Mario Timberlake

liked and commented on

Will Monday’s rally last?

I for sure am excited to see some relief in the markets for 2 days, last Friday 21/3/25 and Monday 24/3/25! $SPDR S&P 500 ETF (SPY.US)$ Daily chart. Looking at price action for both daily and weekly looks positive. With daily chart seeing MACD golden cross forming and RSI rising to the mid point. Weeklies are reapecting 50MA. Selling more buyers stepping up at these levels. Similar performance for $Invesco QQQ Trust (QQQ.US)$ & ...

I for sure am excited to see some relief in the markets for 2 days, last Friday 21/3/25 and Monday 24/3/25! $SPDR S&P 500 ETF (SPY.US)$ Daily chart. Looking at price action for both daily and weekly looks positive. With daily chart seeing MACD golden cross forming and RSI rising to the mid point. Weeklies are reapecting 50MA. Selling more buyers stepping up at these levels. Similar performance for $Invesco QQQ Trust (QQQ.US)$ & ...

20

5

1

📉 Alright, let’s cut through the noise. The $Nasdaq Composite Index (.IXIC.US)$ ’s 10% nosedive in two weeks, $Tesla (TSLA.US)$ getting halved, and the VIX fear gauge spiking above 25 have everyone sweating bullets. 😱But before you start hoarding canned goods and cash, let’s break down what’s actually happening—and how to position yourself for the long game.

The Crash Culprits: Why Markets Are Freaking Out

Here’s the lowdown on why Wall Stree...

The Crash Culprits: Why Markets Are Freaking Out

Here’s the lowdown on why Wall Stree...

+1

30

1

3

Mario Timberlake

liked and voted

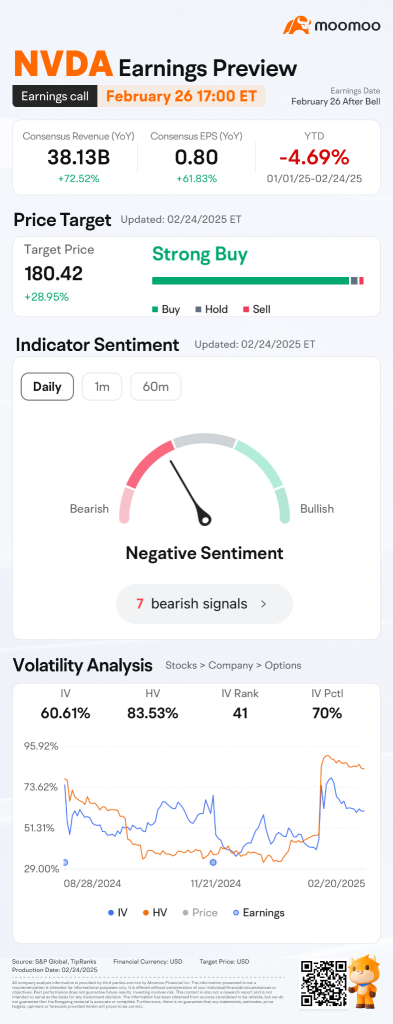

$NVIDIA (NVDA.US)$

Key Drivers and Risks

The primary driver for Nvidia’s expected performance is the surging demand for AI infrastructure. Major clients are significantly increasing capital expenditures: Meta plans to spend up to $65 billion on AI data centers in 2025, up from $39.2 billion last year, while Alphabet forecasts $75 billion, and Amazon could spend over $100 billion. This supports the high revenue and earnings projections.

However, there is some controvers...

Key Drivers and Risks

The primary driver for Nvidia’s expected performance is the surging demand for AI infrastructure. Major clients are significantly increasing capital expenditures: Meta plans to spend up to $65 billion on AI data centers in 2025, up from $39.2 billion last year, while Alphabet forecasts $75 billion, and Amazon could spend over $100 billion. This supports the high revenue and earnings projections.

However, there is some controvers...

