Kou_FX・株式

Set a live reminder

After the interest rate hike at the July policy decision meeting, concerns about the US economy intensified, and the market became significantly unstable with a sharp decline in the yen and a historical plunge in domestic stock prices. The market continues to be in a nervous state.

In the Bank of Japan's monetary policy decision meeting to be held on the 19th and 20th, it is highly likely that the current operation of monetary policy management will be decided to guide the unsecured call overnight interest rate to around 0.25%. There is a growing view that the Bank of Japan is likely to maintain the current operation of monetary policy management by guiding the unsecured call overnight interest rate to around 0.25%. Regarding the future monetary policy of the Bank of Japan, there is a strong expectation that the current operation of monetary policy management will be decided to guide the unsecured call overnight interest rate to around 0.25%.

Do you find any hints about the future monetary policy of the Bank of Japan from the governor's press conference? Don't miss this live stream!! Do you find any hints about the future monetary policy of the Bank of Japan from the governor's press conference? Don't miss this live stream!! Do you find any hints about the future monetary policy of the Bank of Japan from the governor's press conference? Don't miss this live stream!!

For those who wish to watch,"Reservation"button.

In the Bank of Japan's monetary policy decision meeting to be held on the 19th and 20th, it is highly likely that the current operation of monetary policy management will be decided to guide the unsecured call overnight interest rate to around 0.25%. There is a growing view that the Bank of Japan is likely to maintain the current operation of monetary policy management by guiding the unsecured call overnight interest rate to around 0.25%. Regarding the future monetary policy of the Bank of Japan, there is a strong expectation that the current operation of monetary policy management will be decided to guide the unsecured call overnight interest rate to around 0.25%.

Do you find any hints about the future monetary policy of the Bank of Japan from the governor's press conference? Don't miss this live stream!! Do you find any hints about the future monetary policy of the Bank of Japan from the governor's press conference? Don't miss this live stream!! Do you find any hints about the future monetary policy of the Bank of Japan from the governor's press conference? Don't miss this live stream!!

For those who wish to watch,"Reservation"button.

Translated

BOJ Governor's regular press conference, live broadcast

Sep 20 14:30

4

3

Stock prices are falling, partly due to the influence of red rice malt news, but from a technical point of view, it's still impressive.

When it comes to the price range where a short-term Dow conversion occurs, oscillator reversals will also begin, and is it OK to pile up small?

When it comes to the price range where a short-term Dow conversion occurs, oscillator reversals will also begin, and is it OK to pile up small?

Translated

15

The FOMC anticipated interest rate cuts next year and financial markets rose, but later Governor Williams made a statement that it was still too early to talk about interest rate cuts.

As for the exchange rate, the dollar and yen are falling

Technically, I have a lower line of sight. Because the slope is also down

As a matter of fact, I don't know if there will be interest rate cuts, but there is no choice but to keep aiming for a match between the line of sight and slope

Now it's back on sale. You should think about it once you've bridged the gap

As for the exchange rate, the dollar and yen are falling

Technically, I have a lower line of sight. Because the slope is also down

As a matter of fact, I don't know if there will be interest rate cuts, but there is no choice but to keep aiming for a match between the line of sight and slope

