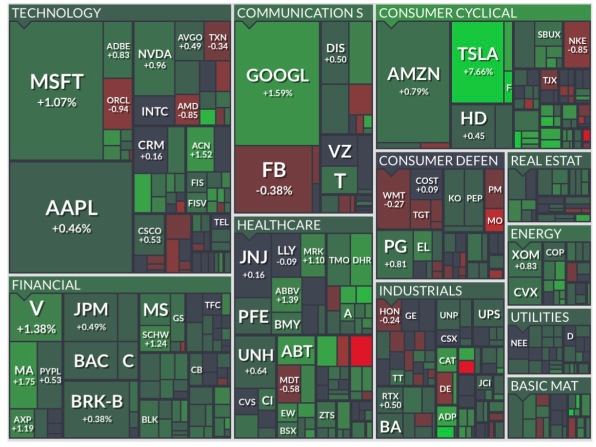

Market is mostly green today $ProShares UltraPro QQQ ETF (TQQQ.US)$ $Invesco QQQ Trust (QQQ.US)$

$Tesla (TSLA.US)$ is back to 1000!

Today I had bought

$Adobe (ADBE.US)$

$Baidu (BIDU.US)$

$Tesla (TSLA.US)$ is back to 1000!

Today I had bought

$Adobe (ADBE.US)$

$Baidu (BIDU.US)$

4

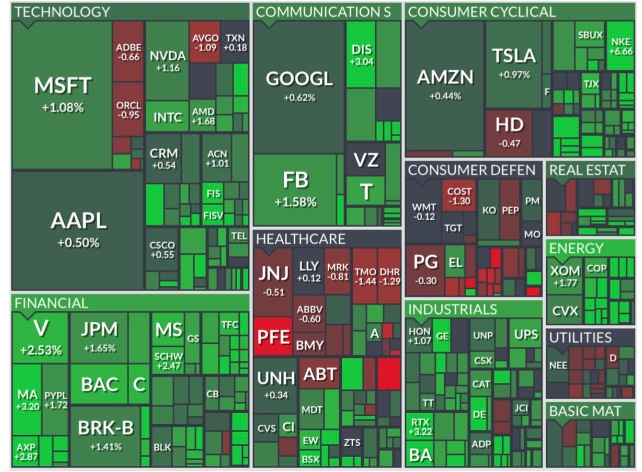

Market is mostly green except some healthcare. Chinese stocks seem to be climbing back. All green will be in financials and industrials.

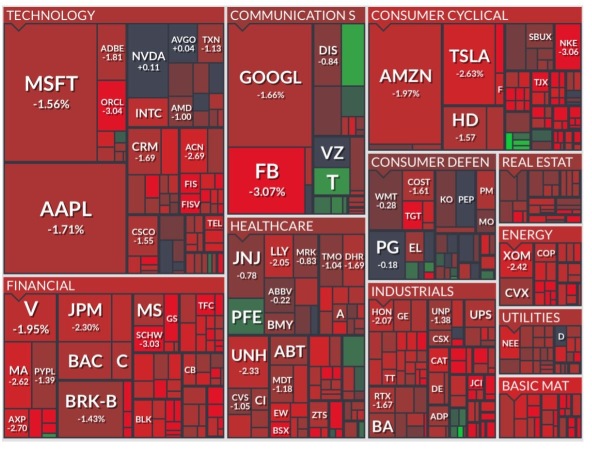

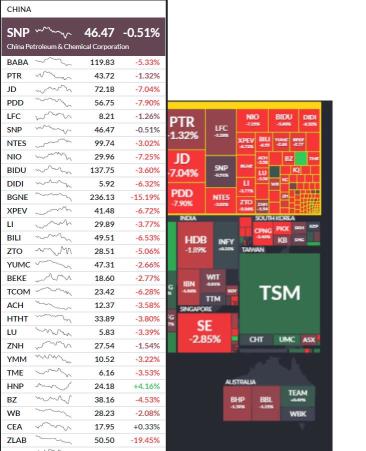

All sectors are down! Only $CBOE Volatility S&P 500 Index (.VIX.US)$ is up. I will take this chance to average into $Invesco QQQ Trust (QQQ.US)$ and $ProShares UltraPro QQQ ETF (TQQQ.US)$.