4

1

$Alphabet-C (GOOG.US)$ $IonQ Inc (IONQ.US)$

For decades, quantum computing has faced a seemingly insurmountable challenge: scaling qubits without introducing overwhelming error rates. Google's revolutionary quantum computing chip, Willow, demolishes this barrier by exponentially reducing errors as qubits scale -- a breakthrough that shatters a 30-year ceiling and redefines the boundaries of possibility.

In performance test...

For decades, quantum computing has faced a seemingly insurmountable challenge: scaling qubits without introducing overwhelming error rates. Google's revolutionary quantum computing chip, Willow, demolishes this barrier by exponentially reducing errors as qubits scale -- a breakthrough that shatters a 30-year ceiling and redefines the boundaries of possibility.

In performance test...

9

2

3

$Strategy (MSTR.US)$ $Invesco QQQ Trust (QQQ.US)$

The price factors for $MSTR have added another critical condition: it ranks 42nd among stocks meeting the NDX criteria. Therefore, its inclusion in the Nasdaq 100 Index is almost certain.

This will impact all passive funds tracking the index, such as the Invesco QQQ Trust ETF (QQQ), with two significant effects. First, passive NDX investors will gain Bitcoin exposure. Once MSTR constitutes 0.55...

The price factors for $MSTR have added another critical condition: it ranks 42nd among stocks meeting the NDX criteria. Therefore, its inclusion in the Nasdaq 100 Index is almost certain.

This will impact all passive funds tracking the index, such as the Invesco QQQ Trust ETF (QQQ), with two significant effects. First, passive NDX investors will gain Bitcoin exposure. Once MSTR constitutes 0.55...

1

1

2

$Palantir (PLTR.US)$ Palantir short float down 0.07%, 4.18% of total float short

$Robinhood (HOOD.US)$ Robinhood short float up 19.52%, 2.88% of total float short

$Tesla (TSLA.US)$ Tesla short float down 1.92%, 2.73% of total float short

$MARA Holdings (MARA.US)$ Marathon short float down 7.88%, 20.67% of total float short

$SoFi Technologies (SOFI.US)$ SoFi short float down 8.37%, 14.42% of total float short

$Hims & Hers Health (HIMS.US)$ Hims short float up 16.76%, 22.3% of total float shor...

$Robinhood (HOOD.US)$ Robinhood short float up 19.52%, 2.88% of total float short

$Tesla (TSLA.US)$ Tesla short float down 1.92%, 2.73% of total float short

$MARA Holdings (MARA.US)$ Marathon short float down 7.88%, 20.67% of total float short

$SoFi Technologies (SOFI.US)$ SoFi short float down 8.37%, 14.42% of total float short

$Hims & Hers Health (HIMS.US)$ Hims short float up 16.76%, 22.3% of total float shor...

16

4

1

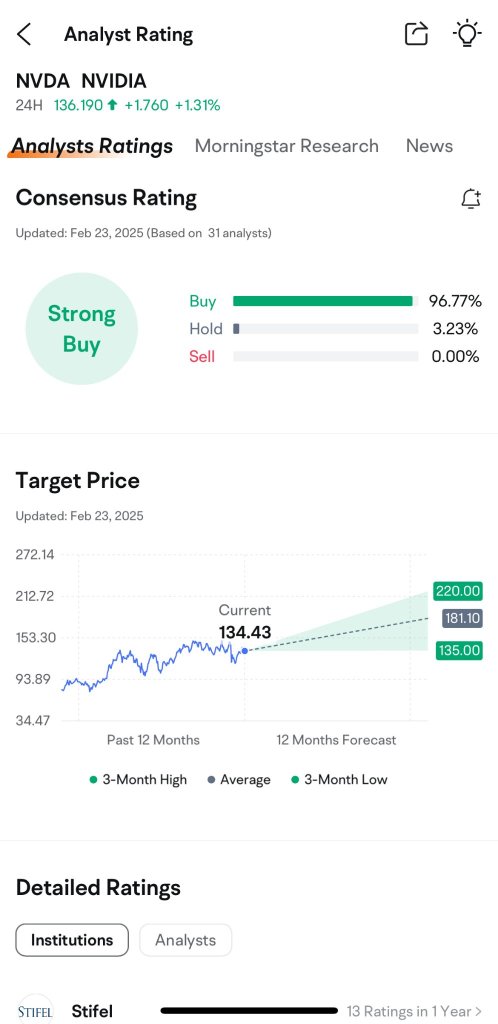

Rosenblatt today raised its price target on Nvidia $NVIDIA (NVDA.US)$ to $220 up from $200 while maintaining its Buy rating

