Manlp1228

liked

99 Speed Mart Retail Holdings Berhad, the largest Malaysian home-grown mini-market chain retailer is set to debut on the MAIN Market under the Consumer Products & Services sector on 9 September 2024. More insights at https://bit.ly/99speedmartipo

#BursaDigitalResearch #IPOAlert

#BursaDigitalResearch #IPOAlert

569

192

Manlp1228

liked

the leading sector ETF (limited gains with limited loss)

$The Health Care Select Sector SPDR® Fund (XLV.US)$

My Individual Pharma Stocks

Many were up more but gave back some gains at close

$Deciphera Pharmaceuticals (DCPH.US)$

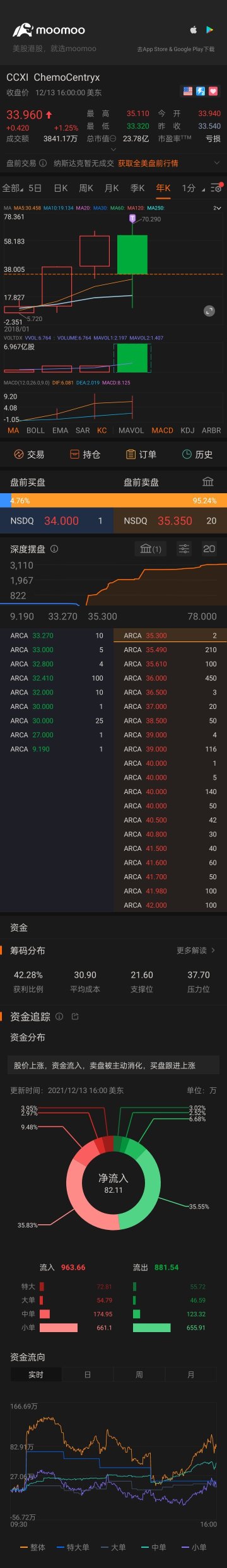

$ChemoCentryx (CCXI.US)$

$Cortexyme (CRTX.US)$

$180 Life Sciences (ATNF.US)$

$CorMedix (CRMD.US)$

$Aurinia Pharmaceuticals (AUPH.US)$

$Citius Pharmaceuticals (CTXR.US)$

$Coherus BioSciences (CHRS.US)$

$Biofrontera (BFRI.US)$

$The Health Care Select Sector SPDR® Fund (XLV.US)$

My Individual Pharma Stocks

Many were up more but gave back some gains at close

$Deciphera Pharmaceuticals (DCPH.US)$

$ChemoCentryx (CCXI.US)$

$Cortexyme (CRTX.US)$

$180 Life Sciences (ATNF.US)$

$CorMedix (CRMD.US)$

$Aurinia Pharmaceuticals (AUPH.US)$

$Citius Pharmaceuticals (CTXR.US)$

$Coherus BioSciences (CHRS.US)$

$Biofrontera (BFRI.US)$

29

6

Manlp1228

liked

Let’s Talk About “Market Makers”

Getting Straight to the point.

There are 3 Licenses needed to be a variation of what most retail traders consider a “Market Maker”.

However each license does not make you a market maker.

There are three different types of license holders:

\-Designated Market Makers (DMMs),

\-Floor brokers

\-Supplemental liquidity providers (SLPs)

1.) The DMMs, formerly known as “specialists,” act as dealers in particular stocks. Typically, each stock on the NYSE is assigned to a single DMM. As a dealer, a DMM maintains a two-sided market, meaning that the DMM continually posts and updates bid and ask prices. Because of this, the DMM ensures there is always a buyer or seller available, promoting market liquidity.

2.) The job of a floor broker is to execute trades for customers, with a LARGE emphasis on getting the best price possible. Floor brokers are generally employees of large brokerage firms. The interaction between floor brokers and DMMs is the key to this old-school, non-electronic trading on the NYSE.

3.) Now the SLPs are essentially investment firms that agree to be active participants in stocks assigned to them. Their job is to regularly make a one-sided market (i.e., offering to either buy or sell). They trade purely for their own accounts (using their own money), so they do not represent customers. They are given a small rebate on their buys and sells, which encourages them to be more aggressive. The NYSE’s goal is to generate as much liquidity as possible, which makes it easier for ordinary investors to quickly buy and sell at prevailing prices. Unlike DMMs and floor brokers, SLPs do not operate on the floor of the stock exchange.

