Today is the last day of trading for 10 HSI call and put warrants and 4 HSTECH warrants. What if I am still holding onto these warrants after today? What do I have to do?

Read more here: https://tinyurl.com/42b2673t

Read more here: https://tinyurl.com/42b2673t

S&P 500: 5,867.08 (-0.09%)

Nasdaq-100: 21,110.51 (-0.47%)

DJIA: 42,342.24 (+0.04%)

Eurostoxx: 4,879.00 (-1.58%)

U.S. crude futures: 69.38 (-0.91%)

U.S. indices posted a mixed finish on Thursday, with the major averages rebounding at the start of the session before erasing gains at the close. The Dow Jones saw a marginal gain, snapping a 10-day streak of consecutive losses. Meanwhile, the S&P 500 closed lower with losses in real ...

Nasdaq-100: 21,110.51 (-0.47%)

DJIA: 42,342.24 (+0.04%)

Eurostoxx: 4,879.00 (-1.58%)

U.S. crude futures: 69.38 (-0.91%)

U.S. indices posted a mixed finish on Thursday, with the major averages rebounding at the start of the session before erasing gains at the close. The Dow Jones saw a marginal gain, snapping a 10-day streak of consecutive losses. Meanwhile, the S&P 500 closed lower with losses in real ...

– Asian indices such as the HSI futures (-1.2% to 19,650) and Nikkei225 (-1.1%% to 38,735) are trading in the red as of 925AM this morning, led by the overnight 2% drop in US indices.

– The moves come after the Fed lowered rates overnight by 25 basis points to 4.25 to 4.5% as expected, but issued quarterly forecasts showing several officials expect fewer rate cuts in 2025 than previously estimated.

– Fifteen of 19 of...

– The moves come after the Fed lowered rates overnight by 25 basis points to 4.25 to 4.5% as expected, but issued quarterly forecasts showing several officials expect fewer rate cuts in 2025 than previously estimated.

– Fifteen of 19 of...

1

Investors should note that all index warrants issued by Macquarie track their respective futures for the relevant futures contract month and not the index level. All of Macquarie’s warrants over the Dow Jones Industrial Average® Index (DJIA), NASDAQ-100® Index (NDX) and S&P 500® Index (SP500) will start tracking their respective March 2025 futures contracts from tomorrow (Thursday, 19 December) until the next roll...

– Sembcorp Industries announced this morning that it was awarded a solar project coupled with Battery Energy Storage System (BESS) by Solar Energy Corporation of India.

– Sembcorp Industries shares had been on a five-day -5% losing streak prior to today’s announcement. The shares are currently up 0.9% as of 1150AM

– Readers keen to find out MQ’s latest view on SembCorp Industries can read more here

Check out how Sembcorp Industries call warrant $SembInd MBeCW250430 (TEWW.SG)$ moves al...

– Sembcorp Industries shares had been on a five-day -5% losing streak prior to today’s announcement. The shares are currently up 0.9% as of 1150AM

– Readers keen to find out MQ’s latest view on SembCorp Industries can read more here

Check out how Sembcorp Industries call warrant $SembInd MBeCW250430 (TEWW.SG)$ moves al...

4

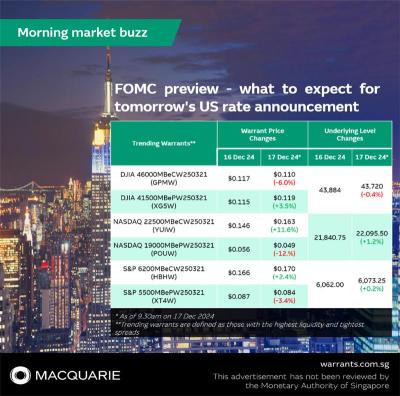

S&P 500: 6,050.61 (-0.4%)

Nasdaq-100: 22,001.08 (-0.4%)

DJIA: 43,449.90 (-0.6%)

Eurostoxx: 4,942.58 (-0.1%)

U.S. crude futures: 69.65 (-1.5%)

U.S. stock markets slipped on Tuesday ahead of the Federal Reserve interest rate decision this evening. The Dow Jones posted its first nine-day losing streak since 1978, which began the day after it closed above 45,000 for the first time on 4 December. Meanwhile, the Nasdaq-100 pulled back from it...