Citi raised its price target on Nvidia $NVDA to $175 up from $170 while maintaining its Buy rating

JPMorgan raised its price target on Nvidia $NVDA to $170 up from $155 while maintaining its Overweight rating

Goldman Sachs raised its price target on Nvidia $NVDA to $165 up from $150 while maintaining its Buy rating

Wells Fargo raised its price target on Nvidia $NVDA t...

Citi raised its price target on Nvidia $NVDA to $175 up from $170 while maintaining its Buy rating

JPMorgan raised its price target on Nvidia $NVDA to $170 up from $155 while maintaining its Overweight rating

Goldman Sachs raised its price target on Nvidia $NVDA to $165 up from $150 while maintaining its Buy rating

Wells Fargo raised its price target on Nvidia $NVDA t...

6

2

Mario Timberlake

liked

$PDD Holdings (PDD.US)$

🔹 Non-GAAP Diluted EPS: ¥18.59 (Est. ¥19.58) 🔴

🔹 Revenue: ¥99.35B (Est. ¥102.83B) 🔴; UP +44% YoY

🔹 Non-GAAP Oper. Margin: 26.9% (Est. 27.4%) 🔴

🔹 Adj net income ¥27.46B, (EST ¥29.21B) 🔴

Revenue Breakdown:

🔸 Transaction Services: ¥50.0B (Est. ¥53B) 😕; UP +72% YoY

🔸 Online Marketing Services & Others: ¥49.35B (Est. ¥49.06B) 😑; UP +24% YoY

Expenses:

🔹 Cost of Revenue: ¥39.71B; UP +48% YoY

🔹 Sales & Marketing Expenses: ¥30.48B; UP +40% YoY

🔹 ...

🔹 Non-GAAP Diluted EPS: ¥18.59 (Est. ¥19.58) 🔴

🔹 Revenue: ¥99.35B (Est. ¥102.83B) 🔴; UP +44% YoY

🔹 Non-GAAP Oper. Margin: 26.9% (Est. 27.4%) 🔴

🔹 Adj net income ¥27.46B, (EST ¥29.21B) 🔴

Revenue Breakdown:

🔸 Transaction Services: ¥50.0B (Est. ¥53B) 😕; UP +72% YoY

🔸 Online Marketing Services & Others: ¥49.35B (Est. ¥49.06B) 😑; UP +24% YoY

Expenses:

🔹 Cost of Revenue: ¥39.71B; UP +48% YoY

🔹 Sales & Marketing Expenses: ¥30.48B; UP +40% YoY

🔹 ...

1

Mario Timberlake

commented on and voted

$NVIDIA (NVDA.US)$ , the kingpin of the semiconductor industry, especially shining bright in the AI chip market with its robust growth potential, always piques the market's curiosity before its fiscal report drops. 👀

Historical data whispers that Nvidia often dips into discount territory before its earnings announcement, then bounces back post-release. Currently, its price action suggests it's consolidating around a fair value ...

Historical data whispers that Nvidia often dips into discount territory before its earnings announcement, then bounces back post-release. Currently, its price action suggests it's consolidating around a fair value ...

+2

14

2

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Mario Timberlake : MACD golden cross and RSI rising? Bullish signals for sure, but with all that geopolitical drama, I’m side-eyeing this ‘relief.’ How confident are you this isn’t just a dead-cat bounce?

Bullish signals for sure, but with all that geopolitical drama, I’m side-eyeing this ‘relief.’ How confident are you this isn’t just a dead-cat bounce?