Luiz小财神

voted

$NVIDIA (NVDA.US)$'s stock fell by 7% to $103.73, significantly outpacing the $Nasdaq Composite Index (.IXIC.US)$'s 1.3% decline, marking its lowest closing share price since May 23. The stock is now down 26% from its June peak of over $140 per share.

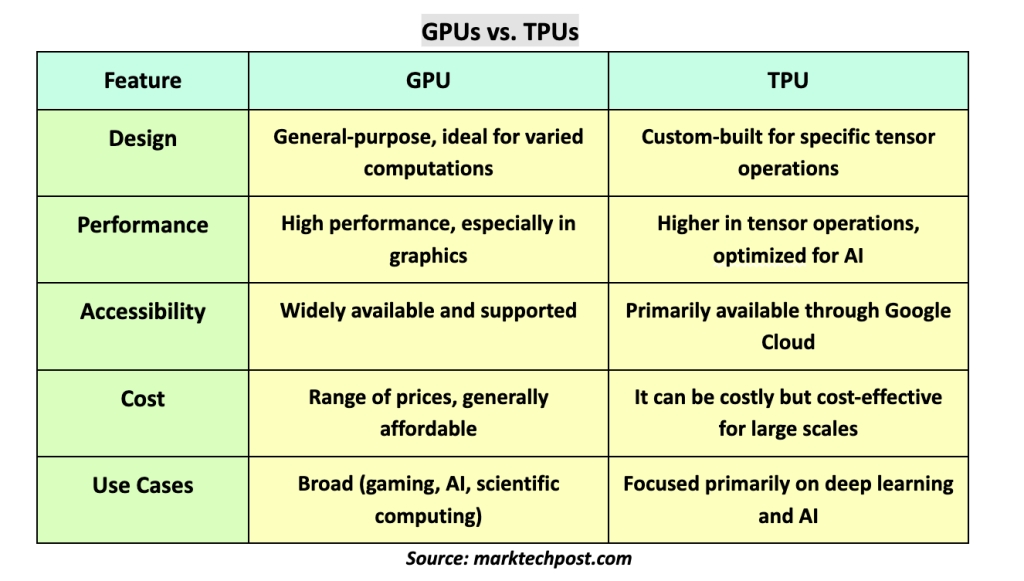

Apple to Train AI Models with Google Chips Instead of Nvidia

Apple announced that its AI models, part of its Apple Intelligence system, were pretrained using Google's Tensor P...

Apple to Train AI Models with Google Chips Instead of Nvidia

Apple announced that its AI models, part of its Apple Intelligence system, were pretrained using Google's Tensor P...

32

1

46

Luiz小财神

commented on

I don't have a love hate relationship with my stocks because I only buy them when I love them. if they are green, I'm happy. If they are red, I buy more, and I'm happy.

Just like my $Discovery-A (DISCA.US)$, I fell in love with it when it crashed thanks to Bill Hwang. Crash more than 50%, buy ahhhhhhhh. Bought in at 43. then it crash even lower to the 20s range. soooo buught even more![]()

![]() Took about 9 month to finally tur...

Took about 9 month to finally tur...

Just like my $Discovery-A (DISCA.US)$, I fell in love with it when it crashed thanks to Bill Hwang. Crash more than 50%, buy ahhhhhhhh. Bought in at 43. then it crash even lower to the 20s range. soooo buught even more

loading...

33

10

3

Luiz小财神

liked

Didi Global rises 5.6% in US premarket trading after its holder tencent reports a 7.4% passive stake at December 31.

tencent reported holding a 7.4% passive stake in Didi as of December 31, 2021. Didi (DIDI.N) rose 5.6% in pre-market trading.

$TENCENT (00700.HK)$

$Tencent (TCEHY.US)$

$DiDi Global (Delisted) (DIDI.US)$

tencent reported holding a 7.4% passive stake in Didi as of December 31, 2021. Didi (DIDI.N) rose 5.6% in pre-market trading.

$TENCENT (00700.HK)$

$Tencent (TCEHY.US)$

$DiDi Global (Delisted) (DIDI.US)$

Translated

7

Luiz小财神

voted

Thanksgiving is a time for food, friends and family. It's also a time to pause, reflect on our lives and think about what we're thankful for.