Example of DMM Role:

On the floor of the exchange are a number of stations. These stations have multiple counters with numerous terminal screens above and on the sides. These stations have multiple counters with numerous terminal screens above and on the sides. People operate behind and in front of the counters in relatively stationary positions.

Each of the counters is a DMM’s post DMMs normally operate in front of their posts to monitor and manage trading in the stocks assigned to them. Clerical employees working for the DMMs operate behind the counter. Moving from the many workstations lining the walls of the exchange out to the exchange floor and back again are swarms of floor brokers, receiving customer orders, walking out to DMMs’ posts where the orders can be executed, and returning to confirm order executions and receive new customer orders.

Important: There are two key differences between the NYSE and NASDAQ: (1) NASDAQ is a computer network and has no physical location where trading takes place, and (2) NASDAQ has a multiple market maker system rather than a DMM system. Notice that there is no direct trading in the crowd as there may be on the NYSE.

Example of DMM Role:

Your clerk has just handed you an order to sell 2,000 shares of Walmart for a customer of the brokerage company that employs you. The customer wants to sell the stock at the best possible price as soon as possible. You immediately walk (running violates exchange rules) to the DMM’s post where Walmart stock is traded. As you approach the DMM’s post where Walmart is traded, you check the terminal screen for information on the current market price. The screen reveals that the last executed trade was at $25.63, and that the DMM is bidding $25.50 per share. You could immediately sell to the DMM at $25.50, but that would be too easy. nstead, as the customer’s representative, you are obligated to get the best possible price. It is your job to “work” the order, and your job depends on providing satisfactory order execution service. So, you look around for another broker who represents a customer who wants to buy Walmart stock. Luckily, you quickly find another broker at the DMM’s post with an order to buy 2,000 shares. Noticing that the dealer is asking $25.76 per share, you both agree to execute your orders with each other at a price of $25.63. This price is halfway between the DMM’s bid and ask prices, and it saves each of your customers $.13 × 2,000 = $260 as compared to dealing at the posted prices.

For a very actively traded stock, there may be many buyers and sellers around the DMM’s post, and most of the trading will be done directly between brokers. This is called trading in the “crowd.” In such cases, the DMM’s responsibility is to maintain order and to make sure that all buyers and sellers receive a fair price. In other words, the DMM essentially functions as a referee. often, however, there will be no crowd at the DMM’s post. Going back to our Walmart example, suppose you are unable to quickly find another broker with an order to buy 2,000 shares. Because you have an order to sell immediately, you may have no choice but to sell to the DMM at the bid price of $25.50. In this case, the need to execute an order quickly takes priority, and the DMM provides the liquidity necessary to allow immediate order execution.

$SPDR S&P 500 ETF (SPY.US)$ $Senseonics (SENS.US)$ $Phunware (PHUN.US)$

Getting Straight to the point.

There are 3 Licenses needed to be a variation of what most retail traders consider a “Market Maker”.

However each license does not make you a market maker.

There are three different types of license holders:

\-Designated Market Makers (DMMs),

\-Floor brokers

\-Supplemental liquidity providers (SLPs)

1.) The DMMs, formerly known as “specialists,” act as dealers in particular stocks. Typically, each stock on the NYSE is assigned to a single DMM. As a dealer, a DMM maintains a two-sided market, meaning that the DMM continually posts and updates bid and ask prices. Because of this, the DMM ensures there is always a buyer or seller available, promoting market liquidity.

2.) The job of a floor broker is to execute trades for customers, with a LARGE emphasis on getting the best price possible. Floor brokers are generally employees of large brokerage firms. The interaction between floor brokers and DMMs is the key to this old-school, non-electronic trading on the NYSE.

3.) Now the SLPs are essentially investment firms that agree to be active participants in stocks assigned to them. Their job is to regularly make a one-sided market (i.e., offering to either buy or sell). They trade purely for their own accounts (using their own money), so they do not represent customers. They are given a small rebate on their buys and sells, which encourages them to be more aggressive. The NYSE’s goal is to generate as much liquidity as possible, which makes it easier for ordinary investors to quickly buy and sell at prevailing prices. Unlike DMMs and floor brokers, SLPs do not operate on the floor of the stock exchange.

Example of DMM Role:

On the floor of the exchange are a number of stations. These stations have multiple counters with numerous terminal screens above and on the sides. These stations have multiple counters with numerous terminal screens above and on the sides. People operate behind and in front of the counters in relatively stationary positions.

