makotonakano

voted

[Rewards]

To the 3 users who made the closest predictions,500 yen Amazon gift cardI will give it as a present.

[How to participate]

By 10/26 8:00 p.m. Japan timeThe opening price of Meta on October 26thPlease anticipate and post! (Example: the opening price is expected to be $320). I would be happy if you could include your own investment ideas too! Please share your impressions and comments on the financial results!

Meta's 2023 Q3 financial results briefing Aftermarket on October 25thIt is scheduled to be held on 10/25 (6:00 a.m. Japan time).

Wall Street is Facebook's parent company33.4 billion 30 millionPer share in dollar sales$3.62 profitI expect to get it. This represents a significant increase in sales and profit compared to net sales of 27.7 billion dollars and earnings per share of 1.64 dollars in the same period last year.

You may be able to find more trading opportunities by receiving financial results!

*The financial results briefing is scheduled for 10/26 at 6 a.m. Japan time.

Click here for the live stream of the financial results briefing:

Meta 2023-Q3 financial results briefing (subtitle translation)

...

To the 3 users who made the closest predictions,500 yen Amazon gift cardI will give it as a present.

[How to participate]

By 10/26 8:00 p.m. Japan timeThe opening price of Meta on October 26thPlease anticipate and post! (Example: the opening price is expected to be $320). I would be happy if you could include your own investment ideas too! Please share your impressions and comments on the financial results!

Meta's 2023 Q3 financial results briefing Aftermarket on October 25thIt is scheduled to be held on 10/25 (6:00 a.m. Japan time).

Wall Street is Facebook's parent company33.4 billion 30 millionPer share in dollar sales$3.62 profitI expect to get it. This represents a significant increase in sales and profit compared to net sales of 27.7 billion dollars and earnings per share of 1.64 dollars in the same period last year.

You may be able to find more trading opportunities by receiving financial results!

*The financial results briefing is scheduled for 10/26 at 6 a.m. Japan time.

Click here for the live stream of the financial results briefing:

Meta 2023-Q3 financial results briefing (subtitle translation)

...

Translated

![[Privileges available] Let's get rewards by predicting the opening price of Meta (Meta) after the Q3 financial results are announced!](https://sgsnsimg.moomoo.com/181000777/editor_image/0d0610bf481c345abe5db23889808978.jpg/thumb)

7

12

makotonakano

voted

Policy makers at the Federal Reserve Board (FRB) are increasingly likely to keep interest rates unchanged at the next meeting in September, following new data indicating signs of cooling inflation.

According to data released by the Bureau of Labor Statistics on August 10th, the Core Consumer Price Index (CPI), which excludes volatile food and energy costs, rose by 0.2% for the second consecutive month. The rate of increase over these 2 months is the smallest in the past 2 years. The overall CPI also rose by 0.2% in July, with a 3.2% increase compared to the same month last year.

Stephen Stanley, Chief Economist at Santander US Capital Markets LLC, said, 'The FRB must have taken courage from two consecutive low numbers. I think the intention of the FRB is to skip in September. It's a certainty that these won't be the final words.'

In July, the Federal Reserve Board (FRB) raised the Federal Funds Rate to a range of 5.25% to 5.5%, the highest level in the past 22 years. The median forecast of FRB officials for the most recent quarter, released in June, indicated two more rate hikes this year, with the first hike achieved in last month's increase.

President Michel Bowman mentioned on August 7th the need for further interest rate hikes to fully restore price stability.

According to data released by the Bureau of Labor Statistics on August 10th, the Core Consumer Price Index (CPI), which excludes volatile food and energy costs, rose by 0.2% for the second consecutive month. The rate of increase over these 2 months is the smallest in the past 2 years. The overall CPI also rose by 0.2% in July, with a 3.2% increase compared to the same month last year.

Stephen Stanley, Chief Economist at Santander US Capital Markets LLC, said, 'The FRB must have taken courage from two consecutive low numbers. I think the intention of the FRB is to skip in September. It's a certainty that these won't be the final words.'

In July, the Federal Reserve Board (FRB) raised the Federal Funds Rate to a range of 5.25% to 5.5%, the highest level in the past 22 years. The median forecast of FRB officials for the most recent quarter, released in June, indicated two more rate hikes this year, with the first hike achieved in last month's increase.

President Michel Bowman mentioned on August 7th the need for further interest rate hikes to fully restore price stability.

