Kris Du

liked

$Direxion Daily TSLA Bull 2X Shares (TSLL.US)$

@ $Palantir (PLTR.US)$ $Tesla (TSLA.US)$

I'm won't buy in any more

@ $Palantir (PLTR.US)$ $Tesla (TSLA.US)$

I'm won't buy in any more

2

4

Kris Du

liked and commented on

2

7

Kris Du

commented on

$Tesla (TSLA.US)$ Looking forward to a gap up and high open after washing the plate.

Translated

2

6

Kris Du

voted

$Tesla (TSLA.US)$ In the short-term market, the battle between long and short positions makes it really difficult to determine.

In the market, the judgment near 385 has triggered over 500K call options, providing fuel for the bearish Gamma Squeeze. Missed the opportunity to profit, so expensive!!! Planning to move back to North America at the right time..

Just chatted with friends from Wall Street, there are two logical perspectives: one observation is that the current trading volume of less than 0.1 million Put Options is low, this wave of bearish pressure makes it difficult to cover losses normally, and the sevenfold weight at the integer threshold of 400 is hard to bear. From a psychological standpoint, bulls are passing the buck to each other, short-term bullish factors are exhausted, both are afraid the other side will run, the willingness for sustained short-term rally cannot be determined. Better to actively prepare ammunition to kill, this wave 'fueled by selling pressure' will return. Based on this logic, in the short term, 400 is seen as a peak.

One way is to avoid short-term Santa trades, Trump trades, and retail bullish sentiment, actively release positive news, boost IV, actively and passively buy underlying stocks to prepare chips (with the air force ammunition being weak under the multi-round flywheel effect), avoid sell the news, reduce short-term losses, and wait for the bearish to fill. Under this logic, it is not yet time to call a top in the short term.

In the Traders Coffee time, there are some logical considerations, which side do you align with more? Which side do you buy more?

In the market, the judgment near 385 has triggered over 500K call options, providing fuel for the bearish Gamma Squeeze. Missed the opportunity to profit, so expensive!!! Planning to move back to North America at the right time..

Just chatted with friends from Wall Street, there are two logical perspectives: one observation is that the current trading volume of less than 0.1 million Put Options is low, this wave of bearish pressure makes it difficult to cover losses normally, and the sevenfold weight at the integer threshold of 400 is hard to bear. From a psychological standpoint, bulls are passing the buck to each other, short-term bullish factors are exhausted, both are afraid the other side will run, the willingness for sustained short-term rally cannot be determined. Better to actively prepare ammunition to kill, this wave 'fueled by selling pressure' will return. Based on this logic, in the short term, 400 is seen as a peak.

One way is to avoid short-term Santa trades, Trump trades, and retail bullish sentiment, actively release positive news, boost IV, actively and passively buy underlying stocks to prepare chips (with the air force ammunition being weak under the multi-round flywheel effect), avoid sell the news, reduce short-term losses, and wait for the bearish to fill. Under this logic, it is not yet time to call a top in the short term.

In the Traders Coffee time, there are some logical considerations, which side do you align with more? Which side do you buy more?

Translated

3

Kris Du

liked

$Tesla (TSLA.US)$ Doing minute charts is tiring.![]() But making profits is really good. Making tens to twenties in profit every day is faster than making long-term profits.

But making profits is really good. Making tens to twenties in profit every day is faster than making long-term profits.![]()

Translated

4

5

Kris Du

voted

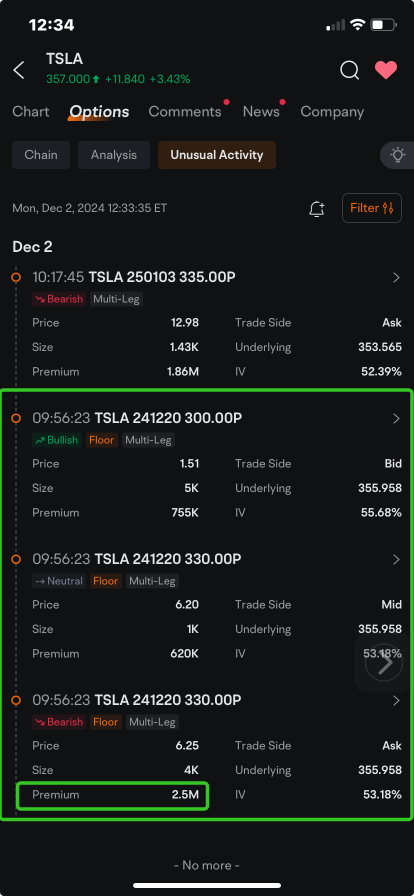

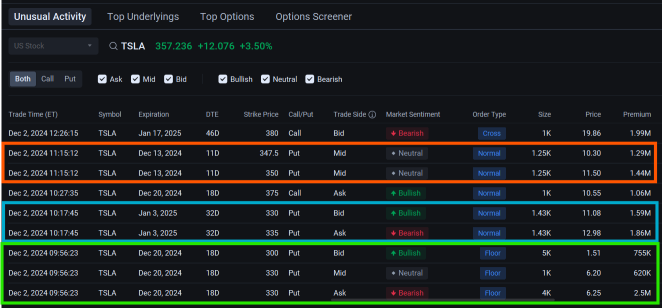

$Tesla (TSLA.US)$ attracted millions of dollars in unusual option trades as the stock rose near this year's high after analysts upgraded their outlook on the stock.

The biggest among the unusual option activities so far Monday involved an active buyer paying a $2.5 million premium to purchase put options that give the holder the right to sell 400,000 Tesla shares at $330 by Dec. 20. That bearish transaction was part of a m...

The biggest among the unusual option activities so far Monday involved an active buyer paying a $2.5 million premium to purchase put options that give the holder the right to sell 400,000 Tesla shares at $330 by Dec. 20. That bearish transaction was part of a m...

26

7

19

Kris Du

reacted to and commented on

Translated

2

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)