Mei Mei 103097577

liked

Weekly market recap

Stock futures fluctuated in overnight trading Sunday following a losing week as investors continued to grapple with the resurgence of Covid cases and an upcoming shift in the Federal Reserve's easy monetary policy.

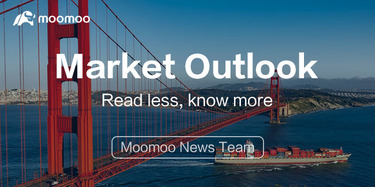

The major averages are coming off a negative week, with the $S&P 500 Index (.SPX.US)$ declining 1.9%. The tech-heavy $Nasdaq Composite Index (.IXIC.US)$ dropped nearly 3% last week as investors dumped high-flying growth stocks on the prospect of higher interest rates, while the $Dow Jones Industrial Average (.DJI.US)$ slipped 1.7%.

Here's a look at the return of S&P 500 sectors

The week ahead in focus

Stock and bond markets around the world will be closed Friday in observance of Christmas. Before the holiday break, Nike and Micron Technology report on Monday, BlackBerry and General Mills on Tuesday, and CarMax, Cintas, and Paychex on Wednesday.

It will be a busy week of economic data releases. On Monday, the Conference Board publishes its Leading Economic Index for November, followed by its Consumer Confidence Index for December on Wednesday.

On Thursday, the Bureau of Economic Analysis reports personal income and consumption expenditures for November. Consumer earnings are forecast to have risen 0.6% while spending is seen climbing 0.5%. The Federal Reserve's preferred measure of inflation, the core PCE price index, is expected to have spiked 4.5% in November.

Also Thursday, the Census Bureau releases the durable goods report for November, which will provide a window into investment spending in the economy. New orders are forecast to have risen 2.1%. Housing-market indicators out this week include existing-home sales for November on Wednesday and new-home sales for November on Thursday.

Monday 12/20

$Micron Technology (MU.US)$ and $Nike (NKE.US)$ report quarterly results.

The Conference Board releases its Leading Economic Index for November. Consensus estimate is for a 119 reading, which would be 0.6% more than October's level. The Conference Board currently projects a 5% growth rate for fourth-quarter gross domestic product and a slower but still robust 2.6% for 2022.

Tuesday 12/21

$BlackBerry (BB.US)$, $FactSet Research Systems (FDS.US)$, and $General Mills (GIS.US)$ announce earnings.

Wednesday 12/22

The NAR reports existing-home sales for November. Economists forecast a seasonally adjusted annual rate of 6.4 million homes sold, slightly more than in October and the highest since the beginning of the year.

$CarMax (KMX.US)$, $Cintas (CTAS.US)$, and $Paychex (PAYX.US)$ hold conference calls to discuss quarterly results.

The Bureau of Economic Analysis reports its third and final estimate for third-quarter GDP. Economists forecast a 2.1% seasonally adjusted annual growth rate, unchanged from November's second estimate.

The Conference Board releases its Consumer Confidence Index for December. Expectations are for a 110 reading, roughly even with the November data. The index is 15% lower than the postpandemic peak reached in June of this year, due to concerns about rising prices and, to a lesser degree, Covid-19 variants.

Thursday 12/23

The Department of Labor reports initial jobless claims for the week ending on Dec. 18. Jobless claims have averaged 225,667 a week in November and December, and have finally reached prepandemic levels.

The Census Bureau reports new-home sales for November. Consensus estimate is for a seasonally adjusted annual rate of 770,000 new single-family houses sold, 25,000 more than in October. The median sales price of new houses sold in October was $407,700, while the average sales price was $477,800 -- both record highs.

The BEA reports personal income and consumption expenditures for November. Economists forecast a 0.6% monthly increase for income and 0.5% for consumption. This compares with gains for 0.5% and 1.3%, respectively, in October. The Federal Reserve's preferred inflation gauge, the core PCE price index, jumped 4.1% year over year in October, the fastest rate since 1991. Predictions are for it to spike 4.6% in November.

The Census Bureau releases the durable goods report for November. New orders for durable manufactured goods are expected to increase 2.1%, to $265.6 billion. Excluding transportation, new orders are seen gaining 0.6%, compared with a 0.5% rise in October.

Friday 12/24

U.S. equity and fixed-income markets are closed in observance of Christmas.

