Manja BitzAbekDollar

reacted to

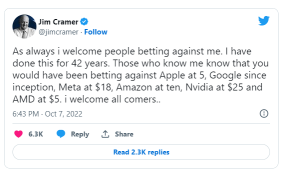

Whether you are a lover or hater of Jim Cramer, you can now express that view via the magic of ETFs.

A pair of new products launched on Thursday that will help investors bet either on or against the stock picks of the host of CNBC's Mad Money show, arguably the world's most famous financial pundit.

The $INVERSE CRAMER TRACKER ETF (SJIM.US)$ seeks to deliver returns that correspond to "the inverse of securities mentioned ...

A pair of new products launched on Thursday that will help investors bet either on or against the stock picks of the host of CNBC's Mad Money show, arguably the world's most famous financial pundit.

The $INVERSE CRAMER TRACKER ETF (SJIM.US)$ seeks to deliver returns that correspond to "the inverse of securities mentioned ...

21

10

16

Manja BitzAbekDollar

reacted to

QUICK SCALP 1 $UPST — STOCK AND OPTION PLAY

NEED IT TO BREAK OVER: $28.55

key indicator for MORE uptrend $28.67

confirmation uptrend - $28.78

mini breakout - $28.88. $Upstart (UPST.US)$

NEED IT TO BREAK OVER: $28.55

key indicator for MORE uptrend $28.67

confirmation uptrend - $28.78

mini breakout - $28.88. $Upstart (UPST.US)$

4

Manja BitzAbekDollar

reacted to

QUICK SCALP $ILAG — STOCK PLAY

NEED IT TO BREAK OVER: $4.26

key indicator for MORE uptrend $4.33

confirmation uptrend - $4.44

mini breakout - $4.68 $Intelligent Living Application (ILAG.US)$

NEED IT TO BREAK OVER: $4.26

key indicator for MORE uptrend $4.33

confirmation uptrend - $4.44

mini breakout - $4.68 $Intelligent Living Application (ILAG.US)$

3

3

Manja BitzAbekDollar

reacted to

QUICK SCALP $QD — STOCK & OPTION PLAY

NEED IT TO BREAK OVER: $2.10

key indicator for MORE uptrend $2.16

confirmation uptrend - $2.27

mini breakout - $2.45. $Qudian (QD.US)$

NEED IT TO BREAK OVER: $2.10

key indicator for MORE uptrend $2.16

confirmation uptrend - $2.27

mini breakout - $2.45. $Qudian (QD.US)$

1

Manja BitzAbekDollar

reacted to

MooMoo's account update 19Jul2022

A volatile but doom forecast coming?

Earning seasons is starting but I would say that, this round, is nothing to excite about. We know that there are two major factors to decide an earning move of a stock: Double beat/miss and forecast. Sometimes, forecast plays more important role in the earning move.

However, because of the higher inflation and higher interest rate environment, we could anticipate companies...

A volatile but doom forecast coming?

Earning seasons is starting but I would say that, this round, is nothing to excite about. We know that there are two major factors to decide an earning move of a stock: Double beat/miss and forecast. Sometimes, forecast plays more important role in the earning move.

However, because of the higher inflation and higher interest rate environment, we could anticipate companies...

4

1

Manja BitzAbekDollar

reacted to

I used to think that macro analysis isn't important if you are investing in companies. Increasingly I think they are important given that governments and central bankers are interfering with the markets more than ever before.

We saw firsthand how the US stock market bull run was fuelled by Quantitative Easing 1-4. Using this indicator alone and just buy stocks whenever there is a huge QE would already yield good returns.

Before you set to become ...

We saw firsthand how the US stock market bull run was fuelled by Quantitative Easing 1-4. Using this indicator alone and just buy stocks whenever there is a huge QE would already yield good returns.

Before you set to become ...

15

1

2

Manja BitzAbekDollar

reacted to

Manja BitzAbekDollar

reacted to

$Dow Jones Industrial Average (.DJI.US)$ $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ We’ve had RETRACTION not GROWTH the last 3 GDP reports. Somehow we are expected to post a positive number of 0.90. Given the econimic headwinds of inflation, a strong dollar discouraging exports, interest rate hikes and expensive oil …. all of which impact GDP negatively … I just don’t see it. $Apple (AAPL.US)$ reports earnings on the same day. We may b...

8

1

Manja BitzAbekDollar

reacted to

MACRO

Morgan Stanley, Goldman Say Stocks Have Yet to Find a Bottom

A rally in stock markets may prove to be short-lived as inflation pressures remain high and a recession seems increasingly likely, according to strategists at $Morgan Stanley (MS.US)$ and $Goldman Sachs (GS.US)$.

For Morgan Stanley, the odds of a US recession continue to increase, with the broker's model showing a 36% probability in the next 12 months, whi...

Morgan Stanley, Goldman Say Stocks Have Yet to Find a Bottom

A rally in stock markets may prove to be short-lived as inflation pressures remain high and a recession seems increasingly likely, according to strategists at $Morgan Stanley (MS.US)$ and $Goldman Sachs (GS.US)$.

For Morgan Stanley, the odds of a US recession continue to increase, with the broker's model showing a 36% probability in the next 12 months, whi...

21

7

17

Manja BitzAbekDollar

reacted to

Hi mooers!

Congratulations! We have passed halfway through this Technical Analysis Challenge journey.![]()

Six sessions have already been released in the past three months, including MA, Bollinger Bands, RSI, KDJ, etc. Over 800 mooers have joined this challenge. How many topics did you participate in? Or are you still new to this challenge?

It's never too late to join! Like @Milk The Cowsaid: "I have heard a lot...

Congratulations! We have passed halfway through this Technical Analysis Challenge journey.

Six sessions have already been released in the past three months, including MA, Bollinger Bands, RSI, KDJ, etc. Over 800 mooers have joined this challenge. How many topics did you participate in? Or are you still new to this challenge?

It's never too late to join! Like @Milk The Cowsaid: "I have heard a lot...

51

20

16

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)