Translated

5

makotonakano

voted

This time, we invited Mr. PAN to talk about his investment experience. How did they choose the investment market and how did they earn 100 million yen in 5 years? How did you reflect when your investment failed...

I was also asked to answer the questions I had received from everyone beforehand. Let's take a look at PAN's answers together!

──What led you to start investing? Have you ever woken up to investing?

PAN: I was living in the US when I started investing in American stocks in 2013, and when I noticed, my bank account balance was around 300,000 dollars.At that time, the US also had zero interest ratesSo even if you keep it in a bank, it won't increase.Investments are importantI had that input into my head, and I thought I had to do something, so I started investing.

The reason I started investing in the first place was that when I went to an American bank for some kind of errand, the person at the counter said, “It's a waste not to manage even though I have quite a bit of balance. I will introduce the person in charge of operation.” I was told that 2 Japanese women were introduced...

Translated

114

5

36

makotonakano

reacted to

I understand the logic that interest rates increase as risk increases.

However, in the following article, it is written that “since demand for safe assets increases, US bonds are being bought and interest rates are also rising.”

Eh, since the rating has gone down, the safety level has dropped, right?

Hmm, I don't understand the logic.

$U.S. 10-Year Treasury Notes Yield (US10Y.BD)$

I wonder if I'll wander around 4% for a while.

Since US interest rates are expected to drop from next year or so, interest rates will probably drop accordingly.

$Direxion Daily 20+ Year Treasury Bull 3X Shares ETF (TMF.US)$

So, TMF is popular.

I thought I'd like to buy TLT or EDV, but it's true that TMF has higher expectations for price increases.

$iShares 20+ Year Treasury Bond ETF (TLT.US)$

However, the risk of a 3x bull is huge, isn't it? In theory, it's “when you stop.”

Why don't you try holding it with a satellite?

Either way, the yen depreciates...

However, in the following article, it is written that “since demand for safe assets increases, US bonds are being bought and interest rates are also rising.”

Eh, since the rating has gone down, the safety level has dropped, right?

Hmm, I don't understand the logic.

$U.S. 10-Year Treasury Notes Yield (US10Y.BD)$

I wonder if I'll wander around 4% for a while.

Since US interest rates are expected to drop from next year or so, interest rates will probably drop accordingly.

$Direxion Daily 20+ Year Treasury Bull 3X Shares ETF (TMF.US)$

So, TMF is popular.

I thought I'd like to buy TLT or EDV, but it's true that TMF has higher expectations for price increases.

$iShares 20+ Year Treasury Bond ETF (TLT.US)$

However, the risk of a 3x bull is huge, isn't it? In theory, it's “when you stop.”

Why don't you try holding it with a satellite?

Either way, the yen depreciates...

Translated

7

makotonakano

reacted to

I don't really understand the connection.

No, that's a lie, I don't understand at all.

$Nikkei 225 (.N225.JP)$

No, that's a lie, I don't understand at all.

$Nikkei 225 (.N225.JP)$

Translated

1

4

makotonakano

reacted to

Credit rating agency Fitch Ratings downgraded the rating of USA bonds from the highest 'AAA' to 'AA+' by one notch on August 1st.

In the past, despite being downgraded in 2011, the price of USA bonds rose. (Details available through YouTube Membership).

It is unclear whether the same will happen this time, but diversification is essential for bond investors as volatility increases. The US employment statistics on August 4th are also worth paying attention to.

In the past, despite being downgraded in 2011, the price of USA bonds rose. (Details available through YouTube Membership).

It is unclear whether the same will happen this time, but diversification is essential for bond investors as volatility increases. The US employment statistics on August 4th are also worth paying attention to.

Translated

8

makotonakano

voted

Summary:

Credit rating agency Fitch downgraded the highest rating of the U.S. government on Tuesday.This provoked anger from the White House and surprised investors, despite the resolution of the debt ceiling crisis two months ago.

Fitch downgraded the U.S. rating from AAA to AA+ citing the country's deteriorating fiscal situation over the next three years and doubts about the government's repayment capacity, resulting from repeated tense debt ceiling negotiations.

As a result of this downgrade, Fitch will become the second largest rating agency in the United States to have its AAA rating revoked following S&P.

Impact on the USA

1. The dollar declined against a wide range of currencies; 2. Single stock futures fell; 3. US bond futures rose

Comments from analysts

Analysts pointed out the risk that further downgrades by major rating agencies could affect investment portfolios holding the highest rated securities.

However, Raymond James analyst Ed Mills stated on Tuesday that he did not expect the market to react significantly to this news.