Source: CNBC, jhinvestments, Dow Jones Newswires

Stock futures fluctuated in overnight trading Sunday following a losing week as investors continued to grapple with the resurgence of Covid cases and an upcoming shift in the Federal Reserve's easy monetary policy.

The major averages are coming off a negative week, with the $S&P 500 Index (.SPX.US)$ declining 1.9%. The tech-heavy $Nasdaq Composite Index (.IXIC.US)$ dropped nearly 3% last week as investors dumped high-flying growth stocks on the prospect of higher interest rates, while the $Dow Jones Industrial Average (.DJI.US)$ slipped 1.7%.

Here's a look at the return of S&P 500 sectors

The week ahead in focus

Stock and bond markets around the world will be closed Friday in observance of Christmas. Before the holiday break, Nike and Micron Technology report on Monday, BlackBerry and General Mills on Tuesday, and CarMax, Cintas, and Paychex on Wednesday.

It will be a busy week of economic data releases. On Monday, the Conference Board publishes its Leading Economic Index for November, followed by its Consumer Confidence Index for December on Wednesday.

On Thursday, the Bureau of Economic Analysis reports personal income and consumption expenditures for November. Consumer earnings are forecast to have risen 0.6% while spending is seen climbing 0.5%. The Federal Reserve's preferred measure of inflation, the core PCE price index, is expected to have spiked 4.5% in November.

Also Thursday, the Census Bureau releases the durable goods report for November, which will provide a window into investment spending in the economy. New orders are forecast to have risen 2.1%. Housing-market indicators out this week include existing-home sales for November on Wednesday and new-home sales for November on Thursday.

Monday 12/20

$Micron Technology (MU.US)$ and $Nike (NKE.US)$ report quarterly results.

The Conference Board releases its Leading Economic Index for November. Consensus estimate is for a 119 reading, which would be 0.6% more than October's level. The Conference Board currently projects a 5% growth rate for fourth-quarter gross domestic product and a slower but still robust 2.6% for 2022.

Tuesday 12/21

$BlackBerry (BB.US)$, $FactSet Research Systems (FDS.US)$, and $General Mills (GIS.US)$ announce earnings.

Wednesday 12/22

The NAR reports existing-home sales for November. Economists forecast a seasonally adjusted annual rate of 6.4 million homes sold, slightly more than in October and the highest since the beginning of the year.

$CarMax (KMX.US)$, $Cintas (CTAS.US)$, and $Paychex (PAYX.US)$ hold conference calls to discuss quarterly results.

The Bureau of Economic Analysis reports its third and final estimate for third-quarter GDP. Economists forecast a 2.1% seasonally adjusted annual growth rate, unchanged from November's second estimate.

The Conference Board releases its Consumer Confidence Index for December. Expectations are for a 110 reading, roughly even with the November data. The index is 15% lower than the postpandemic peak reached in June of this year, due to concerns about rising prices and, to a lesser degree, Covid-19 variants.

Thursday 12/23

The Department of Labor reports initial jobless claims for the week ending on Dec. 18. Jobless claims have averaged 225,667 a week in November and December, and have finally reached prepandemic levels.

The Census Bureau reports new-home sales for November. Consensus estimate is for a seasonally adjusted annual rate of 770,000 new single-family houses sold, 25,000 more than in October. The median sales price of new houses sold in October was $407,700, while the average sales price was $477,800 -- both record highs.

The BEA reports personal income and consumption expenditures for November. Economists forecast a 0.6% monthly increase for income and 0.5% for consumption. This compares with gains for 0.5% and 1.3%, respectively, in October. The Federal Reserve's preferred inflation gauge, the core PCE price index, jumped 4.1% year over year in October, the fastest rate since 1991. Predictions are for it to spike 4.6% in November.

The Census Bureau releases the durable goods report for November. New orders for durable manufactured goods are expected to increase 2.1%, to $265.6 billion. Excluding transportation, new orders are seen gaining 0.6%, compared with a 0.5% rise in October.

Friday 12/24

U.S. equity and fixed-income markets are closed in observance of Christmas.

