$HSI Futures(DEC4) (HSImain.HK)$ target 20088 within 1mth

1

KM鸣明分享官

commented on

$Hang Seng Index (800000.HK)$ 30 mins before closing suddenly up! Why?

2

KM鸣明分享官

liked

$BABA-W (09988.HK)$ eujin got his second chance to sell at 118 but that idiot decided to hodl, now see all his paper gains evaporated

2

2

KM鸣明分享官

voted

Columns Operation plan after the general election and during the Chinese concept financial reporting season.

$NASDAQ 100 Index (.NDX.US)$Under the dual stimulus of the settled election and a 25 basis point rate cut, the market rose by 5% this week to reach 21117 points, which is currently a bit high. Last week's rise was mainly driven by bank stocks, small cap stocks, semiconductors, and technology stocks, reaching the upper band of the Bollinger Bands. An expected short-term pullback is anticipated. Next week, the USA's CPI and PPI data will be released, with a high probability of meeting expectations and a low possibility of a market crash. The current prediction is that the current upward trend should continue until the Christmas market, but with Donald Trump's return to the White House in January next year, there may be a significant pullback in January. Therefore, during this period of policy vacuum, the US stocks are likely to experience an oscillating upward trend. In the short term, due to the crazy rise of US stocks last week, a brief pullback is expected this week, presenting a buying opportunity during the dip.

Regarding Chinese concept stocks, due to the potential policy risks since Trump took office, as well as the lackluster effect of the debt-for-equity policy announced on Friday in stimulating the stock market, leading to a 6% decline, many stocks have directly shifted trends to a downward trajectory this week. $TENCENT (00700.HK)$ $JD.com (JD.US)$ $Alibaba (BABA.US)$ $Bilibili (BILI.US)$ $Cisco (CSCO.US)$ $Occidental Petroleum (OXY.US)$ $Sea (SE.US)$As for Chinese concept stocks, due to the potential policy risks since Trump took office, and the issuance of debt conversion policy on Friday did not have the expected stimulating effect on the stock market, resulting in a sharp 6% drop on Friday, many stocks have directly changed trends to a downward trend next week

Regarding Chinese concept stocks, due to the potential policy risks since Trump took office, as well as the lackluster effect of the debt-for-equity policy announced on Friday in stimulating the stock market, leading to a 6% decline, many stocks have directly shifted trends to a downward trajectory this week. $TENCENT (00700.HK)$ $JD.com (JD.US)$ $Alibaba (BABA.US)$ $Bilibili (BILI.US)$ $Cisco (CSCO.US)$ $Occidental Petroleum (OXY.US)$ $Sea (SE.US)$As for Chinese concept stocks, due to the potential policy risks since Trump took office, and the issuance of debt conversion policy on Friday did not have the expected stimulating effect on the stock market, resulting in a sharp 6% drop on Friday, many stocks have directly changed trends to a downward trend next week

Translated

38

4

4

$HSI Futures(DEC4) (HSImain.HK)$

reports of missile attacks by Iran on Israel led to increased caution about deteriorating Middle East tensions,will it happen further strengthening selling pressure?

reports of missile attacks by Iran on Israel led to increased caution about deteriorating Middle East tensions,will it happen further strengthening selling pressure?

1

1

KM鸣明分享官

voted

$VS (6963.MY)$

It seems that there is a chance of rebound to around 1.07.

It seems that there is a chance of rebound to around 1.07.

Translated

1

KM鸣明分享官

voted

Hi, mooers!