The analyst understands that after the downgrade by S&P, many of these contracts have been redrawn to indicate 'triple A' or 'government-backed'. Therefore, they are more concerned with Fitch's rating...

Credit rating agency Fitch downgraded the highest rating of the U.S. government on Tuesday.This provoked anger from the White House and surprised investors, despite the resolution of the debt ceiling crisis two months ago.

Fitch downgraded the U.S. rating from AAA to AA+ citing the country's deteriorating fiscal situation over the next three years and doubts about the government's repayment capacity, resulting from repeated tense debt ceiling negotiations.

As a result of this downgrade, Fitch will become the second largest rating agency in the United States to have its AAA rating revoked following S&P.

Impact on the USA

1. The dollar declined against a wide range of currencies; 2. Single stock futures fell; 3. US bond futures rose

Comments from analysts

Analysts pointed out the risk that further downgrades by major rating agencies could affect investment portfolios holding the highest rated securities.

However, Raymond James analyst Ed Mills stated on Tuesday that he did not expect the market to react significantly to this news.

The analyst understands that after the downgrade by S&P, many of these contracts have been redrawn to indicate 'triple A' or 'government-backed'. Therefore, they are more concerned with Fitch's rating...

Translated

7

makotonakano

liked

Treasury Secretary Yellen has been downgraded and is extremely aggressive. Market participants expect that the impact will not be significant.

Until now, the rise has been large, with the NASDAQ at the top, so those who take a short break can run for a long time. Even amateurs think so, so professionals probably think so too. They say adjustments need to be made somewhere.

This is a great opportunity! If the market does not adjust even with this, deeper and longer adjustments may come in the future. I want you to stop doing that.

In the short term, positions are reduced or hedged on runaway grounds. I want to buy more stocks I own as a good long-term promotion!

Until now, the rise has been large, with the NASDAQ at the top, so those who take a short break can run for a long time. Even amateurs think so, so professionals probably think so too. They say adjustments need to be made somewhere.

This is a great opportunity! If the market does not adjust even with this, deeper and longer adjustments may come in the future. I want you to stop doing that.

In the short term, positions are reduced or hedged on runaway grounds. I want to buy more stocks I own as a good long-term promotion!

Translated

8

makotonakano

liked and voted

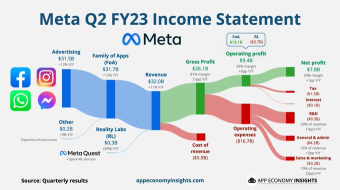

$Meta Platforms (META.US)$ Meta Q2 FY23:

• Daily active people +7% Y/Y to 3.07B.

• Revenue +11% Y/Y to $32B ($1.2B beat).

• Operating margin 29% (flat Y/Y).

• FCF margin 34% (+19pp Y/Y).

• EPS $2.98 ($0.05 beat).

Q3 FY23 guidance:

• Revenue ~$32B-$34.5 (~$2B beat).

- In the second quarter, revenue achieved the largest year-and-a-half YoY growth, and EPS rebounded, halting the decline, with an ...

• Daily active people +7% Y/Y to 3.07B.

• Revenue +11% Y/Y to $32B ($1.2B beat).

• Operating margin 29% (flat Y/Y).

• FCF margin 34% (+19pp Y/Y).

• EPS $2.98 ($0.05 beat).

Q3 FY23 guidance:

• Revenue ~$32B-$34.5 (~$2B beat).

- In the second quarter, revenue achieved the largest year-and-a-half YoY growth, and EPS rebounded, halting the decline, with an ...

10

makotonakano

voted

Columns Coca-Cola - KO quarter!

This could be one of the best quarters for $Coca-Cola (KO.US)$.

The company not only recovered from the COVID-19 period.

It is blossoming and growing much more than it used to.

1. Revenue growth on price action adjustments

Conversely from TSLA, which reported more deliveries yet lower revenue, Coca-Cola did the opposite - unit case volume was even, but net revenue grew 6%. Organically, it was up 11%.

2. Revenues rose at a higher rate than the cost of goods

What amplifies ...

The company not only recovered from the COVID-19 period.

It is blossoming and growing much more than it used to.

1. Revenue growth on price action adjustments

Conversely from TSLA, which reported more deliveries yet lower revenue, Coca-Cola did the opposite - unit case volume was even, but net revenue grew 6%. Organically, it was up 11%.

2. Revenues rose at a higher rate than the cost of goods

What amplifies ...

+1

21

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)