Like that Also can

liked

Columns 45% of Warren Buffett's $398 Billion Portfolio Is Invested in 3 Artificial Intelligence (AI) Stocks.

Warren Buffett led the Berkshire Hathaway $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ holding company since 1965. He likes to invest in companies with steady growth, reliable profitability, strong management teams, and shareholder-friendly initiatives like dividend payments and stock buyback programs.

That strategy is working: Berkshire delivered a 4,384,748% return between 1965 and 2023...

That strategy is working: Berkshire delivered a 4,384,748% return between 1965 and 2023...

+1

52

5

Like that Also can

voted

The race to $4 trillion is on. $Apple (AAPL.US)$, $Microsoft (MSFT.US)$and $NVIDIA (NVDA.US)$are in the $3 trillion club. So, which technology behemoth can adapt to keep growth rates elevated enough to keep the good times going?

We believe over the next year the race to $4 Trillion Market Cap in tech will be front and center between Nvidia, Apple, and Microsoft," wrote Wedbush analyst Daniel Ives in a research note.

Nvidia?

Nvidia could reach a $4 tril...

We believe over the next year the race to $4 Trillion Market Cap in tech will be front and center between Nvidia, Apple, and Microsoft," wrote Wedbush analyst Daniel Ives in a research note.

Nvidia?

Nvidia could reach a $4 tril...

107

28

take quit a while liao

waiting waiting…….snap

Like that Also can

liked

In January, the SEC approved the trading of 11 spot Bitcoin ETFs on the 11th. This approval allows investors to diversify their portfolios with crypto exposure without worrying about the complicated issues of custody. Microsoft had overtaken Apple as the most valuable company for the first time since 2021, which may be largely due to its investment in generative AI, including a stake in ChatGPT. The EV sector also faces fierce competition;...

+11

326

82

Like that Also can

voted

Rewards

● An equal share of 1,000 points: For mooers who correctly guess TSLA's closing price range on July 20 ET by 2:30 PM, July 20 ET. (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

● Exclusive 300 points: For the writer of the top post on analyzing TSLA's earnings preview as an inspiration reward.

*The selection is based on post quality, originality, and user engagement.

Note: 1. Rewards...

● An equal share of 1,000 points: For mooers who correctly guess TSLA's closing price range on July 20 ET by 2:30 PM, July 20 ET. (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

● Exclusive 300 points: For the writer of the top post on analyzing TSLA's earnings preview as an inspiration reward.

*The selection is based on post quality, originality, and user engagement.

Note: 1. Rewards...

86

27

Like that Also can

liked

If the media didn't report, you'll not notice any change at all - normal re-balancing happens quarterly.

Quote:

Nasdaq announced a special rebalance of the Nasdaq-100, effective Monday, July 24, which will be the first day of trading based on the new rebalance parameters.

Normal rebalancing happens on a quarterly basis—at the end of March, June, September and December. Nasdaq is doing this “special” rebalancing to...

Quote:

Nasdaq announced a special rebalance of the Nasdaq-100, effective Monday, July 24, which will be the first day of trading based on the new rebalance parameters.

Normal rebalancing happens on a quarterly basis—at the end of March, June, September and December. Nasdaq is doing this “special” rebalancing to...

2

3

Like that Also can

voted

$Meta Platforms (META.US)$ $Nasdaq Composite Index (.IXIC.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Tesla (TSLA.US)$

3

6

Like that Also can

voted

$Apple (AAPL.US)$ Anyone willing to pay USD3,500 to try this new toy? Life changing or meh…

Thank you everyone for actively participating in this post.![]() Its now featured in 2023 Recap (Half-Year)

Its now featured in 2023 Recap (Half-Year)

Thank you everyone for actively participating in this post.

6

Like that Also can

liked

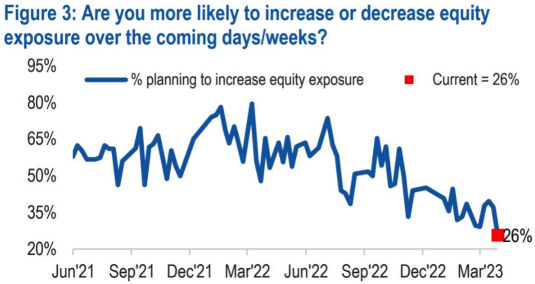

Markets remain strong and the global economy is holding up better than expected. Yet, sentiment turns more bearish in April![]() .

.

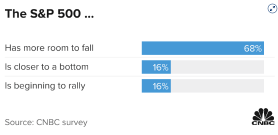

CNBC surveyed 400 Chief Investment Officers, equity strategists, portfolio managers and contributors who manage money about where they stood on the markets for the second quarter and beyond. 68% of them anticipated there would be more room to fall for the $S&P 500 Index (.SPX.US)$.

Likewise wit...

CNBC surveyed 400 Chief Investment Officers, equity strategists, portfolio managers and contributors who manage money about where they stood on the markets for the second quarter and beyond. 68% of them anticipated there would be more room to fall for the $S&P 500 Index (.SPX.US)$.

Likewise wit...

+1

16

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)