Each of the counters is a DMM’s post DMMs normally operate in front of their posts to monitor and manage trading in the stocks assigned to them. Clerical employees working for the DMMs operate behind the counter. Moving from the many workstations lining the walls of the exchange out to the exchange floor and back again are swarms of floor brokers, receiving customer orders, walking out to DMMs’ posts where the orders can be executed, and returning to confirm order executions and receive new customer orders.

Important: There are two key differences between the NYSE and NASDAQ: (1) NASDAQ is a computer network and has no physical location where trading takes place, and (2) NASDAQ has a multiple market maker system rather than a DMM system. Notice that there is no direct trading in the crowd as there may be on the NYSE.

Example of DMM Role:

Your clerk has just handed you an order to sell 2,000 shares of Walmart for a customer of the brokerage company that employs you. The customer wants to sell the stock at the best possible price as soon as possible. You immediately walk (running violates exchange rules) to the DMM’s post where Walmart stock is traded. As you approach the DMM’s post where Walmart is traded, you check the terminal screen for information on the current market price. The screen reveals that the last executed trade was at $25.63, and that the DMM is bidding $25.50 per share. You could immediately sell to the DMM at $25.50, but that would be too easy. nstead, as the customer’s representative, you are obligated to get the best possible price. It is your job to “work” the order, and your job depends on providing satisfactory order execution service. So, you look around for another broker who represents a customer who wants to buy Walmart stock. Luckily, you quickly find another broker at the DMM’s post with an order to buy 2,000 shares. Noticing that the dealer is asking $25.76 per share, you both agree to execute your orders with each other at a price of $25.63. This price is halfway between the DMM’s bid and ask prices, and it saves each of your customers $.13 × 2,000 = $260 as compared to dealing at the posted prices.

For a very actively traded stock, there may be many buyers and sellers around the DMM’s post, and most of the trading will be done directly between brokers. This is called trading in the “crowd.” In such cases, the DMM’s responsibility is to maintain order and to make sure that all buyers and sellers receive a fair price. In other words, the DMM essentially functions as a referee. often, however, there will be no crowd at the DMM’s post. Going back to our Walmart example, suppose you are unable to quickly find another broker with an order to buy 2,000 shares. Because you have an order to sell immediately, you may have no choice but to sell to the DMM at the bid price of $25.50. In this case, the need to execute an order quickly takes priority, and the DMM provides the liquidity necessary to allow immediate order execution.

$SPDR S&P 500 ETF (SPY.US)$ $Senseonics (SENS.US)$ $Phunware (PHUN.US)$

21

Manlp1228

liked

$NIO Inc (NIO.US)$ why you still dropping? isnt NIO day arriving?

11

1

Manlp1228

liked

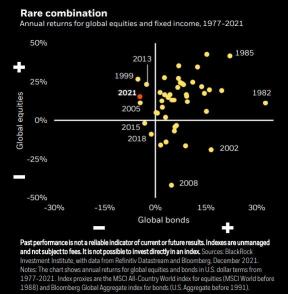

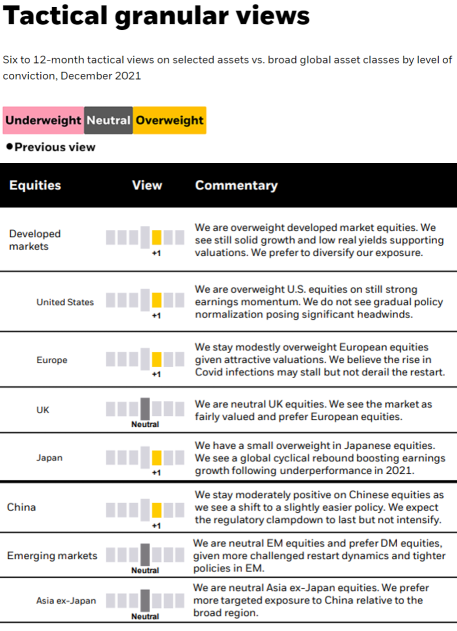

We are entering a new market regime unlike any in the past half century: We see another year of positive equity returns coupled with a down year for bonds. But BlackRock have dialed back our risk-taking given the wide range of potential outcomes in 2022.

The global investment manager--BlackRock published 2022 Global Outlook 'Thriving in a new market regime' and offered three investment themes and suggestion.