Source: CNBC, jhinvestments, Dow Jones Newswires

+2

113

7

Mei Mei 103097577

liked

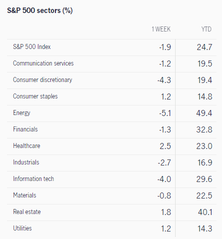

Once more, Co-Wise: moomoo Tutorial Contest Part 5, "How to build a portfolio with a windfall of $1 million?" ended successfully. Thanks for participating in the contest.![]() With the $1 million windfalls, everyone has a different asset allocation method and a unique way to build the best portfolio. The top three candidates to be put into the portfolio are stocks, ETFs, and cryptocurrencies. Asset allocation aims to maximize future returns and minimize risks.

With the $1 million windfalls, everyone has a different asset allocation method and a unique way to build the best portfolio. The top three candidates to be put into the portfolio are stocks, ETFs, and cryptocurrencies. Asset allocation aims to maximize future returns and minimize risks.![]() However, high returns come with high stakes. There is no best, only the most suitable portfolio for investors. Would you please follow me to review some of the high-quality posts from mooers?

However, high returns come with high stakes. There is no best, only the most suitable portfolio for investors. Would you please follow me to review some of the high-quality posts from mooers?

Here are the rewards for your active participation: 1 FREE $Ford Motor (F.US)$ share for the five best posts, 1 FREE $ContextLogic (WISH.US)$ share for the five outstanding posts, and 66 points for posts with a minimum of 30 words. Congratulations to all the winners!![]()

*The rewards will be distributed to winners within 15 working days. The ranking is sorted in alphabetical order.

Part Ⅰ: High-Quality Post Collection

![]() @AxThePro Balanced portfolio

@AxThePro Balanced portfolio

1 million is a huge sum to begin with, it is very important to have growth for this portfolio. At the same time, we also must make sure it is safe from significant losses. I’ll allocate my portfolio with 4-3-2-1 strategy. I am an agreesive investors, I do not believe in bonds, so I will allocate 100% in equity portfolio.

![]() @Dadacai My Portfolio If I Had A S$1 Million Windfall

@Dadacai My Portfolio If I Had A S$1 Million Windfall

If I had a $1 million windfall, I would put 90% of it in an S&P ETF like $Vanguard S&P 500 ETF (VOO.US)$ , $SPDR S&P 500 ETF (SPY.US)$ and $iShares Core S&P 500 ETF (IVV.US)$ , and 5% in Treasury bills. The remaining 5% will be reserved for stocks that I think have the potential to become the next $Amazon (AMZN.US)$ , $Tesla (TSLA.US)$ , $Sea (SE.US)$ , $Apple (AAPL.US)$ and $Microsoft (MSFT.US)$ .

![]() @David W Clark How would I invest $1,000,000

@David W Clark How would I invest $1,000,000

I'd put it in an account that at least pays as much interest as possible while researching for stocks, bonds, ETFs and other such ways to invest and grow. I may do this with a 45/45/10 split, Dividend Stocks/ Value Stocks / Cash.

![]() @Mars Mooo The Squid Game Multi-Portfolios Portfolio

@Mars Mooo The Squid Game Multi-Portfolios Portfolio

The Squid Game Multi-Portfolios portfolio is made up of 4 main portfolios, as follows:

40% weightage: Player 456 (Seong Gi-hun) Portfolio.

30% weightage: Player 218 (Cho Sang-woo) Portfolio.

20% weightage: Player 067 (Kang Sae-byeok) Portfolio.

10%: weightage: Liquid Portfolio.

![]() @Panda2102 Barbell strategy to build a portfolio with a $1m windfall

@Panda2102 Barbell strategy to build a portfolio with a $1m windfall

One portfolio (85-90%) holds extremely safe investments, while the other aggressive portfolio (10-15%) holds highly speculative or leveraged investments. Depending if you are in the Wealth Accumulation stage or Wealth Preservation stage of your life, you can tweak the two portfolio accordingly.

![]() @atelophobia Portfolio building

@atelophobia Portfolio building

Building a portfolio is aka finding the best equilibrium and striking a balance of allocation across the different classes. There is no right or wrong answer to how should one build a portfolio for the fact that Trading/Investment is an Art not a Sciene as such there is no scientific way to judge an artpiece as beauty lies in the eyes of beholder!

![]() @Mama Cass $1M Playmoney!

@Mama Cass $1M Playmoney!

If lucky enough to find or be given $1M to invest I'm afraid that at my age (55) I wouldn't go crazy with aggressive return seeking investments. Different age groups have different portfolio allocations. I'm a caviar kind of gal so I'm going to get a pro to take my million and make it pay off without loss.