Now it's back on sale. You should think about it once you've bridged the gap

Translated

6

3

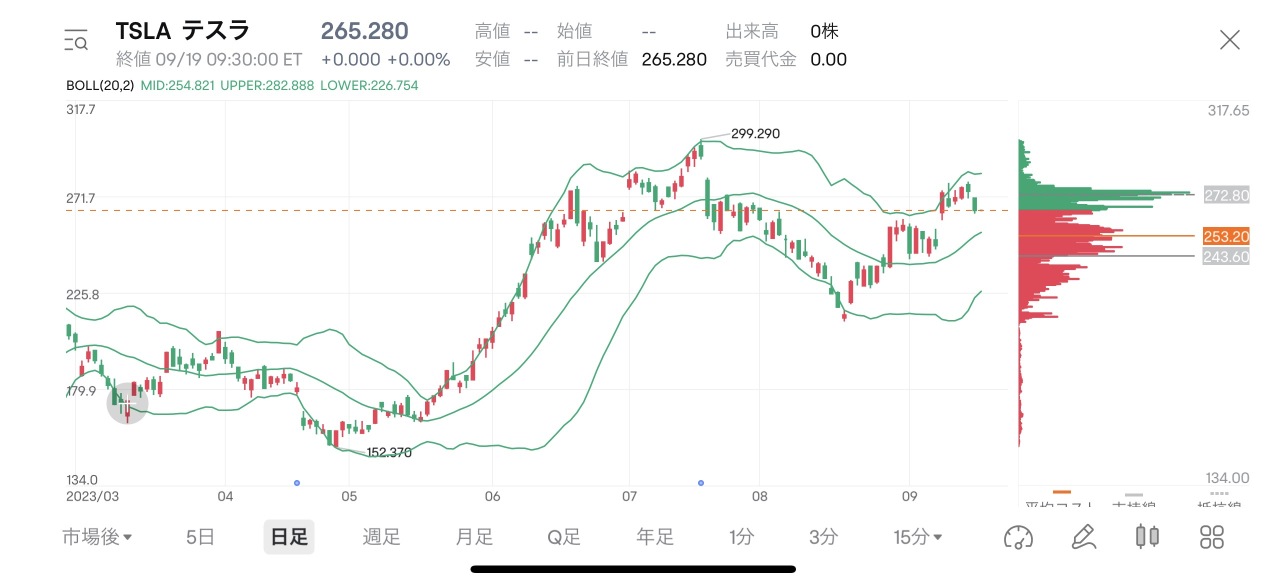

Financial results fell short of expectations and fell by about 5%

In terms of technical analysis

・Weekly chart

Close to the previous low on an upward Dow

↓

・Daily chart

It has gone downhill and is expanding downward in terms of Bollinger Bands

↓

・4-hour timeframe

Same as daily chart, downward downtrend, expansion, and downward slope

・1 hour chart

Down down, slope down.

My beard is sticking out, but I still can't buy it with this alone

↓

Based on these, it's still higher on the weekly level, but it's already going downward from the daily chart to the lower level.

Even if stock prices rise in the future, the decline will still be strong in the near future.

Short-term periods switch to an upward line of sight, and the slope is upward

I still don't know what's going to happen until I start moving up, so I'll wait for it to go down one more step

In terms of technical analysis

・Weekly chart

Close to the previous low on an upward Dow

↓

・Daily chart

It has gone downhill and is expanding downward in terms of Bollinger Bands

↓

・4-hour timeframe

Same as daily chart, downward downtrend, expansion, and downward slope

・1 hour chart

Down down, slope down.

My beard is sticking out, but I still can't buy it with this alone

↓

Based on these, it's still higher on the weekly level, but it's already going downward from the daily chart to the lower level.

Even if stock prices rise in the future, the decline will still be strong in the near future.

Short-term periods switch to an upward line of sight, and the slope is upward

I still don't know what's going to happen until I start moving up, so I'll wait for it to go down one more step

Translated

![[Tesla] Is it still technically below?](https://sgsnsimg.moomoo.com/feed_image/181381609/8fc92d735c973fed9b76aa1dfae36220.jpg/thumb)

![[Tesla] Is it still technically below?](https://sgsnsimg.moomoo.com/feed_image/181381609/0d34b7d96e3b3e48ac260a674e873cad.jpg/thumb)

![[Tesla] Is it still technically below?](https://sgsnsimg.moomoo.com/feed_image/181381609/9a956eef82c9309bb70c8196d71c1a48.jpg/thumb)

+1

2

1

There is a possibility that yen, which is a safe currency, will be bought even in the exchange market,

Be wary of exchange intervention (conditions are not in place, but if settlement comes in in the market, it starts to drop, participants doubt intervention, respond, etc.)

Once it starts moving, there is a possibility that it will fluctuate.

War may be a trigger, but if you trade by looking at a chart, “it's not too late even after it starts moving”

What you can do now is think about the fear that volatility will intensify

Protect the money you have now.

Fortify your defenses and survive so you can fight when you have the chance!

Be wary of exchange intervention (conditions are not in place, but if settlement comes in in the market, it starts to drop, participants doubt intervention, respond, etc.)

Once it starts moving, there is a possibility that it will fluctuate.

War may be a trigger, but if you trade by looking at a chart, “it's not too late even after it starts moving”

What you can do now is think about the fear that volatility will intensify

Protect the money you have now.

Fortify your defenses and survive so you can fight when you have the chance!

Translated

3

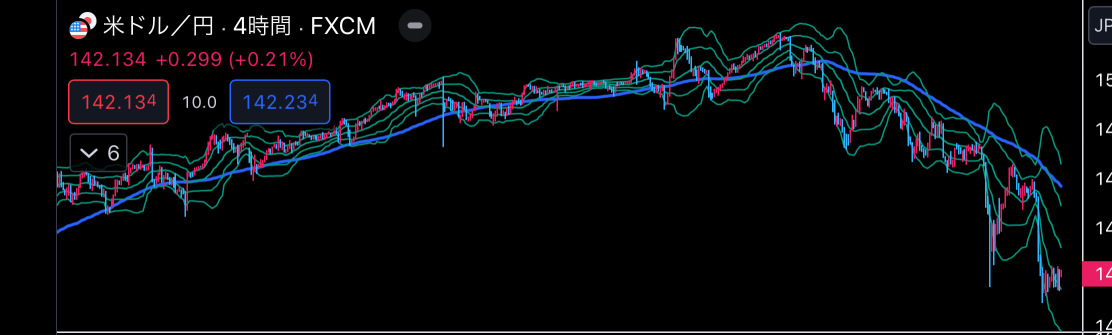

The CPI results have exceeded expectations and the dollar yen has risen, but the 150 yen barrier is getting thicker due to intervention warnings, etc.