BlackRock favors Chinese assets in 2022 outlook. Meanwhile, JP Morgan, Goldman Sachs, Bridgewater, Fedility, Vanguard and other Wallstreet insitutions bullish on China.

01 Living with inflation

We expect inflation to be persistent and settle above pre-Covid levels. We expect central banks to kick off rate hikes but remain more tolerant of price pressures, keeping real interest rates historically low and supportive of risk assets.

Implication: prefer equities over fixed income and remain overweight inflation- linked bonds.

02 Cutting through confusion

A unique mix of events – the restart, new virus strains, supply-driven inflation and new central bank frameworks – could cause markets and policymakers to misread inflation. We keep the big picture in mind but acknowledge risks – to the upside and downside - around our core view.

Implication: trim risk amid an unusually wide range of outcomes.

03 Navigating net zero

The journey for the world to achieve net-zero emissions by 2050 is happening now, and is part of the inflation story. We believe a smooth transition is the least inflationary outcome, yet even this still amounts to a supply shock playing out over decades.

Implication: favor developed market (DM) equities over emerging markets (EM).

Meanwhile,Blackrock said they see a significant shift in China's overall policy stance toward greater state intervention and social objectives, even at the occasional expense of growth. The regulatory clampdown and tighter policy stance that rattled global investors in 2021 made that shift clear.

Yet we believe the low starting point of global investor allocations to Chinese assets is at odds with the economy's growing heft in the world. We estimate current allocations in global portfolios point to an overly negative economic outlook in coming years- such as a long-lasting growth shock akin to Japan in the 1990s.

We maintain our long-term overweight to Chinese assets relative to low global allocations. We assume greater regulation over a strategic horizon as China balances social and economic mobjectives – one reason we bake in materially higher uncertainty and risk premia for China compared with DM markets.

We recognize the risks, yet see current valuations as offering eligible investors adequate compensation for them.

$Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$ $S&P 500 Index (.SPX.US)$ $Hang Seng Index (800000.HK)$ $SSE Composite Index (000001.SH)$ $Hang Seng TECH Index (800700.HK)$

$Tesla (TSLA.US)$

The global investment manager--BlackRock published 2022 Global Outlook 'Thriving in a new market regime' and offered three investment themes and suggestion.

BlackRock favors Chinese assets in 2022 outlook. Meanwhile, JP Morgan, Goldman Sachs, Bridgewater, Fedility, Vanguard and other Wallstreet insitutions bullish on China.

01 Living with inflation

We expect inflation to be persistent and settle above pre-Covid levels. We expect central banks to kick off rate hikes but remain more tolerant of price pressures, keeping real interest rates historically low and supportive of risk assets.

Implication: prefer equities over fixed income and remain overweight inflation- linked bonds.

02 Cutting through confusion

A unique mix of events – the restart, new virus strains, supply-driven inflation and new central bank frameworks – could cause markets and policymakers to misread inflation. We keep the big picture in mind but acknowledge risks – to the upside and downside - around our core view.

Implication: trim risk amid an unusually wide range of outcomes.

03 Navigating net zero

The journey for the world to achieve net-zero emissions by 2050 is happening now, and is part of the inflation story. We believe a smooth transition is the least inflationary outcome, yet even this still amounts to a supply shock playing out over decades.

Implication: favor developed market (DM) equities over emerging markets (EM).

Meanwhile,Blackrock said they see a significant shift in China's overall policy stance toward greater state intervention and social objectives, even at the occasional expense of growth. The regulatory clampdown and tighter policy stance that rattled global investors in 2021 made that shift clear.

Yet we believe the low starting point of global investor allocations to Chinese assets is at odds with the economy's growing heft in the world. We estimate current allocations in global portfolios point to an overly negative economic outlook in coming years- such as a long-lasting growth shock akin to Japan in the 1990s.

We maintain our long-term overweight to Chinese assets relative to low global allocations. We assume greater regulation over a strategic horizon as China balances social and economic mobjectives – one reason we bake in materially higher uncertainty and risk premia for China compared with DM markets.

We recognize the risks, yet see current valuations as offering eligible investors adequate compensation for them.

$Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$ $S&P 500 Index (.SPX.US)$ $Hang Seng Index (800000.HK)$ $SSE Composite Index (000001.SH)$ $Hang Seng TECH Index (800700.HK)$

$Tesla (TSLA.US)$

69

7

Manlp1228

liked

34

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)