![]() @nickelrust Buy. Hold. Sell. Repeat.

@nickelrust Buy. Hold. Sell. Repeat.

Me as a lower risk taker would opt for a safer option, to put the money into a basket of bluechip stocks and let it grow over a period of 3 to 5 years. With the current market still at its low, and globally economies are opening up and striving to stabilise and enter the real new normal.

![]() @Sufy87 It comes down to portfolio allocation and what you know best.

@Sufy87 It comes down to portfolio allocation and what you know best.

Personally, I would allocate 60% stocks, 20% into ETFs, 15% options, 5% cash. Stocks are basically what builds wealth. ETFs are basically to get exposure to segments of the economy. Options are just to hedge against some of my positions. Cash is always as "bullets" when opportunity arise.

![]() @102252718 What is your purpose to invest?

@102252718 What is your purpose to invest?

Everyone invest for a different reason. For me, I invest to grow my wealth pot for retirement and my child's education.

70-80% GROWTH STOCKS $TSLA $PLTR.

10% ETF $ARK Innovation ETF (ARKK.US)$ $ARKF.

10% Crypto $ETH. $BTC.

Please click "How to build a portfolio with a windfall of $1 million?" for more engaging posts.![]() If you are inspired by any post from "How to build a strong portfolio?", please share your thoughts and join us for further discussion. Don't forget to leave your comments and tell mooers what you have learned.

If you are inspired by any post from "How to build a strong portfolio?", please share your thoughts and join us for further discussion. Don't forget to leave your comments and tell mooers what you have learned.![]()

Part Ⅱ: Voting on the “Mentor Moo” Title

It's time for voting! Let's vote for the candidates to see who will win the "Mentor Moo" title. Whose idea do you think is the best? When evaluating the posts, please take the following factors into account: logic, practical content, type settings, picture displays, and engagement.

By the end of the poll, the one with the most votes will win the "Mentor Moo" title. What a great honor! Come and vote for your favorite mentors. Your vote means a lot to them.

Diversification is a critical concept in portfolio management. Different levels of risk tolerance and holding time could directly affect the category selections of investors. Do you have any other portfolio-building methods? Share your portfolio with mooers to explore investment opportunities together.![]()

Disclaimer: All investment involves risk. Neither Futu Inc, nor Futu SG, nor moomoo endorses any particular investment strategy. You should carefully consider your investment goals and objectives when deciding on an investment strategy. Past performance is no guarantee of future results.

Here are the rewards for your active participation: 1 FREE $Ford Motor (F.US)$ share for the five best posts, 1 FREE $ContextLogic (WISH.US)$ share for the five outstanding posts, and 66 points for posts with a minimum of 30 words. Congratulations to all the winners!

*The rewards will be distributed to winners within 15 working days. The ranking is sorted in alphabetical order.

Part Ⅰ: High-Quality Post Collection

1 million is a huge sum to begin with, it is very important to have growth for this portfolio. At the same time, we also must make sure it is safe from significant losses. I’ll allocate my portfolio with 4-3-2-1 strategy. I am an agreesive investors, I do not believe in bonds, so I will allocate 100% in equity portfolio.

If I had a $1 million windfall, I would put 90% of it in an S&P ETF like $Vanguard S&P 500 ETF (VOO.US)$ , $SPDR S&P 500 ETF (SPY.US)$ and $iShares Core S&P 500 ETF (IVV.US)$ , and 5% in Treasury bills. The remaining 5% will be reserved for stocks that I think have the potential to become the next $Amazon (AMZN.US)$ , $Tesla (TSLA.US)$ , $Sea (SE.US)$ , $Apple (AAPL.US)$ and $Microsoft (MSFT.US)$ .

I'd put it in an account that at least pays as much interest as possible while researching for stocks, bonds, ETFs and other such ways to invest and grow. I may do this with a 45/45/10 split, Dividend Stocks/ Value Stocks / Cash.

The Squid Game Multi-Portfolios portfolio is made up of 4 main portfolios, as follows:

40% weightage: Player 456 (Seong Gi-hun) Portfolio.

30% weightage: Player 218 (Cho Sang-woo) Portfolio.

20% weightage: Player 067 (Kang Sae-byeok) Portfolio.

10%: weightage: Liquid Portfolio.