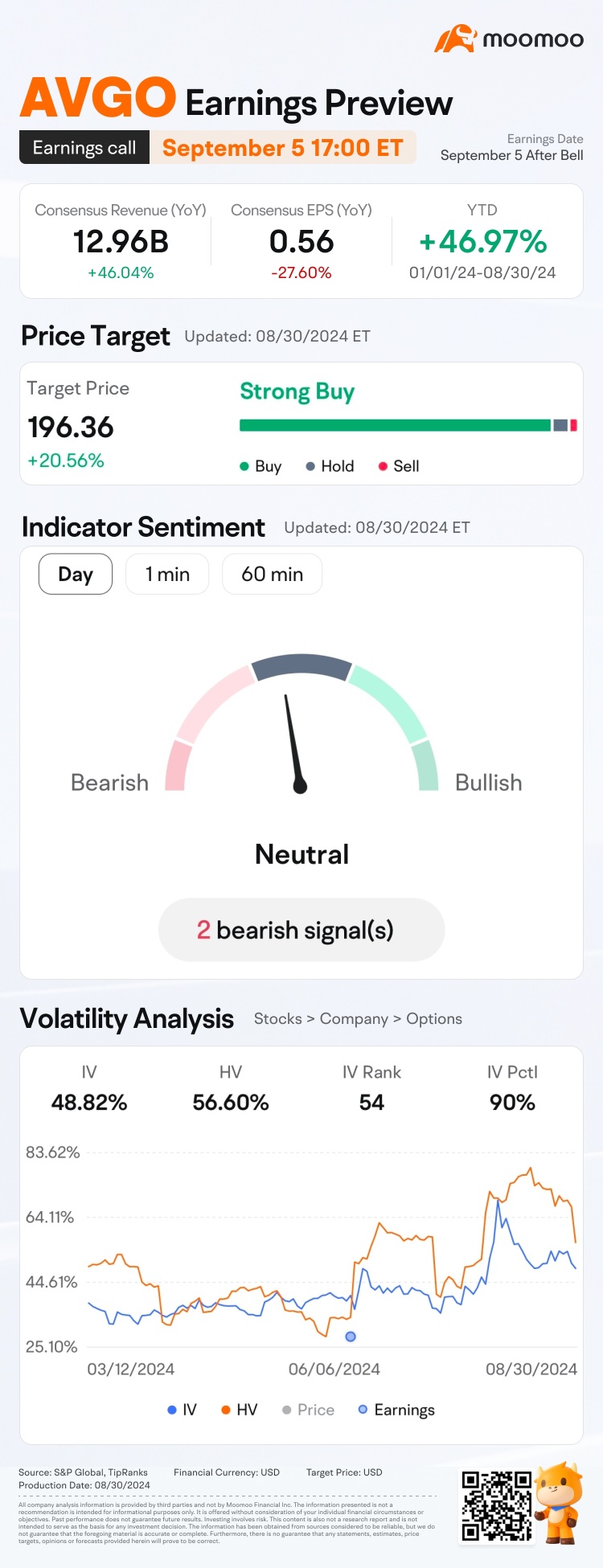

$Broadcom (AVGO.US)$ is releasing its Q3 earnings on September 5 after the bell. Unlock insights with AVGO Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 earnings release, shares of $Broadcom (AVGO.US)$ have seen an increase of 9.22%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 points: For mooers who corr...

$Broadcom (AVGO.US)$ is releasing its Q3 earnings on September 5 after the bell. Unlock insights with AVGO Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 earnings release, shares of $Broadcom (AVGO.US)$ have seen an increase of 9.22%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 points: For mooers who corr...

Expand

Expand 80

114

12

KM鸣明分享官

voted

Hi, mooers!

Ever wonder how to make your idle money work smarter? Are you looking for ways to boost your idle funds while keeping them readily available?![]()

You might want to get familiar with Cash Plus!![]()

Here's a snapshot of what Cash Plus offers:

1. Daily returns: Enjoy returns of up to 3.5% p.a.*, even on non-trading days.

2. Ultra-low threshold: Dive in with as little as RM0.01 without any cap.

3. Flexible redemption: Cash out for stoc...

Ever wonder how to make your idle money work smarter? Are you looking for ways to boost your idle funds while keeping them readily available?

You might want to get familiar with Cash Plus!