10

Volatility for technology sector, the rest of the market is up.

I took the opportunity to buy $ProShares UltraPro QQQ ETF (TQQQ.US)$ & $Invesco QQQ Trust (QQQ.US)$ which has a positive correlation with nasdaq. I also double my stake on $UP Fintech (TIGR.US)$ pulling down my losses from 68% to 28%.

My watchlist (might average in)

$Alibaba (BABA.US)$

$Baidu (BIDU.US)$

$PayPal (PYPL.US)$

I took the opportunity to buy $ProShares UltraPro QQQ ETF (TQQQ.US)$ & $Invesco QQQ Trust (QQQ.US)$ which has a positive correlation with nasdaq. I also double my stake on $UP Fintech (TIGR.US)$ pulling down my losses from 68% to 28%.

My watchlist (might average in)

$Alibaba (BABA.US)$

$Baidu (BIDU.US)$

$PayPal (PYPL.US)$

38

4

Stocks that are super undervalued

Basically I feel these 3 stocks are of the highest potential in Chinese ADR listed in US. I will average in while it is cheap.

Basically I feel these 3 stocks are of the highest potential in Chinese ADR listed in US. I will average in while it is cheap.

7

3

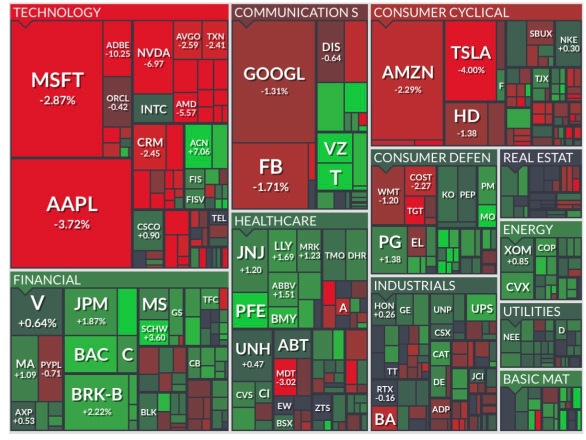

Healthcare, consumer defensive, consumer defensive, real estate and utilities are mainly up. Financials are slightly down with $MasterCard (MA.US)$ and $PayPal (PYPL.US)$ dropping about 1%. Tesla $Tesla (TSLA.US)$ continues to falls.

10

1

Barclays had initiated an "OVERWEIGHT"

On 3rd November 2021, Barclays had initiated an "OVERWEIGHT" rating on Baidu to 243.

What is $Baidu (BIDU.US)$doing?

I guessed not everyone had heard of this counter called $Baidu (BIDU.US)$ / $BABA-W (09988.HK)$ , but in fact they are the $Alphabet-C (GOOG.US)$ of China. As Google is banned in China, the natives mostly used Baidu search. They are a chinese internet related and artifical intelligence company based in Beijing.

Robotaxi Launch

$Baidu (BIDU.US)$ aims to launch its driverless taxi service in 100 cities by 2030. Users can hail an autonomous car via an app. Currently, Baidu operates its Apollo Go robotaxi service in five Chinese cities. Baidu looks to expand Apollo Go to 65 cities by 2025 and then 100 cities by 2030. The cost of a human driver accounts for about 60% of the user payment in ride-sharing, according to a Credit Suisse report. Baidu's strategy for building a robotaxi business is to reduce the cost of self-driving technology and target specific user scenarios.