But it's still technically superior, so I have no choice but to make a big purchase.

Daily chart and upper line

4-hour time frame, eyes are vague depending on the viewer

The slope is upward

Double bottoms have also been confirmed, is the top still strong?

The line of sight is vague even on the 1-hour chart

The slope of the indicator is down

The 15 minute chart also tilted downward because my line of sight was vague

Due to the influence of the decline of about 3 yen in early October, from the perspective of the Dow theory

The sense of direction is unclear because there is also a subtle part about whether or not it has fallen below the push low price.

It is currently in a state where it continues to move within that large shadow line that dropped all at once (inside)

As it is now, the slope of 15 minutes is up,

When the inclination of the foot for 1 hour comes to the side

The short-term upward break led to a 4-hour trend, and since it matches the daily line of view, I'm still aiming for it.

In the current state, the loss margin is wide, so I'm going to push a little further or see if the horizontal axis adjusts in the price range where the indicator is moving upward

Think about buying according to the upper chart until it falls below the 15 minute low

But it's still technically superior, so I have no choice but to make a big purchase.

Daily chart and upper line

4-hour time frame, eyes are vague depending on the viewer

The slope is upward

Double bottoms have also been confirmed, is the top still strong?

The line of sight is vague even on the 1-hour chart

The slope of the indicator is down

The 15 minute chart also tilted downward because my line of sight was vague

Due to the influence of the decline of about 3 yen in early October, from the perspective of the Dow theory

The sense of direction is unclear because there is also a subtle part about whether or not it has fallen below the push low price.

It is currently in a state where it continues to move within that large shadow line that dropped all at once (inside)

As it is now, the slope of 15 minutes is up,

When the inclination of the foot for 1 hour comes to the side

The short-term upward break led to a 4-hour trend, and since it matches the daily line of view, I'm still aiming for it.

In the current state, the loss margin is wide, so I'm going to push a little further or see if the horizontal axis adjusts in the price range where the indicator is moving upward

Think about buying according to the upper chart until it falls below the 15 minute low

Translated

+1

4

1

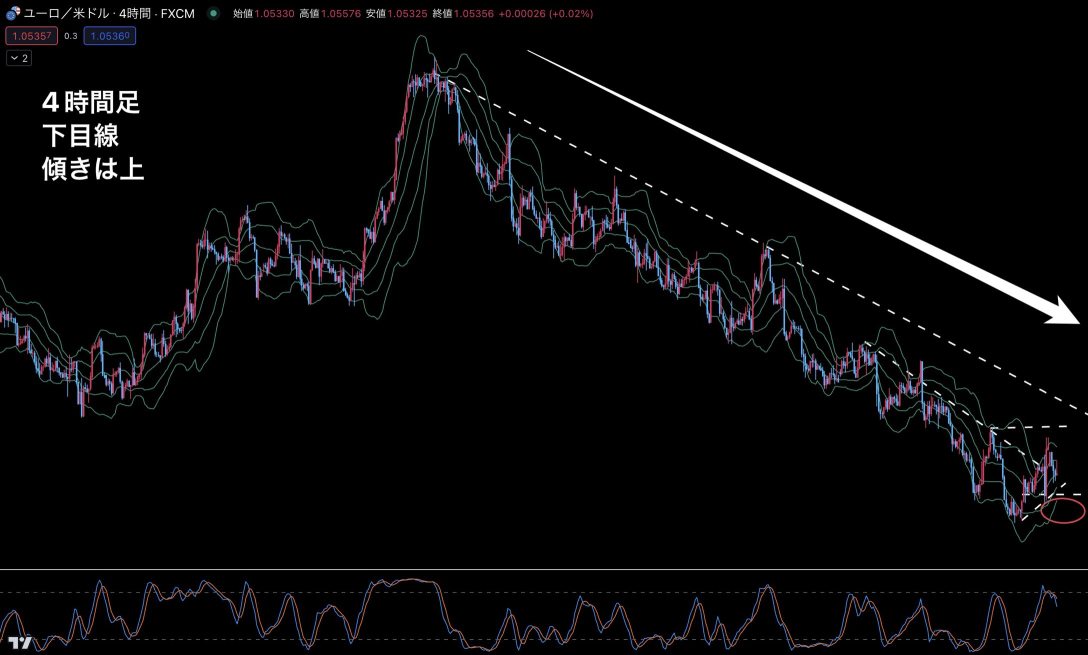

After falling due to the announcement of US employment statistics, it rose again to around 1.06 and became the Taiyo Line.