Nasdaq-100: 22,001.08 (-0.4%)

DJIA: 43,449.90 (-0.6%)

Eurostoxx: 4,942.58 (-0.1%)

U.S. crude futures: 69.65 (-1.5%)

U.S. stock markets slipped on Tuesday ahead of the Federal Reserve interest rate decision this evening. The Dow Jones posted its first nine-day losing streak since 1978, which began the day after it closed above 45,000 for the first time on 4 December. Meanwhile, the Nasdaq-100 pulled back from it...

2

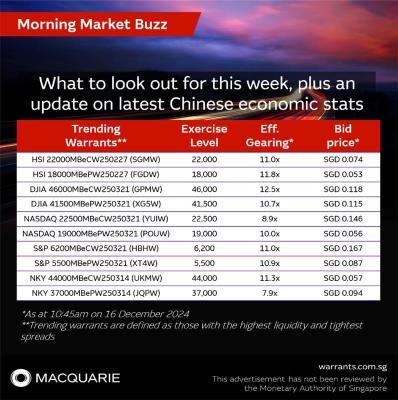

– The overnight US sentiment was relatively positive, with a widely expected 25 basis point cut from the US Federal Reserve seen as fresh support for stocks

– The rosy US sentiment stands in contrast to losses in Asia yesterday following the soft print in China’s stats

– Meanwhile, the Bank of Japan will also make a rate announcement this Thursday

– Could this week be the final active week for 2024?

– Find out what Macquarie’s Sale...

– The rosy US sentiment stands in contrast to losses in Asia yesterday following the soft print in China’s stats

– Meanwhile, the Bank of Japan will also make a rate announcement this Thursday

– Could this week be the final active week for 2024?

– Find out what Macquarie’s Sale...

– This morning at 10AM: China released economic numbers related to November retail sales, industrial output, fixed asset investment and jobless rate.

– While November's industrial production rose in line with expectations (+5.4% year on year), and the jobless rate of 5% remained steady, retail sales for November rose only 3% compared to the 5% expectation. The latest retail sales stats validate the Chinese government...

– While November's industrial production rose in line with expectations (+5.4% year on year), and the jobless rate of 5% remained steady, retail sales for November rose only 3% compared to the 5% expectation. The latest retail sales stats validate the Chinese government...

4

S&P 500: 6,051.09 (0.0%)

Nasdaq-100: 21,780.25 (+0.8%)

DJIA: 43,828.06 (-0.2%)

Eurostoxx: 4,967.95 (0.0%)

U.S. crude futures: 71.29 (+1.8%)

U.S. equities had a mixed performance on Friday. Technology shares powered higher, leading the Nasdaq-100 Index to climb 0.8%, largely driven by a surge in Broadcom Inc. due to predicted high demand for its artificial intelligence chips. However, the S&P 500 Index closed flat for the session and recorded its worst weekly...

Nasdaq-100: 21,780.25 (+0.8%)

DJIA: 43,828.06 (-0.2%)

Eurostoxx: 4,967.95 (0.0%)

U.S. crude futures: 71.29 (+1.8%)

U.S. equities had a mixed performance on Friday. Technology shares powered higher, leading the Nasdaq-100 Index to climb 0.8%, largely driven by a surge in Broadcom Inc. due to predicted high demand for its artificial intelligence chips. However, the S&P 500 Index closed flat for the session and recorded its worst weekly...

– The two-day Central Economic Work Conference has ended with an announcement that was broadcasted by the state-run Xinhua News: officials will raise the fiscal deficit target in 2025 for only the second time in a decade to help lift consumption "vigorously" and stimulate overall domestic demand.

– The government also vowed to strengthen the social safety net with broad promi...

– The government also vowed to strengthen the social safety net with broad promi...

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)