Baidu Enters Into License Agreement With Sanofi to Enable Next-Generation mRNA Therapeutics and Vaccines

Baidu a leading AI company with strong Internet foundation, and Sanofi, a leading biopharmaceutical company focused on human health, have entered into an agreement to integrate Baidu's messenger ribonucleic acid (mRNA) design optimization platform, LinearDesign, into Sanofi's product design pipeline. Under the agreement, Sanofi will leverage the LinearDesign platform to contribute to the optimization of mRNA sequences for human therapeutic and preventive uses. This agreement marks a milestone for Baidu to use its strengths in computational biology to optimize mRNA vaccine and therapy designs in real-world pharmaceutical practice beyond Covid-19.

Baidu will receive milestone payments when any mRNA-based therapy or vaccine candidate discovered by Sanofi using its algorithm enters clinical trials, said Huang Liang, a Baidu scientist leading the project. "The fact that this agreement includes milestone payments shows that [Sanofi] has great confidence in bringing candidates developed with Baidu algorithm into clinical trials and to the market," Huang told Reuters. He declined to disclose the size of the deal. Baidu's algorithm is designed to deliver a larger number of optimised mRNA sequences and there are early signs that it could be more suitable than standard algorithms in vaccine and therapeutic drug development, Huang said.

Baidu Continue To Gain Cloud Market Share At The Cost Of Huawei, Tencent

Chinese tech majors Huawei Technologies Co and Tencent holdings have lost cloud services market share in the third quarter amid formidable competition from market leader Alibaba and Baidu. The cloud units of Alibaba, Huawei, Tencent, and Baidu Inc (NASDAQ:BIDU) held a combined 80% of the China market in Q3. However, the second most significant player Huawei Cloud's market share, contracted 230 bps to 17% Q/Q. The third-largest player Tencent Cloud's market share declined to 220 bps to 16.6% Q/Q. Alibaba Cloud's market share expanded 450 bps to 38.3%. Baidu AI, Cloud's market share, expanded 40 bps to 8.2%. Baidu grew 64.7% in Q3, thanks to its more significant customer base across different sectors and industrial internet projects. Baidu grew 64.7% in Q3, thanks to its more significant customer base across different sectors and industrial internet projects.

Analysis of Baidu's financials

Price to Earning Ratios: BIDU is good value based on its PE Ratio (23.3x) compared to the US Interactive Media and Services industry average (27.1x).

Price to Book Ratio:BIDU is good value based on its PB Ratio (1.5x) compared to the US Interactive Media and Services industry average (3.2x).

Earnings as at 30 september = 11.2% profit margin

Debt is not a concern

Short Term Liabilities: BIDU's short term assets (CN¥215.4B) exceed its short term liabilities (CN¥73.9B).Long Term Liabilities: BIDU's short term assets (CN¥215.4B) exceed its long term liabilities (CN¥85.9B).

Debt Level: BIDU has more cash than its total debt.

Baidu's Top Shareholders

Disclaimer:

Hi Moomoo, i am a passionate long term investor, i currently do hold baidu (US listed) and i intends to buy more as it is currently undervalued. This is my research view and i would like to share with all my moomoo followers.

References:

https://www.cnbc.com/2021/11/25/baidu-kicks-off-robotaxi-business-after-beijing-citys-fare-approval.html

https://www.reuters.com/markets/europe/baidu-partnership-with-sanofi-use-its-algorithm-mrna-vaccine-therapy-development-2021-11-22/

https://finance.yahoo.com/news/alibaba-baidu-continue-gain-cloud-112725781.html

On 3rd November 2021, Barclays had initiated an "OVERWEIGHT" rating on Baidu to 243.

What is $Baidu (BIDU.US)$doing?

I guessed not everyone had heard of this counter called $Baidu (BIDU.US)$ / $BABA-W (09988.HK)$ , but in fact they are the $Alphabet-C (GOOG.US)$ of China. As Google is banned in China, the natives mostly used Baidu search. They are a chinese internet related and artifical intelligence company based in Beijing.

