Kevin Williams5

voted

Hi, mooers!

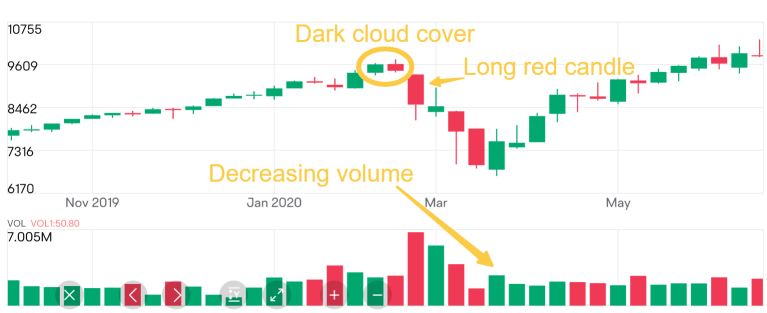

After learning to identify some useful bearish candlestick patterns, it's important to identify a real bearish trend to assist your trading. Don't worry, here are some basic skills you might need!

Basic Theory

Before diving into trading bearish candlestick patterns, it's important to keep in mind two principles:

1. A valid bearish reversal pattern should arise during an uptrend; otherwise, it might indicate a con...

After learning to identify some useful bearish candlestick patterns, it's important to identify a real bearish trend to assist your trading. Don't worry, here are some basic skills you might need!

Basic Theory

Before diving into trading bearish candlestick patterns, it's important to keep in mind two principles:

1. A valid bearish reversal pattern should arise during an uptrend; otherwise, it might indicate a con...

55

6

34

Kevin Williams5

voted

Welcome back, mooers! ![]()

As is widely acknowledged, market fluctuations can result in downturns, underscoring the significance of promptly mitigating losses by means of effective stop-loss strategies. Today, we will delve into six bearish candlestick patterns to help you gain proficiency in interpreting stop-loss signals. Let's go!![]()

Hanging man & Shooting star

The hanging man pattern is considered the bearish counterpart of a...

As is widely acknowledged, market fluctuations can result in downturns, underscoring the significance of promptly mitigating losses by means of effective stop-loss strategies. Today, we will delve into six bearish candlestick patterns to help you gain proficiency in interpreting stop-loss signals. Let's go!

Hanging man & Shooting star

The hanging man pattern is considered the bearish counterpart of a...

+3

75

20

85

Kevin Williams5

voted

Bearish candlestick patterns can sometimes be useful when attempting to predict potential reversals. Knowing when the price can possibly turn around can be very profitable for swing traders.

There are many bearish technical patterns, but the one I utilize most often is Bearish MACD or RSI Divergence.

Bearish divergence occurs when a tickers price action is diverging or deviating from the implications of the oscilating indicators, like MACD and RSI.

Basically, ...

There are many bearish technical patterns, but the one I utilize most often is Bearish MACD or RSI Divergence.

Bearish divergence occurs when a tickers price action is diverging or deviating from the implications of the oscilating indicators, like MACD and RSI.

Basically, ...

+2

49

17

19

Kevin Williams5

voted

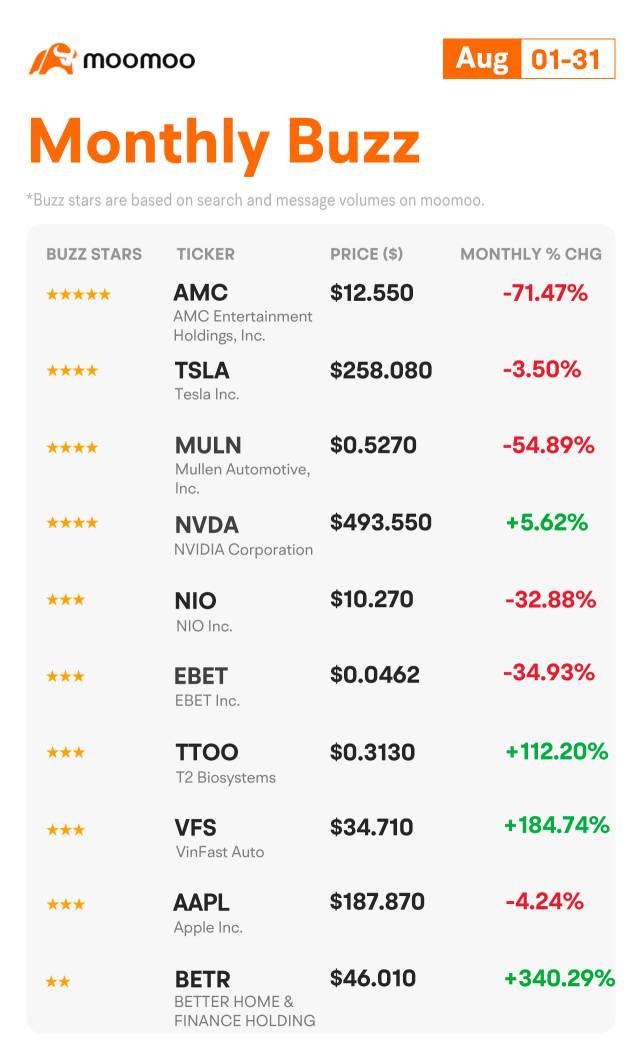

August has been a turbulent month for stocks, having relinquished over a quarter of the S&P 500's impressive gains this year. As earnings reports wind down, Nvidia's impressive resurgence is making waves in the tech industry. Meanwhile, all eyes were on Fed Chief Powell at the Jackson Hole Symposium as the Federal Reserve debated halting its campaign of interest rate hikes.

Our community of mooers has been sharing their technical analyses, strategies, and observ...

Our community of mooers has been sharing their technical analyses, strategies, and observ...

+7

77

33

50

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)