrate the achievements and strides made in these past five weeks.![]()

Challenge Highlights:

The sheer scale of this challenge was monumental, with registrations breaking past 150,000! This milestone is a test...

What an incredible journey it has been! Our Global Paper Trading Challenge has officially concluded, and the results are nothing short of spectacular. With participants from across seven markets, let's celebrate the achievements and strides made in these past five weeks.

Challenge Highlights:

The sheer scale of this challenge was monumental, with registrations breaking past 150,000! This milestone is a test...

85

70

14

kenny103827823

voted

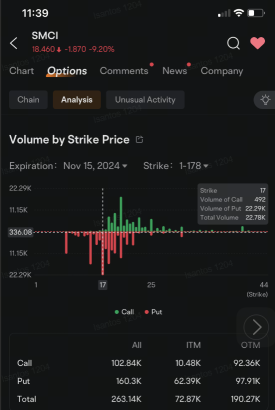

$Super Micro Computer (SMCI.US)$ attracted heavier options volume as the stock price slumped to the lowest since May 2023 after the developer of server solutions said it's unable to file its financial report for the quarter ended Sept. 30. That compounded concerns that the company could be delisted.

The company still hasn't hired a new auditor. Ernst & Young resigned in October, noting that it's "unwilling to be associated with...

The company still hasn't hired a new auditor. Ernst & Young resigned in October, noting that it's "unwilling to be associated with...

31

11

17

kenny103827823

voted

Good morning, traders. Happy Monday, November 18th. You will not make it through the day without news about the animal spirits moving the market today.

My name is Kevin Travers, and the S&P 500 climbed on Monday, but key stocks were pulling down the Dow.

$Super Micro Computer (SMCI.US)$ was the highest climbing stock on the S&P 500, up 11% after a rumor Friday that the firm might file a plan to file their still dela...

My name is Kevin Travers, and the S&P 500 climbed on Monday, but key stocks were pulling down the Dow.

$Super Micro Computer (SMCI.US)$ was the highest climbing stock on the S&P 500, up 11% after a rumor Friday that the firm might file a plan to file their still dela...

34

13

1

From my past experiences, I’ve gained invaluable lessons. Starting as a novice and gradually mastering fundamental investment analysis, I’ve come to appreciate the ever-changing nature of the market and the importance of sound decision-making. For this upcoming round, I plan to improve in the following areas:

1. Developing a More Comprehensive Investment Strategy

The market is full of uncertainties, but a solid strategy ...

1. Developing a More Comprehensive Investment Strategy

The market is full of uncertainties, but a solid strategy ...

15

kenny103827823

voted

Good morning, traders. Happy Tuesday, November 12. Indexes are pulling back after all three hit all-time closing highs.

My name is Kevin Travers; here is the news about animal spirits moving markets today.

$Shopify (SHOP.US)$ shares climbed 25% after the Canadian e-commerce firm posted Q3 revenue grew more than expected and showed top-line forward guidance for the holiday season.

$Tyson Foods (TSN.US)$ climbed 8%-1...

My name is Kevin Travers; here is the news about animal spirits moving markets today.

$Shopify (SHOP.US)$ shares climbed 25% after the Canadian e-commerce firm posted Q3 revenue grew more than expected and showed top-line forward guidance for the holiday season.

$Tyson Foods (TSN.US)$ climbed 8%-1...

16

6

3

kenny103827823

voted

Columns Operation plan after the general election and during the Chinese concept financial reporting season.

$NASDAQ 100 Index (.NDX.US)$Under the dual stimulus of the settled election and a 25 basis point rate cut, the market rose by 5% this week to reach 21117 points, which is currently a bit high. Last week's rise was mainly driven by bank stocks, small cap stocks, semiconductors, and technology stocks, reaching the upper band of the Bollinger Bands. An expected short-term pullback is anticipated. Next week, the USA's CPI and PPI data will be released, with a high probability of meeting expectations and a low possibility of a market crash. The current prediction is that the current upward trend should continue until the Christmas market, but with Donald Trump's return to the White House in January next year, there may be a significant pullback in January. Therefore, during this period of policy vacuum, the US stocks are likely to experience an oscillating upward trend. In the short term, due to the crazy rise of US stocks last week, a brief pullback is expected this week, presenting a buying opportunity during the dip.

Regarding Chinese concept stocks, due to the potential policy risks since Trump took office, as well as the lackluster effect of the debt-for-equity policy announced on Friday in stimulating the stock market, leading to a 6% decline, many stocks have directly shifted trends to a downward trajectory this week. $TENCENT (00700.HK)$ $JD.com (JD.US)$ $Alibaba (BABA.US)$ $Bilibili (BILI.US)$ $Cisco (CSCO.US)$ $Occidental Petroleum (OXY.US)$ $Sea (SE.US)$As for Chinese concept stocks, due to the potential policy risks since Trump took office, and the issuance of debt conversion policy on Friday did not have the expected stimulating effect on the stock market, resulting in a sharp 6% drop on Friday, many stocks have directly changed trends to a downward trend next week

Regarding Chinese concept stocks, due to the potential policy risks since Trump took office, as well as the lackluster effect of the debt-for-equity policy announced on Friday in stimulating the stock market, leading to a 6% decline, many stocks have directly shifted trends to a downward trajectory this week. $TENCENT (00700.HK)$ $JD.com (JD.US)$ $Alibaba (BABA.US)$ $Bilibili (BILI.US)$ $Cisco (CSCO.US)$ $Occidental Petroleum (OXY.US)$ $Sea (SE.US)$As for Chinese concept stocks, due to the potential policy risks since Trump took office, and the issuance of debt conversion policy on Friday did not have the expected stimulating effect on the stock market, resulting in a sharp 6% drop on Friday, many stocks have directly changed trends to a downward trend next week

Translated

38

4

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)