One portfolio (85-90%) holds extremely safe investments, while the other aggressive portfolio (10-15%) holds highly speculative or leveraged investments. Depending if you are in the Wealth Accumulation stage or Wealth Preservation stage of your life, you can tweak the two portfolio accordingly.

Building a portfolio is aka finding the best equilibrium and striking a balance of allocation across the different classes. There is no right or wrong answer to how should one build a portfolio for the fact that Trading/Investment is an Art not a Sciene as such there is no scientific way to judge an artpiece as beauty lies in the eyes of beholder!

If lucky enough to find or be given $1M to invest I'm afraid that at my age (55) I wouldn't go crazy with aggressive return seeking investments. Different age groups have different portfolio allocations. I'm a caviar kind of gal so I'm going to get a pro to take my million and make it pay off without loss.

Me as a lower risk taker would opt for a safer option, to put the money into a basket of bluechip stocks and let it grow over a period of 3 to 5 years. With the current market still at its low, and globally economies are opening up and striving to stabilise and enter the real new normal.

Personally, I would allocate 60% stocks, 20% into ETFs, 15% options, 5% cash. Stocks are basically what builds wealth. ETFs are basically to get exposure to segments of the economy. Options are just to hedge against some of my positions. Cash is always as "bullets" when opportunity arise.

Everyone invest for a different reason. For me, I invest to grow my wealth pot for retirement and my child's education.

70-80% GROWTH STOCKS $TSLA $PLTR.

10% ETF $ARK Innovation ETF (ARKK.US)$ $ARKF.

10% Crypto $ETH. $BTC.

Please click "How to build a portfolio with a windfall of $1 million?" for more engaging posts.

Part Ⅱ: Voting on the “Mentor Moo” Title

It's time for voting! Let's vote for the candidates to see who will win the "Mentor Moo" title. Whose idea do you think is the best? When evaluating the posts, please take the following factors into account: logic, practical content, type settings, picture displays, and engagement.

By the end of the poll, the one with the most votes will win the "Mentor Moo" title. What a great honor! Come and vote for your favorite mentors. Your vote means a lot to them.

Diversification is a critical concept in portfolio management. Different levels of risk tolerance and holding time could directly affect the category selections of investors. Do you have any other portfolio-building methods? Share your portfolio with mooers to explore investment opportunities together.

Disclaimer: All investment involves risk. Neither Futu Inc, nor Futu SG, nor moomoo endorses any particular investment strategy. You should carefully consider your investment goals and objectives when deciding on an investment strategy. Past performance is no guarantee of future results.

154

32

Mei Mei 103097577

liked

What Happened: Gurman said that $Netflix (NFLX.US)$ is allowing its users to sign up for subscriptions inside of its games through $Apple (AAPL.US)$ ’s in-app purchase system.

“That gives Apple up to a 30% cut. Even more surprising is that those subscriptions also work in the main Netflix video streaming app,” Gurman wrote in his weekly newsletter.

Gurman said that this is a signal that tensions between Apple and Netflix “seem to be cooling.”

Why It Matters: The development surrounding in-app payments is notable, according to Gurman, because Netflix stopped letting its customers subscribe through Apple’s service in 2018.

“Now it’s providing a new way to sign up that lets Apple take a cut again,” said Gurman.

Netflix has yet to reinstate in-app purchases through its main app. Gurman said he does not anticipate that happening, terming the games concession a “major change.”

“I’m curious to see what this is a precursor to. Perhaps Netflix will ask Apple for an exemption to the ban on all-in-one gaming apps, letting the streaming giant provide a more streamlined offering to its customers.”

Last week, Netflix launched 5 games for iPhone and iPad users through an app available on the App Store marketplace.

“That gives Apple up to a 30% cut. Even more surprising is that those subscriptions also work in the main Netflix video streaming app,” Gurman wrote in his weekly newsletter.

Gurman said that this is a signal that tensions between Apple and Netflix “seem to be cooling.”

Why It Matters: The development surrounding in-app payments is notable, according to Gurman, because Netflix stopped letting its customers subscribe through Apple’s service in 2018.

“Now it’s providing a new way to sign up that lets Apple take a cut again,” said Gurman.

Netflix has yet to reinstate in-app purchases through its main app. Gurman said he does not anticipate that happening, terming the games concession a “major change.”