Since then, at a time when there are many vacations and liquidity is falling, it has dropped to about the level before employment statistics were announced.

There is a sense of downward direction in terms of long-term flow, but the inclination of the 4-hour foot is upward. (The line of sight is still down)

The environment is becoming troubling due to inconsistency with the long-term sense of direction, but when it falls, it falls below the short-term uptrend line, and if the short-term perspective also looks down, the slope of the 4-hour foot disappears.

↓

It's getting easier to sell.

I can still think of both right now, so let's not force trade and just wait for a sense of direction to come out!

Since then, at a time when there are many vacations and liquidity is falling, it has dropped to about the level before employment statistics were announced.

There is a sense of downward direction in terms of long-term flow, but the inclination of the 4-hour foot is upward. (The line of sight is still down)

The environment is becoming troubling due to inconsistency with the long-term sense of direction, but when it falls, it falls below the short-term uptrend line, and if the short-term perspective also looks down, the slope of the 4-hour foot disappears.

↓

It's getting easier to sell.

I can still think of both right now, so let's not force trade and just wait for a sense of direction to come out!

Translated

5

The numbers in employment statistics are good, and the dollar-yen rate is rising

There is a fact that it dropped about 3 yen from 150 yen

Due to that influence, it is now in a state where it continues to move within the large yin line (inside)

Technically, it's still in the upward direction, but there is a possibility that the sense of direction will be bothersome due to the fact that it has declined, so if you trade, is it still safer for a relatively short period of time?

Waiting impatiently.

There is a fact that it dropped about 3 yen from 150 yen

Due to that influence, it is now in a state where it continues to move within the large yin line (inside)

Technically, it's still in the upward direction, but there is a possibility that the sense of direction will be bothersome due to the fact that it has declined, so if you trade, is it still safer for a relatively short period of time?

Waiting impatiently.

Translated

3

Use the supercomputer “Dojo” to learn AI for autonomous driving

↓

It is predicted that there is a possibility that Morgan Stanley will boost Tesla's total market value by 76% due to expectations for the Dojo (approximately 600 billion dollars)

↓

The market reacted and stock prices rose by about 10%!

↓↓

Currently, that increase has been restored.

In terms of technical analysis

↓

Hidari

It's getting close to the moving average line with an upward line of sight

4 hour chart

The part where the slope of the moving average line is touched at the top

From these, it is easy for purchases to become slightly stronger due to Granville's law.

However, if you look at the 1-hour chart

The moving average line is pointing downward and there are people who want to sell back (still can't buy)

The inclination of the 15 minute foot is about to level off.

If you break the small horizontal range upward

・The 15-minute slope is upward

・The downward direction of the foot will disappear for 1 hour

↓

Is it still higher if it matches a slope of 4 hours or more?

I still can't buy it now, but compared to when it rose 10%, it's getting close to a form that is easy to buy.

Wait and see for a little longer

↓

It is predicted that there is a possibility that Morgan Stanley will boost Tesla's total market value by 76% due to expectations for the Dojo (approximately 600 billion dollars)

↓

The market reacted and stock prices rose by about 10%!

↓↓

Currently, that increase has been restored.

In terms of technical analysis

↓

Hidari

It's getting close to the moving average line with an upward line of sight

4 hour chart

The part where the slope of the moving average line is touched at the top

From these, it is easy for purchases to become slightly stronger due to Granville's law.

However, if you look at the 1-hour chart

The moving average line is pointing downward and there are people who want to sell back (still can't buy)

The inclination of the 15 minute foot is about to level off.

If you break the small horizontal range upward

・The 15-minute slope is upward

・The downward direction of the foot will disappear for 1 hour

↓

Is it still higher if it matches a slope of 4 hours or more?

I still can't buy it now, but compared to when it rose 10%, it's getting close to a form that is easy to buy.

Wait and see for a little longer

Translated

+1

2

1

Until now, I've touched on US stocks a bit, but I was at a loss because fees are inevitably high.

This time, there are no fees for 2 months, and things that weren't easy anywhere else, such as being free of fees for 2 months, and up to 200 shares will be realized, so I'm going to use this as the main account for US stocks!

I'm really looking forward to it!

This time, there are no fees for 2 months, and things that weren't easy anywhere else, such as being free of fees for 2 months, and up to 200 shares will be realized, so I'm going to use this as the main account for US stocks!

I'm really looking forward to it!

Translated

10

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)