The question we want to ask you on this Thanksgiving day is--What are you grateful for during your investing journey? Is it your supporting family? Your investing pals? Your profittable stock? A book you read? Maybe a guru? The list goes on and on. There are so many things that we appreciate and feel grateful deep down in our heart. Why don't you take this chance to say a big thank-you now!?

What stocks are you most thankful for this year? Or on the contrary, which stocks teach you a lesson? Be it success or setback, there's always a reason for us to be grateful because it made us grow stonger and become more experienced in investing.

Trading or investing is never an easy job. Thankfully, our family or friends provides emotional support during challenging time, encouragement along investing life's twists and turns, and the comfort of being understood and accepted for what you want to do with life.

Do you have a guru that guides you at the beginning of your investing journey? Do you find any book that's helpful for you to make a decision? There are countless online lessons and books you can turn to when you are at a loss. Which one do you want to express your thanks to?

By the time we decided to invest and started to learn from the ground up, we made a brave decision and hard choice. Don't forget that we are a courageous man/ woman and we should feel thankful for that.

5 best posts will get 1,888 points;

10 featured posts will get 888 points;

All participants will get 88 points.

Duration: Now – Nov. 29, 11:59 PM (ET)

Note:

1. Only relevant posts and those add topic #For this, I am grateful count. (Please post under the topic.)

2. Minimum word requirement: 50 words

3. Winners will be announced on Dec. 2nd.

Thank you, and best of luck to all of our trading or investing endeavors. Do forget to attach a picture of your thanksgiving dinner while joining the the topic here #For this, I am grateful

253

30

9

Luiz小财神

reacted to

1

Luiz小财神

liked

At this time, it’s even more important to learn Buffett’s investment philosophy. Many people start to learn Buffett’s investment philosophy when value stocks are soaring, and then invest in some value stocks. Regardless of whether the price is high or low, when the value plummets, they say that value investment is invalid. This is not value. Investment, and was controlled by emotions because of the rise and fall. What is the value investor? First of all, you have to understand a company (buying stocks is equivalent to doing business). If you know that a company is worth 100 yuan, and the current price is only 30 or 50 yuan, would you buy it? Of course you will buy it (because it is a bargain). There is a problem here, that is, how do you know that this company is worth 100 yuan? This is what Buffett calls the margin of safety. For example, I am the general manager of an automobile 4S shop. How much I value the automobile 4S shop can be roughly understood through a few data, and the value of this 4S shop. So Buffett’s concept is really simple and easy to understand. The only thing we need to improve is our own margin of safety. Only when the margin of safety is increased can you find better and cheaper companies. This way market volatility will give you more opportunities. (That is to say, Mr. Market will give you the opportunity to buy good companies and cheap), now you don’t want to look at the market, and spend a lot of time thinking about (which industries or companies have: mental monopoly, just-need addiction, technology monopoly, scarcity of products, resource Monopoly, high-frequency consumption, future growth) If you are looking at the current price (whether it is cheap) $Tencent (TCEHY.US)$ $Alibaba (BABA.US)$ $Futu Holdings Ltd (FUTU.US)$

2

Luiz小财神

commented on

$TENCENT (00700.HK)$ $BABA-W (09988.HK)$ The Internet platform that has been blocked for so many years has finally formally communicated with each other. At present, some products under Tencent and Alibaba have opened external links.

In addition to Taobao which does not support WeChat, most of the other apps of Ali already support WeChat payment. WeChat can also open Douyin links and Taobao links.

Interconnection is good for Taobao, WeChat, and Douyin, but who is more good for?

For Douyin, just continue to produce high-quality content to get more traffic from WeChat, such as Kuaishou's sinking market users.

For Taobao, off-site traffic can be obtained from WeChat and Douyin platforms. Although the traffic port may be left on Douyin and WeChat in the long-term, the short-term benefits are obvious. This is the reason for the surge in Alibaba's Hong Kong stocks.

For WeChat, merchants will divert the traffic of Taobao and Douyin to WeChat, and maintain the relationship between users through private domain operations, thereby improving the repurchase rate and monetization efficiency.

If it is truly fully open, the above logic makes sense. Both Douyin and Taobao have gained new increments, WeChat's social relationship will be more stable, and WeChat Pay's share may soon surpass Alipay.

Of course, the links to Douyin and Taobao can only be shared to WeChat and can be opened, but the display effect is not very good.

The most important part of Internet products is user experience. Without a good experience, even if it is open, users may not use it frequently.

