GoGoGoUSA

voted

Hi, mooers!

It's Knight Moo from the Moo Chess Set.![]() Guess what? I'm now into mountain climbing. This chessboard warrior is now adventuring up real mountains!

Guess what? I'm now into mountain climbing. This chessboard warrior is now adventuring up real mountains!

From castle spires to mountain peaks, my quest for adventure never ends.![]() The thrill of new elevations and the refreshing breezes up high are truly Moo-velous! It's similar to smart investing: you weigh the risks carefully and enjoy the spectacular views when you reach your goals.

The thrill of new elevations and the refreshing breezes up high are truly Moo-velous! It's similar to smart investing: you weigh the risks carefully and enjoy the spectacular views when you reach your goals.

Fe...

It's Knight Moo from the Moo Chess Set.

From castle spires to mountain peaks, my quest for adventure never ends.

Fe...

18

3

GoGoGoUSA

voted

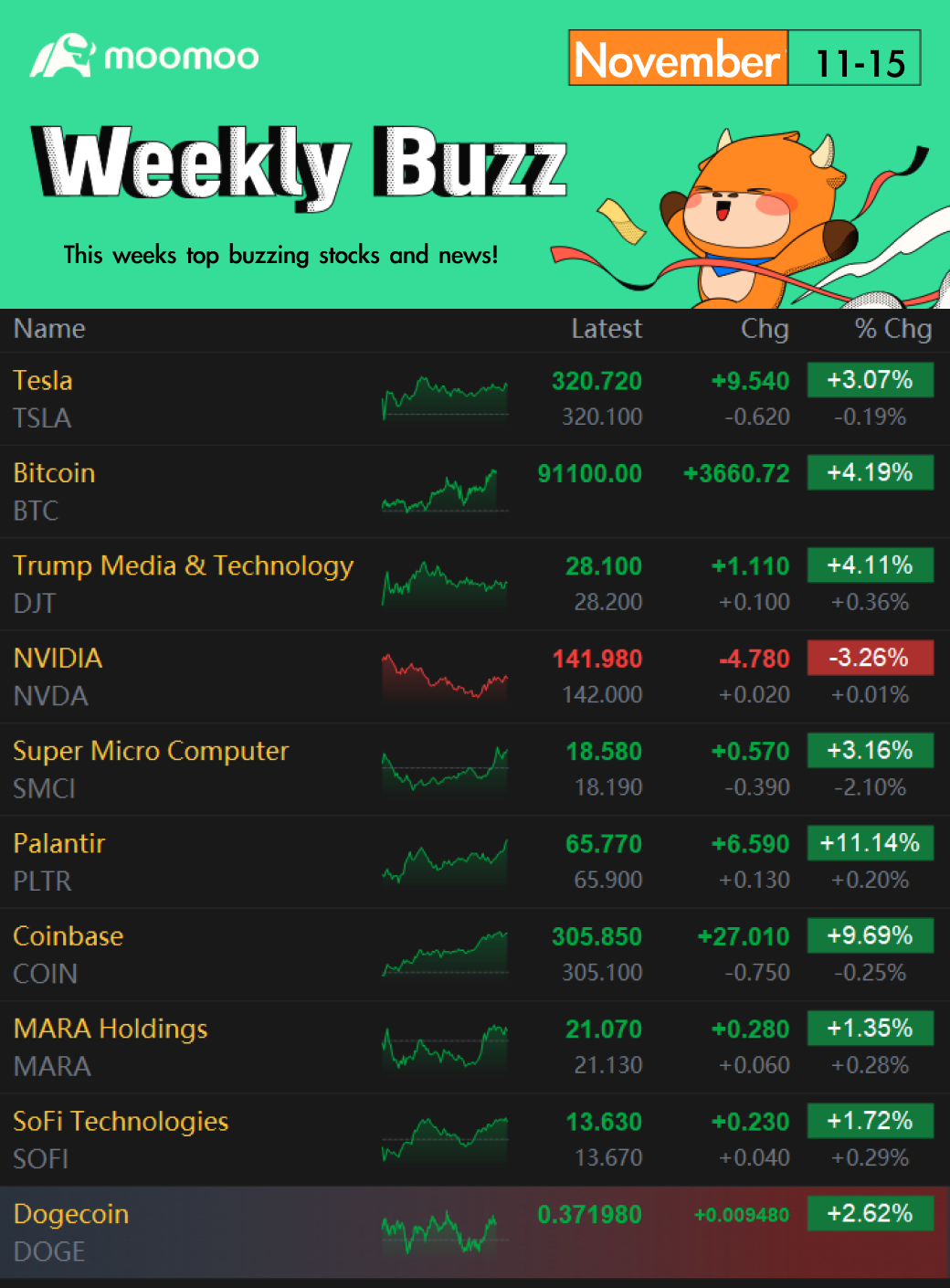

Happy weekend, investors! Welcome back to Weekly Buzz where we talk about the top ten buzzing stocks on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Make Your Choice

Weekly Buzz

This week was the first full trading week after the presidential election, and the market continued to respond positively to President-Elect Donald Trump and watched as the GOP won a majority in the Congressional House and Senat...

Make Your Choice

Weekly Buzz

This week was the first full trading week after the presidential election, and the market continued to respond positively to President-Elect Donald Trump and watched as the GOP won a majority in the Congressional House and Senat...