Robotaxi Launch

$Baidu (BIDU.US)$ aims to launch its driverless taxi service in 100 cities by 2030. Users can hail an autonomous car via an app. Currently, Baidu operates its Apollo Go robotaxi service in five Chinese cities. Baidu looks to expand Apollo Go to 65 cities by 2025 and then 100 cities by 2030. The cost of a human driver accounts for about 60% of the user payment in ride-sharing, according to a Credit Suisse report. Baidu's strategy for building a robotaxi business is to reduce the cost of self-driving technology and target specific user scenarios.

Baidu Enters Into License Agreement With Sanofi to Enable Next-Generation mRNA Therapeutics and Vaccines

Baidu a leading AI company with strong Internet foundation, and Sanofi, a leading biopharmaceutical company focused on human health, have entered into an agreement to integrate Baidu's messenger ribonucleic acid (mRNA) design optimization platform, LinearDesign, into Sanofi's product design pipeline. Under the agreement, Sanofi will leverage the LinearDesign platform to contribute to the optimization of mRNA sequences for human therapeutic and preventive uses. This agreement marks a milestone for Baidu to use its strengths in computational biology to optimize mRNA vaccine and therapy designs in real-world pharmaceutical practice beyond Covid-19.

Baidu will receive milestone payments when any mRNA-based therapy or vaccine candidate discovered by Sanofi using its algorithm enters clinical trials, said Huang Liang, a Baidu scientist leading the project. "The fact that this agreement includes milestone payments shows that [Sanofi] has great confidence in bringing candidates developed with Baidu algorithm into clinical trials and to the market," Huang told Reuters. He declined to disclose the size of the deal. Baidu's algorithm is designed to deliver a larger number of optimised mRNA sequences and there are early signs that it could be more suitable than standard algorithms in vaccine and therapeutic drug development, Huang said.

Baidu Continue To Gain Cloud Market Share At The Cost Of Huawei, Tencent

Chinese tech majors Huawei Technologies Co and Tencent holdings have lost cloud services market share in the third quarter amid formidable competition from market leader Alibaba and Baidu. The cloud units of Alibaba, Huawei, Tencent, and Baidu Inc (NASDAQ:BIDU) held a combined 80% of the China market in Q3. However, the second most significant player Huawei Cloud's market share, contracted 230 bps to 17% Q/Q. The third-largest player Tencent Cloud's market share declined to 220 bps to 16.6% Q/Q. Alibaba Cloud's market share expanded 450 bps to 38.3%. Baidu AI, Cloud's market share, expanded 40 bps to 8.2%. Baidu grew 64.7% in Q3, thanks to its more significant customer base across different sectors and industrial internet projects. Baidu grew 64.7% in Q3, thanks to its more significant customer base across different sectors and industrial internet projects.

Analysis of Baidu's financials

Price to Earning Ratios: BIDU is good value based on its PE Ratio (23.3x) compared to the US Interactive Media and Services industry average (27.1x).

Price to Book Ratio:BIDU is good value based on its PB Ratio (1.5x) compared to the US Interactive Media and Services industry average (3.2x).

Earnings as at 30 september = 11.2% profit margin

Debt is not a concern

Short Term Liabilities: BIDU's short term assets (CN¥215.4B) exceed its short term liabilities (CN¥73.9B).Long Term Liabilities: BIDU's short term assets (CN¥215.4B) exceed its long term liabilities (CN¥85.9B).

Debt Level: BIDU has more cash than its total debt.

Baidu's Top Shareholders

Disclaimer:

Hi Moomoo, i am a passionate long term investor, i currently do hold baidu (US listed) and i intends to buy more as it is currently undervalued. This is my research view and i would like to share with all my moomoo followers.

References:

https://www.cnbc.com/2021/11/25/baidu-kicks-off-robotaxi-business-after-beijing-citys-fare-approval.html

https://www.reuters.com/markets/europe/baidu-partnership-with-sanofi-use-its-algorithm-mrna-vaccine-therapy-development-2021-11-22/

https://finance.yahoo.com/news/alibaba-baidu-continue-gain-cloud-112725781.html

+1

14

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)