Luckygirl

liked

$Tilray Brands (TLRY.US)$ Tesla can help you break even, Tesla's upward movement is stress-free, the upward trend is full, first look at 417. Soon 800.

Translated

2

Luckygirl

liked

$Tilray Brands (TLRY.US)$ It's not that individual stocks are bad, it's that the entire Sector is not doing well.

Translated

1

Luckygirl

liked

$Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$ Where it rises, it will fall... That's Chinese concept.![]()

Translated

2

Luckygirl

liked

$Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$ This chives are cut very well.

Translated

1

Luckygirl

commented on

Luckygirl

liked

$Tilray Brands (TLRY.US)$The Lunar New Year is still two months away, could you please hurry up a bit, I need to get off the car.

Translated

2

6

Luckygirl

liked

$Aurora Cannabis (ACB.US)$After peaking in 2020, revenue declined continuously for two years, operating profit lost continuously for 5 years, and net profit lost continuously for 4 years. The situation continued to deteriorate in the first two quarters of 2023, and there is currently no investment value.

Translated

2

Luckygirl

liked

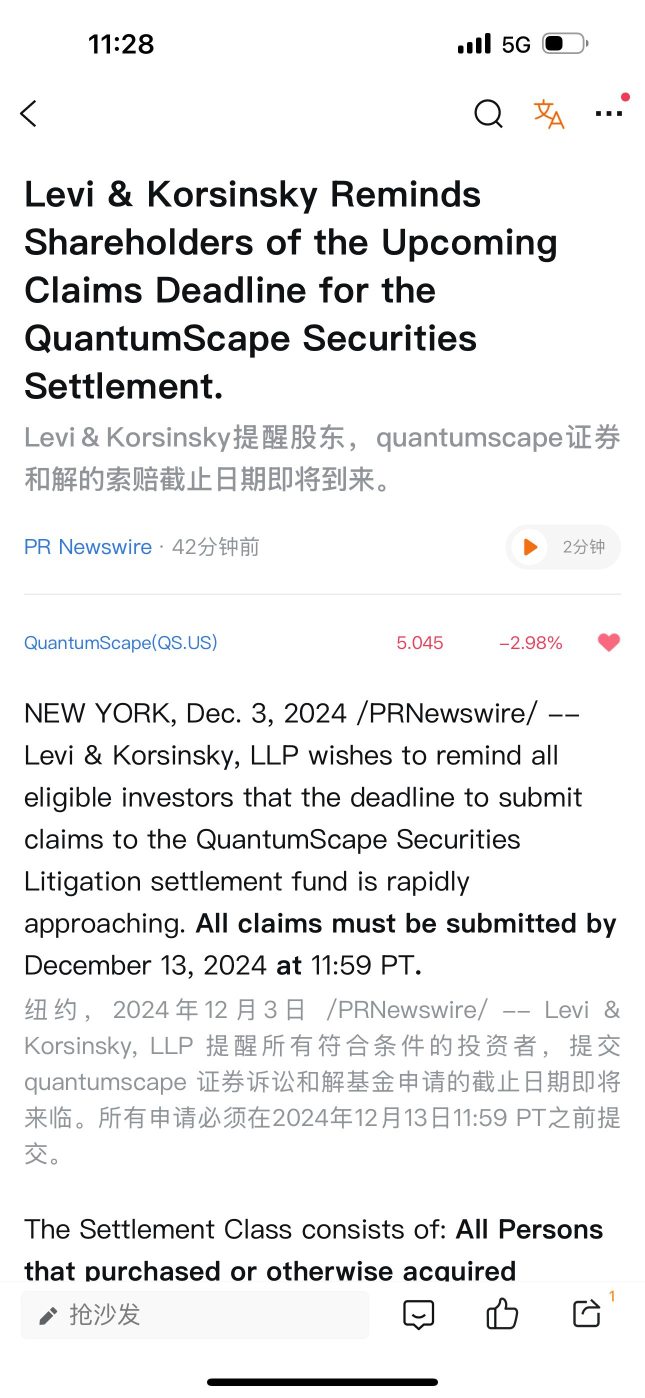

$QuantumScape (QS.US)$

How to trade and invest in high-tech potential stocks that are still in the speculative stage?

1. Only buy on dips, especially when there is a sustained large drop, and gradually build positions in batches.

2. Never go all in at once, trying to make a big bet and hold positions for a major rise. The probability of failure is very high.

The elasticity of hairy tickets' stock price fluctuations is not very good. Once the stock price drops, it is difficult to rebound in the short term. Therefore, attempting to lower the average holding cost by increasing positions has a very poor effect. The most deadly consequence is that precious limited funds are likely to be trapped here, leading to loss of control. Over 99% of people without risk awareness stumble here, starting to lose their freedom. Therefore, one must not haphazardly increase positions to dig the bottom.

4. Relatively rigorously and objectively establish the Baum-Welch algorithm model and hidden Markov model, as well as perform a differential geometric quantitative analysis on the profit chip ratio function curve: The net inflow of block orders is far from reaching the lowest limit for stock price outbreaks (such as EVTV, GP, QS, GSIT, etc., GP has not even obtained early settlements from any of the three Wall Street pioneers, Blackrock, and Capital Group Global in Vanguard). Sometimes, objectively and rationally understanding things is not an easy task.

How to trade and invest in high-tech potential stocks that are still in the speculative stage?

1. Only buy on dips, especially when there is a sustained large drop, and gradually build positions in batches.

2. Never go all in at once, trying to make a big bet and hold positions for a major rise. The probability of failure is very high.

The elasticity of hairy tickets' stock price fluctuations is not very good. Once the stock price drops, it is difficult to rebound in the short term. Therefore, attempting to lower the average holding cost by increasing positions has a very poor effect. The most deadly consequence is that precious limited funds are likely to be trapped here, leading to loss of control. Over 99% of people without risk awareness stumble here, starting to lose their freedom. Therefore, one must not haphazardly increase positions to dig the bottom.

4. Relatively rigorously and objectively establish the Baum-Welch algorithm model and hidden Markov model, as well as perform a differential geometric quantitative analysis on the profit chip ratio function curve: The net inflow of block orders is far from reaching the lowest limit for stock price outbreaks (such as EVTV, GP, QS, GSIT, etc., GP has not even obtained early settlements from any of the three Wall Street pioneers, Blackrock, and Capital Group Global in Vanguard). Sometimes, objectively and rationally understanding things is not an easy task.

Translated

2

2

1

Luckygirl

liked

$Micron Technology (MU.US)$ You are really shameless, when others rise you fall, when others fall you still fall, never independently rise.

Translated

1

1

Luckygirl

liked

$Super Micro Computer (SMCI.US)$ To make money, yesterday simply invest in nvidia to earn 3-4%, those who want to lose money quickly get on the AMD car.

Translated

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)