For example, WeChat now opens the Taobao product link instead of opening it directly, but first prompts the risk of the external link, and then logs in to the Taobao account before you can enter to view the product.

The situation after opening the Douyin link on WeChat is similar to Taobao. It also prompts the risk of external links before opening the video.

However, the situation of Douyin and Taobao are still different. Douyin can jump directly to the Douyin APP, and Taobao must log in, otherwise you can't do any subsequent operations.

Under such a user experience, the experience of WeChat linking into Taobao shopping is really not as convenient as opening the Taobao APP directly.

Compared with JD.com, JD.com links can be opened directly, and can be directly authorized to log in through WeChat. JD.com and Pinduoduo also support direct jumps.

Is it because Alibaba does not want users to have a good user experience on WeChat? Or does Tencent still do not want to open it completely? This question is unclear.

Complete opening is good for Alibaba in the short term, but in the long run, if the user experience on WeChat is too good, users may develop the habit of opening Taobao from WeChat. What is the value of the Taobao platform?

In any case, after the full opening of the external chain, it can indeed solve some of the traffic monopoly problem, but no matter how fierce the competition is, it is always good for the head company.

In addition to Taobao which does not support WeChat, most of the other apps of Ali already support WeChat payment. WeChat can also open Douyin links and Taobao links.

Interconnection is good for Taobao, WeChat, and Douyin, but who is more good for?

For Douyin, just continue to produce high-quality content to get more traffic from WeChat, such as Kuaishou's sinking market users.

For Taobao, off-site traffic can be obtained from WeChat and Douyin platforms. Although the traffic port may be left on Douyin and WeChat in the long-term, the short-term benefits are obvious. This is the reason for the surge in Alibaba's Hong Kong stocks.

For WeChat, merchants will divert the traffic of Taobao and Douyin to WeChat, and maintain the relationship between users through private domain operations, thereby improving the repurchase rate and monetization efficiency.

If it is truly fully open, the above logic makes sense. Both Douyin and Taobao have gained new increments, WeChat's social relationship will be more stable, and WeChat Pay's share may soon surpass Alipay.

Of course, the links to Douyin and Taobao can only be shared to WeChat and can be opened, but the display effect is not very good.

The most important part of Internet products is user experience. Without a good experience, even if it is open, users may not use it frequently.

For example, WeChat now opens the Taobao product link instead of opening it directly, but first prompts the risk of the external link, and then logs in to the Taobao account before you can enter to view the product.

The situation after opening the Douyin link on WeChat is similar to Taobao. It also prompts the risk of external links before opening the video.

However, the situation of Douyin and Taobao are still different. Douyin can jump directly to the Douyin APP, and Taobao must log in, otherwise you can't do any subsequent operations.

Under such a user experience, the experience of WeChat linking into Taobao shopping is really not as convenient as opening the Taobao APP directly.

Compared with JD.com, JD.com links can be opened directly, and can be directly authorized to log in through WeChat. JD.com and Pinduoduo also support direct jumps.

Is it because Alibaba does not want users to have a good user experience on WeChat? Or does Tencent still do not want to open it completely? This question is unclear.

Complete opening is good for Alibaba in the short term, but in the long run, if the user experience on WeChat is too good, users may develop the habit of opening Taobao from WeChat. What is the value of the Taobao platform?

In any case, after the full opening of the external chain, it can indeed solve some of the traffic monopoly problem, but no matter how fierce the competition is, it is always good for the head company.

1

Luiz小财神

commented on

Although the overall trend of $TENCENT (00700.HK)$ is still upward, I have been watching the market for a long time today. According to the pending orders, we can see that many of the pending orders bought today are small orders, and many of the sold orders are large ones. And the resistance has always been great during the rise, so I expect the resistance will be great tomorrow, and the probability of falling will be a little bit higher. In terms of technical indicators, kdj and macd are going a bit different, kdj will reach a high point tomorrow, and macd has not yet come out. The red line, maybe macd will directly follow the second wave of green line, the overall macd's upward trend is a bit weak, only when kdj and macd resonate, the rise will be stronger (personal real experience), and the whole is currently suppressed by the boll midline , And in conjunction with the holiday, there will be no Beishui tomorrow. In the past two days, Beishui has bought quite a lot. So overall, I think the probability of a fall tomorrow is high.

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)