KPLV1000k

voted

Good morning, traders. Happy Wednesday, October 2, the market is falling, a boring day after a crazy day. My name is Kevin Travers; here stonks and stories mooving the U.S. stock market today.

$Tesla (TSLA.US)$ fell 5%, the lowest on the Nasdaq after it posted Q3 deliveries that grew YoY and QoQ. The firm shipped 462,890 vehicles during the July-to-September period, nearly on point but 1,003 less than the highest of estimates. The re...

$Tesla (TSLA.US)$ fell 5%, the lowest on the Nasdaq after it posted Q3 deliveries that grew YoY and QoQ. The firm shipped 462,890 vehicles during the July-to-September period, nearly on point but 1,003 less than the highest of estimates. The re...

41

18

KPLV1000k

commented on

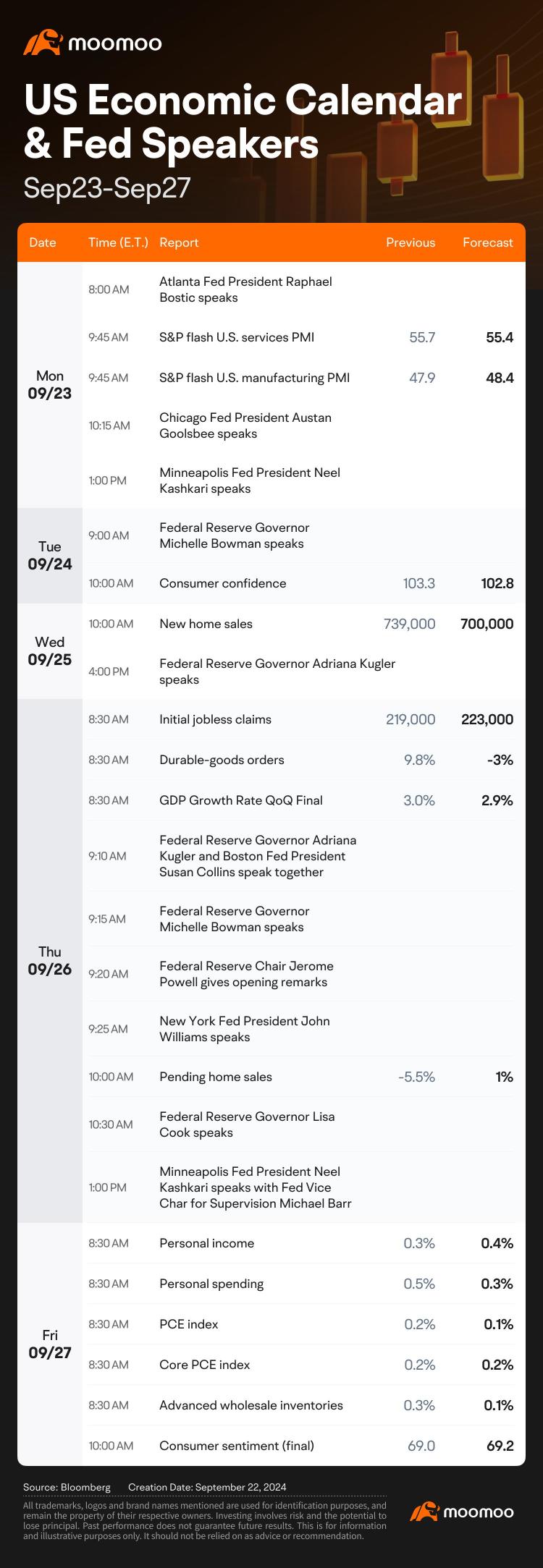

We also have to consider that the fed cutting rates is not a cause and effect with respect to a recession. There are other metrics to consider like the GDP growth and Consumer Confidence. Which we will see how those are performing in the coming week. If they prove to continue to be strong, the rate cut may have been more precautionary than signaling that there’s a major problem in the economy. However if they show weakness in those metrics then it would definitely signal the economy is slowing.

@71814415:Excelent explanation good ideal considering that the feds cut rates by .5.

The last time the feds cut rates two weeks later the market fell substantially.

The last time the feds cut rates two weeks later the market fell substantially.

Long Strangle

Long Strangle

KPLV1000k

commented on

The upcoming week features a light schedule, yet it holds ample opportunities. $KB Home (KBH.US)$ and $Costco (COST.US)$ are among the stocks approaching buy levels ahead of their earnings reports. At the same time, $Micron Technology (MU.US)$'s shares have been significantly depressed, but analysts predict substantial earnings and revenue growth.

KB Home Earnings Preview

KB Home (KBH) is a strong ...

KB Home Earnings Preview

KB Home (KBH) is a strong ...

+3

84

21

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)