Here's a snapshot of what Cash Plus offers:

1. Daily returns: Enjoy returns of up to 3.5% p.a.*, even on non-trading days.

2. Ultra-low threshold: Dive in with as little as RM0.01 without any cap.

3. Flexible redemption: Cash out for stoc...

225

371

19

KM鸣明分享官

voted

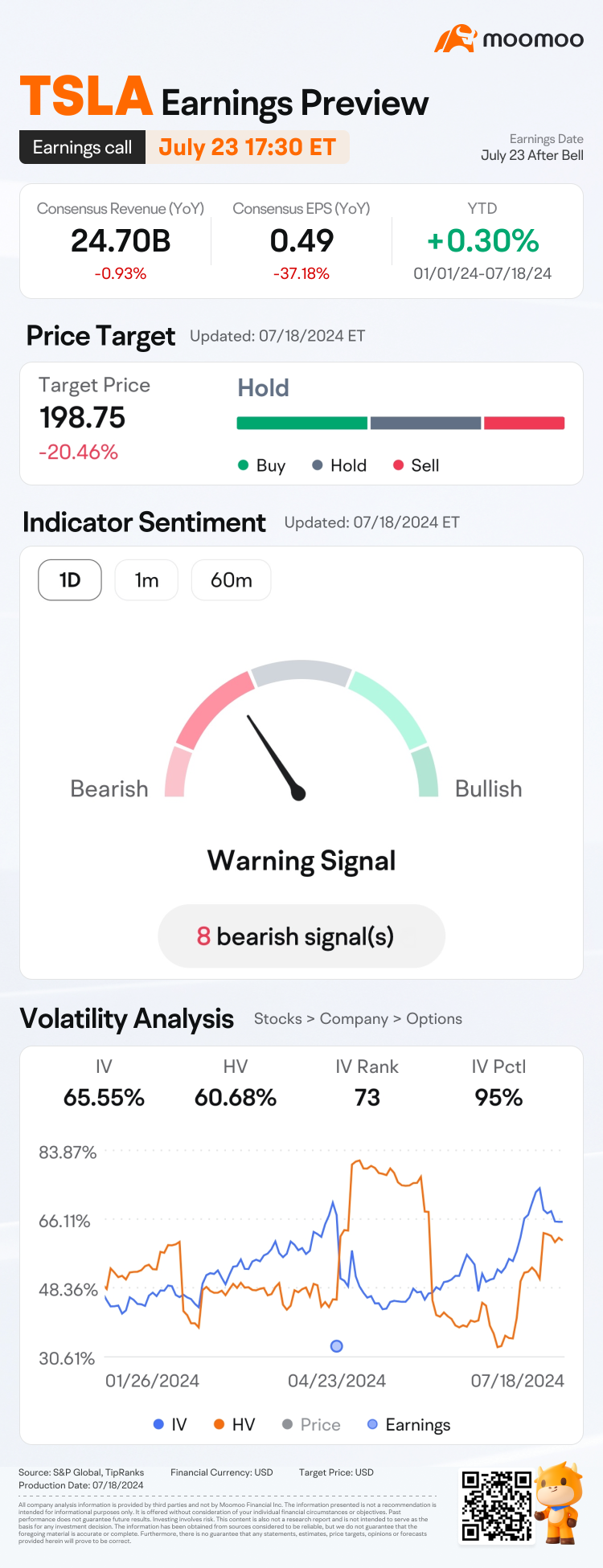

$Tesla (TSLA.US)$ is releasing its Q2 earnings on July 23 after the bell. Unlock insights with TSLA Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Tesla (TSLA.US)$ have seen an increase of 72.26%!![]() How will the market react to the upcoming results? Make your guess now!

How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 10,000 points: For mooers who correctly guess th...

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Tesla (TSLA.US)$ have seen an increase of 72.26%!

Rewards

● An equal share of 10,000 points: For mooers who correctly guess th...

Expand

Expand 128

250

25

KM鸣明分享官

Set a live reminder

[Synopsis]

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

A Pivotal Year: Strategies for Capturing Income

Jun 28 17:00

24

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)