+10

74

33

GoGoGoUSA

commented on

$MAYBANK (1155.MY)$

After several consecutive days of decline, a typical bottom reversal signal has appeared. From a technical analysis perspective, there is strong support at the bottom, and the bearish momentum has significantly weakened. The volume has also increased, further confirming the active involvement of bid. The market is expected to see a rebound next week. It is recommended to closely monitor the follow-up trends, grasp the rhythm reasonably, and actively seek potential opportunities!

After several consecutive days of decline, a typical bottom reversal signal has appeared. From a technical analysis perspective, there is strong support at the bottom, and the bearish momentum has significantly weakened. The volume has also increased, further confirming the active involvement of bid. The market is expected to see a rebound next week. It is recommended to closely monitor the follow-up trends, grasp the rhythm reasonably, and actively seek potential opportunities!

Translated

5

2

$Advanced Micro Devices (AMD.US)$

Recently, AMD's stock price has continued to decline in the market fluctuations, gradually approaching the important technical support area. In addition, the decreasing trading volume during the pullback process indicates a weakening bearish momentum, potentially forming a temporary bottom in the technical aspect.

The company's strong fundamentals provide a solid support. AMD's position in high-performance computing, semiconductor technology, and ai chip fields, along with its expanding market share, still remains bullish on the long-term growth prospects. The performance expected in 2025 is likely to further improve, providing medium to long-term support for the stock price.

With the stock price pulling back to the range of $138 and $127, considering AMD's strong technological innovation and industry competitiveness, amidst the continuous growth of the global semiconductor market, the current adjustment can be seen as a good opportunity for long-term investors to grasp core assets. It is expected that they will enjoy significant potential gains when the market recovers in the future.

I will carefully layout in this key range, grasp the entry opportunity for this long-term growth potential stock!

Recently, AMD's stock price has continued to decline in the market fluctuations, gradually approaching the important technical support area. In addition, the decreasing trading volume during the pullback process indicates a weakening bearish momentum, potentially forming a temporary bottom in the technical aspect.

The company's strong fundamentals provide a solid support. AMD's position in high-performance computing, semiconductor technology, and ai chip fields, along with its expanding market share, still remains bullish on the long-term growth prospects. The performance expected in 2025 is likely to further improve, providing medium to long-term support for the stock price.

With the stock price pulling back to the range of $138 and $127, considering AMD's strong technological innovation and industry competitiveness, amidst the continuous growth of the global semiconductor market, the current adjustment can be seen as a good opportunity for long-term investors to grasp core assets. It is expected that they will enjoy significant potential gains when the market recovers in the future.

I will carefully layout in this key range, grasp the entry opportunity for this long-term growth potential stock!

Translated

GoGoGoUSA

commented on

6

2

GoGoGoUSA

reacted to

$MAYBANK (1155.MY)$

The upcoming financial report may be lower than expected. Maybank's profit growth may face pressure, including a slowdown in loan demand in Malaysia. Analysts have also lowered their expectations for Maybank's financial report.

The depreciation of the Malaysian Ringgit. The softening of the Ringgit and foreign capital outflows have increased pressure on Maybank, as Maybank operates in multiple Southeast Asian markets, so both profits and balance sheets will be affected by exchange rate fluctuations. Especially if the Ringgit weakens, the value of overseas assets will decrease, which will certainly impact the company's financial performance.

Anhua's new policy of imposing a 2% tax on dividend income exceeding 0.1 million Ringgit may increase investors' concerns about the outlook for bank stocks, especially Maybank's high dividend yield.

[Short-term: If there is no substantial improvement in the global and local economies, the stock may continue to decline. However, if the financial reports released at the end of the month exceed expectations or market sentiment improves, it may rebound.]

[Long-term: There are no major issues with the fundamentals, showing strong profitability, high dividend yield, excellent cost management. Although the PE ratio is not high, it is somewhat attractive compared to other banks in Southeast Asia.]

The upcoming financial report may be lower than expected. Maybank's profit growth may face pressure, including a slowdown in loan demand in Malaysia. Analysts have also lowered their expectations for Maybank's financial report.

The depreciation of the Malaysian Ringgit. The softening of the Ringgit and foreign capital outflows have increased pressure on Maybank, as Maybank operates in multiple Southeast Asian markets, so both profits and balance sheets will be affected by exchange rate fluctuations. Especially if the Ringgit weakens, the value of overseas assets will decrease, which will certainly impact the company's financial performance.

Anhua's new policy of imposing a 2% tax on dividend income exceeding 0.1 million Ringgit may increase investors' concerns about the outlook for bank stocks, especially Maybank's high dividend yield.

[Short-term: If there is no substantial improvement in the global and local economies, the stock may continue to decline. However, if the financial reports released at the end of the month exceed expectations or market sentiment improves, it may rebound.]

[Long-term: There are no major issues with the fundamentals, showing strong profitability, high dividend yield, excellent cost management. Although the PE ratio is not high, it is somewhat attractive compared to other banks in Southeast Asia.]

Translated

32

GoGoGoUSA

commented on

$Taiwan Semiconductor (TSM.US)$ Good price, add a little warehouse.

Translated

2

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)