“I’m curious to see what this is a precursor to. Perhaps Netflix will ask Apple for an exemption to the ban on all-in-one gaming apps, letting the streaming giant provide a more streamlined offering to its customers.”

Last week, Netflix launched 5 games for iPhone and iPad users through an app available on the App Store marketplace.

25

3

Mei Mei 103097577

liked

$AMC Entertainment (AMC.US)$ $GameStop (GME.US)$ $BlackBerry (BB.US)$ $SNDL Inc (SNDL.US)$ No Selling know what you hold!!!🦍🦍🦍💎💎💎🖐🏿🖐🏿🖐🏿

38

2

Mei Mei 103097577

liked

Compare to the previous generations, Gen Z do have multiple advantages such as faster Internet access (5G network), bigger social media ( $Meta Platforms (FB.US)$ , $Twitter (Delisted) (TWTR.US)$ ), smarter mobile devices ( $Apple (AAPL.US)$ ) and more online trading platforms and brokerage ( $Futu Holdings Ltd (FUTU.US)$ MooMoo ), allowing them to trade not just stocks, but also forex, options, futures, CFD, cryptocurrencies and many more. Also, some of them are rich and have started their own business. Thus, there is no doubt to the 90% increase, even though I was expecting a 300% increase. ![]()

31

1

Mei Mei 103097577

liked

The financial report of listed companies mainly focuses on the accounting data and financial indicators of the listed company, the total number of shareholders at the end of the reporting period and the number of shares held by the top ten shareholders of tradable shares, management discussion and analysis, the reporting period profit and profit distribution statement, etc. For information disclosure, listed companies in the market usually have clear information, expected information, and unexpected information to make announcements to the market.

For the quarterly reports released by listed companies, the sudden information of listed companies is more influential than expected information, and the impact on stock prices will be more severe. For example, the stock of Central Communications suffered a large loss in the quarterly report due to fines on the performance of the listed company, which affected the stock price at that time.

The expected announcement of the listed company will gradually ferment the stock investment sentiment in the market, and the influence will be gradual. For example, before the release of the quarterly report of a listed company, the expected quarterly performance of the listed company will double, which will increase the investment sentiment of the market and possibly promote the rise of stocks.

Investors need to pay attention to the fact that the earnings report is less than expected after the release, which will have a negative impact on stock prices. If it is in line with expectations, there is a high probability that a small part of the stock price will pull back. If the released financial report is significantly higher than expected, there is a high probability that the stock price will rise rapidly in the short term.

Generally speaking, stock financial reports can effectively analyze the latest stock fundamentals, and investors need to recognize the authenticity of listed company reports when referring to them. If the report is modified or omitted, the report will be distorted. However, there is no perfect investment method and interpretation method in the investment market. They all need to be combined with other market indicators and market environment as well as individual stocks for reference.

For example, $Apple (AAPL.US)$ this company faced various lawsuits in August, and it continued to rise after the financial report! So I also think that after the financial report in October, it will also give investors a good price!![]()

![]()

![]()

For the quarterly reports released by listed companies, the sudden information of listed companies is more influential than expected information, and the impact on stock prices will be more severe. For example, the stock of Central Communications suffered a large loss in the quarterly report due to fines on the performance of the listed company, which affected the stock price at that time.

The expected announcement of the listed company will gradually ferment the stock investment sentiment in the market, and the influence will be gradual. For example, before the release of the quarterly report of a listed company, the expected quarterly performance of the listed company will double, which will increase the investment sentiment of the market and possibly promote the rise of stocks.

Investors need to pay attention to the fact that the earnings report is less than expected after the release, which will have a negative impact on stock prices. If it is in line with expectations, there is a high probability that a small part of the stock price will pull back. If the released financial report is significantly higher than expected, there is a high probability that the stock price will rise rapidly in the short term.

Generally speaking, stock financial reports can effectively analyze the latest stock fundamentals, and investors need to recognize the authenticity of listed company reports when referring to them. If the report is modified or omitted, the report will be distorted. However, there is no perfect investment method and interpretation method in the investment market. They all need to be combined with other market indicators and market environment as well as individual stocks for reference.

For example, $Apple (AAPL.US)$ this company faced various lawsuits in August, and it continued to rise after the financial report! So I also think that after the financial report in October, it will also give investors a good price!

240

14

Mei Mei 103097577

commented on

$GE Aerospace (GE.US)$ waiting for u 11

2

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)